Hi All,

One of the Bitcoin topics that received far too much attention over the last few years is the infamous Stock-to-Flow model, originally by Plan B.

Now, this is a nuanced conversation involving questionable statistics, number fudging, clout chasing, and sky-high price estimates that the masses love to retweet. However, as of the end of 2021, I think we can now firmly say that the current iteration of the S2F model, which predicted an end-of-year price of $100k, is firmly debunked.

However…

There is one S2F model that predicted the end-of-year price very nicely…the one calculated by yours truly. Now, this is absolutely not me tooting my own horn. I believe my model is completely wrong too. But it is a hilarious case study of the outcome when one analyst uses a robust calculation framework, vs another whom changed the model on a seemingly weekly basis to chase clout, followers, and clicks.

Let me explain.

The Original S2F model

- First published in 2019, this model by Plan B used a fairly simple analysis framework of performing a log-log regression between price, and Stock-to-Flow (the inverse of inflation rate).

- It was very meme-worthy because, unlike many models, we can project S2F into the future and thus estimate future prices. Given BTC was trading at $4k after a year of brutal bear, this was just the hopium everyone needed.

- The problem arose when trained statisticians pointed out that under the hood, the statistical correlation was ‘spurious’ and not ‘cointegrated’ as previously thought –> in layman’s terms, it is simply a coincidence (mathematically provably so), and S2F is completely statistically irrelevant when estimating the price.

- This was followed by iteration after iteration of new S2F models, with higher price estimates and of course –> leading to more followers. It even predicted the value of diamonds and housing! Wow, what wizardry!

- I was blocked by Plan B on Twitter when I also pointed out two things:

- 1) that a log-log regression of PRICE and S2F ignored the demand from new coins mined. If BTC is trading at the same price of $47k 12 months later, that surely means the coins mined over the last year were absorbed by demand –> thus MARKET CAP is a better metric to perform the regression on if one seeks to account for demand in a robust manner.

- 2) that all instances of the model cherry-picked data. Sometimes it used just one price per month, other times it clustered whole cycles of data together…the number fudging was just incredible.

Anyway, the end result was as anyone with a semblance of background in statistics or mathematics expected, the S2F model failed to deliver and is now irrefutably debunked. Check out this post by Charles Edwards that sums it up perfectly:

The Checkmate Dark Horse S2F Model

I am the first to admit that I loved the idea of the original model when it first came out. I spent a lot of time studying it and running my own calculations and even calculated a model for another coin I am fond of, DCR. What I then found was that we get a far better and more mathematically rigorous outcome when we do the following:

- Calculate using Market Cap and S2F –> accounts for newly mined coin demand

- Calculate using every daily datapoint –> not cherry-picking to give the desired price estimate

- Recalculate every day –> use all information at our disposal and adjust accordingly

- Not take it too seriously –> once the statisticians formally debunked it, I just used it as a meme and a little more. Have some fun, don’t hang my personal brand on it.

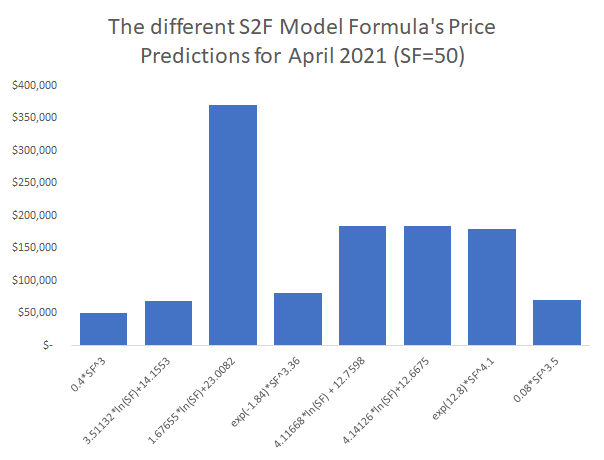

So, whilst both models are completely bogus, how did they fair in 2021?

Well, the original moon mission model had predictions of 100k+ by the end of 2021. We undershot that by more than 50% –> Nice one!

The dark horse model predicted prices of $50.38k at year’s end, and we closed at $46.35k –> undershot by 8% –> what a scam!

Really, the take-home message from this is never to take a single model and the work of a single analyst as gospel. None of us know what will happen in the future, and whilst Bitcoin’s supply schedule is programmatic, markets are absolutely not. It is so very easy to chase clout and attract followers when you put out unrealistic moon mission targets. Sure it can be lots of fun, but the analyst also needs to be humble and take on feedback. Rather than adapting and accepting critiques, in this instance, the block button was used liberally.

All models are wrong, but some are useful. In this instance, S2F is little more than a meme, but it is a meme that the masses like to follow. So long as you consider it in that framework, it can be useful. If used as a roadmap for price, probably going to have a bad time.

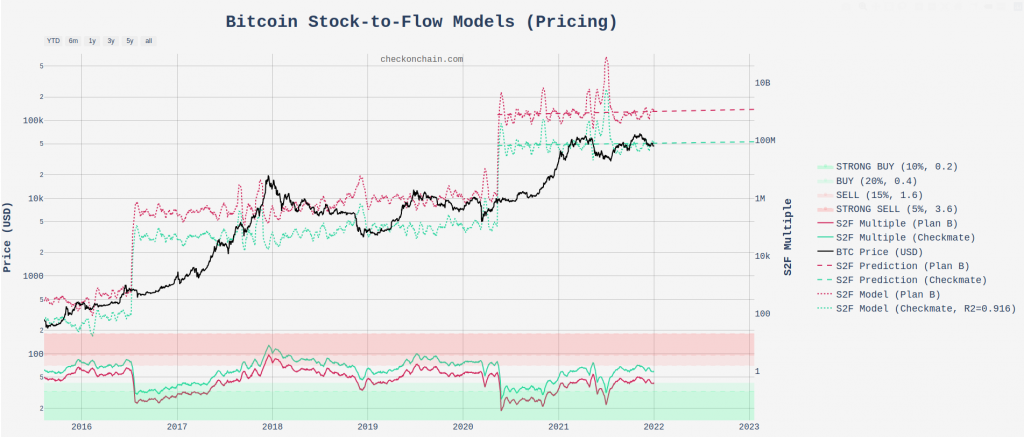

Comparison between the original S2F model (pink) and my model (green) (Live Chart)

Comparison between the original S2F model (pink) and my model (green) (Live Chart)