Amid Bitcoin’s halving buzz and ETF anticipation, the Lightning Network continues to quietly revolutionise the Bitcoin ecosystem and how bitcoin is used as money. Below, I share an update on the Lightning Network and explain its significance.

Key Takeaways

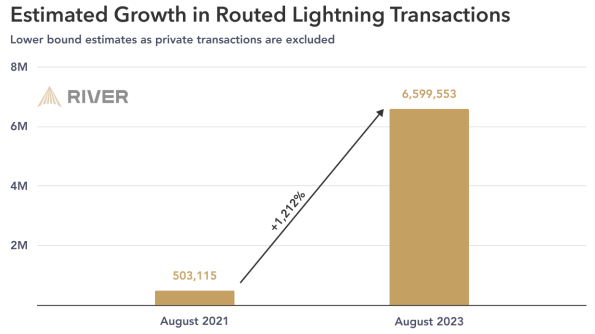

- Lightning Network total payments grew 1,212% over the past two years.

- Plateauing total channels or BTC locked but increasing total transactions indicates nodes are becoming more efficient with their capacity.

- More exchanges are supporting Lightning, helping it overcome long-lasting distribution challenges.

- Companies such as Lightspark are abstracting away the complexity of supporting Lightning.

- One major catalyst for 2024 is the full rollout of stablecoin assets created by Lightning Labs.

Contents

Lightning Network Continues to Grow

The Lightning Network (LN) continues to advance, particularly in usage and efficiency.

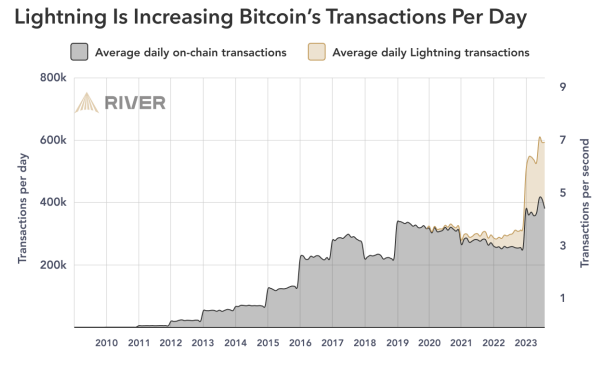

Total payments on Lightning grew by 1,212% over the past two years—a period of heavily deflated prices and general interest in crypto. As per River’s latest Lightning Report, average daily transactions on Lightning accelerated rapidly, hitting 600K for the first time this year.

Lightning Report 2023 (Source: River)

Lightning Report 2023 (Source: River) Lightning Report 2023 (Source: River)

Lightning Report 2023 (Source: River)The number of Lightning nodes, channels, and capacity have held steady over the past year. (Lightning nodes are servers run by participants in the network that allow users to send and receive Lightning payments.)

Plateauing total channels or BTC locked but increasing total transactions indicates that node efficiency is improving.

Overcoming Distribution Hurdles With Increased Support

One significant roadblock to Lightning’s broader acceptance was the sluggish adoption pace among exchanges.

Distribution and support where the users are is critical.

More major exchanges are adding LN support. For example, Binance recently announced Lightning support, and Coinbase promised to roll out support in 2024.

Over the last year, an estimated 250M users now have LN access. This number should surge post-Coinbase integration.

A major part of this increased support is work by two Bitcoin companies, Lightspark and Strike.

Lightspark helping make Lightning easier

Lightspark is simplifying the hurdles for businesses to support Lightning.

Led by early payments pioneer David Marcus, Lightspark’s service abstracts all the complexity from Lightning—such as managing channel creation, set-up, or balancing liquidity—making Lightning easy to use.

One example is last month’s announcement unveiling a new Universal Money Address (UMA) standard. UMA’s make sending a Lightning transaction as easy as sending an email, providing real-time settlement with compliance and foreign exchange capabilities.

Strike building out support

Strike remains another company building Bitcoin-focused tools and Lightning infrastructure.

Strike’s latest update has seen them, slowly but surely, rolling out its services worldwide and increasing its connectivity to the traditional banking system. A few major updates included:

- direct deposits to be paid in Bitcoin;

- supporting wire transfers for U.S. banks; and

- enabling card deposits.

The Stablecoin Opportunity on Lightning

The issuance of stablecoins on Bitcoin and Lightning Network is an emerging frontier. This segment is an enormous opportunity, with over $120B in stablecoins circulating on other blockchains.

Lightning Labs recently launched Taproot Assets on Mainnet for developers, enabling stablecoin assets. It adds a new layer of possibilities to the network and hints at a future where stablecoins might find a home on Bitcoin and Lightning. Expect a full launch and integration with Lightning next year.

Expanding Bitcoin Utility: Back To Its Roots

In a sense, entities like Lightspark, Strike and Lightning Labs are steering Bitcoin back to its foundational ethos, as outlined in the original Bitcoin paper published 15 years ago. In particular, Lightning Labs’ TAP could bolster Bitcoin’s stature not merely as a store of value but also as a medium of exchange.

But how?

Contrary to the common perception of using Bitcoin for everyday purchases, the real potential lies in utilising Bitcoin, particularly satoshis, for settling transactions on Lightning. This shift could see Bitcoin facilitating and settling transactions of other goods on Lightning.

Recap: What Does It All Mean For Bitcoin?

An enormous amount of development is ongoing with the LN, which has significant implications for Bitcoin.

- We could see more adoption of LN through improved distribution, thanks to Lightspark and Strike.

- Bitcoin and LN could capture some of the emerging $120B stablecoin market.

- Increased LN efficiency, adoption and infrastructure could also unlock new use cases.

- The potential for Bitcoin to evolve as a better medium of exchange.

- The undercurrents of LN’s evolution amid the broader crypto dialogue is a narrative worth monitoring.

For more on Lightning, read my previous article, ‘Is Bitcoin’s Lightning Network Development Being Underappreciated?‘