Yield Guild Games ygg

Summary

Yield Guild (Organisation) is a DAO for investing in NFTs used in virtual worlds and blockchain-based games built on Ethereum. Its goal is to create the biggest virtual world economy through maximising its community-owned assets and allowing profit sharing with token holders. It does this through investing in play-to-earn games and in-game digital assets.

YGG combines the best of [NFTs and DeFi], bringing yield farming to game economies while adding value to these virtual worlds by developing the content and economy of these games…We want to own and develop assets in the metaverse as we believe that virtual economies will be more valuable than real-world economies over time. At the same time, we want to create value in the virtual world for our guild members to thrive in a virtual environment – the competitive gamers, the artists, and content creators that populate the metaverse.

Yield Guild manages a variety of game-related NFTs, digital assets and virtual land parcels, which members use to create greater earnings. At launch, the treasury and guild will focus on play-to-earn games that have shown strong potential and community support, such as Axie Infinity, The Sandbox and League of Kingdom. The guild is also invested in other games such as Illuvuim and Splinterlands.

The Yield Guild DAO (YGG DAO) generates revenue and accrues value via the following mechanisms:

- Scholarships: Yield Guild invests in game NFTs and lends them to guild members for a portion of the in-game rewards going directly to YGG—the most recent example being Axie Infinity.

- Land: Revenue can be generated by non-guild members conducting economic activities on Yield Guild’s in-game land.

- NFT appreciation: Its underlying NFT assets may appreciate on the open market.

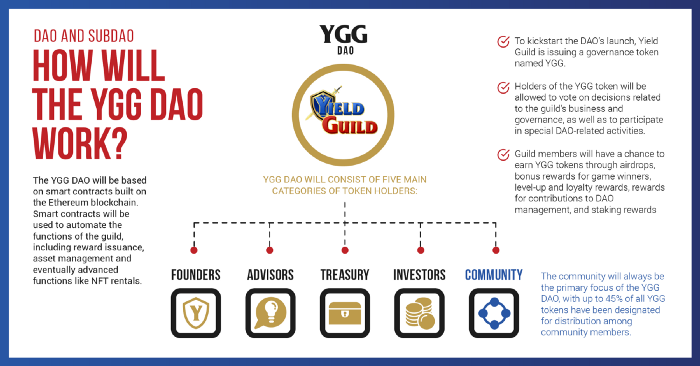

YGG DAO plays an important role in overseeing the treasury and management of its assets to maximise value—all value is returned to the YGG DAO over time. Along with ensuring revenue is growing, the DAO is also responsible for:

- buying assets in the form of cryptocurrencies, virtual assets in the metaverse, NFTs or in-game tokens;

- arbitraging farms to maximise yields;

- running financial operations; and

- managing locked, unvested and undistributed token.

YGG Token Utility

Yield Guild’s native token is YGG, an ERC-20 standard with a 1B maximum supply.

YGG is an ERC-20 token and has several functions:

- Rewards: YGG is distributed as in-game rewards to the community of play-to-earn gamers or for activities. (For example, Axie Infinity players can earn YGG for winning battles.)

- Producing revenue: YGG holders can share in the revenue from the rental or sale of YGG-owned NFT assets for a mark-up. (For example, renting Axies to players as part of a profit-sharing model.)

- Payment: Used to pay for services in its network.

- Governance: Holders can vote and participate in the YGG DAO. Governance issues to be voted upon by YGG DAO members will revolve around technology implementations, products and projects, YGG distribution, and governance structure.

- Staking: YGG holders can stake their YGG in vaults, allowing them to invest in the success of specific components of the guild’s revenue stream. For example, holders who want exposure to revenue from Axie’s breeding program can stake YGG in a vault created specifically for that purpose.

Staking YGG also provides exclusivity perks surrounding things like content and merchandise.

Guild members can earn YGG by:

- airdrops;

- bonus rewards for game winners;

- level-up and loyalty rewards;

- rewards for contributions to DAO management; or

- staking rewards.

YGG was distributed as follows: community (43%), investors (24.9%), founders (15%), treasury (13.3%) and advisors (1.85%).

Vesting:

- Founders: 2-year lock-up, YGG is then vested linearly for another 3 years.

- Advisors: Advisors have a 1-year lock-up.

- Investors (Seed & Series A): Seed investors have 20% of their YGG released upon launch, with the remainder subjected to a 1-year lock-up. After this period, their YGG vests linearly for 1 year.

Collective Shift Analysis

To see Collective Shift’s analysis, sign up for our membership!