An airdrop is a growth mechanism for projects that provides a financial incentive to early adopters and participating members of these communities.

Collective Shift believes that hundreds of projects will continue launching tokens over the coming years, offering plenty of financial opportunities for active onchain users. Successful airdrop campaigns that Collective Shift members have participated in are listed at the bottom.

Contents

What Are Airdrops?

An airdrop is a distribution of cryptocurrencies to a predefined set of users’ wallet addresses free of charge. (Sometimes, eligible recipients must pay a small transaction fee to claim the airdrop.)

In the broadest sense, airdrops can be performed by any crypto project. Each project has an app or protocol that can track its users’ activity. Typically, airdrops are determined by the extent to which early users interact with the project’s app or protocol. A broad airdrop strategy for investors is to use as many apps and protocols as reasonably possible thereby registering their wallet with each of them.

Airdrops are handled slightly differently depending on the industry:

- Airdrops for DeFi organisations are typically determined by the transaction or staking volume of a user on a specific platform during a specific period. For DEXes this typically means exchange-traded volume and amount of Liquidity Pool tokens locked in the platform and for how long. For lending platforms generally, the amount of funds lent or borrowed.

- Airdrops for NFT collections typically require the holding of an NFT at a ‘snapshot’ date. A ‘snapshot’ is the list of all NFT holders at a given point in time. Snapshots are typically either teased beforehand or taken unbeknownst to the holders and retroactively announced. Those addresses on the snapshot list will be eligible for the airdrop.

Airdrop Ratings

Below is a list of the projects building blockchains, wallets, dapps and NFTs that could launch their own tokens and conduct initial airdrops. (See below for the distinction between initial and follow-on airdrops.)

⭐⭐⭐⭐⭐ represents the greatest possible potential of an airdrop.

Last updated on Jul. 16, 2024. The next update will be Jan. 22, 2025. The newest additions and updates are highlighted in green.

L1 Blockchains & L2 Networks

| Blockchain | Airdrop Potential | Action Steps |

|---|---|---|

| Scroll (Twitter / X) | ⭐⭐⭐⭐ | An Ethereum scaling solution that launched on mainnet in Oct. 2023 after more than two years of development. Bridge to the Scroll network and use apps to qualify for a possible token airdrop. |

| Base (Twitter / X) | ⭐⭐⭐⭐ | The Coinbase-incubated Ethereum L2 launched in August 2023. Although Coinbase stated there would be no native token, there could remain airdrop opportunities from cryptocurrencies launched on Base or NFTs from Base itself. Other dapps deployed on Base may target early users of Base by offering incentives (e.g. airdrops, boosted yield). |

| Linea (Twitter / X) | ⭐⭐ | Consensys’ new Ethereum network, Linea, launched in 2023. Consensys is the company behind MetaMask, the most popular crypto wallet. Early users of Linea may qualify for an airdrop if Linea tokenises. |

| Berachain (Twitter / X) | ⭐⭐⭐⭐⭐ | An upcoming L1 in the Cosmos ecosystem powered by liquidity providers. Launched a testnet in Jan. 2024 with developers outlining plans for testnet tokens to hold economic value. Using the testnet should improve the odds of qualifying for an eventual airdrop. |

| Monad (Twitter / X) | ⭐⭐⭐⭐ | An emerging L1 blockchain that attempts to distinguish itself by delivering higher network throughput. Testnet may go live in 2024. Using the testnet should improve the odds of qualifying for an eventual airdrop. (Warning: be careful of scams claiming the testnet is live.) |

| Movement (Twitter / X) | ⭐⭐⭐⭐ | A network of modular blockchains written in the Move language. Currently running the ‘Parthenon‘ testnet campaign to allow builders and users to experiment with Movement’s parallelised Move-EVM. |

| Eclipse (Twitter / X) | ⭐⭐⭐⭐ | Eclipse is building an Ethereum L2 using the Solana Virtual Machine. Currently in testnet and gearing up for a mainnet launch this year. Interacting with the testnet, and the eventual mainnet, will presumably increase the chances of qualifying for an airdrop. |

| Hyperliquid (Twitter / X) | ⭐⭐⭐⭐ | A new L1 with native support for spot trading. Currently has a points program. |

| MegaETH (Twitter / X) | ⭐⭐⭐⭐ | A new Ethereum L2 backed by Ethereum co-founder Vitalik Buterin. Enters testnet in late 2024—engaging in the ecosystem from day one could provide the best chance to become eligible if they tokenise and airdrop. |

Adding an RPC to a Web3 Wallet

‘RPC’ stands for ‘remote procedure call’, a set of protocols that allow a client (e.g. MetaMask) to interact with a blockchain. Use Chainlist to add the Ethereum Virtual Machine (EVM) compatible RPCs to their MetaMask wallet. (It is best practice to cross-check this information with the relevant chain’s documentation.)

Wallets

| App | Airdrop Potential | Action Steps |

|---|---|---|

| MetaMask (Twitter / X) | ⭐⭐ | Create a wallet and transact using its swap feature. |

| Phantom (Twitter / X) | ⭐⭐⭐⭐ | Create a wallet and swap inside. |

| Zapper (Twitter / X) | ⭐⭐⭐ | Use the protocol. Complete quests, earn NFTs and Volts. |

| Zerion (Twitter / X) | ⭐⭐⭐ | Use the protocol. The team has signalled a desire to decentralise. |

| Rainbow (Twitter / X) | ⭐⭐⭐⭐ | Use the wallet and claim points via its ‘Rainbow Points‘ event. |

| Rabby (Twitter / X) | ⭐⭐⭐⭐ | Being a product of DeBank, users of Rabby may qualify for an eventual DeBank token. The Rabby team teased a snapshot in January 2024. |

| Backpack (Twitter / X) | ⭐⭐⭐⭐ | A new crypto wallet and exchange. Raised $37M from FTX Ventures and Jump Crypto. |

Bridges & Infrastructure

| App | Airdrop Potential | Action Steps |

|---|---|---|

| Zora (Twitter / X) | ⭐⭐⭐⭐ | Hold the Zorbs NFT. Consistently collect and create some NFTs on Zora’s Ethereum L2. |

| Karak (Twitter / X) | ⭐⭐⭐⭐⭐ | A universal restaking service that recently raised a $48M Series A. Deposit and restake supported cryptocurrencies. |

| Symbiotic (Twitter / X) | ⭐⭐⭐⭐⭐ | Another restaking service similar to EigenLayer and Karak. Deposit and restake supported cryptocurrencies. |

| Avail (Twitter / X) | ⭐⭐⭐ | A data-availability layer helping to secure PoS blockchains. Participate in testnets and be an early adopter to support the network. |

DeFi & Dapps

| App | Airdrop Potential | Action Steps |

|---|---|---|

| Unstoppable Domains (Twitter / X) | ⭐⭐ | Buy and hold a domain name. |

| Matcha (Twitter / X) | ⭐ | Use the protocol. |

| Lens (Twitter / X) | ⭐⭐⭐⭐⭐ | Minting Lens profiles are currently unavailable. Users can only buy Lens profiles on OpenSea. Buying for an airdrop may not be wise due to high cost, and prices likely plummet once Lens opens to the public and supply increases to infinite. |

| Irys (Twitter / X) | ⭐⭐⭐ | Watch for more Irys Quests and opportunities to participate in its permissionless data network. |

| DefiLlama (Twitter / X) | ⭐ | One of the top crypto data and analytics sites. Recently expanding into token swapping and becoming an aggregator. Could tokenise, but less likely than others. |

| Swell Network (Twitter / X) | ⭐⭐⭐⭐⭐ | An ETH liquid staking network. Similar to Lido airdropping governance tokens to early stakers, Swell Network could do the same. Increase chances by engaging with its ongoing points program. Token should launch in Q3 after some delays. |

| MilkyWay (Twitter / X) | ⭐⭐⭐⭐⭐ | A liquid-staking protocol for Celestia’s modular ecosystem. Stake TIA on the MilkyWay dapp and receive milkTIA. Confirmed 10% of the MILK supply will go to mPoints holders. |

| Astaria (Twitter / X) | ⭐⭐⭐⭐ | A DeFi app solving for instant liquidity of onchain assets. V1 and whitepaper were recently released after pivoting from solely NFTs. Test the new version when live. |

| Infinex (Twitter / X) | ⭐⭐⭐⭐⭐ | A new exchange powered by Synthetix that aims to blend the best of DeFi with the ease of using a centralised exchange or fintech app. Participate in early campaigns (e.g. Speedrun the Waitlist, Craterun) to win Patron NFTs. |

| Phoenix (Twitter / X) | ⭐⭐⭐⭐ | A Solana-based order book exchange. Trade on the exchange to potentially qualify for an airdrop if they tokenise. |

| MarginFi (Twitter / X) | ⭐⭐⭐⭐ | A decentralised lending protocol on Solana. Participate in its ongoing points program. |

| Grass (Twitter / X) | ⭐⭐⭐⭐⭐ | A web-scraping protocol where incentivised users contribute unused internet bandwidth for use by organisations training AI. Announced a $3.5M seed round in December 2023. |

| Meteora (Twitter / X) | ⭐⭐⭐⭐⭐ | The first dynamic yield infrastructure on Solana, starting with highly capital-efficient AMM pools. Currently has a points program. |

Follow-On Airdrops

After conducting their initial airdrop—which often corresponds with the launch of the token itself—many projects will carry out a series of follow-on airdrops. Generally, compared to the initial airdrop, these follow-on airdrops are worth materially less and have narrower eligibility criteria.

For the sake of this resource, we have listed only those projects that have yet to conduct an initial airdrop. While certain follow-on airdrops can be worthwhile pursuing, there are currently dozens of projects in the process of conducting follow-on airdrops. The above list would become far too long if these projects were to be included.

Here are some projects doing follow-on airdrops: Jupiter (JUP), EigenLayer (EIGEN), Optimism (OP), Ethena (ENA), Neon (NEON), Blast (BLAST), EtherFi (ETHFI) and Kamino (KMNO).

NFT Collections

The great NFT collections are building into the metaverse for the long term by creating ideals, values, storylines and an ethos for a group of decentralised people. These collections have proven to have a high probability of airdrop for NFT holders. Collections have proven to provide a yield to holders through the accumulation and sale of additional NFTs released by the creators.

The best-case scenario for holders is that additional NFTs are airdropped to them for free or given to them for the cost of claim fees (typically $25–$75). At a minimum, holders are often given priority to mint additional NFTs released by creators at a normal or discounted cost. In both scenarios, NFT holders are given financial incentives for simply being a holder.

In 2021 and 2022, most NFT startups were creating their first NFT collections for their digital brands. Through the natural building of a startup’s metaverse, an initial collection of 10,000 NFTs will be released, followed by an additional 10,000–20,000 NFTs to grow the brand and tell a story. Those holding the initial collection typically reap the financial and non-financial incentives from the release of secondary and tertiary collections.

To complement the long-term nature of our research, we periodically share the current airdrop actions that Collective Shift analysts are making in the execution of each’s airdrop strategy.

To see Collective Shift’s analysis, sign up or try our free trial today!

Our Analyst Actions

Airdrop Strategies

Some strategies when looking for airdrops include:

- Providing staking: Many users focus on staking a wide variety of cryptocurrencies (e.g. ATOM) to be eligible for protocol airdrops.

- Participate in governance: Many tokens airdrop to users who use governance tokens to vote.

- Finding your niche: Crytpo organisations are getting wiser about airdrop farmers. Instead of scattering your eggs, it may be better to focus on a particular niche (e.g. the Cosmos Hub ecosystem, Ethereum L2s).

- Using testnets: Often, cryptocurrencies will provide some early supply to those who helped test the protocol via testnets and early releases.

- Active in Discord: Cryptocurrency protocols often airdrop an early supply to its most active and earliest Discord members. It pays to be active and give value. You can’t be in all Discords, so find your niche or favourites.

- Avoid simple giveaways: CoinMarketCap and other websites have an airdrop feature. Strongly consider avoiding these, as many of the tokens don’t have much value, some are illegitimate, it’s riskier, and there are many low-quality projects.

- Be active onchain: A vast majority of airdrops go towards those providing liquidity and performing on-chain transactions.

- Who needs a token: Not all blockchain-based apps need a native token. Look for which platforms would benefit from a native token or which need to decentralise (governance tokens are one way to do this). DefiLlama maintains an airdrop page—although, be extremely careful with new or forked protocols—enter at your own risk.

- Look at previous eligibility criteria: Projects are becoming more adept at excluding airdrop farmers. It’s worth looking at previous eligibility criteria to maximise a chance at an airdrop.

- Follow airdrop hunters: A few popular airdrop hunters and tools include @OlimpioCrypto, @TheDeFISaint, @ViktorDefi, @Abrahamchase09 and @ardizor. DefiLlama has a free tool displaying popular projects that might airdrop.

Risks & Considerations

Be safe out there. Keep the majority of your funds in a cold, separate wallet. Ideally, use a separate computer or browser wallet for connecting to more “risky” airdrops.

Although the allure of ‘free money’ is strong, it’s important to remember the risks and challenges:

- Malicious sign: Always be careful with what you permit when signing your wallet. Take best practices when using early and experimental protocols. Also, ensure you don’t have a significant value attached to that hot wallet when engaging in these activities.

- Rug pull: If you receive cryptocurrency from an unknown project, it could be malicious or rug pull. It’s important to do your due diligence and use best security practices.

- Time: It can be time-intensive to farm airdrops—consider how valuable your time is.

- Cost: Although airdrops are generally ‘free’, they aren’t exactly, especially if you are specifically farming them. You might make transactions, spend gas, bridge or incur transaction fees you may not have otherwise done. This costs money, so these airdrops aren’t necessarily ‘free’.

- Legal: You may not be able to claim your airdrop. Many U.S.-based users were excluded from some highly prized airdrops.

- Tax: Depending on where you live you may have a taxable event as soon as you claim an airdrop, and then again when you sell. Consult your tax professional if you’re unsure of the tax laws in your country.

- Scams: The most common risk out there. Many scammers imitate projects to trick users into minting or claiming a token that’s not real. For example, see the below fake Arbitrum airdrop—clear red flags are the inability to comment and incorrect X (formerly Twitter) handle.

- Don’t try too hard. Ask yourself a few questions:

- What is your time worth?

- How much time will it cost to undertake these actions

- What’s the possible outcome?

About Airdrop Checkers

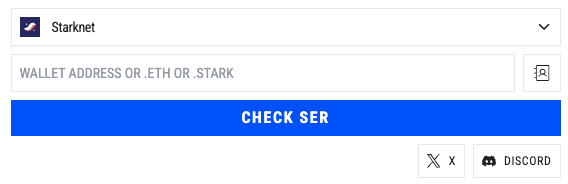

As the name implies, airdrop checkers are websites that let you see whether you (i) qualify for ongoing airdrops and (ii) may qualify for future airdrops from certain projects. The safest and most convenient airdrop checkers only require you to paste your blockchain address into a search box.

Please note, that airdrop checkers are a common target of hackers who make copycat websites that trick you into thinking you are using the legitimate website. If an airdrop checker is designed like the one described above (i.e. pasting your address and not connecting your wallet), then the chance of a phishing attack is quite small. However, if an airdrop checker requires you to connect your wallets and sign onchain transactions, the security risk increases.

Earnfi and WENSER are two of the most popular airdrop checkers. As of Jul. 2024, you can use these checkers without needing to connect your wallet. This is ideal as it mitigates security risk while giving you the convenience of seeing whether you qualify for any ongoing airdrops and/or may qualify for future airdrops. (You have the option to connect your wallet to gain additional functionality.)

Successful Airdrop Campaigns

Completed airdrops that were previously included in the above list, ordered from least to most recent.

| App | Action Steps |

|---|---|

| Optimism (1) | Airdropped 5% of the OP supply to early users in May 2022. (Announcement) |

| Optimism (2) | Airdropped 0.27% of the OP supply to governance participants and active users in February 2023. (Announcement) |

| Hop Protocol | ~55M HOP were airdropped to previous users of the Ethereum L2 bridge. (Announcement) |

| sudoswap | SUDO, the governance token of the sudoAMM protocol, was launched in early 2023. (Announcement) |

| Metaplex | Airdropping MPLX to Solana NFT creators. (Announcement) |

| Aptos | A not-yet-launched blockchain by ex-Meta executives. Will tokenise. Some will likely be airdropped to those participating in the current series of incentivised testnets. |

| Blur (1) | Airdropped 12% of the BLUR supply to certain early users in February 2023. (Announcement) |

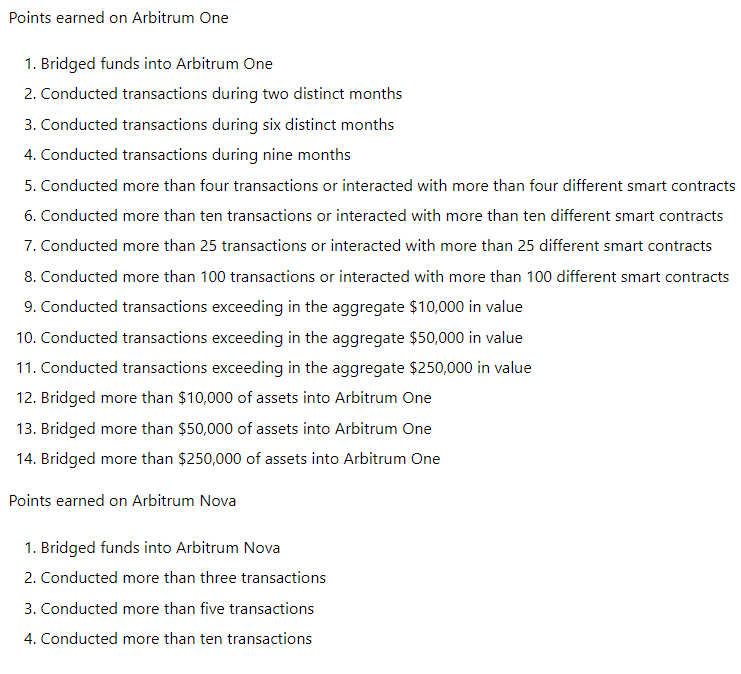

| Arbitrum | Airdropped ARB to early users of Abitrum based on criteria of activity. (Airdrop eligibility) |

| ZigZag | Early ZigZag users were rewarded with seven airdrops. (Airdrop eligibility) |

| LayerZero | Airdropped 8.5% of the ZRO supply to certain early users in June 2023. Claim window is ongoing. (Announcement) |

| Optimism (3) | The third OP airdrop occurred in Sep. 2023, with the main recipients being those who participated in governance. Airdrops were automatically sent to eligible addresses (i.e. there was no claim window). |

| Celestia | Airdropped 6% of the TIA supply to certain early users in October 2023. (Announcement) |

| Blur (2) | Airdropped 10% of the BLUR supply to Season 2 participants in November 2023. (Announcement) |

| Jito | Airdropped 10% of the JTO supply to certain early users in December 2023. Claim window ends Jan. 6, 2024. (Announcement) |

| Starknet | Airdropped 7% of the STRK supply to certain early users in February 2024. (Announcement) |

| Tensor | Airdropped 12.5% of the TNSR supply to certain early users in April 2024. (Announcement) |

| Wormhole | Airdropped 11% of the W supply to certain early users in April 2024. (Announcement) |

| Ethena | Airdropped 5% of the ENA supply to certain early users who held certain NFTs or collected ‘Shards’. (Announcement) |

| Kamino | Airdropped 7.5% of the KMNO supply to certain early users. (Announcement) |

| Zeta | Airdropped 8% of the ZEX supply to certain early users. An additional 2% was airdropped to early stakers of ZEX. (Announcement) |

| Drift | Airdropped 10% of the DRIFT supply to certain early users. (Announcement) |

| ZKsync | Airdropped 17.5% of the ZK supply to certain early users. Claim window ends Jan. 3, 2025. (Announcement) |

To keep up with the latest airdrop news, speculation and announcements, visit the Airdrops Mega Thread in our member-only Facebook group.