There can be a lot of focus on the immediate short-term in the market.

Zooming out, I feel there’s still a lack of knowledge and emphasis on Ethereum scaling solutions—also called ‘layer 2’s’ (L2s). They remain with low TVL and appear ripe for adoption over the next couple of years.

This significant shift could be potentially overlooked by the market and present a potential opportunity.

I outline why this is a significant focus for me over the next 12-36 months.

This post is a deeper dive covering:

- What is Ethereum scaling solutions?

- The opportunity.

- Looking ahead.

- How does this translate to value for ETH? (Where’s the opportunity for me?).

- What’s the state of these solutions?

- Risks.

- Summary.

Refresher: What Are Ethereum Scaling Solutions?

Ethereum scaling solutions are a pretty broad term. They generally refer to networks or technologies which aim to reduce congestion and increase usability on Ethereum.

They fall into 2 categories:

Layer 2s (L2s): Move transactions away from Ethereum’s base layer and build on top. They’re an L2 if they inherent Ethereum’s security.

- Such as Optimistic roll-ups (Optimism) and ZK roll-ups (Loopring, zkSync, StarNet etc).

Side-chains: They are associated with Ethereum and have compatibility, but they do not inherent Ethereum’s security and have their own validators controlling transactions.

- Polygon is a side-chain with its own validators—although it plans to move away from this.

READ: Ethereum Layer 2 Solutions

The Opportunity: Low TVL locked

2021 was the year for multichain

2021 was the year demand flowed into crypto and showed the need for a multichain world. Ethereum TVL as a % of all chains was reduced by ~45%

In my opinion, the multichain ecosystem is here to stay. But I don’t see it as a zero-sum game. There is a demand for decentralised, immutable and open infrastructure for digital assets.

Low TVL locked in Ethereum L2s?

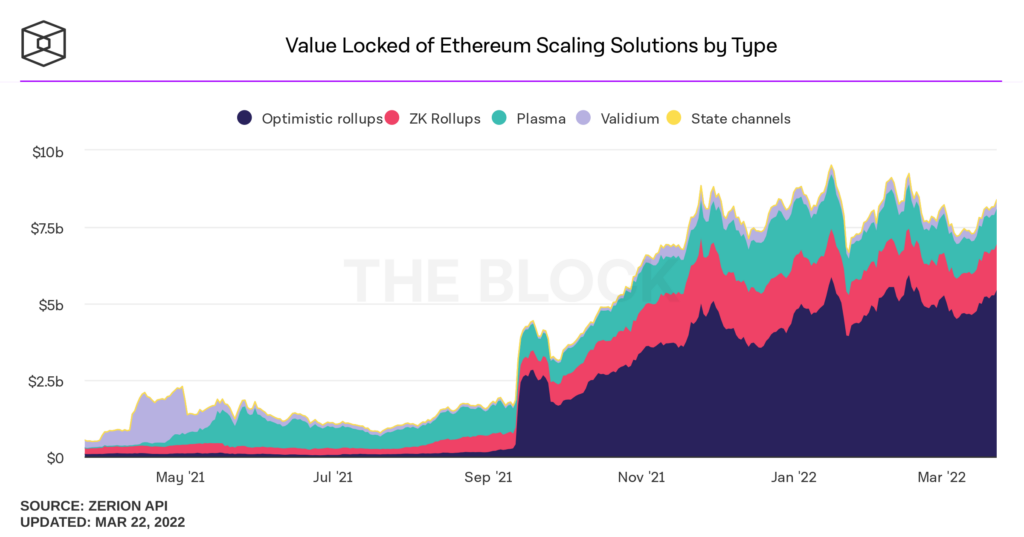

Currently, ~$8B is locked inside Ethereum scaling solutions. Approximately $5B with Optimistic roll-ups (Arbitrum, Optimism) and only $1B with ZK roll-ups (these are less established).

I feel this is extremely low—but understandable as these solutions remain in their infancy.

TVL & usage to begin to expand?

Two highly backed ZK roll-ups—zkSync and StarkNet—are yet to launch their smart contract platforms fully.

According to DeFi Llama, the biggest Ethereum L2 is Arbitrum, with $2B TVL—placing it outside the top 10 chains per TVL.

At this stage, Ethereum scaling solutions only have >4% of TVL across DeFi.

Looking Ahead

Given the current market, it can be easy to overlook longer-term plays— especially as the focus remains on layer 1 ecosystems.

Over the next couple of years, I see more TVL moving to these networks as they’re a core part of Ethereum’s scaling roadmap.

My thesis

- Whales, major protocols & networks will only use Ethereum L1: New projects will deploy directly to L2 and skip L1.

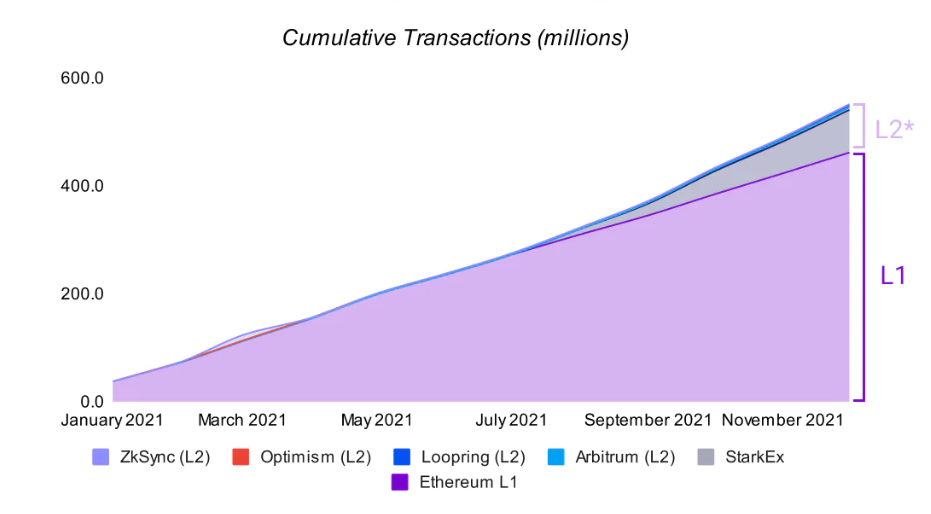

- Ethereum L1 to be a settlement layer: To settle executed transactions on these other emerging networks—Optimism, Arbtrium, StarkNet and zkSync etc—need to settle back to Ethereum L1.

- L2 to house bulk of everyday transactions: Activity and retail usage will begin to happen on these solutions versus Ethereum L1.

How I see it

2021: The year these scaling solutions opened the community, albeit with extreme handicaps and soft launches.

2022: The year roll-ups begin to expand and generate large volumes.

2023-24 When these solutions see serious adoption and become more trusted.

The figure below could be much different in a few years—we can see the limited adoption in total Ethereum TVL for these networks (as of the end of 2021).

Source: The Year in Ethereum 2021

Source: The Year in Ethereum 2021 Not a winner take all

Although I think these L2s have a chance to amass significant usage and TVL, it isn’t a zero-sum game.

I see the demand for block space and blockchains being very high and many blockchains co-existing as they serve different purposes, functions and end-users.

See more on block space in this Team Insight.

How Does This Translate To Value For ETH? Where’s The Opportunity For Me?

You might be asking yourself these questions.

I see the value in 2 ways: (i) airdrops/rewards and (ii) ETH accruing value

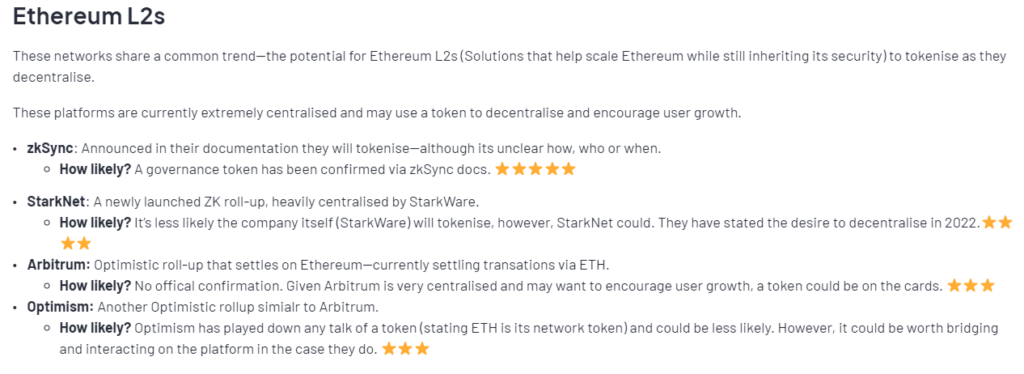

#1 Airdrops/rewards

I discussed in my airdrops post why I think Ethereum L2s may issue native tokens. We have also made this a regularly updated resource!

If this proves true and infrastructure or networks do tokenise in some form, this could prove fruitful and early adopters could be rewarded.

Action: I suggest engaging with these solutions, creating an AgentX wallet (For the moment, utility is only for developers but this could change once it updates), onboarding to zkSync and participating in StarkNet when dApps and bridges are deployed (not yet available).

Tip: If gas is high and you want to save some $, I suggest using a centralised exchange to onboard directly to Arbitrum. You can also use a workaround to withdraw to Polygon and use Hop Protocol to move between roll-ups to onboard for a couple of dollars (see this explainer).

#2 ETH value accrual

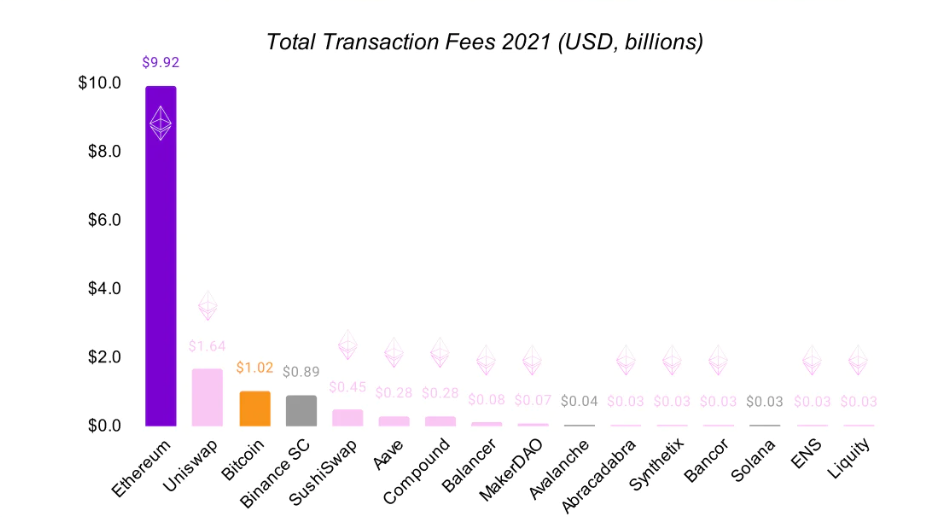

Many layer 1 blockchains boomed as Ethereum could not meet demand and was restricted via congestion. This is still the case.

There is high demand for Ethereum block space and security. If these solutions satisfy users/developers, I see significant TVL moving to these networks.

Many users have been willing to pay high fees to use the network.

Source: The Year in Ethereum 2021

Source: The Year in Ethereum 2021Transactions settled on Ethereum L1

All transactions are settled back to Ethereum, which requires ETH.

Even though transactions might not be directly on Ethereum L1, there should still be significant demand for ETH in the future if these solutions take off and Ethereum does become a settlement layer for Ethereum L2s.

What’s The State Of These Solutions?

A quick rundown of the major players:

dApp specific

DeFi applications could begin ramping up their move to L2s. I’d expect to see many more onboard to Optimistic roll-ups, zkSync or StarkNet over the next 12 months, especially as the networks prove themselves.

For example, Aave plans to deploy on StarkNet. This could be a sign of things to come for other dApps.

Network-specific

The underlying networks are also expanding and begging to take the training wheels off. There are a lot of networks and L2s, so I’ll cover only a few.

zkSync: Testing is live on zkSync 2.0, which will feature smart contracts. I’d expect an announcement on public deployment in the coming weeks/months.

StarkNet: Released to developers at the end of 2021. You can create an Agent X wallet, although there is not much built, any native bridges and dApps for non-developers to use. But keep an eye out for when users can participate.

Optimism: Announced an innovation to bring down transaction fees. Over the next 18 months, Optimism will continue to introduce new, improved infrastructure to continually lower gas.

Arbritrum: New upgrade Arbritrum Nitro inches closer. Like Optimism, this means gradually lower transaction fees.

Loopring: Loopring tech is underpinning GameStop’s upcoming NFT marketplace.

Immutable X: Immutable (the team building out Immutable X) raised $200M in Series C funding in March. Immutable X continues to develop partnerships and become an L2 for NFTs and gaming.

The highly anticipated game Illuvium built on Immutable is expected to open to the public in the coming months.

MetisDAO: A scaling solution that has already tokenised and launching a liquidity mining event.

Polygon: Polygon plans to move from a pure side-chain (with its own validators) toward a fully pledged roll-up. They plan to be a scaling hub and aim to invest $1B into ZK-based solutions and research—announcing a host of different roll up technologies.

They essentially have half a dozen plus technologies in development.

I expect big things from Polygon over the next 12 to 36 months as they move beyond its PoS side-chain and release a ZK roll-up.

Risks

The biggest risks here are in the immediate short-term, as these solutions are still in their infancy and getting going—which is why I’m focused on the medium-term vs immediate.

Centralised: These solutions are centralised at the moment. The core teams have extreme control over nodes and infrastructure. They also have the power to upgrade the network anytime with admin keys.

- However, this is why I think they may tokenise.

Gas still high: Today Ethereum gas spiked again, and so did costs on L2s. They still remain far more expensive than using other L1s.

- Although ZK roll-ups aim to use an economies of scale approach—i.e the more adoption, the cheaper fees become.

New technology: I suggest only bridging only a small portion of funds in each of the solutions. There are still a lot of unknowns, they can be tricky to use and UI isn’t great.

- Optimism showed the potential risks in February when a critical bug could have crippled the network.

In Summary

I firmly believe the broader market is overlooking Ethereum L2s. I see heavy development, huge investment and low current TVL. They are a core part of Ethereum’s scaling roadmap.

I think TVL in these solutions will significantly increase over the next 12 to 36 months as the current $8B TVL explodes.

This presents 2 opportunities.

- Airdrops: Potential for these solutions to tokenise in some form and reward early adopters.

- ETH value accrual: As these solutions need to settle back to Ethereum, I see consistent and robust demand for ETH in the future. Many users want to use Ethereum, and these solutions aim to open up Ethereum to more people.

I don’t see it as a zero-sum game and think ecosystems like Solana can co-exist together due to the enormous market opportunity for secure, permissionless blockchains.