Alchemix alcx

Summary

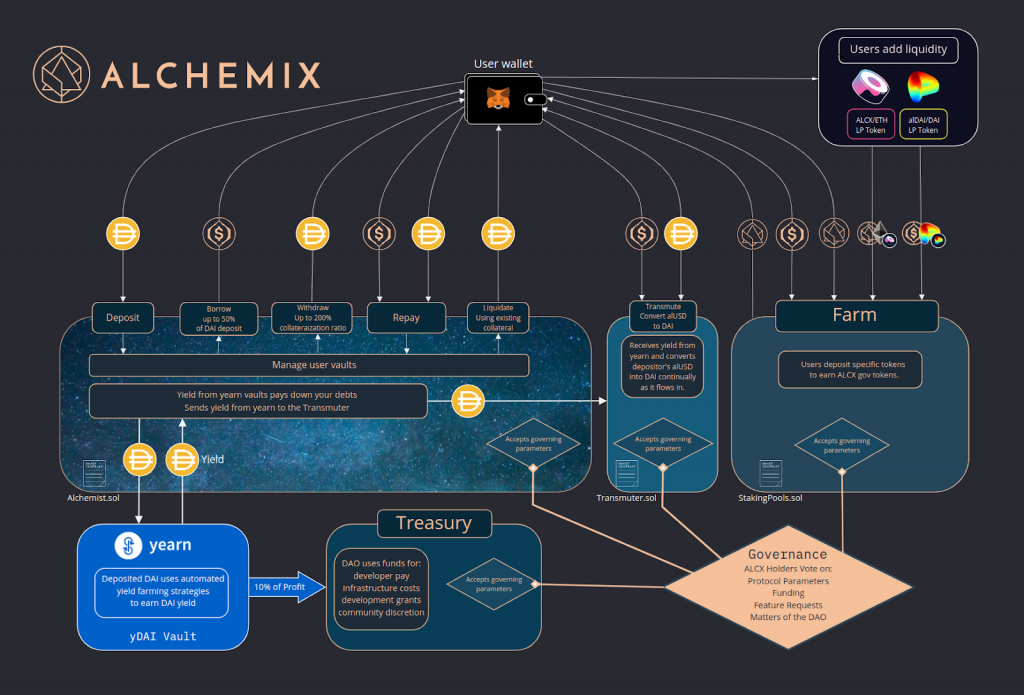

Alchemix Finance (Alchemix) is a DeFi protocol that lets users draw on loans based on future income by earning advances on the future yield of their cryptocurrency. Depositors can get their future yield immediately, contrary to traditional finance where interest is paid periodically. Assets are collateralised by yield with no liquidation risk, providing users with flexible loans that they can gradually repay themselves.

Essentially, the vaults give users a flexible line of credit for their future yield. Users can enter and exit anytime without committing to long lockups. There will never be a liquidation of a user’s collateral unless they do it themselves because your debt will only ever go down.

The core team—which is anonymous and led by developer ‘Scoopy Trooples’—released Alchemix on Feb. 27, 2021.

ALCX Token Utility

Alchemix’s native token is ALCX, which has a total supply of ~1.09M. There is no hard cap, but it does have an emissions schedule, with the overall supply expected to grow to ~2.39M ALCX after 3 years.

ALCX is the governance token for the Alchemix protocol and grants governance rights in Alchemix DAO. These rights are currently very limited.

That said, the team recently outlined their vision for adding utility to ALCX: users who stake it into Alchemix DAO will get cash flow via set cryptocurrencies, meaning ALCX will become a claim on protocol revenue. To earn cash flow, users will need to participate in a ‘Voting Points’ system of governance. ALCX stakers will also be responsible for deciding the amount of ALCX slashed in the event of a protocol loss.

Collective Shift Analysis

To see Collective Shift’s analysis, sign up for our membership!