Hi all,

Today’s on-chain daily post looks at NVT/RVT Ratio and how we can derive an assessment that Bitcoin is undervalued at current prices.

Bitcoin is both a monetary asset (BTC) and a monetary network (mainchain, Lightning, etc). Users of the protocol can hold/store value in the coins, and also transact and send them around the world with limited friction. Now, of course, more people are using Bitcoin for the assets’ SOV properties than as a payment system at present, but that actually adds further weight to the following argument.

Based on the volume of value settled by Bitcoin right now, the network is undervalued on a historical basis.

When more value is settled by a monetary network, it speaks to a demand for blockspace, and likely a demand for the asset. As BTC prices rise and market liquidity deepens, larger transactions can be settled, and increasingly large settlements can safely occur. I mean, MicroStrategy and Tesla made multi-billion $ investments, and the market absorbed it like a champion.

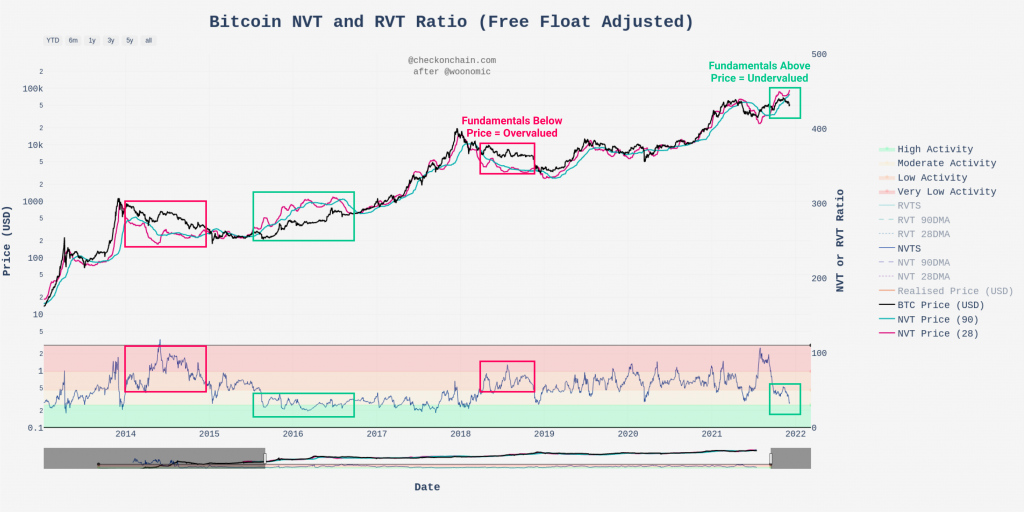

The chart below presents three metrics:

- NVT Ratio (oscillator): where high values are bearish (low activity), low values are bullish (high activity), and sideways are sustainable trends

- NVT Price (28-day, pink): Mapping NVT ratio over the last 28-days to an estimated ‘fair value’

- NVT Price (90-day, Blue): Ditto but on a quarterly basis

All three metrics are currently looking pretty healthy. NVT Prices are suggesting between $77k and 91k as fair value, and the NVT ratio is at the lowest level since the 2018 November capitulation. On the basis of users settling value on-chain, Bitcoin looks remarkably undervalued. But we all knew this, the question is, when will price respond?

NVT Price and Ratios (Live Chart)

NVT Price and Ratios (Live Chart)