Hi all,

Today’s on-chain daily post looks at the flow of funds on the Bitcoin ledger, aiming to assess buying and selling.

Bitcoin (and cryptocurrencies in general) provide a pretty radical degree of transparency and insight. We can see the flow of funds around the network, kind of like seeing into the SWIFT banking pipeline to see where money is coming from, and where it is heading.

Now with pseudonymous addresses, and one physical entity being able to control many wallets, this can be imprecise unless going deep in the weeds like Chainalysis. However, when it comes to gauging sentiment of the market, we usually don’t need data at an individual level, and would rather have a birds-eye view. On-Chain analytics provides us with plenty of tools and proxies to achieve this.

The three main tools and concepts we can use for this analysis: Lifespan (the age of coins), Liquidity (how frequently it is spent), and Entity Adjustment (identifying specific multi-wallet owners).

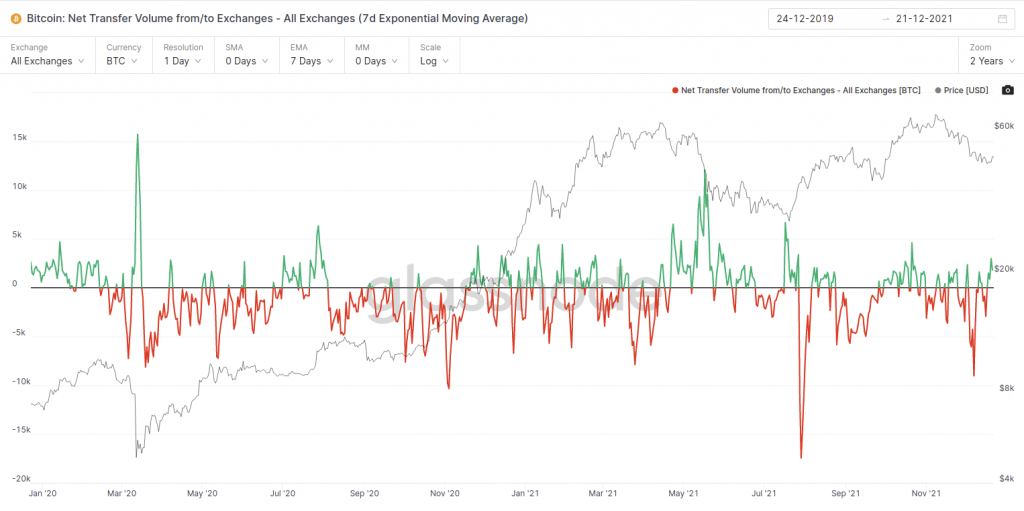

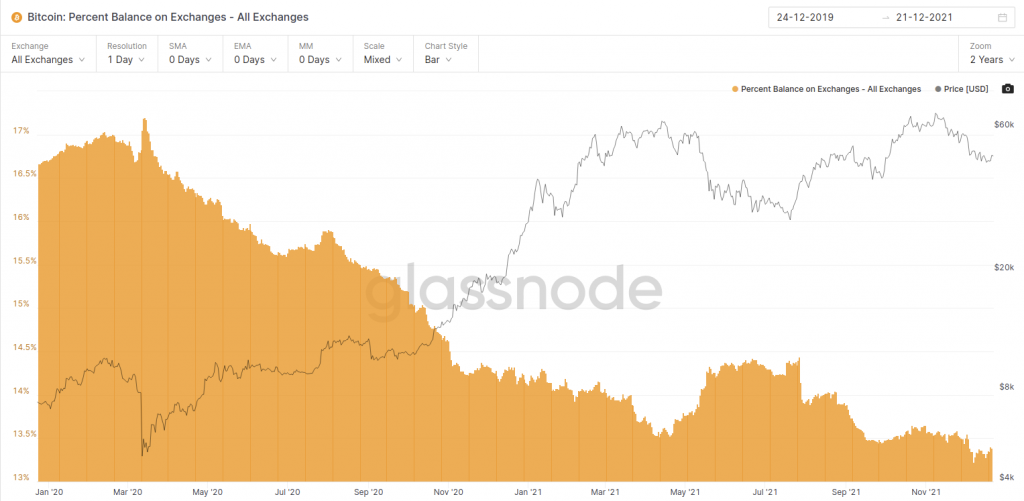

First, we can look at exchange flows, which are the most intuitive version of Entity Adjustment. What we can see is that whilst it has been fairly constructive during this correction, with outflows dominating, there have been some inflows over the past few days. Nothing too extreme, but one to keep an eye on.

On net, it hasn’t changed the macro outflow trend in exchange balances, so I am not changing my perspective until we get a much larger inflow dominance.

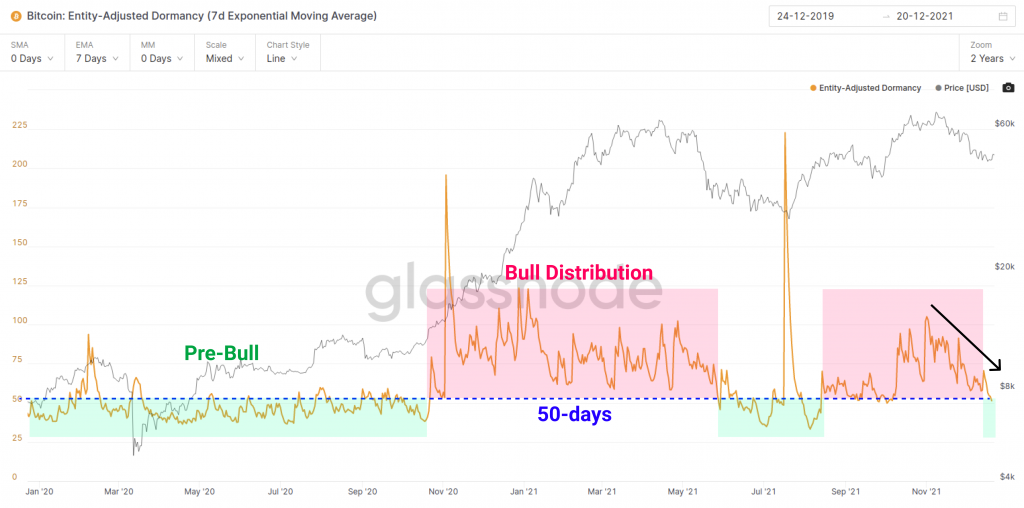

On the Lifespan front, we can see that Dormancy is in a local downtrend and just broke below 50-days. This means the average age of all coins spent is around 50-days on a per unit BTC basis. Note how this usually defines the border between accumulation and distribution which paints a more constructive picture, albeit still quite early in the piece.

Generally speaking, declining Lifespan metrics indicate returning conviction of old hands, and the increased probability they are buying the dip, not selling in fear.

Lastly, we look at coin liquidity, and we have two key metrics to observe here. The first is the Long-Term Holder supply, which is more or less flat over the past month. Those folks with coins older than 155-days are sitting tight. This speaks to a conviction of the strong hand cohort, even with everything looking as grim as it does.

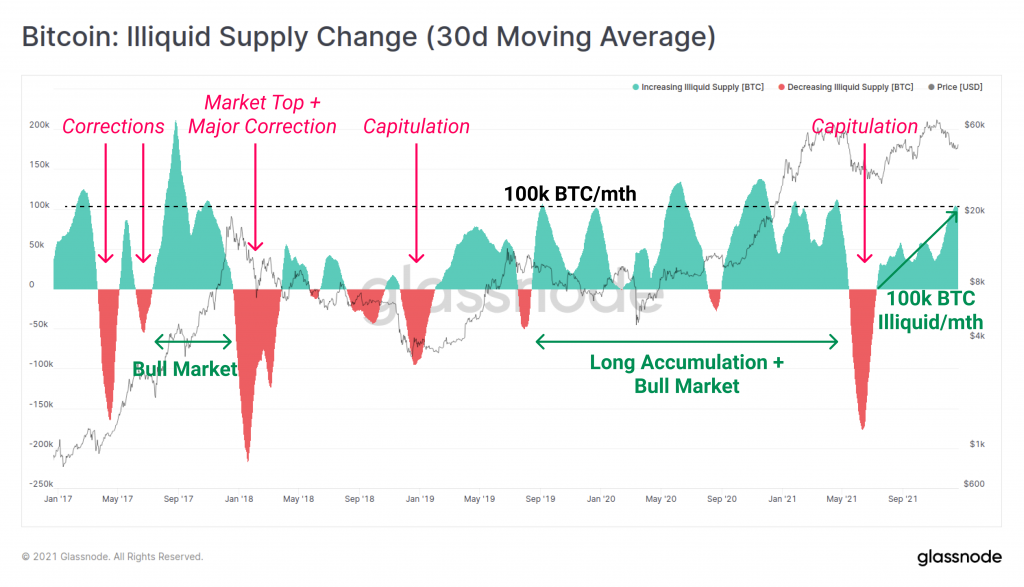

Whilst LTH supply tells us more about what happened in the past (HODLing) and whether LTHs are spending, it doesn’t really tell us anything about accumulation behaviour today. For that, we can turn to the Illiquid supply change metric, which shows we just hit 100k BTC per mth moving into an illiquid state. Alongside exchange outflows, this speaks to an underlying buy side that is likely consistent with LTHs having conviction during this dip.

Price may look grim, but the underlying demand dynamics, still look very constructive. No change yet.