Chainlink link

Collective Shift Analysis

To see Collective Shift’s analysis, sign up for our membership!

Chainlink Summary

Chainlink is a platform for building decentralised oracle networks that are able to connect blockchain-based smart contracts with external systems. By doing so, smart contracts can execute based upon inputs and outputs from the real world. (Simply put, in a world where oracles did not exist, smart contracts would only be able to do a fraction of what they do today.)

Thousands of crypto projects rely on Chainlink in order to function. These projects span various sectors such as decentralised finance (DeFi), payments and gaming. (More on Chainlink’s use cases.)

Chainlink went live on mainnet in early 2019 after being developed for several years. Since then, more than 1,000 oracle networks have been built using Chainlink.

It is the dominant oracle provider based on several metrics (e.g. number of connected feeds, total transaction value enabled, the market cap of its token). Competitors include Pyth Network (PYTH), Chronicle, API3 (API3) and Band Protocol (BAND). Since releasing CCIP, a cross-chain messaging protocol, the likes of Wormhole (W), LayerZero and Axelar (AXL) are partially competitive with Chainlink.

Services Offered By Chainlink

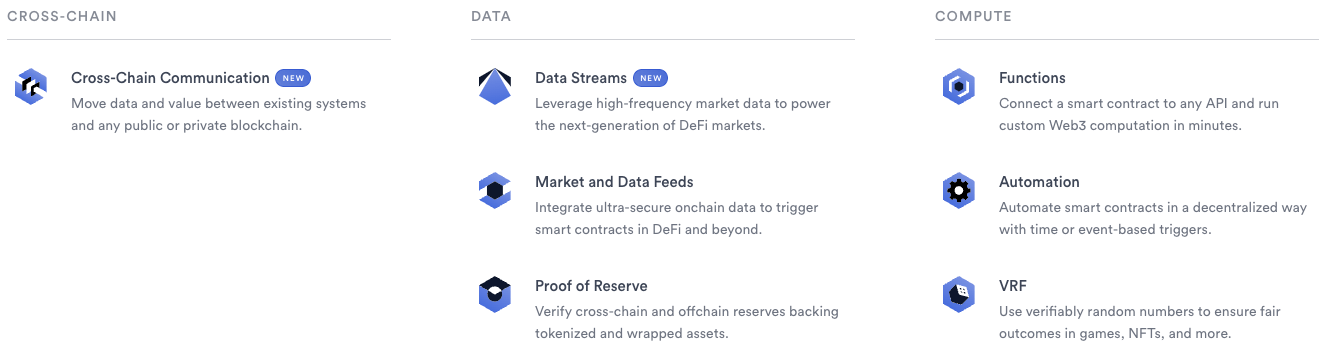

Chainlink initially focused on supplying DeFi projects with price and market data. While this is still core to Chainlink’s offering, its suite of services has expanded considerably over the years. As per the below graphic, Chainlink now offers oracle services across cross-chain interoperability, external data and offchain computation.

LINK Token Utility

Chainlink is powered by LINK, an ERC-20 token. The maximum supply is 1 billion LINK. The token’s two main functions are as follows:

- Payments: LINK is used to pay Chainlink node operators for providing oracle services. Prices are set by node operators based on market forces.

- Staking: LINK must be staked by node operators to help align incentives and ensure the network operates as intended. Slashing applies to operators. General holders of LINK can stake with the community pool, the cap of which is gradually being lifted.

The LINK token was created in September 2017. Distribution details are outlined below.

- Token sale participants (35%): Priced at $0.09 (private sale) and $0.11 (public sale) per token.

- Rewards (35%): Reserved for node operators and ecosystem rewards.

- Team (30%): Chainlink’s parent company, SmartContract.com.