Avalanche avax

Summary

Avalanche is a layer-1 smart contract platform for launching decentralised applications (dApps) in one flexible ecosystem—similar to blockchains like Ethereum and Solana—and is designed to be high-performing, scalable and flexible.

Distinguishing it from other blockchains, Avalanche is focused on asset tokenisation and gaming. It also has an emphasis on regulatory compliance. Optionality for developers is another core value of Avalanche, as underscored by the sheer customisability of subnets.

Avalanche provides near-instant transaction finality and uses proof of stake (PoS) to secure the network. It held its mainnet launch in Sep. 2020 and is open source.

Currently, Avalanche can process up to 4,500 transactions per second (TPS)—although this depends on which chain you’re using. Unlike Bitcoin or Ethereum, it has a network of many diverse blockchains and validators (known as subnets).

Avalanche was conceptualised in 2018 by Emin Gün Sirer and a team of Cornell researchers, and is now developed by Ava Labs and the Avalanche Foundation (the Team).

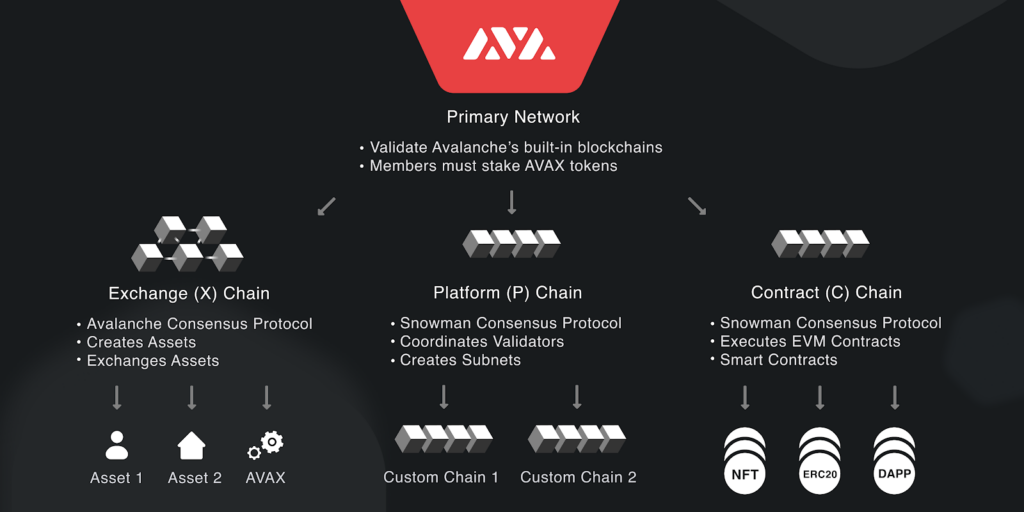

Avalanche is unique as it has 3 different chains to use:

- P (Staking): The platform chain focuses on staking AVAX via being a validator or delegator.

- X (Transfers): The exchange chain sends and receives funds. It has an ‘X-avax’ address with fixed transaction fees of 0.001 AVAX.

- C (Smart contract): The smart contract chain allows users to connect to DeFi dApps. It uses an Ethereum or EVM-compatible ‘0x’ address which you can add to MetaMask.

Avalanche differentiates itself from other smart contracts in two ways: the protocol’s consensus formula and the use of subnets.

- Consensus: Uses a unique consensus algorithm called Snowball Consensus, claiming to be significantly faster and more scalable than other consensus mechanisms.

- Subnets: Allows for connected blockchains to exist in parallel. Assets can seamlessly transfer between subnets overcoming the composability and fractionalised liquidity constraints of roll-ups.

AVAX Token Utility

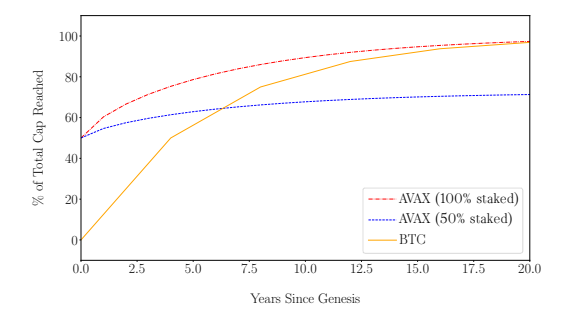

Avalanche’s native token is AVAX which has a maximum total supply of 720M (although the rate AXAX is minted can be changed).

AVAX has four primary use cases

- Pay for fees: Transaction fees on the network are paid in AVAX.

- Staking: Users can set up a validator or delegate their AVAX to stake and earn rewards as passive income. Nodes must stake AVAX (2,000) to show that they have some ownership in the system.

- Basic unit of account: Used as a unit of account between the multiple subnets created on Avalanche.

- Protocol changes and utility: AVAX users govern how fast new coins are minted—via voting to adjust the amount of AVAX paid as a reward for adding new blocks.

Avalanche is used for NFTs, DeFi and DAOs—any new digital assets and sub-networks require AVAX.

Token burning

Transactions fees on Avalanche are permanently burned, instead of going to miners or validators.

Collective Shift Analysis

To see Collective Shift’s analysis, sign up for our membership!