November 2021 Inaction Plan 💎 ✋

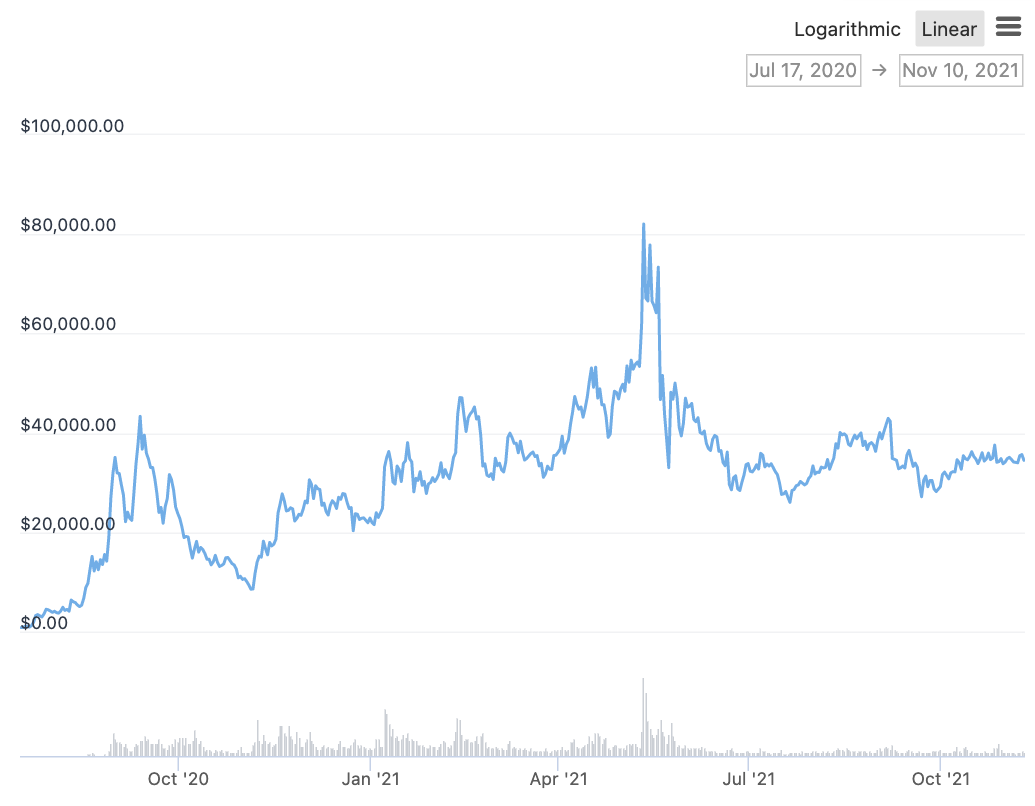

As we enter the last 2 months of 2021, my investment strategy has consciously moved into the “execution phase” of its long-term cycle, given the anticipation of a 2017-repeated blow-off top in price performance for the crypto industry.

Portfolio strategy for November can be summarised as complete inaction on the sell-side and continued decreasing expenditures on the buy-side. With my focus squarely on December and January as the potential peaks of the long-term crypto bull run, it is vitally important to remove November as an option to sell any crypto assets. It’s said that “inaction may be the biggest form of action,” and this is certainly the case for selling crypto in Nov. 2021.

Monday’s ‘On-Chain Analysis’ post by Checkmate on the lengthening of $BTC cycles further strengths this short-term plan of inaction.

DeFi 2.0 💵 💸

The massive growth of “DeFi 2.0” organisation’s has been a welcomed relief for crypto investors from the constant onslaught of NFTs. While much is still being coded, written and understood about DeFi 2.0 mechanics, my reading has broken the innovations into 3 different common mechanics.

- Protocol-controlled liquidity (PCV)

- In DeFi 1.0, liquidity mining was the preferred token distribution mechanism. Tokens were distributed to investors based on the amount of capital staked in each project. The overarching problem is that when token yield for stakers naturally decreases over time, the capital providers move their assets elsewhere, and then the governance token is also now not in the hands of a core set of believers.

- In DeFi 2.0, “Bonding” (the swapping of LP tokens for discounted tokens) and staking is the preferred token distribution mechanism

- PCV is the accumulation of funds by a project from its users to support project growth and applications. The success of OlympusDAO has been heralded to its ability to own its own liquidity pool tokens, and to the percentage of users staking OHM. The DAO owns the majority of its OHM-FRAX LP pool and OHM-DAO LP pool on SushiSwap. Meanwhile, $OHM holders are staking 98% of tokens currently on the platform.

- Increased capital efficiency

- Uniswap V3 introduced the concept of concentrated liquidity, and with it, the ability for investors to earn the same nominal yield, but with less capital deposited. The practical management of concentrated liquidity pools is difficult and expensive on Ethereum, and a new wave of asset management tools targeting concentrated liquidity strategies has appeared.

- Composable Yield Tokens (interest-bearing tokens)

- New projects are utilising interest-bearing tokens (yvYFI, yvUSDC, xSUSHI,…) from DeFi 1.0 platforms and then building to enhance or extend a DeFi 1.0 primitive. One example is Abracadabra Money is a lending market enabling investors to borrow capital using interest-bearing tokens as collateral.

Here is a partial list of DeFi 2.0 projects.

Strong conviction in Yearn Finance 🔵 📈

The Collective Shift team has been discussing our most favourite cryptocurrency, and mine was Yearn Finance ($YFI), which yielded questions from colleagues on “why do you like it so much compared to others?”

Currently valued at $1.2B market cap, $YFI has just recently dropped out of the top 100 cryptocurrencies. As a long-term holder, I’ve noticed a distinct decrease in price volatility in the last month of trading, with the token trading for the majority of the time between $32K–$36K from Oct. 8 to today.

Quantitatively, the organisation is a foundational yield aggregator for DeFi, primarily providing yield on $6.6B in single-sided asset Vaults. Deposited assets typically earn a variable rate between 0% – 15%, with top-performing Vaults sometimes producing Net APYs up to 55% for the highest APY pool at the time of writing. The project seems to continually out-compete other yield aggregators and has deeply integrated Curve Finance $CRV and $veCRV tokens into their yield strategies. Personally, I view Yearn as one of the safest platforms to deposit long-term crypto holdings, a place that unofficially promises a 0%–20% return and a place where I will be happy with a safe 5% – 10%.

Qualitatively, the organisation is one of, if not the best operated decentralised organisation in crypto. They are a gold standard in financial reporting, producing a Quarterly Financial Report (Q2 2021 Report) and through their community built financial dashboard at yfistats.com. YFIstats in my opinion is a glimpse into the future of on-chain financial reporting, and as a former auditor, I’m quite excited by the income statement and balance sheet figures they display by month.

Operationally, the project has incorporated multiple autonomous operations tools including Coordinape, a decentralised grant selection and disbursement model, and keep3r.network, a decentralised keeper network for projects that need external developer operations and for external teams to find keeper jobs for Yearn. Yearn is truly exercising and using the “autonomous” nature of DAOs far more than other decentralised organisations.

Yearn V3 is currently in open beta.

Yearn is currently revisiting their tokenomics through community input.

Zapper Quests & Airdrops 📊 🪂

The success this week of the Ethereum Name Service ($ENS) and its new $ENS token again reminds crypto users of the power of the airdrop. Long-term users of ENS are reporting 4- and 5-figure USD returns in what has been largely a well-executed airdrop.

$ENS grew over 100% in price on the first day of trading, surpassing $500M in market capitalisation. [CoinGecko] This airdrop has me looking to other long-standing, tokenless products, and it’s imperative that no one looks past Zapper.fi.

Zapper.fi is currently operating a “Quests” program until the end of 2021, offering “Volts” for tasks completed including logging in, making swaps, adding or removing liquidity and earning interest through savings. You are able to complete these tasks on Binance Smart Chain (BSC), Polygon and Avalanche where gas fees for transactions for magnitudes lower than Ethereum. Personally, I use $15 each week to both make a swap and then add/remove liquidity on BSC, which satisfied the requirements for earning vaults without spending high gas fees on Ethereum.

There is also a wonderful “All Rumors Airdrops” public document that lists tokenless Web3 apps across many blockchains. My strategy is to use this list by blockchain, and ensure I used all the apps on each blockchain that I currently have assets on, thereby enhancing the possibility of future airdrops.