Token unlocks are events where previously restricted tokens become transferable. Understanding unlock schedules is essential for investors as they can heavily influence prices. In this article, I explain everything you need to know about token unlocks.

Key Takeaways

- Token unlocks can greatly affect the price performance of an individual cryptocurrency, making them important for investors to understand.

- Long-term lockups can signal that the stakeholders are involved in the project for the right reasons (i.e. deep alignment with the vision and mission).

- You can research unlocks more efficiently by using certain websites (e.g. CryptoRank, TokenUnlocks).

- Timing the unlocks can be profitable, but it requires time, effort and active monitoring.

Contents

What Are Token Unlocks?

Token unlocks refer to the process by which previously restricted tokens become available for trading or transfer on the open market. Many crypto projects, particularly those that have conducted token sales, implement lock-up periods during which tokens are inaccessible.

These periods prevent immediate selling pressure and help to align the incentives of all token holders. Once these periods end, the locked tokens are said to be ‘unlocked’, meaning they can be freely traded, transferred, or utilised in the ways they are intended.

Token unlocks play a crucial role in shaping the market dynamics of a crypto project. The timing and scale of token unlocks can significantly impact token prices, market liquidity and investor sentiment. Projects must carefully manage unlocks to avoid flooding the market with excess supply and causing prices to fall.

Conversely, a well-timed token release can provide liquidity to the market, facilitate price discovery and foster investor confidence in the project’s long-term viability. Therefore, investors should understand token-unlock schedules for each project they invest in. Not knowing these details can contribute to poor decisions and risk management.

Who Has Token Lockups?

Most stakeholders within a project will have their token allocations locked for at least 12 months after launch. These stakeholders include team members, advisors, private investors and strategic partners.

Team members typically undergo lock-up periods to align their interests with the project’s long-term success and prevent immediate selling pressure that would harm token prices.

Advisors and early investors may also face lockups to demonstrate commitment to the project and maintain investor confidence. Additionally, strategic partners or institutions may agree to lockup provisions as part of their involvement in the project, ensuring stability and security within the ecosystem.

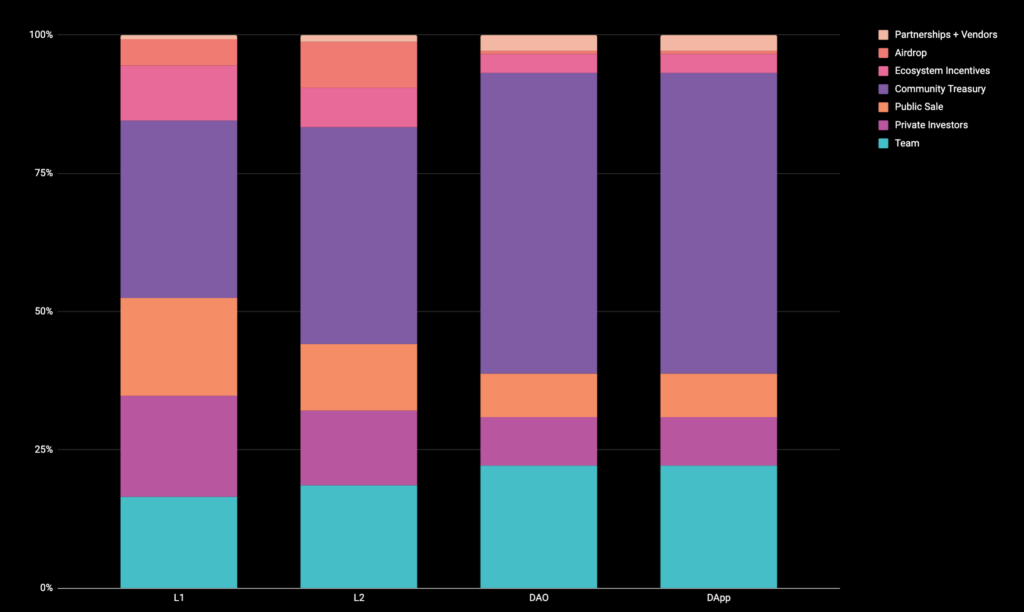

Distribution breakdown by project and allocation type, based on an analysis of more than 150 projects and protocols (Source: Pantera)

Distribution breakdown by project and allocation type, based on an analysis of more than 150 projects and protocols (Source: Pantera)Why Investors Should Care About Unlocks

Crypto investors need to understand token unlocks because they directly impact the circulating supply of tokens in the market, affecting token prices and market dynamics.

As more tokens unlock, they increase the circulating supply, potentially leading to increased selling pressure and a lower price. Unlocks themselves may not impact price, but the anticipation of unlocks will. Quite often, the price of a token struggles if a large unlock is approaching.

However, depending on the unlock size, prices can rise at the time of the unlock because the threat of the unlock has been priced before the event.

To go deeper on token unlocks and their effect on price, read the below thread by Mustafa Qazi (6th Man Ventures) summarising his analysis of more than 5,000 unlock events. (Full blog post here.)

DIY Research

Websites like CoinGecko and CoinMarketCap have tokenomics details for several, but not all, cryptocurrencies. CryptoRank has a useful dashboard for tracking token unlocks, as does TokenUnlocks and DefiLlama. (If none of these sites have information about a particular project you are researching, then go to the project’s documentation or blog. If you still cannot find the information you need, consider it a red flag.)

Using DYDX as an example, we can see that 50.1% of the tokens have been unlocked, with the next unlock being 0.28% of the total supply. The next four rounds of unlocks will equate to 1.01% of the token supply valued at $5.63M.

The pie chart illustrates the breakdown of token holders and their unlocked vs. locked proportion. Around a third of the investors and team member tokens have yet to be released, and 26.1% are reserved for the community treasury.

Deeper research is required to understand the timing of these token releases and assess whether they can be absorbed by the market without there being too much of a price decline.

When assessing BRC20X, we can see the influx of tokens that is set to flood the market. The price chart is a direct reflection of this. In 29 days, 9% of the total supply will be unlocked. However, since only 20% of tokens have been released, this is an increase of 45% of token supply into the market.

Moreover, in 91 days, the token supply will nearly double to 39.5%. This is unsustainable and will likely need a prolonged period of sideways or downward movement until this additional supply has been absorbed. Of course, this is a very low FDV project, so a whale can manipulate the price, but as an investor, you can never rely on this.

Major Unlocks of Top Tokens

The below table shows major unlocks of the top tokens by market cap. The smaller percentages are less of a concern during bull markets, but they can still impact the downside in bear markets.

Of note, Avalanche will release AVAX tokens to the equivalent of 2.43% of its market cap within the next 9 weeks. While it is a material release, the price impact on AVAX will be short-term.

Conversely, Celestia will be releasing TIA tokens to the value of 94.5% of its market cap within the next 19 weeks. Undoubtedly, this will have longer-term ramifications. The market must absorb nearly $2B worth of tokens to remain neutral. While this may seem incorrect on the surface, Celestia has only released 18% of its token supply. An increase to around 30% of the token supply is still considered a low float. Refer to my recent article on market cap vs FDV.

What To Do & When

Below are some strategies that people use when investing or trading based on token unlocks.

Timing the Market

Pre-unlock sales: If lots of tokens are about to be unlocked, early investors or team members could exert selling pressure. Investors might consider selling before the unlock to avoid a potential price drop.

Post-unlock opportunities: Conversely, if a token has undergone a significant unlock and the price has dipped, it might present a buying opportunity if the fundamentals remain strong and the selling pressure subsides.

Diversification

Spread risk: By diversifying investments across various tokens with different unlock schedules, investors can spread risk. This way, the impact of a large token unlock on one investment can be mitigated by the performance of others.

Monitoring Supply & Demand

Assessing supply impact: Investors should analyse how the unlocked tokens will be used. If tokens are used for staking, rewards, or other value-generating activities, the price impact of the unlock might be less severe.

Demand forecasting: If a project is growing and attracting more users, increased demand might offset the effects of additional supply from token unlocks.

Research & Due Diligence

Understanding tokenomics: Thoroughly research the project’s tokenomics, including the total supply, circulating supply, and unlock schedule. It’s crucial to know the vesting periods and the purpose of token allocations (e.g. team, advisors, community incentives).

Team and investor behaviour: Investigate past behaviour of the team and early investors. If they have a history of holding rather than selling immediately, the impact of unlocks might be less pronounced. Sometimes, teams will extend their unlocks in an effort to signal their long-term commitment to the project. One notable example of this was dYdX, and another more recent one was Parallel.

Engage With The Community

Stay informed: Participate in community forums, follow project updates, and engage with other investors to gauge sentiment and get timely information about upcoming unlocks.

Utilise Tools & Platforms

Tracking tools: Use platforms or websites to track upcoming token unlocks and other relevant metrics.

Analytics platforms: Leverage advanced analytics tools to monitor onchain data, whale movements, and trading volumes around unlock periods.

Recap

Investors can better navigate the volatile crypto market by incorporating token-unlock schedules into their research processes. Combining this information with other fundamental and technical analyses is important to make well-informed decisions.

Diversification, ongoing research, and staying engaged with the community are key practices for managing risks associated with token unlocks.