For the long-term investor who is also an active investor, it’s quite natural for one’s portfolio to evolve over time. During the creation of a long-term crypto investment strategy in 2019/2020, NFTs were not on my radar and didn’t play a part in my strategy. Given the growth in crypto in 2020 and 2021, we have seen an increase in investment opportunities in non-Ethereum blockchains and NFTs. People have referred to investments in non-Ethereum assets and NFTs as a “digital land grab”, with investors staking their claim of a blockchain or within an NFT community. This article quickly explores how my thought process has changed from Jan. 2021 and Sep. 2021 based on investments in crypto in 2021.

Broadly I’ve categorised investments into Bitcoin, Ethereum, altcoins and NFTs. This article doesn’t address stablecoins and yield-bearing stablecoins, which are great investment mechanisms that provide far less volatile crypto exposure than the asset categories presented below.

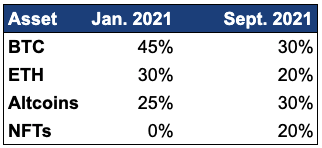

Jan. 2021: Before 2021, my long-term philosophy centred around being a “digital asset accumulator” and a solo venture capitalist (VC), holding a diversified portfolio of cryptocurrencies and blockchain-based investments.

To me, Bitcoin is digital gold, and my strategy is to have it as the largest single investment in my portfolio. Before Jan. 2021, BTC comprised approximately 40% of my portfolio, and if I didn’t enjoy investing in altcoins so much, I probably would have had greater than 50% of my crypto portfolio in Bitcoin.

After Bitcoin, my strategy focused on DeFi and it was evident Ethereum had the largest number of live decentralised applications (dApps), with applications like Compound, MakerDAO, Uniswap, Yearn, Synthetix and Aave providing wonderful non-custodial financial services. The goal was for Ethereum to clearly be the 2nd largest investment in my portfolio, and it accounted for ~30% of my portfolio.

With BTC and ETH secured, the 3rd part of the strategy was accumulating coins/tokens of the best live apps on Ethereum, which included many of the blue-chip DeFi tokens mentioned earlier. Altcoins accounted for ~30% of my portfolio, which is a far higher percentage of one’s portfolio than recommended for most investors.

Sep. 2021: Active investment in crypto throughout 2021 has morphed my portfolio in potentially good and bad ways. Investment allocation has been taken from the largest and safest investments, BTC and ETH, and has been allocated to altcoins and a new category NFTs. Three major reasons for this:

- After Bitcoin crossed $40K in early Jan. 2021, the asset seemed overvalued and the potential upside diminished as compared to other cryptocurrencies.

- The Cambrian explosion of live dApps being launched on non-Ethereum but EVM-compatible blockchains like BSC, Polygon, Fantom, Avalanche, Energy Web Chain, Solana, etc., demonstrated that other blockchains were following Ethereum’s lead and creating DeFi native to their blockchain. As discussed in a prior article, this industry narrative shift also shifted my long-term crypto strategy, as I now wanted to participate and own all major general-purpose layer-1 blockchains.

- And lastly, NFTs became a new category in the portfolio around May 2021 after the release of Bored Ape Yacht Club (BAYC), the continued success of Art Blocks and the creative explosion around NFTs we’ve seen this year. My estimates are that heavier investments in altcoins and NFTs in 2021 as compared to BTC and ETH has seen ~25% of my portfolio being grown into altcoins and NFTs.

Looking forward

- In 2021 I’ve allocated capital away from BTC and ETH, and based on this, my strategy is to resume the accumulation of BTC and ETH using a dollar-cost average approach during market downturn periods.

- The long-term strategy of being a “digital asset accumulator” is the same, it just appears that the types of digital assets being acquired are becoming more complex than simple ERC-20 tokens.

- If the BTC bull-run continues, I’m cautious of a BTC price top in Dec. 2021, and a subsequent crypto market top shortly after. Therefore, as the 2021 year continues, my allocation of disposable income to crypto investments will decrease.

- Do not overinvest into NFTs. As NFTs are denominated in the native token of the blockchain it’s on, investments into NFTs can be seen as a long position in that blockchain’s native token. If you buy an Ethereum NFT, you have continued exposure to ETH through holding that NFT. Based on my portfolio example above, my Sept. 2021 portfolio could be seen as having a 40% position in ETH given I have 20% in ETH and 20% in NFTs (nearly all Ethereum-based NFTs).

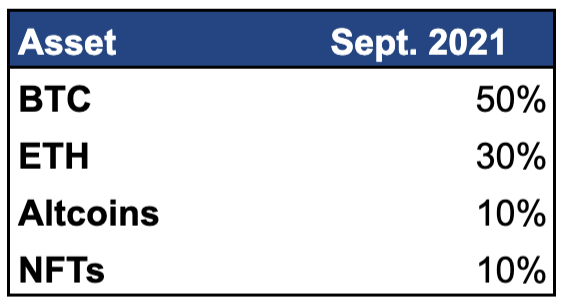

A More Reasonable Portfolio

For a more conservative portfolio, an allocation of 50% BTC, 30% ETH, and 10% for altcoins and NFTs could be a reasonable means of providing exposure to higher risk/higher reward investments responsibly.