Curve DAO crv

Summary

Curve is an automated market maker (AMM) for swaps between stablecoins and other pegged assets. Unlike a central order book, Curve facilitates trading through pools of crypto-assets provided by users who earn fees through their deposits.

Curve provides a marketplace for stablecoins or other pegged assets with low fees, slippage and competitive yield. Launched in late 2020 by founder Michael Egorov, Curve’s grown to become one of the largest marketplaces for stablecoins and pegged assets.

Its native token CRV can be locked up to 4 years for veCRV, with users receiving increased rewards, fees and voting influence over the platform (see tokenomics).

How Curve works

Curve uses a ‘StableSwap’ mechanism for efficient stablecoin swaps, especially at high volume/cost swaps.

- Focus on stablecoins: Curve focuses on creating markets for stablecoins—such as USDT, DAI or coins pegged against other cryptocurrencies (wBTC).

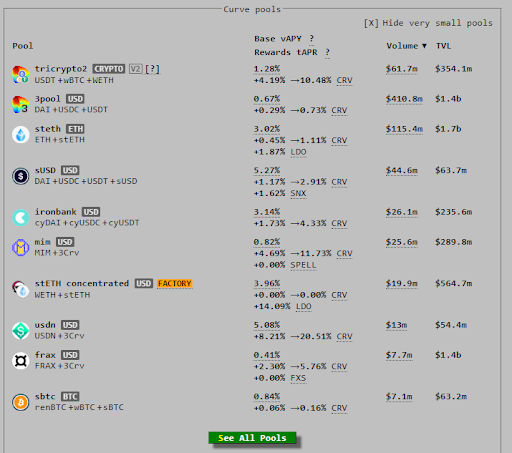

- Variable APY for liquidity providers (LPs): LPs of a trading pool earn a share of the trading fees of the pool and Curve governance token ($CRV) rewards. Token rewards range from a ‘Base’ and ‘Rewards’ APY—there’s greater APY and rewards for those who lock up CRV.

- Changes to Curve with Curve V2: Curve V2 is coming to more pools in the ecosystem—it’s designed to compete with Uniswap and open up the platform to non-pegged stablecoin assets.

How does Curve make money? Curve receives a .04% swap fee on any swap on the platform. This revenue is distributed to:

- 50% to LPs: Those who provide liquidity to the pools.

- 50% to veCRV holders: Users who lock their CRV up receive voting rights and greater rewards.

Ecosystem and relationship with Convex Finance

Convex Finance was designed to overcome the problem of users not being willing to lock their CRV. It works harmoniously with Curve to generate the highest APY on Curve with your CRV.

With Convex Finance, users supply CRV and receive cvxCRV—receiving a greater yield and allowing cvxCRV holders to decide where Convex’s veCRV goes.

As of Mar. 27, Convex Finance has 45% of the veCRV voting power. For more on CRV, veCRV, the Curve Wars and where Convex Finance fits in, watch the below video by Justin Bram.

CRV Token Utility

Curve has a dual-token design: CRV and vote-escrowed CRV (veCRV).

CRV is the native token of Curve. It is an ERC-20 token used primarily for governance and has a maximum supply of 3.3 billion.

Holders can lock their CRV in return for veCRV, which gives them a say in setting the rules on the Curve platform. CRV serves little function by itself and must be locked to reap the full benefits and utility.

veCRV is the token that CRV holders receive when they irreversibly lock some or all of their CRV for a nominated period of 1–4 years. The longer the lock-up, the more veCRV received and therefore more voting power over the protocol.

There are 3 core use cases for veCRV

- More rewards: Receive higher rewards in Curve pools. As more $CRV is locked for veCRV, you unlock a higher reward.

- Fees: veCRV earns 50% of exchange fees.

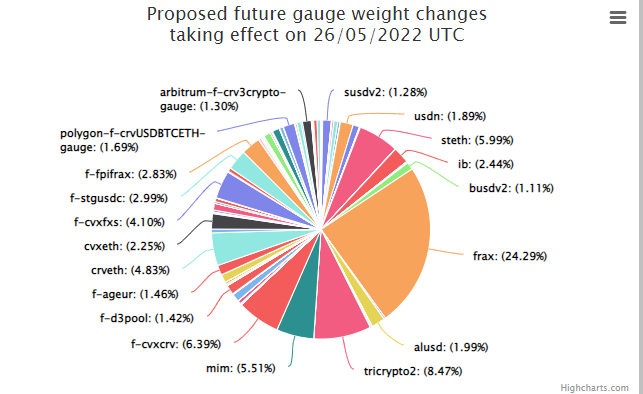

- Voting power (aka Curve Wars): veCRV holders vote on which pools CRV rewards are allocated to. More votes = greater CRV rewards = more liquidity. This is known as the Curve Wars, as more whales and protocols acquire CRV to influence rewards and the protocol.

Below is an example of a weekly change that determines how much CRV each pool gets.

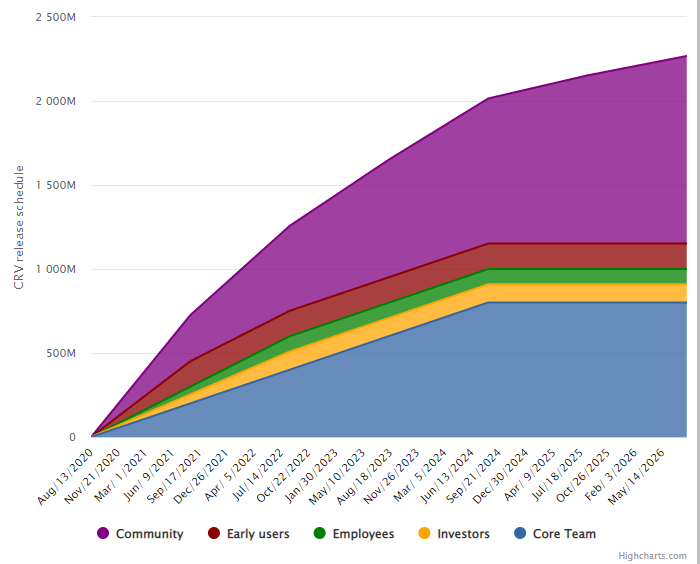

CRV is distributed as follows: Community liquidity providers (62%), team and investors (30%), employees (3%) and community reserve (5%).

The team have a vesting cliff of 2–4 years while employees’ CRV is vested over 2 years. As you can see below, there will be more CRV entering the market in the next couple of years.

Collective Shift Analysis

To see Collective Shift’s analysis, sign up for our membership!