For years, we were told triple-figure bitcoin would come once the institutions arrived. Well, they’re here, and Bitcoin is inches away from $100,000!

I dive into the recent wave of Bitcoin purchases driving demand, which could be set to continue 👇

MicroStrategy Make Biggest Ever Buy

MicroStrategy acquired another 51,780 BTC for $4.6B.

And they’re doubling down. Earlier in the month, they shared an ambitious plan to purchase more bitcoin faster than ever before.

Sharing The Playbook

Not only is MicroStrategy accumulating Bitcoin at an unprecedented scale, but they’re helping others follow suit.

For example, Chairman Michael Saylor is helping Rumble CEO to add BTC to its balance sheet.

And he is not stopping there. He will meet with the Microsoft board next month to present why they should add BTC to their balance sheet.

We’re seeing a wave of companies purchasing bitcoin for their treasuries in November alone:

- Metaplanet bought $11.3M worth of BTC, bringing its total to 1,142.

- Semler Scientific acquired another 215 BTC between Nov. 6 and Nov. 15. It now holds 1,273 bitcoins.

- Hoth Therapeutics allocated $1M to bitcoin.

- Solidion Technology committed last week to use 60% of its excess cash from operations to buy BTC.

- Nano Labs announced it will allocate some excess liquidity to bitcoin as a strategic reserve asset.

- Cosmos Health shared it will add BTC and ETH as treasury reserve assets.

- Genius Group adopted BTC as a reserve asset, buying $10M in BTC.

- Marathon Digital announced a $850M convertible note, partially to buy more BTC.

Public and private companies now own almost 4% of the Bitcoin supply, up from 1.68% in June 2021.

Simply, institutional interest in Bitcoin has never been higher.

The exciting part? We have no idea how many more private companies are buying bitcoin but are keeping it to themselves.

Will Nation-States Be Next?

We have already seen countries like El Salvador and the Kingdom of Bhutan get involved, but who is next?

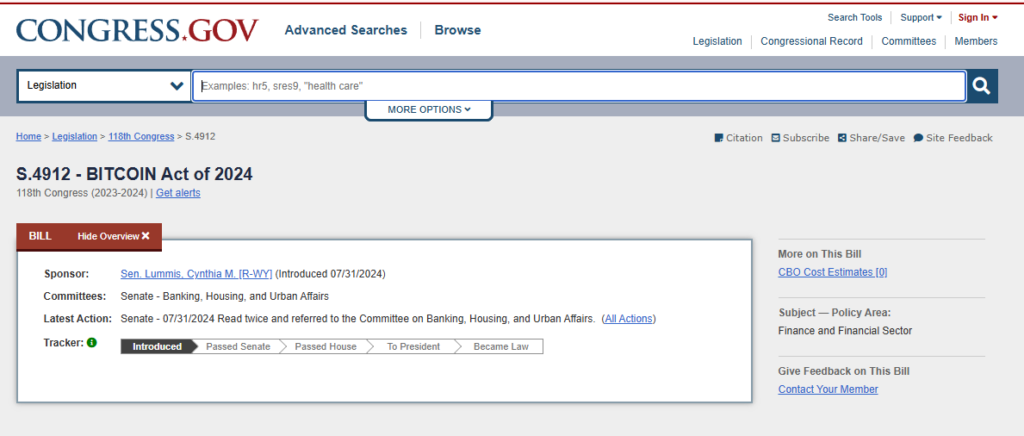

This week, U.S. Senator Cynthia Lummis introduced the Bitcoin Act 2024 to Congress.

The bill would create a strategic Bitcoin reserve to acquire 5% of the total Bitcoin supply—1 million BTC—to be held for 20 years. In part, it would swap part of its gold reserve into BTC.

But How Realistic Is It?

The U.S government buying BTC would no doubt be the biggest event in Bitcoin’s 15-year history.

It would cause a bitcoin arms race—if this happens, there is no limit to the mania that would follow.

We would love to see this happen, but the odds remain fairly slim. There seem to be too many other important focuses than a Bitcoin Reserve, and it isn’t clear why the U.S. would endorse a competitor to the dollar.

Businesses Are Buying BTC Faster Than Ever

Only 450 BTC are mined per day, and demand is far outstripping supply. This trend looks set to continue in the short term into 2025.