Arweave ar

Collective Shift Analysis

To see Collective Shift’s analysis, sign up for our membership!

Conclusion

Arweave continues to shine as one of the only cryptocurrency protocols to have found real market fit with strong developer activity, consistent demand data storage and transaction growth. Its upcoming new network, AO, is a significant catalyst to scale Arweave’s network further and enter into supporting new applications and use cases. The biggest challenge for Arweave is a split with its most prominent builder, Irys, and increasing competition from applications built on lower-cost networks such as Solana.

Overall, we expect Arweave to continue becoming a vital infrastructure layer in the crypto economy.

Bullish

Catalysts abound—launching a new network

In February, Arweave launched a new AO network on public testnet. AO is a new blockchain network designed to offer scalability improvements built on the existing Arweave network, unlocking new use cases that require high transaction throughput (e.g. AI, social media). They aim for a public mainnet launch sometime this year, providing Arweave with a major catalyst as we enter the Bitcoin Halving.

Genuine market fit & activity

Despite leading web2 social media companies such as Instagram and Facebook discontinuing their NFT services (which used Arweave), overall transactions and data stored on Arweave have grown.

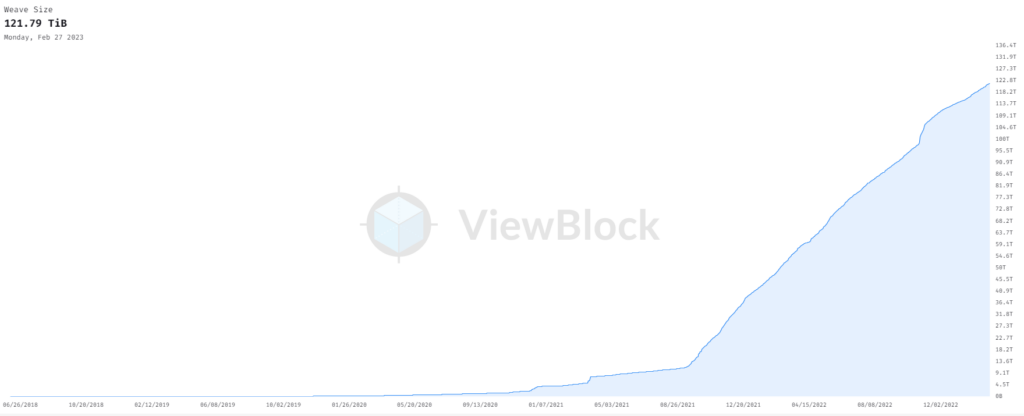

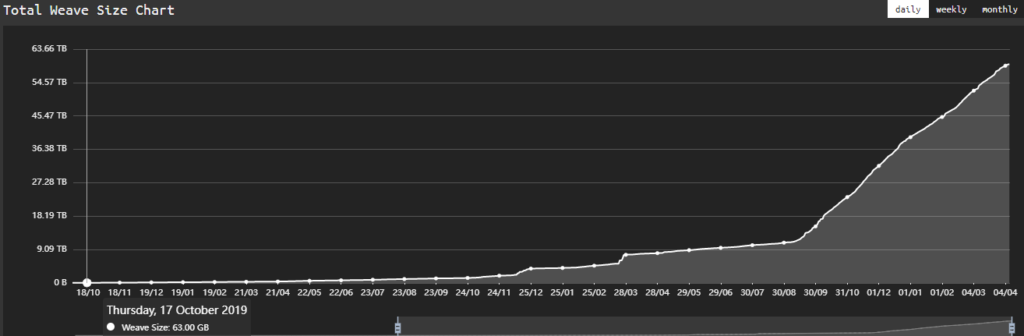

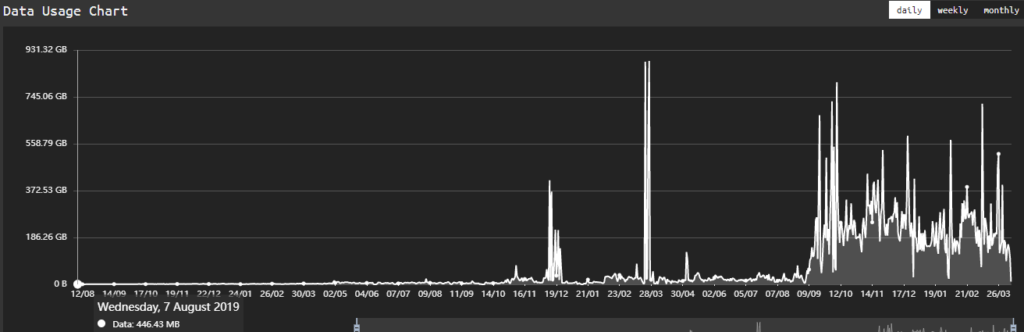

Arweave hit 4 billion total transactions just 31 days after celebrating 3 billion, marking a potential inflection point. The total amount of data stored on Arweave (weave size) continues to rise, increasing by 33% since February 2023.

Developers remain

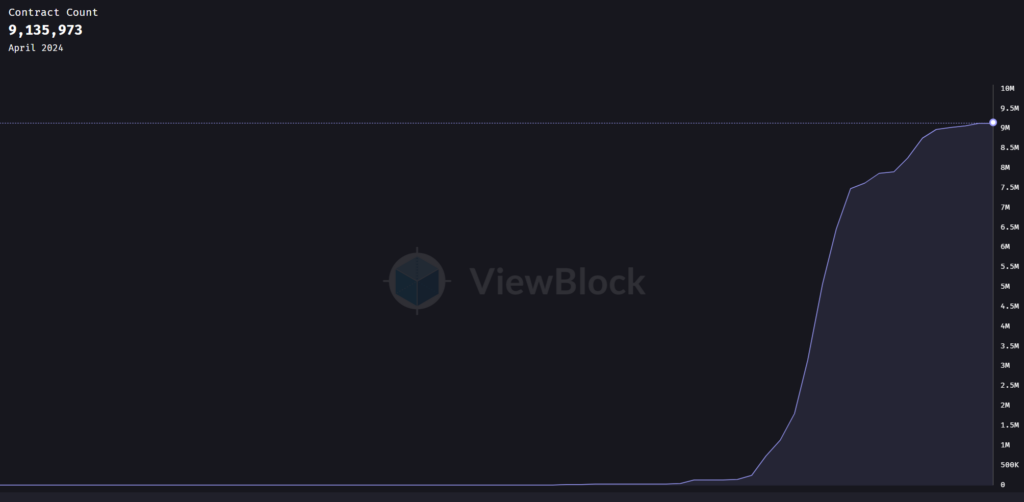

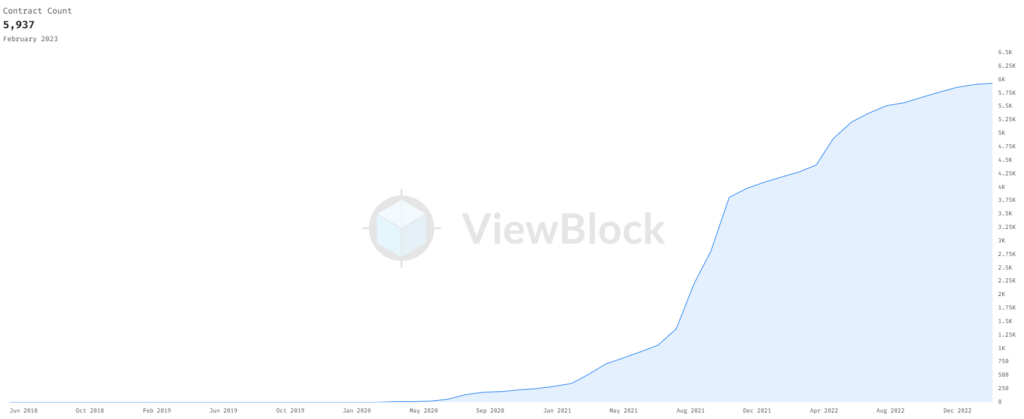

Developers continue building on Arweave. Since our last analysis, the contract count on Arweave increased by 55%. A big focus will be on developer adoption and the ability to harness this developer community on its upcoming AO Network.

Bearish

A fork with its most prominent builder

Arweave’s most popular infrastructure project, Irys, raised eyebrows by publically considering a network fork. Despite the idea being downplayed and Irys recommitting to Arweave, it represents a possible risk, considering Irys routes 75-90% of total Arweave transactions.

Increasing competition

Solana’s largest NFT protocol, Metaplex, released a new standard for inscriptions on Solana. Inscriptions represent a direct competitor to Arweave. Although Arweave remains a leader in onchain storage, it will be a narrative to watch to see if Metaplex engravings challenge Arweave.

Analysed on Apr. 03, 2024

Conclusion

One of the only cryptocurrency protocols to have found real market fit with strong developer, usage and transaction growth. Big names are using Arweave to store data and the continued rise of NFTs makes it an important infrastructure layer in the crypto economy that should continue to grow.

Bullish

Genuine product-market fit

Very few cryptocurrency protocols have found product market fit. Arweave’s permanent storage satisfies a tangible market need for lasting data leveraging public blockchains. The rise of NFTs has been a huge boom for Arweave, and even in a bear market, core metrics such as weave size (data stored on the Arweave) and transactions are growing.

Market fit can be attributed to Arweave’s unique product positioning, solving for permanent storage rather than temporary storage. Filecoin offers a different product more similar to traditional data storage companies like Amazon Web Services.

Prominent names are choosing to store their NFTs on Arweave, such as Instagram and leading web3 blog, Mirror.

Developers building on Arweave

Arweave continues to see strong support from developers building on the platform. Contracts deployed on Arweave increased 41% in the last 12 months during a brutal bear market. One example is Bundlr—a data layer that provides a scalable and performant way to build on Arweave’s lasting storage protocol.

Future growth and increasing scalability

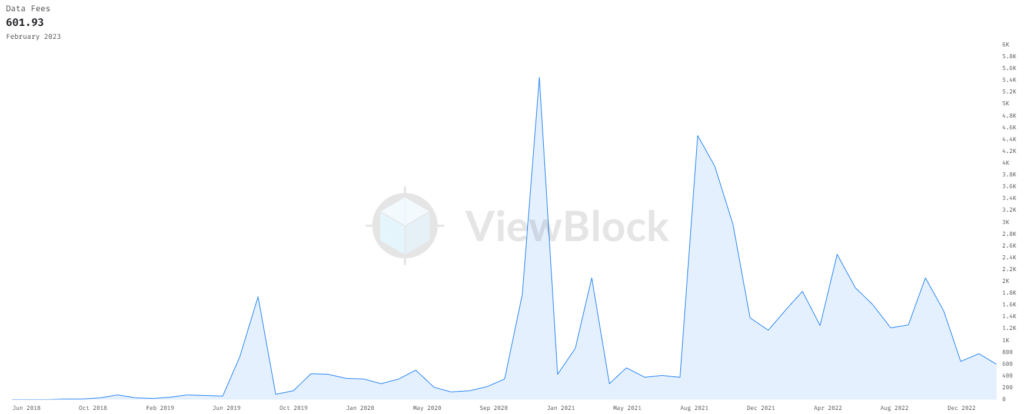

Arweave is poised to capitalise on NFT growth. As mentioned, Instagram chose Arweave for their data storage—if the NFT market continues to grow and become a popular method for preserving or sharing digital content, Arweave will be a huge winner. Arweave hit an all-time high in transactions per second in March 2022, with a near-all-time high in February 2023.

There are positive signs Arweave will continue to scale with scalability protocol Bundlr hitting 50,000 TPS in a test. Given this is only a test and currently, the Bundlr network is centralised, there are plans to open it to the public in the next year.

Bearish

Marketing problem

Arweave may encounter a serious marketing problem, i.e. the confusion over its “pay once, store forever” model. Creators may struggle to understand why they must pay an upfront fee for years of storage in advance, vastly different to pay-as-you-go or subscription-based models.

Ultimately, Arweave could fail if it’s unable to educate users on the benefits of permanent storage of its upfront payment model.

Long-term viability

As mentioned in our earlier analysis, the biggest barrier to Arweave’s success is maintaining its “pay once, store forever” model. It’s unclear whether this will be a viable and sustainable model in the long term, especially as other competitors attempt to take market share away from Arweave and compete in the permanent data storage market.

For example, despite the sustained growth in contracts, transactions and data storage, Arweave hit a near 2-year low for data and transaction fees.

Bullish

Clear market need as NFTs and web3 grow

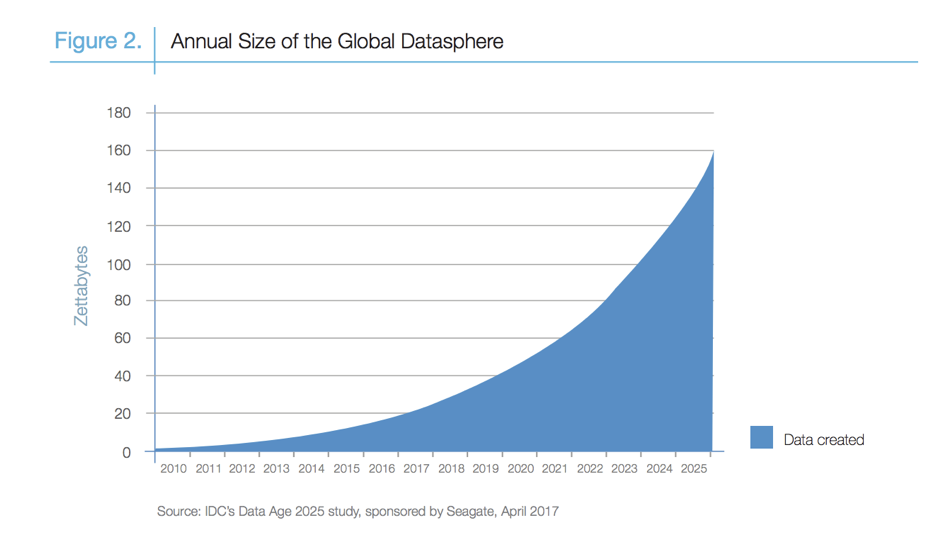

If the NFT market continues expanding, Arweave is primed to benefit. Many NFT creators choose to store their NFTs on Arweave, with web3 playing a significant role in the demand for permanent data storage. In short, decentralised storage is a critical component of the crypto ecosystem.

This has already been seen with a significant spike in data stored since mid-2021. It’s no coincidence the year NFTs arrived, was the year activity broke out on Arweave.

Strong fundamentals—increasing network growth and usage

Arweave has grown considerably across various metrics such as transactions, data usage and the size of data secured via Arweave. This signals immense demand for Arweave’s permanent storage. It shows strong underlying fundamentals behind AR’s price rise and its success to date.

Emerging ecosystem

Arweave’s underlying data storage layer allows users to build dApps on top. There’s strong support via Arweave Grants, the Foundry incubator program and Arweave Boosts (an accelerator program).

This has resulted in significant developers building on the ecosystem—applications built using Arweave storage grew from 35 to 65 in only 3 months to end 2021 (Credit: Allana Levin).

Bearish

Emerging competition

Arweave currently holds a significant market share over the decentralised storage industry.

Filecoin and IPFS (InterPlanetary File System) remain the biggest competitor. They use a “pay-to-use” model whereas Arweave focuses on permanent storage with a one-off fee.

As the NFT and web3 markets grow, greater solutions and data storage options could come to market. (That said, the market for data storage appears extremely large.)

Questions over its token mechanics and long-term viability

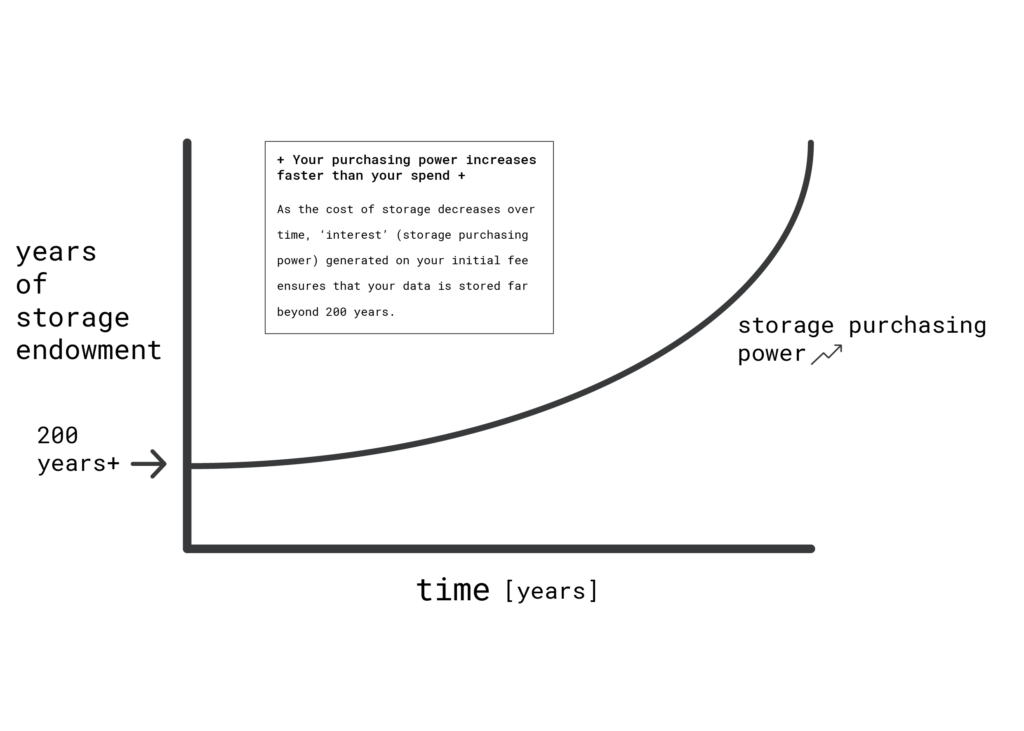

Although Arweave promises “permanent” file storage, this is untested over a medium-term timeframe and with this activity level. A lot hinges on maintaining miners, incentives and its current token design.

Its token mechanisms remain experimental—it remains to be seen how a one-time upfront payment can sustain over the long term, especially as new entrants enter the market. A lot hinges on its storage endowment assumptions.

Questions that remain unanswered:

- (i) Will it be cheaper in the long term than competitors?

- (ii) Will the one-off model compete with subscription-based “pay-to-use” models?

Short-term correlation to NFTs and complexity

AR’s price has grown explosively following strong adoption, from roughly $0.30 at the start of 2020 to roughly $33 at April 2022.

There’s a risk if NFT enthusiasm wanes whether AR could see a short-term reduction in buy pressure (demand for storage). It also remains relatively complex, which could affect AR buy pressure by holders.

Arweave Summary

Arweave is a data storage and infrastructure cog in the growing web3 and crypto ecosystem. Its network allows data to be stored permanently, with a single upfront fee.

Think of Arweave as a permanent data storage provider for web3 and NFTs. Arweave’s gathered quite an extensive ecosystem known as “the permaweb”, where developers can build on top of its data storage layer.

The permaweb is a global, permanent web of pages and applications that live forever.

Arweave was founded in 2017 by Sam Willaims and Williams Jones. It’s similar to other decentralised storage platforms like Filecoin, Storj or Sia—its main differentiator is offering permanent, upfront data storage versus temporary or subscription-based (pay as you go) storage.

The goal

The long-term vision is for secure, accessible, low-cost and permanent data storage. It aims to fix problems such as centralised data control and loss of data (through deletion, lost information or broken links).

It’s targeting the enormous data storage industry, focusing on cheap, distributed, permanent data storage using blockchain and crypto-native incentives.

How does it work?

Arweave connects users with excessive storage spaces to users looking to store data, rewarding hosts with a native token, AR. It provides permanent storage through a blockchain-like network called the ‘blockweave’. Developers can build apps on this network that users can access. (More on Arweave’s technology.)

But how? Arweave’s data storage is backed by an economic model where this one-time upfront payment is given to those that offer hard drive space so that they can profit from their storage contributions.

Essentially, you pay upfront to store your data on Arweave for 200 years of storage. Arweave estimates storing a megabyte for 200 years only costs $0.005.

Ecosystem

Allowing dApps to build on Arweave has created a booming ecosystem of data and apps.

Arweave regularly holds hackathons and incubators—the team recently ran its third incubator program ‘Open Web Foundry‘. So far, $1.25M in seed investments has been rewarded.

AR Token Utility

Arweave is powered by its native utility token, AR, which has a maximum supply of 66M.

AR has 3 core use cases:

- Transactions fees: Transactions are paid and denominated in AR.

- AR is also used to pay out revenue through Profit Sharing Communities, allowing people to earn money by building websites and apps on Arweave.

- Miner reward: AR is paid to miners to indefinitely store the network’s data.

- Moderation: Miners can implement content policies by selecting which blocks (storage data) they wish to store.