Hi all!

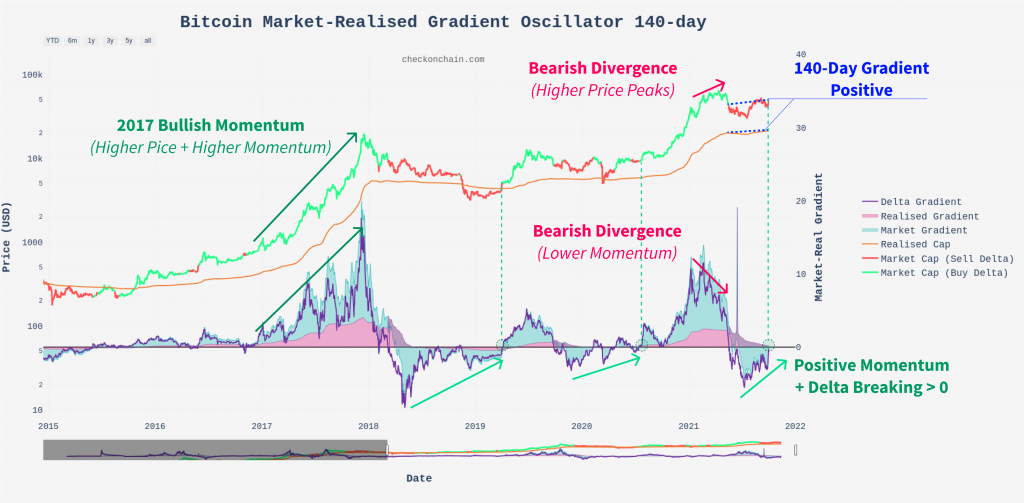

Today’s on-chain daily post looks at the positive transition of on-chain momentum to a bullish signal on the 140-day MRGO indicator.

This weekend’s video is reasonably bullish. What we have is a fairly strong confluence of indicators and signals in the market that point in a similar direction: up.

What we have seen is a strong rally in $BTC from the recent correction lows at $40K up to $48K. We hypothesised that there appeared to be larger-than-normal buy support down at $40K, despite the chart looking somewhat grim. This has been validated as we can see that ~9% of the coin supply changed hands during the correction and has now returned to profit.

We now have 3 important data points:

- ~16% of the supply was re-accumulated in the May–July sell-off which preceded a rally from $29K to $52K in short order.

- A reasonable volume of those coins were redistributed from August to September and we experienced a sell-off down to $39K.

- HODLers once again stepped in and held the floor at $40K, accumulating some 9% of the supply.

Note how what we’ve just described is, in technical analysis terms, a ‘higher low’. HODLers have lifted the floor where they see $BTC as a value buy to defend has risen from $29K to $40K over 2 months.

Alongside this, we have positive momentum across all 3 versions of the Market-Realised Gradient Oscillators (‘MRGOs‘). The most interesting is of course the big one, the 140-day that really signals macro trend shifts. Being such a long-range indicator, this is essentially telling us that we’ve been in a correction for 140-days and now are breaking out of that range with momentum behind it. This period oscillator doesn’t trigger often, but when it does, it usually holds a trend for several months.

The market still needs to confirm, and ideally a break up into the $50K range and holding it would be the final trigger. Perhaps we get a retest of the 200-day MA at $45.2K. But for now, several indicators are pointing to the upside which is great to see. Amazing how quickly sentiment can shift, isn’t it?

Find this chart on checkonchain.com under Bitcoin > Realised Value or directly here.

Find this chart on checkonchain.com under Bitcoin > Realised Value or directly here.