Featured Research

What The War In The Middle East Means For Crypto

Matt shares his take on how crypto will react depending on certain scenarios in the Middle East.

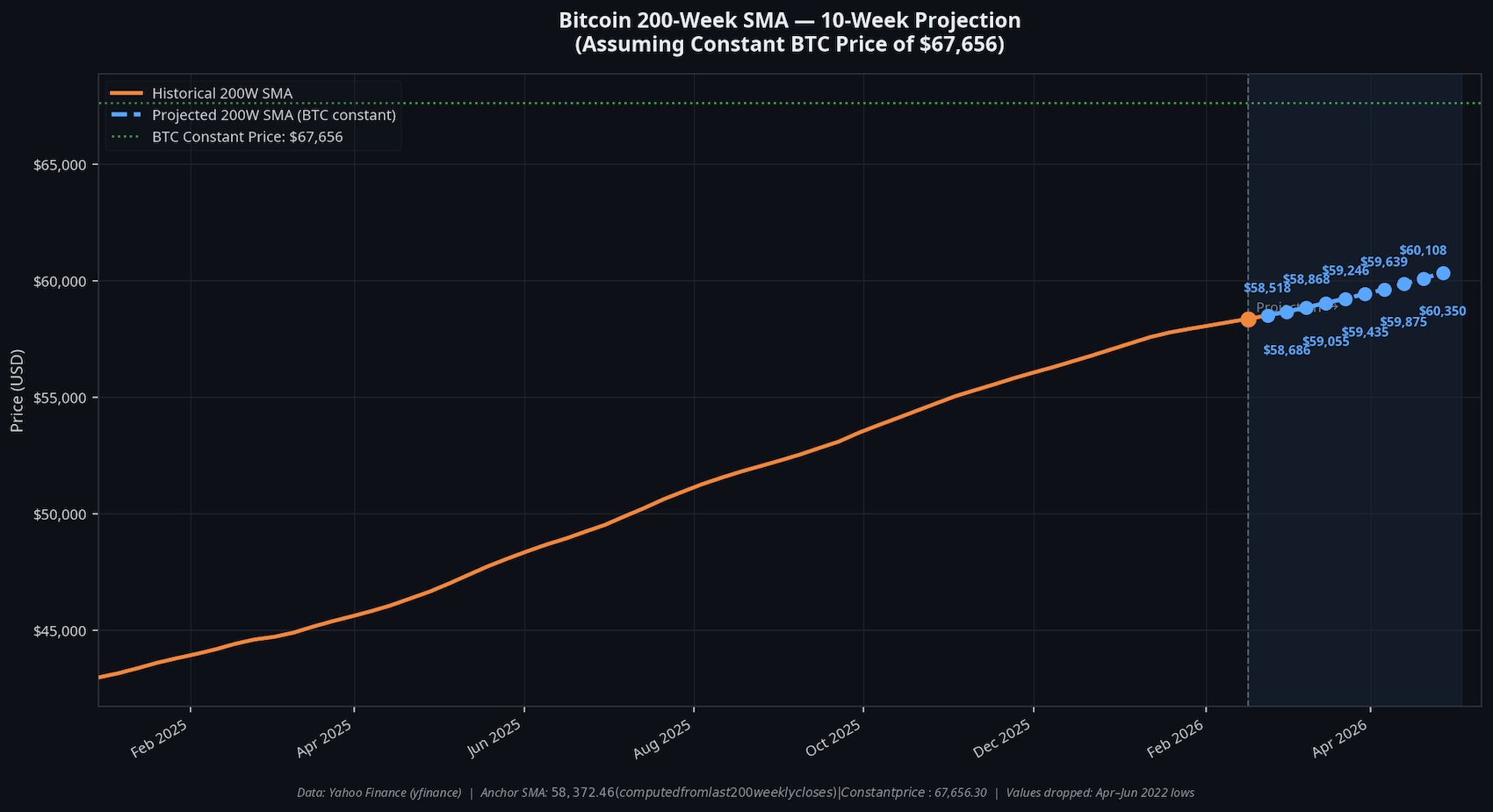

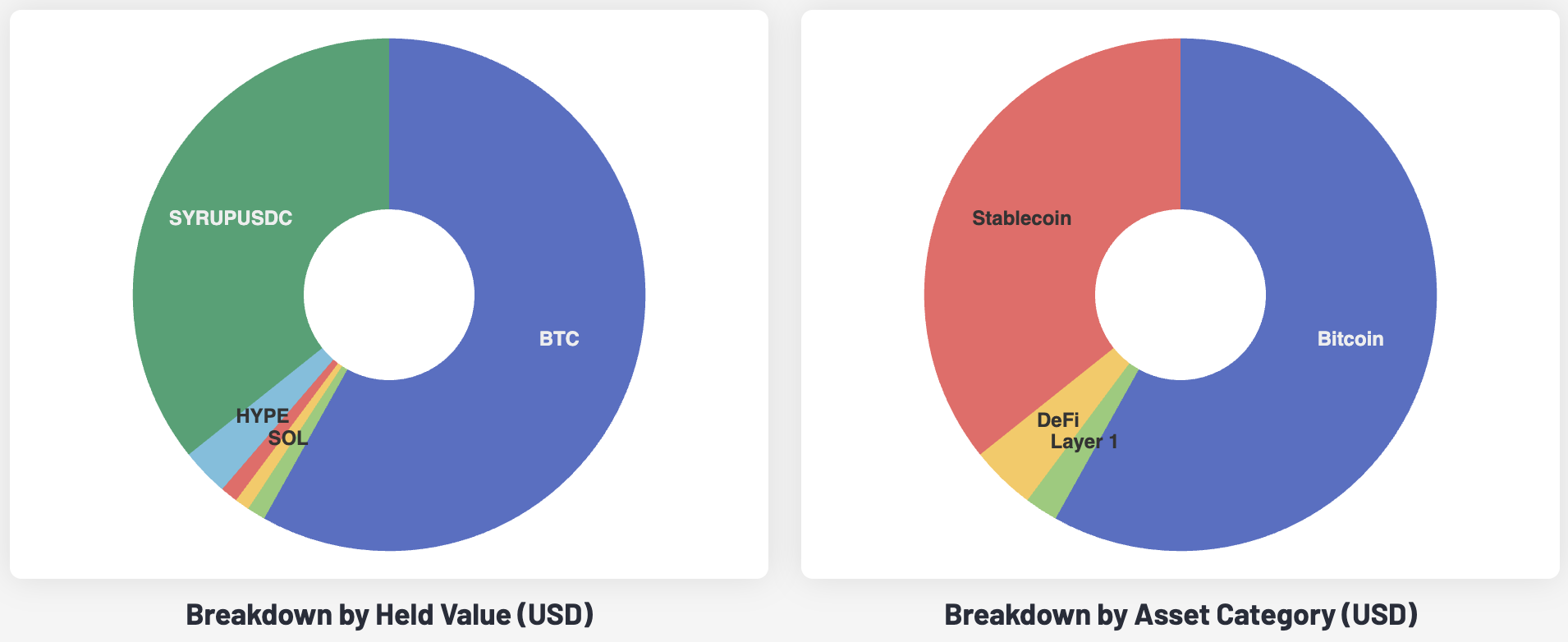

Our Portfolio Plan: Accumulation Strategy

Sharing our portfolio accumulation strategy, including the price at which we plan to buy more Bitcoin (BTC). We also cover how new investors can navigate the current market.

Don’t Fall for the Relief Rallies, Here’s Exactly Where, When & What We’re Buying

In today’s video, I walk through the key Bitcoin levels, how I’m gradually deploying capital into this range, and what we’re looking to buy next.

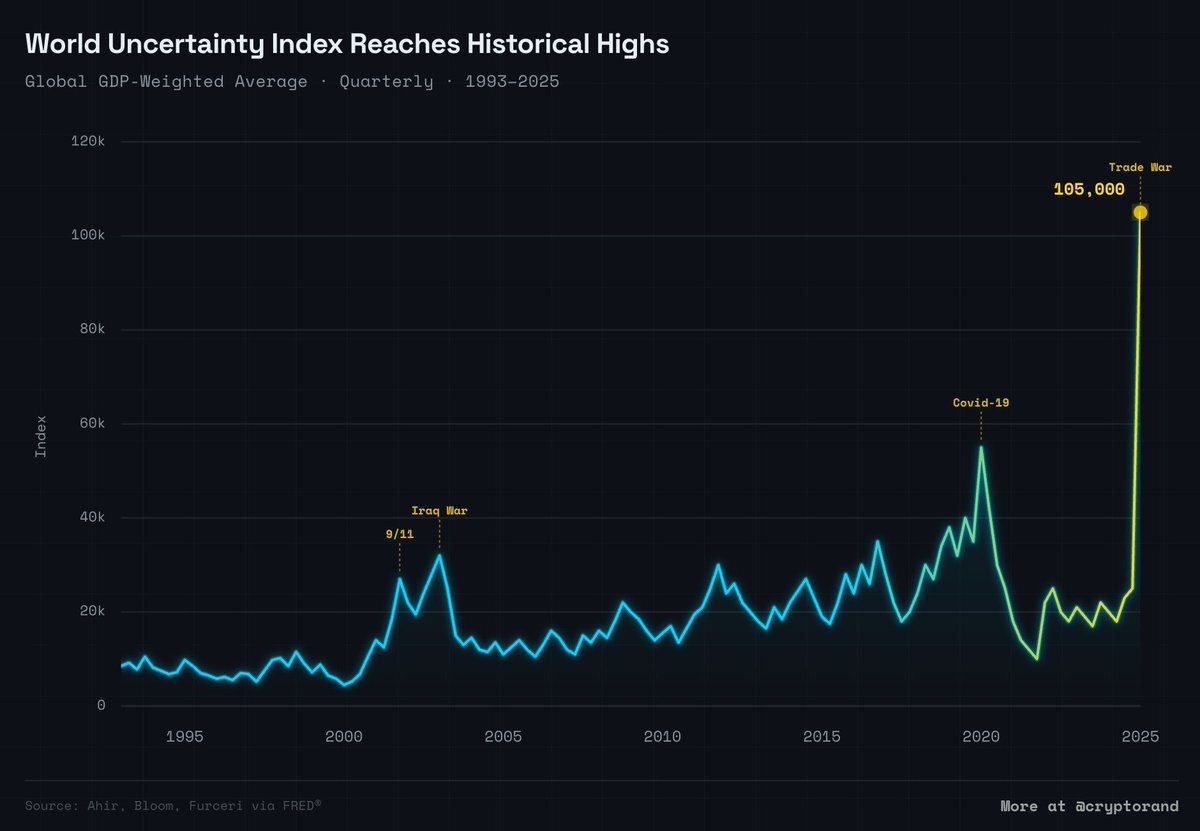

Record Fear, Record Uncertainty, $3.6 Trillion Wiped in 90 Minutes

Fear and global uncertainty has increased, here is our outlook and positioning update.

Is This the Bottom, Bear Market Rallies and When We Are Buying Back In? – Market Update (Feb 12)

There’s likely more downside to come. Protect your capital. Stay patient. When the real shift happens, we’ll have the data to back it up.

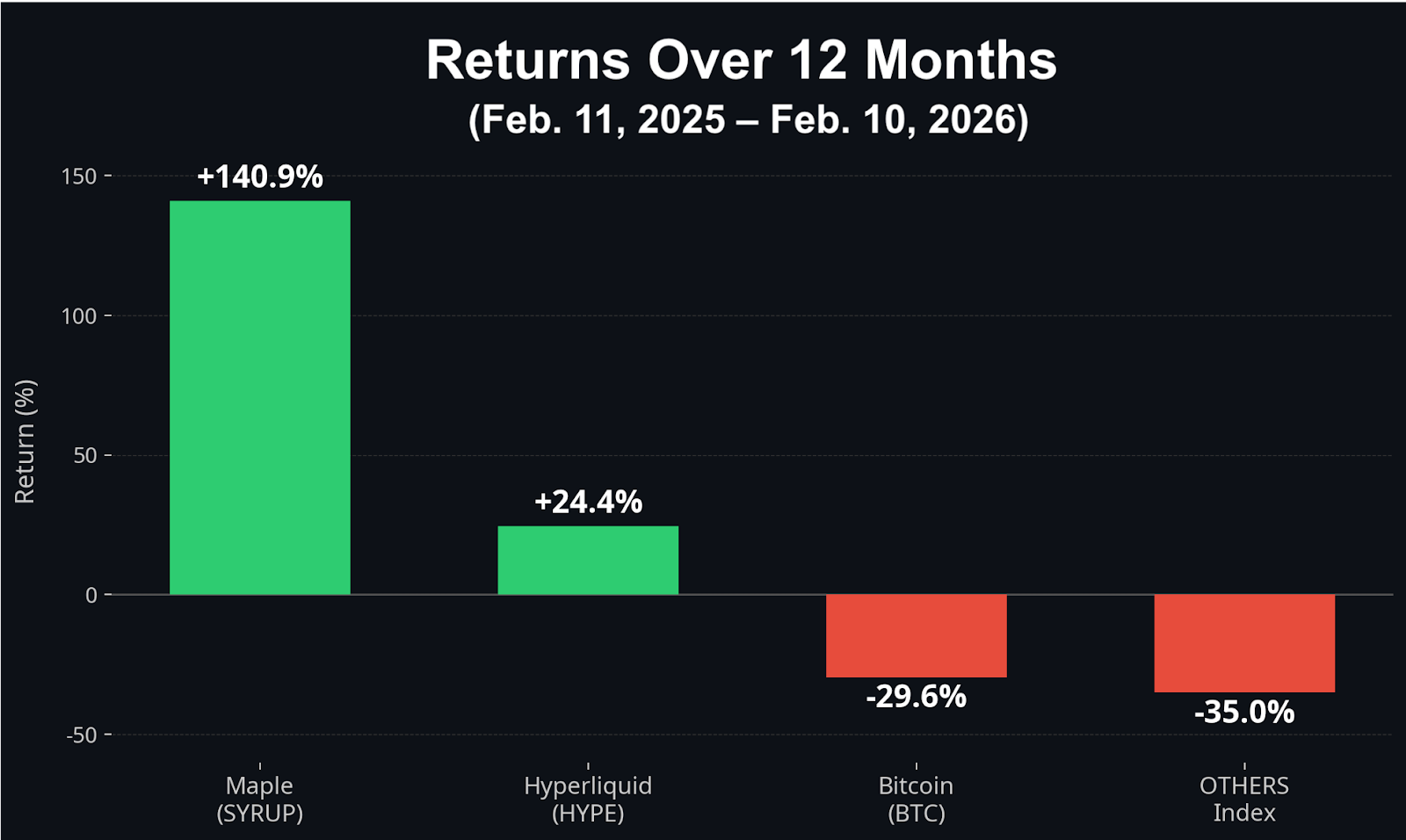

Video Member Update (Feb 11): Altcoin Revenue & Why Fundamentals Matter More Than Ever

For years, crypto valuations were propped up by narratives, speculation, hype, and potential. That era is ending.

Video Market Update (Feb. 10): Altcoins in 2025 & The Where Next Crypto Winners Will Come From

This update breaks down why altcoins struggled, why portfolio allocation and risk management mattered more than ever, and how we’re thinking about positioning for the next phase. The biggest opportunities in crypto rarely come from chasing what worked last cycle.

Video Market Update: Painful, Normal & Moving Into Value Territory (Feb. 9, 2026)

Despite how violent the recent sell-offs have been, nothing we’re seeing is technically abnormal when viewed through the lens of prior Bitcoin bear markets. Bitcoin is down roughly 45% around 125 days after its all-time high, almost exactly in line with previous cycles.

Collective Shift Portfolio & Market Update: Feb. 2, 2026

The team shares how they further de-risked in accordance with the plan laid out on Friday, and why they continue to expect further downside.