Aptos apt

Summary

Aptos is a layer-1 blockchain optimised for safety, scalability and upgradability. It launched on Oct. 12, 2022, with a set of 102 validators. The blockchain was built by Aptos Labs (the Team), which was co-founded by a pair of former Meta employees—Mo Shaikh and Avery Ching—who left the company after it abandoned Diem.

Some distinguishing components of Aptos are listed below. (More details in Aptos’ whitepaper and developer documentation.)

- AptosBFT is the consensus algorithm of the Aptos network. It is based on HotStuff and further optimised.

- BullShark is an algorithm used in Aptos’ consensus protocol. Detailed in Spiegelman’s 12-tweet thread, this paper and this research seminar. (Whilst other blockchains are implementing BullShark, Aptos is among the first to do so.)

- Block-STM is a parallel execution engine for smart contracts. Detailed in this blog post and this paper.

- Move is the programming language that implements all the transactions on the Aptos blockchain. It is open-source and inspired by Rust.

“Aptos is inherently designed to address today’s key challenges around mainstream Web3 adoption. Our goal is to deliver the most performant, production-ready blockchain through a flexible, modular architecture designed for people-first usability and engineered to upgrade and evolve.” – Shaikh

The Team announced in Jul. 2022 that it raised $150M in a Series A round. In September, Binance Labs announced a follow-on investment in the Team at a valuation reportedly quadruple that of the Series A.

APT Token Utility

Aptos has an eponymous native token with the ticker APT. Initially, the total supply APT was 1 billion. APT is used for network fees, validator staking and governance. (The Team said on Oct. 17 that “a more comprehensive explanation of Aptos tokenomics and values is coming soon.)

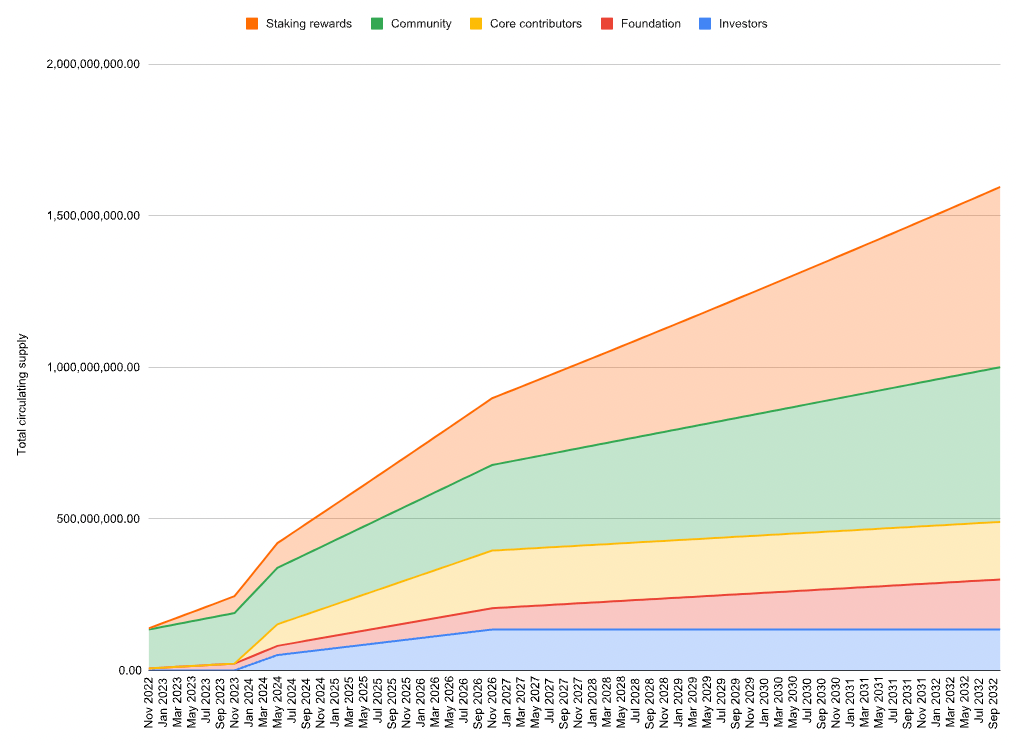

APT is distributed as follows: community (51.02%), core contributors (19.00%), the Aptos Foundation (the Foundation) (16.50%) and investors (13.48%). All investors and current core contributors are subject to a 4-year vesting schedule with a 1-year cliff.

Staking rewards earned by locked APT holders are liquid; a widespread critique covered further in our analysis below.

Collective Shift Analysis

To see Collective Shift’s analysis, sign up for our membership!