Layer 2s (L2s) are essential to Ethereum’s growth and scalability. We’re beginning to get a glimpse into Ethereum’s future, where new users may not use Ethereum directly, and its role as a core settlement and security layer increases.

Key Takeaways

- Ethereum L2s are becoming an increasingly large source of demand for Ethereum gas and block space.

- It’s an insight into what the future of Ethereum may look like.

- Most new users entering the space into 2024 likely won’t use the main Ethereum chain directly.

- This trend should only continue as more Ethereum-like networks go live.

Ethereum L2s Continue To Demand Ethereum Blockspace

Blockspace, gas and L2s are all relatively confusing to understand for most. But they’re critical to understanding Ethereum’s value and future.

Let’s break it down as simply as possible because if you’re a holder of ETH, this directly impacts you.

Blockspace is the space on a blockchain that can run code or store data. It is the product the Ethereum blockchain sells, and ETH is the economic incentive to run the chain, the token to pay fees or perform actions on the network.

- For example, an NFT project may choose to secure its artwork and tokens on Ethereum; an individual may secure a large trade, and an application deploys its contracts or value on the network.

It’s important because who wants Ethereum blockspace is critical to valuing ETH and its success in the long run.

In the past, applications, projects and users were major demanders of blockspace. My initial hunch was we’re going to see L2s start to become big gas spenders on Ethereum, and recent data is proving this to be true.

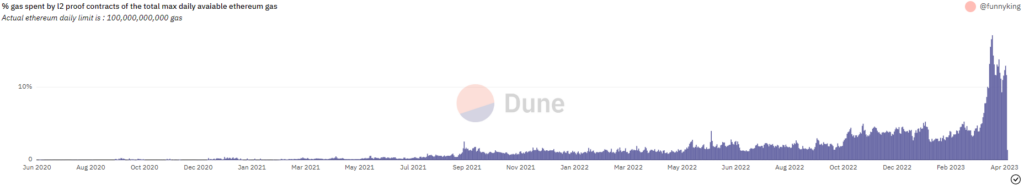

L2 gas usage is spiking and becoming big gas spenders, hitting a high of ~18% of total Ethereum gas in its most considerable uptick ever. It’s worth noting the high level remains even after the spike due to the Arbitrum airdrop.

% gas spent by L2 proof contracts of the total max daily available Ethereum gas (Source:Dune)

% gas spent by L2 proof contracts of the total max daily available Ethereum gas (Source:Dune)Why does it matter?

This trend is an insight into what the future of Ethereum may look like. L2 networks and scaling solutions are becoming large customers of Ethereum security, demanders of blockspace and total gas consumption.

New users entering the space in 2023 and especially 2024 likely won’t use Ethereum L1, and smaller users may not even know they’re using Ethereum at all. It’s a potential insight into the bull case for Ethereum as it becomes a core settlement and security layer.

The future

Although this trend may decrease in the short term with upcoming fixes such as EIP-4844 (reducing the cost to settle back to Ethereum L1, thus lowering gas spent), over the long term, we could continue to see L2s become some of the highest demanders of Ethereum blockspace.

Let’s also remember there are still significant Ethereum-like networks yet to go live, such as:

- Starknet is yet to gain any meaningful adoption as it awaits major upgrades.

- zkSync Era and Polygon’s zkEVM are only now launching.

- Coinbase’s ‘Base’ L2 is only in testnet.

- Various other scaling solutions, such as Linea from Consensys (the company behind MetaMask), remain in testnet.

Of course, whether these L2s can accrue value is still debated. I’ll explore this in an upcoming post.