dHEDGE DAO dht

Summary

dHEDGE is a non-custodial, decentralised asset manager on Ethereum. Powered by Synthetix, it focuses on synthetic assets which means users retain ownership over their funds as opposed to investment managers. Their ultimate goal is to create a permissionless hub for asset management.

This decentralised asset management platform lets users create pools through smart contracts that are based on an investment manager’s transparent track record. Enzyme Finance is also rolling out a similar protocol—another competitor to traditional asset management firms. Users can not only trade cryptocurrency assets, including tokenised assets available on the Synthetix exchange. (Managers can also long or short certain assets.)

Synthetix’s native stablecoin, sUSD, is used by investors to buy into a pool. In exchange for depositing sUSD, investors receive a pool token representing their claim on the pool, which they can enter or exit anytime. dHEDGE pool managers are able to earn a performance fee based on their trading skills and tracking the pool’s ROI.

DHT Token Utility

dHedge’s native token is dHEDGE DAO (DHT). As of this writing, 9,111,443 DHT are in circulation, with a hard-capped maximum supply of 100,000,000 DHT. Total supply may change, should DHT holders agree that doing so would be what’s best for the protocol. The DAO raised ~$10M in token sales in Sep. 2020.

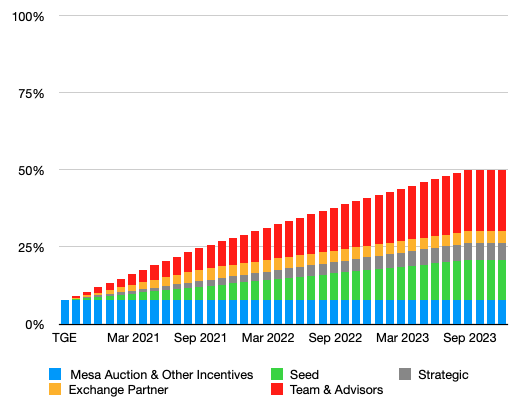

DHT circulating supply * this excludes future Performance Mining of DHT

DHT governs the protocol and has several use cases:

- Facilitates decentralised governance. For example, DHT holders can permit changes such as modifying the protocol-level fee so that DHT captures greater value.

- Rewards for DHT stakers will be paid in DHT and sUSD. (More on DHT staking in ‘Recent Developments’ below.)

- Holders may choose to charge an administration fee on the dHEDGE platform.

- Incentivise investors to pool assets with top-performing managers.

- Incentivise managers to earn greater returns.

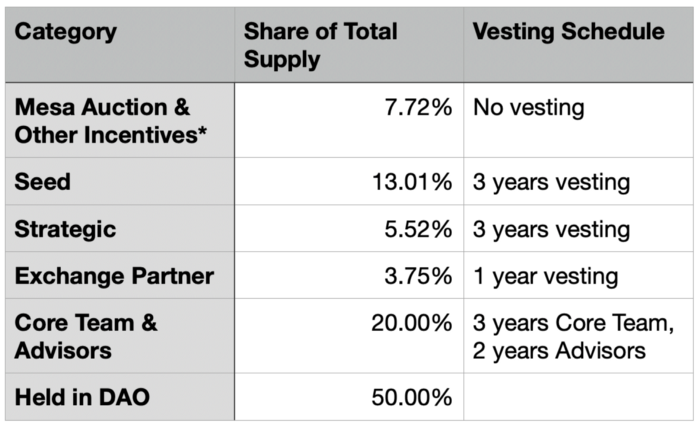

DHT distribution and vesting schedule

Collective Shift Analysis

To see Collective Shift’s analysis, sign up for our membership!