Hyperliquid hype

Collective Shift Analysis

To see Collective Shift’s analysis, sign up for our membership!

Hyperliquid Summary

Hyperliquid is a high-performance layer-one (L1) blockchain initially optimised to facilitate onchain trading of perpetual and spot markets. (Perpetuals, or ‘perps’, are a type of derivative that has no expiration date.)

The blockchain itself uses a proof-of-stake (PoS) model and HyperBFT, a custom consensus algorithm the team built from the ground up. Like most PoS chains, blocks are produced by validators in proportion to the native token staked to each validator. In the case of Hyperliquid, validators stake HYPE tokens.

In 2025, the team is executing a phased release of HyperEVM, transforming Hyperliquid from a suite of onchain trading products to a general-purpose L1 blockchain that competes more directly with the likes of Solana and Sui.

“The ultimate goal is for all of finance to be on Hyperliquid. It’s transparent. It’s 24/7. It’s low latency. It’s auditable. It has so many things going for it. It should be a 10x upgrade on legacy financial systems.”

– Jeff Yan (Co-Founder, Hyperliquid) on the ‘Bell Curve’ podcast in May 2025

HYPE Token Utility

HYPE is the native token of Hyperliquid. Its initial total supply of 1 billion HYPE is slowly declining due to a buyback-and-burn mechanism (see below).

HYPE’s token generation event (TGE) was in late November 2024, with substantial value airdropped to early users of Hyperliquid, more than nearly every token airdrop to date. The airdrop was relatively large for various reasons, with a major one being that Hyperliquid’s core development team never raised external financing. (Meaning there was no need for any HYPE tokens to be allocated to early investors—a rare occurrence in this space.)

The initial percentage distribution of HYPE was as follows:

- Future emissions and community rewards: 38.888% (388.88M HYPE)

- Early users (i.e. TGE distribution): 31.0% (310M HYPE)

- Current and future core contributors: 23.8% (238M HYPE)

- Hyper Foundation budget: 6.0% (60M HYPE)

- Community grants: 0.3% (3M HYPE)

- Hyperliquidity (HIP-2): 0.012% (0.12M HYPE)

Core contributors’ HYPE tokens are locked for one year after TGE (i.e. Nov. 29, 2025). While additional vesting terms are unclear, the team has noted that “most vesting schedules will complete between 2027–2028; some will continue after 2028.” (Presumably, after the one-year cliff, core contributors will be subject to monthly linear unlocks over 12 or 24 months.)

Like many cryptocurrencies, HYPE serves multiple purposes, some of which are listed below.

- Network security: HYPE is the staking asset underpinning HyperBFT, where stakers are compensated with additional HYPE tokens (i.e. ‘future emissions’ in the above distribution breakdown). At the time of writing, 420M HYPE (42% of the total supply) is staked and earning an APR of 2.17% in the form of additional HYPE, as per ASXN Data.

- Access to fee discounts: HYPE can be staked to access reduced trading fees on Hyperliquid based on a tiered model (see below).

- Gas token: HYPE is the gas token for transactions on the HyperEVM chain.

- Governance: HYPE holders can participate in governance of Hyperliquid, proposing and voting on protocol upgrades, policy changes, and other matters that shape the protocol’s direction.

- Incentive alignment: Third parties will soon be able to permissionlessly deploy onchain perp markets on Hyperliquid. To do so, they must stake 1M HYPE, as described in HIP-3. This balance is slashable via governance, helping deter malicious behaviour while serving as another token sink for HYPE.

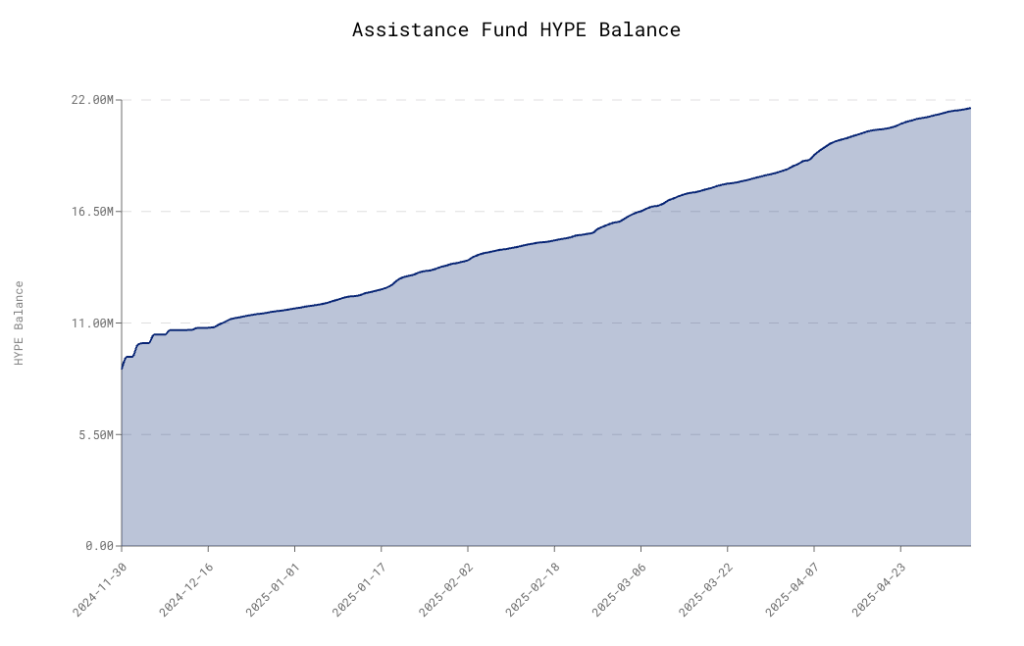

Hyperliquid also has in-built value-accrual mechanisms that, all else being equal, increase the price of HYPE. For example, Hyperliquid has an Assistance Fund (AF) that automatically uses the majority of protocol revenue to accumulate HYPE. Similarly, there is a buyback-and-burn mechanism that uses a portion of fees from spot DEX trading to remove HYPE from circulation.

To illustrate the extent of the AF’s buying, at the time of writing, it has purchased $39M (USD) worth of HYPE in the past 30 days. Market volatility is arguably the main variable affecting this figure (i.e. more volatility –> more fees –> more HYPE accumulated). Over the next 12 months, it’s not unreasonable to foresee the AF accumulating another $300M–$400M worth of HYPE.

In May 2025, staking tiers were introduced, establishing another demand driver for the HYPE token. Initially, the sole benefit associated with these tiers was reduced trading fees on Hyperliquid spot and perps.

| Staking tier | HYPE staked | Trading fee discount |

|---|---|---|

| Wood | >10 | 5% |

| Bronze | >100 | 10% |

| Silver | >1,000 | 15% |

| Gold | >10,000 | 20% |

| Platinum | >100,000 | 30% |

| Diamond | >500,000 | 40% |