Celestia tia

Collective Shift Analysis

To see Collective Shift’s analysis, sign up for our membership!

Celestia Summary

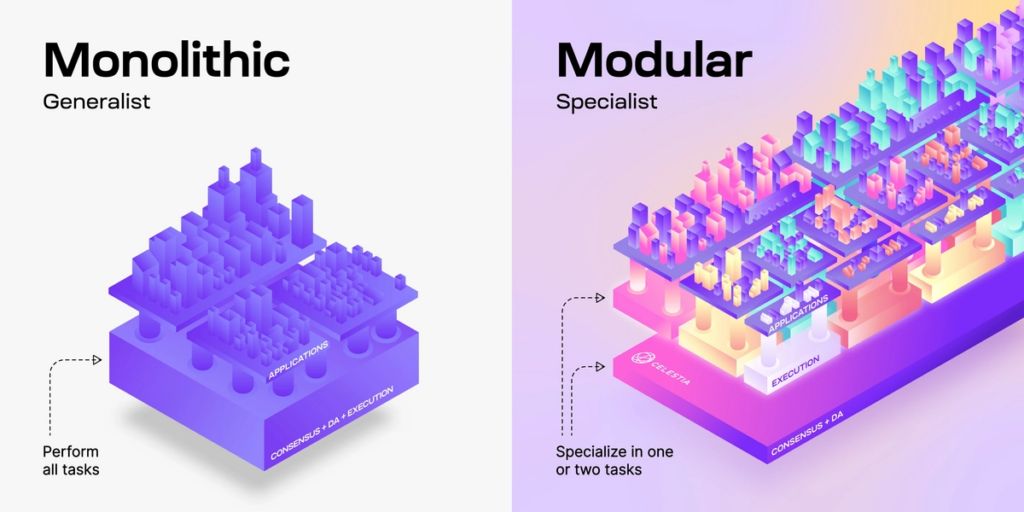

Celestia is one of the first examples of a modular blockchain, specialising in data availability (DA) and consensus. Modular blockchains are distinct from monolithic or integrated blockchains (e.g. Solana, Sui), which are designed to perform all the essential functions traditionally associated with a blockchain.

How Celestia Works

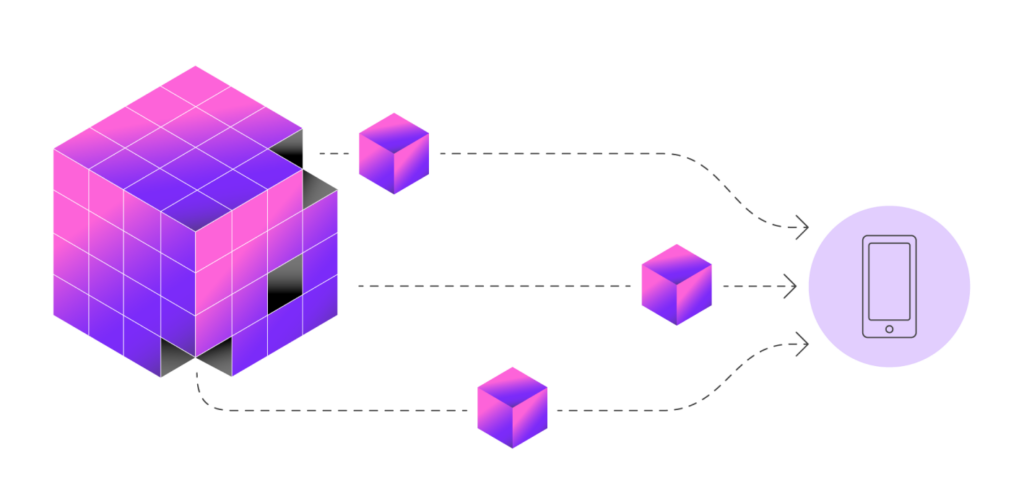

Celestia’s secret sauce is data availability sampling (DAS), a mechanism that allows anyone (i.e. light nodes) to efficiently inspect and verify the ledger of transactions secured by Celestia. Crucially, as the network of light nodes expands, Celestia’s capacity to handle data increases.

Why does any of this matter? Celestia aims to solve the scalability challenges that blockchains have long endured. It attempts to do this by providing DA that is orders of magnitude cheaper than legacy options.

“Celestia is a very simple blockchain. All it does is allows developers to push blobs of data through it. That’s basically its only use case. Arbitrary data is posted to Celestia, and Celestia’s job is to make sure that data is ordered in relation to other data, and to make sure that data is verifiably published to the entire internet.”

– Mustafa Al-Bassam (CEO & Co-Founder, Celestia Labs)

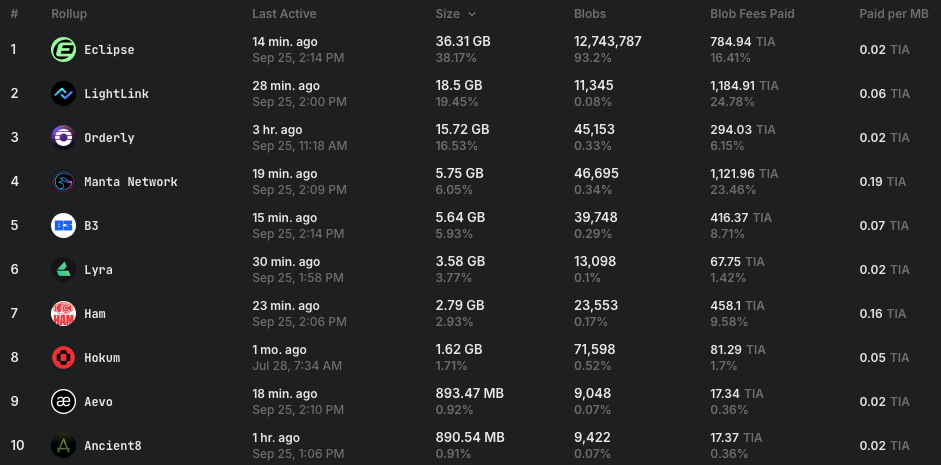

Target users of Celestia’s DA network are developers of rollups or other modular blockchains. Importantly, Celestia can support any type of rollup, regardless of its execution environment (e.g. EVM, SVM, MoveVM) or smart-contract language (e.g. Solidity, Move).

TIA Token Utility

Celestia’s native token is TIA, which has a total supply of 1 billion. The token generation event (TGE) for TIA was on October 31, 2023.

Use cases for TIA are as follows:

- Paying for blobspace: To publish data to Celestia’s blobspace, rollups must pay the transaction fee with TIA.

- Securing the network: Because Celestia is a proof-of-stake blockchain, validators must stake a certain amount of TIA to participate in consensus. TIA holders can delegate their TIA to a Celestia validator for a portion of their validator’s staking rewards.

- Paying for gas on other rollups: Developers can choose to make TIA the gas token for their rollups. While this can simplify the construction of a rollup, it also introduces various challenges. (More on this in our member-only analysis above.)

- Contributing to governance: TIA holders and stakers can propose and vote on governance proposals to change a subset of network parameters (e.g. Celestia’s block size). They can also vote to spend TIA from the community pool, which receives 2% of all Celestia block rewards.

Also, as per Celestia’s FAQ page and roadmap, a fee-burn mechanism similar to Ethereum’s EIP-1559 will eventually be put forward in a governance proposal. (That is, a mechanism where a portion of the TIA used to pay for transactions will effectively be deleted, lowering the supply of TIA.)

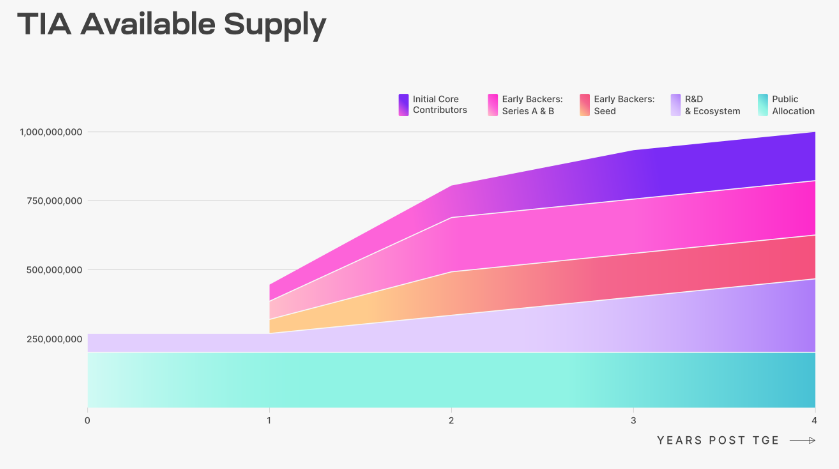

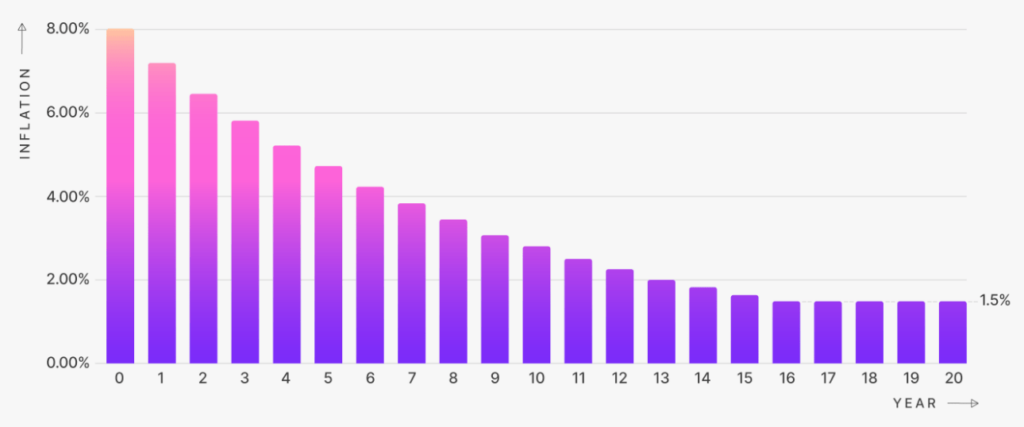

TIA inflation schedule

The annual inflation rate of TIA is 8.0% for the first year following the TGE. It then decreases by 10% per year until reaching an annual inflation floor of 1.5%.

Allocation of TIA

Below is a table that shows the five categories to which TIA was allocated at launch and their respective unlock schedules.

| Category (initial % allocation) | Unlock schedule |

|---|---|

| Public: Genesis drop and incentivised testnet (7.4%) | Fully unlocked at launch. |

| Public: Future initiatives (12.6%) | Fully unlocked at launch. |

| R&D and ecosystem (26.8%) | 25% unlocked at launch, with the remaining 75% unlocking linearly from years 1–4. |

| Initial core contributors (17.6%) | 33% unlocked at year 1, with the remaining 67% unlocking linearly from years 1–3. |

| Seed investors (15.9%) | 33% unlocked at year 1, with the remaining 67% unlocking linearly from years 1–2. |

| Series A and B investors (17.6%) | 33% unlocked at year 1, with the remaining 67% unlocking linearly from years 1–2. |