Lido ldo

Collective Shift Analysis

To see Collective Shift’s analysis, sign up for our membership!

Lido Summary

Lido is a liquid-staking protocol for Ethereum and other proof-of-stake blockchains. Lido DAO provides a service allowing you to stake ETH in return for an annual percentage rate (APR) without locking it or running a validator node.

Lido DAO offers an alternative to staking with an exchange or self-staking, solving problems associated with ETH staking to provide a flexible and inclusive Ethereum staking service. Lido is built on four core pillars:

- Users can earn staking rewards without a full lock-up.

- Smaller holders who own less than 32 ETH can participate in staking.

- Provide a safe environment for ETH staking, with node operators never having direct access to user-assigned ETH.

- Provide a stETH token so that users can still participate in DeFi whilst their ETH is locked.

Launched in Jan. 2021, Lido is managed by the Lido DAO, with DAO members ensuring the efficiency and stability of its growing infrastructure services. Lido DAO has a focus on creating an eventual community-owned staking service for Ethereum, raising an initial $2M in Dec. 2020, followed by another $73M round in May 2021 led by Paradigm, which itself purchased $51M worth of LDO from the treasury. In mid-2022, Dragonfly purchased 10M LDO (i.e. 1% of total supply) from the treasury with a one-year lock-up period.

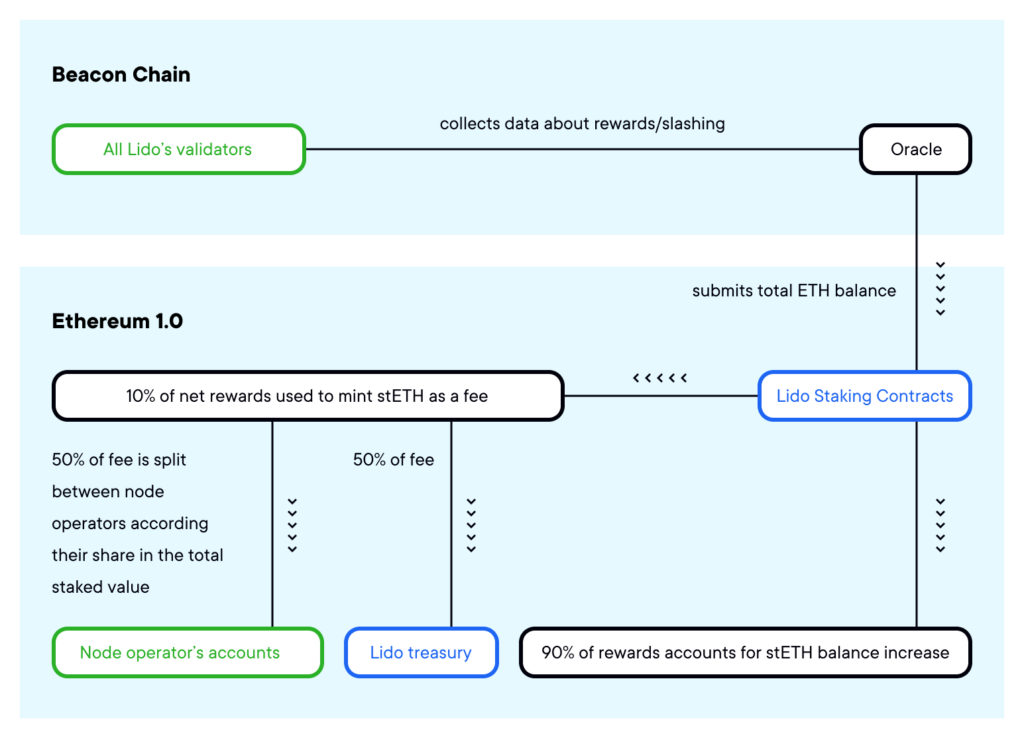

How does it generate revenue? In return for providing the staking infrastructure, risk and rewarding validators, Lido DAO earns a 10% fee of staking rewards. This isn’t taken from a user’s staked ETH, but the rewards earned—which is split evenly between node operators and the DAO treasury.

LDO Token Utility

Lido DAO’s native token is LDO, an ERC-20 standard with a maximum supply of one billion.

LDO is mainly used for governance, granting holders rights in the DAO. Lido DAO governs the staking protocol, with holders able to vote or influence decisions such as key protocol-level parameters like the 10% fee. The more LDO a holder locks in the voting contract, the greater their decision-making power gets.

LDO was distributed as follows: DAO treasury (36.32%), investors (22.18%), validators and signature holders (6.5%), initial Lido developers (20%) and founders and future employees (15%). Included in this distribution is 0.4% of the supply being airdropped to early stakers.

The LDO distributed to developers, validators, investors, founders and employees was unlocked in Dec. 2021 and subject to a one-year vesting period.

Lido DAO also has other tokens that are minted and distributed to token-holders who stake via Lido. For example, when a user stakes ETH, they receive stETH. It’s designed to be a liquid token equivalent (i.e. if you stake 1 ETH with Lido, you get 1 stETH in return). With stETH, holders can participate in the DeFi ecosystem while still accruing staking rewards.