Cardano ada

Collective Shift Analysis

To see Collective Shift’s analysis, sign up for our membership!

Cardano Summary

Cardano is a proof-of-stake (PoS) smart-contract blockchain. It uses a similar PoS mechanism to Ethereum called Ourobors, allowing users to stake ADA and earn rewards for securing the network.

What makes Cardano different to other blockchains is its focus on academic peer review, with all major changes undergoing peer review and heavy academic critique.

Cardano, like other blockchains such as Ethereum or Solana, is used as a general-purpose network to allow anyone to host applications or secure value.

History: Cardano was founded in 2015 by Charles Hoskinson, a founding member of Ethereum. Hoskinson founded 3 entities that receive ADA to develop and fund the ecosystem: Cardano Foundation, IOHK and EMURGO.

Roadmap: Cardano follows a 5 step roadmap or “eras” to its initial development.

- Byron: Kickstarted the chain, wallets and ecosystem (Completed)

- Shelley: Beginning of decentralisation (Completed)

- Goguen: Smart contracts activated (Completed)

- Basho: Scaling Cardano (Ongoing)

- Voltaire: Boosting governance (Ongoing)

ADA Token Utility

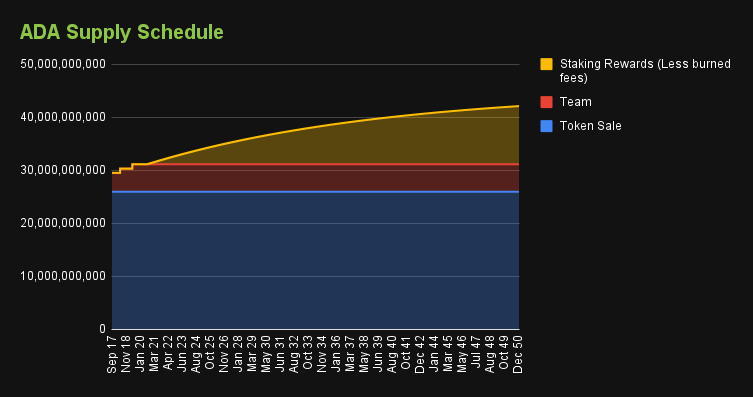

As of writing, the total supply of ADA is 35 billion, with a total and max supply of 45 billion.

ADA has an inflation rate set at 0.3% per epoch (an epoch lasts ~ 5 days)—this works out to ~2% a year.

Rewards to validators come from 2 sources: (i) monetary expansion and (ii) transaction fees. 80% is awarded to validators, with the remaining 20% going to the treasury.

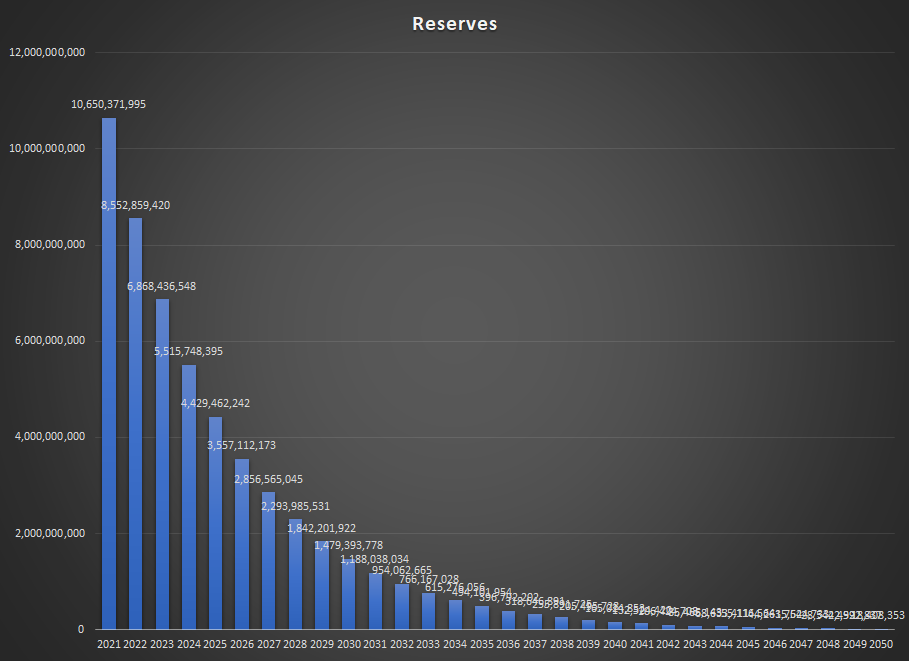

Currently, most staking rewards are paid via ‘Reserve’ tokens set aside; however, this rapidly reduces, and a main source of rewards will be paid via transaction fees.

Token utility

ADA is the native token of Cardano. It has three main sources of utility:

- Fees: ADA is used to pay transaction fees on the network

- Staking: ADA is staked to validators by users to secure the blockchain

- Governance: ADA stakers can participate in on-chain governance or vote on development proposals.

Token allocation and supply schedule

The initial distribution of ADA was:

- 57.60% for the ICO;

- 11.50% for the team; and

- 30.90% for staking rewards.