Spot Bitcoin ETFs have been a hot topic all year, but what exactly do they mean? Is it just hot air, or is the hype justified?

I dive into how an approval could impact the market, how it could play out in the short term, and why the hype could be justified in the long term.

Key Takeaways

- SEC’s Recent Move: The SEC postponed the ETF applications to January 10, 2024. However, record pressure is being applied by the courts and politicians.

- Short-Term Projections: Objectively, a restrained rally post-approval seems probable, but let’s not forget these things tend to follow a “buy the rumour, sell the news” dynamic. The most probable could be a combination of both followed by gradual accumulation.

- Long-Term Implications: The Bitcoin ETF is not just a passing trend, and the hype appears legitimate for several reasons:

- Simplifies the process for mainstream exposure.

- Allows exposure via traditional players

- Positions ETFs as crucial players through consistent and new capital inflows.

- Underscores Bitcoin’s status as a recognised asset class.

Contents

Rewind: Delayed But Inevitable?

The market got very excited by the entry of BlackRock in the Bitcoin spot ETF race in June.

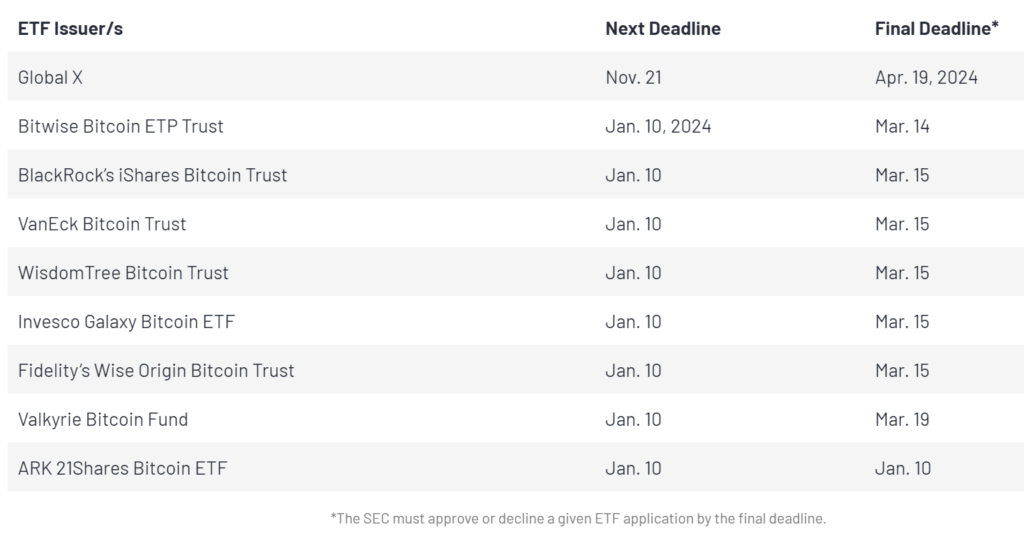

However, we remain in limbo as the SEC continues to push back a decision, this time with a new deadline of Jan. 10, 2024.

Read: BlackRock’s Proposed Bitcoin ETF & Why Investors Need To Know About It

Spot Bitcoin ETF deadlines

Spot Bitcoin ETF deadlinesDespite the delays, there’s growing optimism. Odds of a Bitcoin spot ETF in the U.S. remain very high.

- Two Bloomberg ETF analysts expect a 70% chance this year that a spot ETF will be approved and a 95% chance by 2024.

- U.S. politicians strongly advised the SEC to approve the product “immediately.”

- An ex-BlackRock Director said it could come in the next “3 to 6 months.”

How Could It Play Out In The Short-Term?

One of the most pressing questions remains ‘what could happen in the lead-up to an approval?’.

Although I do not possess a crystal ball, it’s always fun to speculate on a few short-term scenarios on how it could play out.

Scenario 1: Approval leads to a short-term rally | Highly likely

It would mean big asset managers like BlackRock getting approval and Grayscale, the creators of the largest Bitcoin Trust (holding ~3% of all BTC), could be converted into an ETF.

It’s difficult not to see this triggering an initial price rally—Bitcoin will be all over the news, and large asset managers will be doing national TV interviews.

It’s worth noting that previous price pumps (SEC vs Ripple Labs ruling, BlackRock ETF application announcement) saw their rally short-lived as buyer apathy took hold.

Scenario 2: Sell-off on listing date | Likely

We could see the approval being positive on price; however, there is a scenario of a “sell-the-news”, when the ETF goes live.

Historically, this has been the case, for example, if we look at the muted Ethereum Futures ETFs, which went live this week.

Scenario 3: It’s all a sell-the-news event | Less Likely

Due to the widespread expectation of approval, it could all be a sell-the-news event.

Scenario 4: Limited impact on price but gradual accumulation, ETFs become massive net accumulators of Bitcoin | Most likely

My most probable scenario is the real price impacts on Bitcoin not being revealed until months after the ETFs have gone live.

We could see a rally on approval, but as a growing majority believe approval is evitable, one has to wonder how much is priced in and will move the market on launch.

Large amounts of BTC could be scoped up by ETF issuers, and combined with halving, it could impact Bitcoin price later on.

Scenario 5: No ETFs approved |Least likely

Of course, we must consider all the possibilities, one being that the ETF never comes. A failure to get an ETF could be a massive hit to legitimacy.

Impact In The Long-Term: Why The Hype Is Justified

The most important question remains the long-term impacts.

I believe the hype is justified for a few reasons.

#1 Makes it easy for anyone to get exposure

Bitcoin is not easy to hold. Easily getting Bitcoin exposure via a traditional ETF removes store risks, trusting dubious exchanges and knowing how to use it.

A 2021 Grayscale survey found 77% of U.S. investors would be more likely to invest in Bitcoin if an ETF existed.

#2 Allows exposure via traditional players

Many will only trust traditional ETF products or issuers such as BlackRock or Fidelity.

The ETF is the formay in which the boomers and the financial advisors prefer their investments delivered in. And this matters because financial advisors manage about $30 trillion in assets.

Bloomberg ETF analyst Eric Balchunas via Cointelegraph

#3 Net accumulators & bringing in new money

We could see ETF issuers being the largest holders of Bitcoin, increasing the high 3.5% of all BTC held in exchange-like traded products (of which Grayscale holds ~3%).

Take it with a grain of salt, but estimations expect spot ETFs to bring substantial new money.

| Amount | Who? | Rationale (Claim) |

| $300B | Mark Yusko (CEO of Morgan Creek Capital Management) | Provides a bridge for institutional investors to confidently enter the market, labelling “Institutional investors have been cautious about entering the crypto space due to regulatory uncertainties and concerns about custody.” |

| $200B | Steven Schoenfield (Ex BlackRock Director and CEO of MarketVector Indexes) | Substantial value flowing into “investment products in the short-term” that might “double or triple the amount of [assets under management] in current bitcoin products”. |

| $150B | Eric Balchunas (Bloomberg ETF analyst) | $30T worth of capital is managed by U.S financial advisors—if 0.5-1% is allocated to Bitcoin, this equates to ~$150-$300B. |

| $55B | Matthew Hougan (Bitwise Asset Management CIO) | The estimate is based on the performance of bitcoin ETFs in other markets. |

| $30B | Crypto trading firm NYDIG | Cited (i) brand recognition, (ii) simplicity of position & tax reporting, and (iii) familiarity as core reasons for large inflows. |

How much money will flow into Bitcoin ETFs?#4 Symbolic

Many forget Bitcoin was only a fringe concept that is now getting accepted as an alternative asset by the world’s payment leaders, investment firms and companies.

The spot ETF puts a flag in the ground as a milestone for its acceptance—it’s easy to forget it was only six years ago BlackRock CEO Larry Fink called Bitcoin an “index of money laundering.”