In this report, we explain recent changes to The Shift List and break down key developments regarding Bitcoin (BTC), Ethereum (ETH), Solana (SOL) and any other cryptocurrencies that have had meaningful updates. These monthly reports are also where we explain changes (e.g. additions, removals, re-ratings) made to cryptocurrencies listed in The Shift List.

Key Takeaways

- Bitcoin (BTC) remains near $111,000 with volatility at multi-month lows, signalling a quiet prelude to key U.S. inflation data (Sep. 11) and the Federal Reserve’s next rate decision (Sep. 17).

- Ethereum (ETH) is enjoying its strongest rally in years, largely due to increased demand for ETH from public treasury companies. While the level of buying may ease, it should still help ETH higher.

- Solana (SOL) is similarly benefitting from heightened demand from treasury companies, with the highest-profile of them announced last week. Pleasing to see multiple short-term catalysts lining up.

- Hyperliquid (HYPE) climbed to fresh all-time highs after continued growth across key adoption metrics. It comes as development teams are fiercely competing to be granted the rights to issue USDH, a new ‘Hyperliquid-first’ stablecoin.

Contents

The Shift List At A Glance

Asset & Rating Changes

In case you missed it, in May, we updated The Shift List to allow ratings to be updated live based on price performance. Importantly, we continue to monitor and periodically review each cryptocurrency in The Shift List, which can result in us manually upgrading or downgrading our outlook based on fundamentals. These changes are always communicated through these monthly Shift List Updates you’re currently reading.

In the past month, there were no re-ratings, additions or removals made to The Shift List.

Monthly Update of Shift List Assets

A breakdown of important updates for Bitcoin, Ethereum and certain cryptocurrencies in The Shift List that have had meaningful recent developments. While our outlook for the below assets is unchanged, we consider these updates worth your time.

The big takeaway: Volatility and volumes have been noticeably down for BTC in recent weeks, which is typical for this time of the year. Encouragingly, price has held above key support levels. Don’t be surprised to see this uneventful period continue up until the Federal Reserve’s interest rate decision next week.

Holding pattern: For the first time in a long time, Bitcoin has very much faded into the background over the past month. While demand from corporate treasuries and ETF issuers has continued, the level has eased in recent weeks. We fully expect it to ramp up again soon, potentially after the rate decision next week.

The big takeaway: ETH has been on a rare run, clearly benefiting from the continued bid of public treasury companies (e.g. SharpLink, BitMine). While these companies will likely slow their pace of accumulation, at least based on current valuations, the trend is still very much with ETH.

Years in the waiting: After multiple years of underperformance, ETH has regained momentum over BTC in recent months. This run has lasted for 20 weeks and has mostly coincided with the emergence of ETH treasury companies (covered below).

- Historically, the ETH/BTC pair has been widely seen as a go-to indicator of ‘alt season’. While we still think it is somewhat useful as a gauge of investors’ risk appetite, we caution against blindly relying on it in light of the ETH treasury movement (i.e. a demand factor specific to ETH).

Persistent buying from ETH treasury companies: Various public companies have continued executing their ETH treasury strategies in recent weeks, led by SharpLink Gaming (SBET) and BitMine Immersion (BMNR).

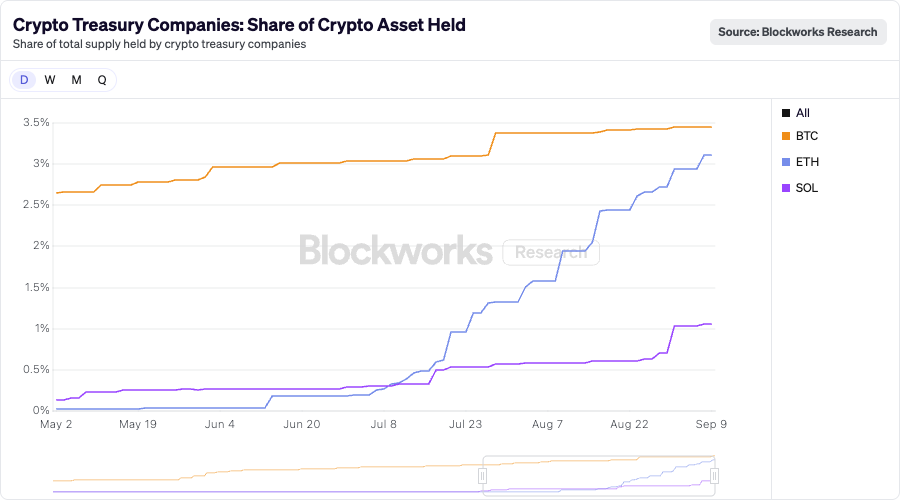

- These companies now hold 3.11% of the total ETH supply, up from 0.03% at the start of June, according to Blockworks data. While the pace of growth is expected to slow due to a recent cooling of Ethereum treasury companies’ valuations, it still likely won’t be long before this metric surpasses BTC (3.46%).

- As covered in last month’s update, there are several secondary benefits of this trend that go beyond the obvious price impact on ETH.

The big takeaway: SOL is trading at a seven-month high of $220 and, similar to ETH, is benefiting from demand from treasury companies. Considering the incoming buy pressure from Forward Industries and others, not to mention other short-term catalysts (‘Alpenglow’ release, Breakpoint conference, ‘Seeker’ campaign), SOL looks poised to continue rallying.

Highest-profile SOL treasury company yet: While various SOL treasury companies have been operating since mid-year, a high-profile one had been lacking.

- That was until last week, when Forward Industries announced a raise of $1.65B in cash and stablecoins. The raise was led by a trio of high-profile investment firms in Galaxy Digital, Jump Crypto and Multicoin Capital. (Importantly, the raise did not include locked or liquid SOL.)

Seeker Season kicks off: The long-awaited Seeker smartphone was released and started shipping globally. To celebrate the launch, an activation campaign called ‘Seeker Season’ is running throughout September. It will bring exclusive features, early access, airdrops and other benefits from Solana-based apps.

Next major upgrade approved: The community approved a proposal to proceed with the ‘Alpenglow’ upgrade, the most significant overhaul of the network’s consensus protocol to date. Testnet deployment is expected by year-end, followed by mainnet release in Q1 2026.

- In brief, ‘Alpenglow’ aims to make Solana’s performance comparable to traditional financial infrastructure, enabling faster deposits and more responsive apps. Post-upgrade, transaction finality times (i.e. the time it takes for a transaction to be considered irreversible) are expected to be sub-200 milliseconds, down from around 12.8 seconds today.

Big takeaway: Whether its HYPE price or key network metrics, all-time highs have continued for Hyperliquid in recent weeks. For various reasons, it’s hard to see momentum slowing any time soon.

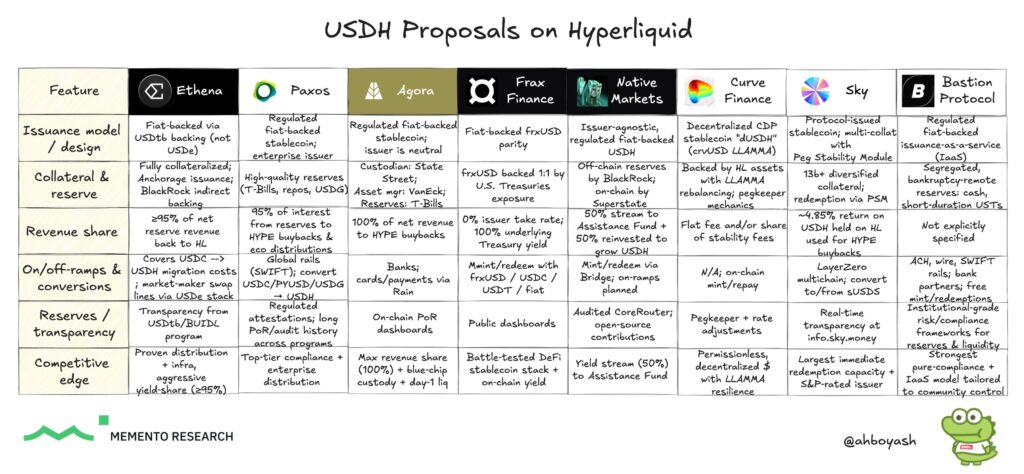

Bidding war for USDH stablecoin: Hyperliquid is preparing to launch its native USDH stablecoin in an effort to reduce reliance on major stablecoins (e.g. USDC) and capture revenue from reserve assets.

- Various development teams have submitted proposals as to why they should be granted the rights to issue USDH. The proposal deadline is Sep. 10, and validators are expected to vote by Sep. 14 for their preferred team.

- While other stablecoins can launch on Hyperliquid moving forward, only one can have the USDH ticker. Given its positioning as a ‘Hyperliquid-first’ stablecoin, it’s very likely to be heavily adopted within the Hyperliquid ecosystem by builders and users alike.

- Notably, several proposers are pledging to commit the vast majority of interest generated from would-be USDH reserves toward the Hyperliquid ecosystem.

- For example, Paxos proposed pledging 20% of yield from USDH reserves to the Assistance Fund (i.e. buybacks), increasing to as high as 70% if USDH supply grows to beyond $5B.

Revenue growth continues: Adoption of Hyperliquid continues to climb, leading to increased protocol revenue and, therefore, increased automatic buybacks of the HYPE token by the Assistance Fund.

Altcoin Calendar: Upcoming Milestones & Events

| Project | Event | Expected Date |

|---|---|---|

| Hyperliquid (HYPE) | Onchain vote for USDH ticker assignment | Sep. 14 |

| Sui (SUI) | SuiFest | Oct. 2 |

| XRP (XRP) | Ripple Swell | Nov. 4–5 |

| Ethereum (ETH) | ‘Fusaka’ upgrade | Early November |

| Solana (SOL) | Solana Breakpoint | Dec. 11–13 |