With the Ethereum Merge on the horizon, it’s time to start thinking about new Ethereum onchain metrics.

The video above takes you through a whole suite of new metrics which explain how the PoS consensus mechanism is operating, breakdown of validator stake, and an estimate of the net supply dynamics post-Merge.

However, I’m sure that there are 2 primary questions you want to know:

- How much ETH will my validator earn me per year?

- Will ETH be deflationary post-Merge?

ETH Revenue Estimates

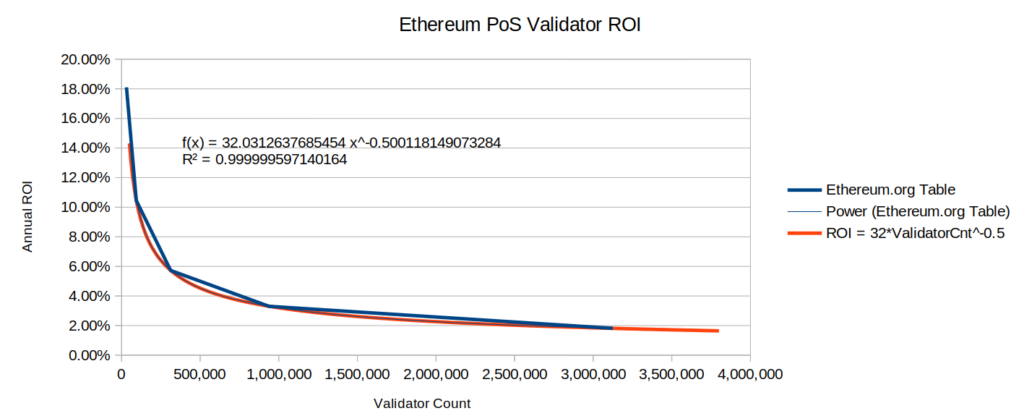

In the current environment, validators are taking home around 4.45% in ETH-denominated rewards for a 32 ETH stake. Now note that this will decline as more people stake. The Ethereum system is designed such that the ROI will decrease the more validators enter the system.

You can actually calculate the ROI directly off an assumed number of validators ROI = 32 * Validator_Count^-0.5.

I would expect that validator count (currently 418k) will add an additional 50% at least following the Merge, which will bring the yield down to 4.13%, but it could also double to 800k with a yield of 3.6%. So assuming around 3.6% as a lower bound is probably sensible for now.

Will ETH be Deflationary?

Almost certainly yes.

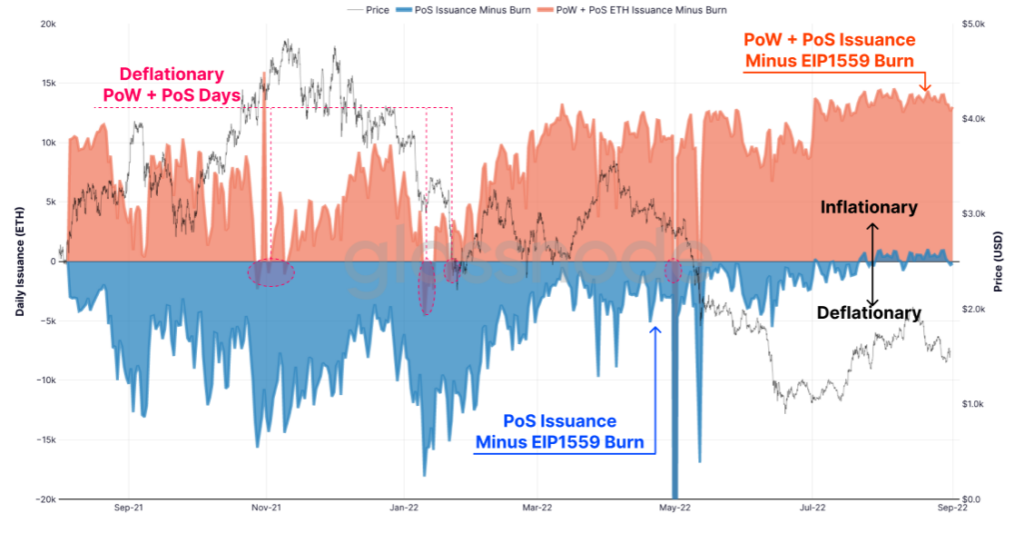

- Orange curve shows the current state of play: PoW + PoS + EIP-1559. As you can see, it has been inflationary almost always, bar a handful of days.

- Blue curve shows PoS + EIP-1559 if we imagine the Merge went live in August 2021. With exception of right now where gas prices are sub-10 gwei, it would have been deflationary for the last 12 months

For the bulls, this sounds like great news. It probably will be good for price. What we’re going to find out is whether it is good for Ethereum the network or not. (For more on this, watch my recent video on why I think the Merge is a monumental blunder.)

Watch: 3 Reasons Why Ethereum Merge Is Bullish for ETH Price