‘Everyone has a plan until they get punched in the face’ — Mike Tyson

G’day Folks,

After a pretty wild start to the week, it is a great time to do a damage assessment. In this piece, I will step some of the key concepts and tools that I use to assess market conditions after a major sell-off event like this.

What I am trying to do is gauge whether this sell-off is likely to be savage enough that it breaks the confidence and conviction of the Bitcoin bulls.

As it stands, over 25% of the circulating BTC supply is now underwater, and almost every Short-Term Holder coin is now held at a loss. We have seen similar conditions at the start of the 2018, 2019, and 2022 bear markets, so it is important we dig in to assess the damage.

So without further ado, let’s run through the on-chain data to make an objective assessment as to whether we need to be putting on our bear market goggles.

TL;DR

- With over 25% of the Bitcoin supply now underwater, there are many conditions that resemble the start of bear markets of the past.

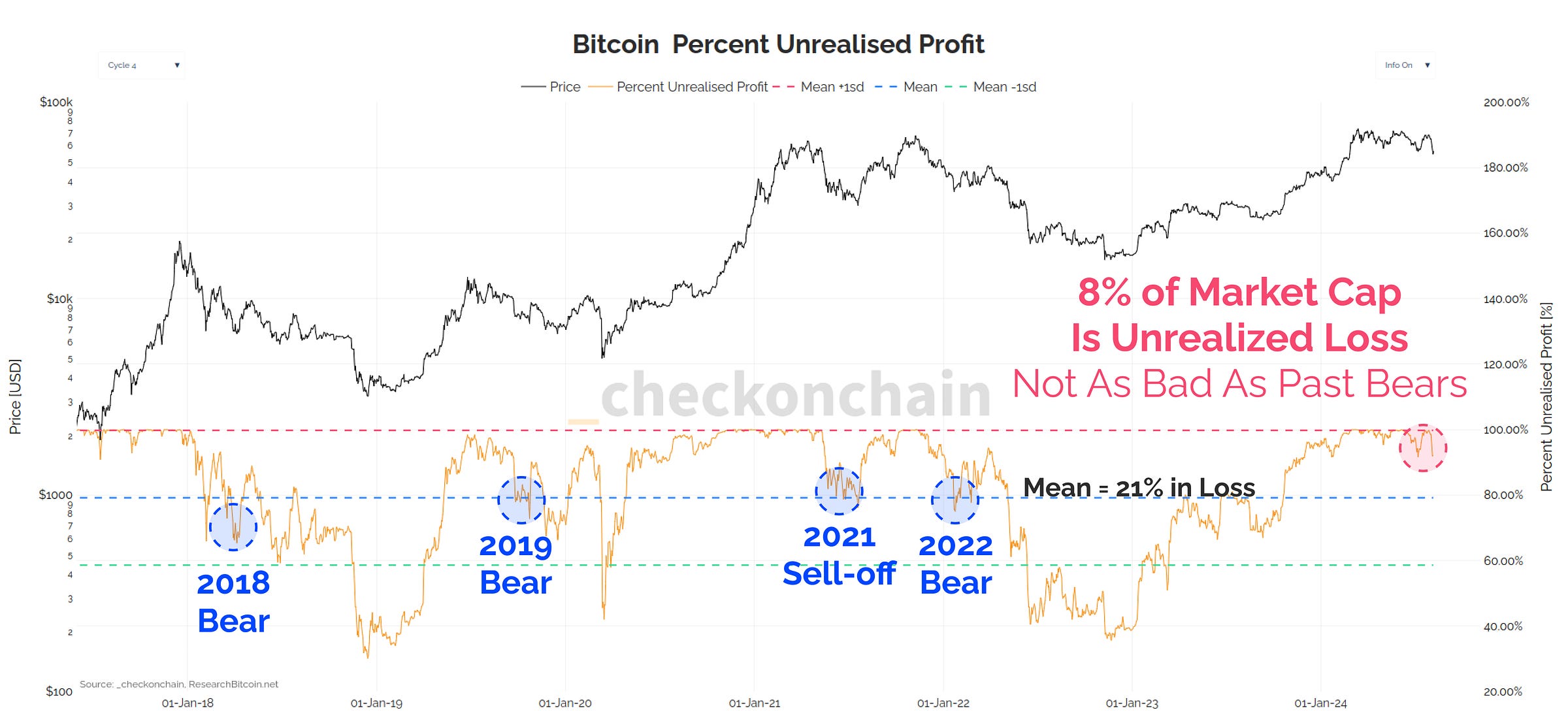

- However, the magnitude of the unrealised loss is currently at 8% of the Market Cap, which is a far cry from the 20% or more that previously broke the spirit of the bulls.

- We have seen a ‘mini’ capitulation event, with losses locked in exceeding $540M. Short-Term holders puked out coins on a scale similar to bear market lows.

Check the Analyst has one bear market goggle on, whilst Check the HODLer is patiently waiting for more bites at the cheap corn cherry.

Dramatic Drawdowns

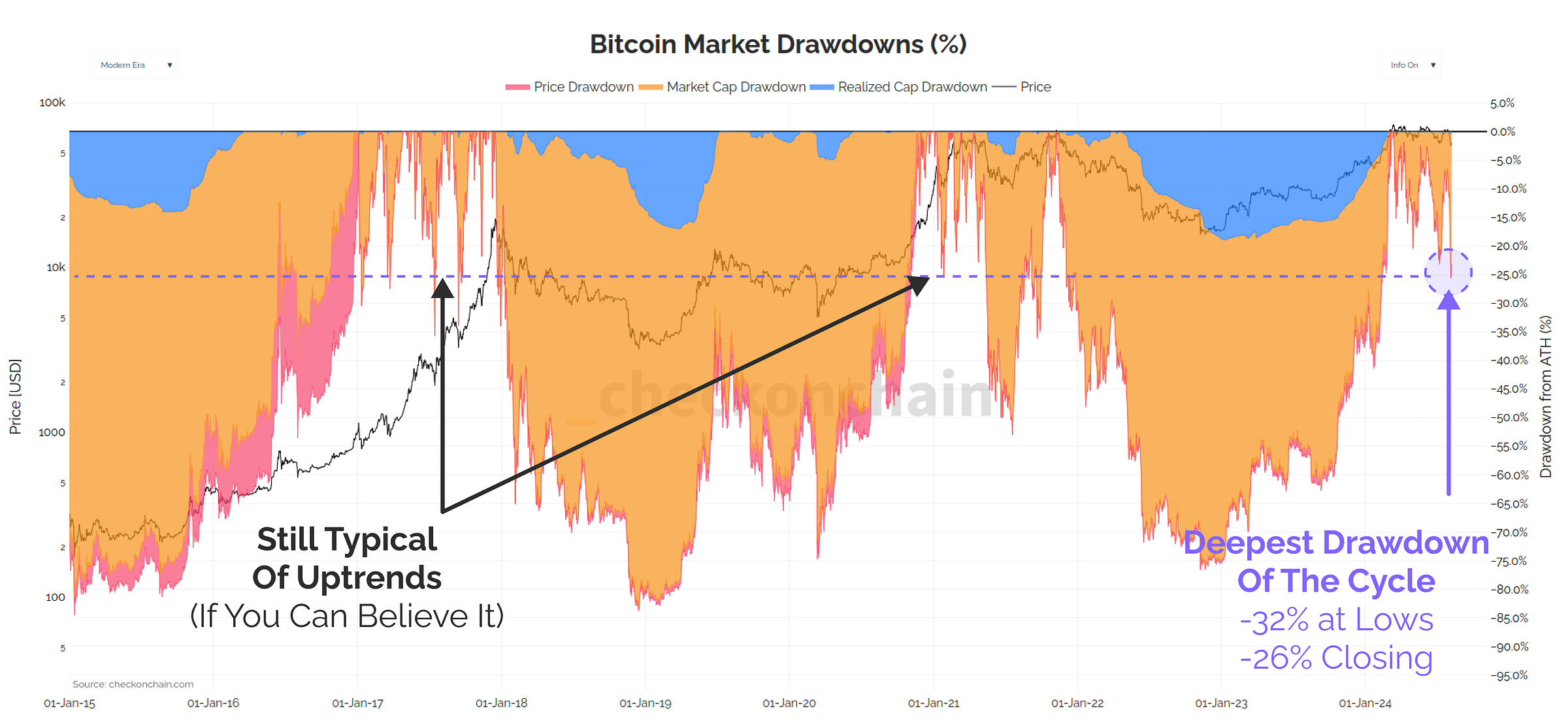

This drawdown has been by far the worst since the FTX bottom, with the market trading -32% below the all-time-high intra-day, and recovering to close down -26%.

This is the deepest correction of the cycle, and we should take it seriously. With that said, it remains somewhat typical of a Bitcoin bull to pullback by this much (and several times no less).

Live Chart

Live ChartWhilst the market drawdown is important, I believe the underlying profitability of investors is more important. If the market is down 30% from the all-time-high, but only one dude bought the top…who cares?

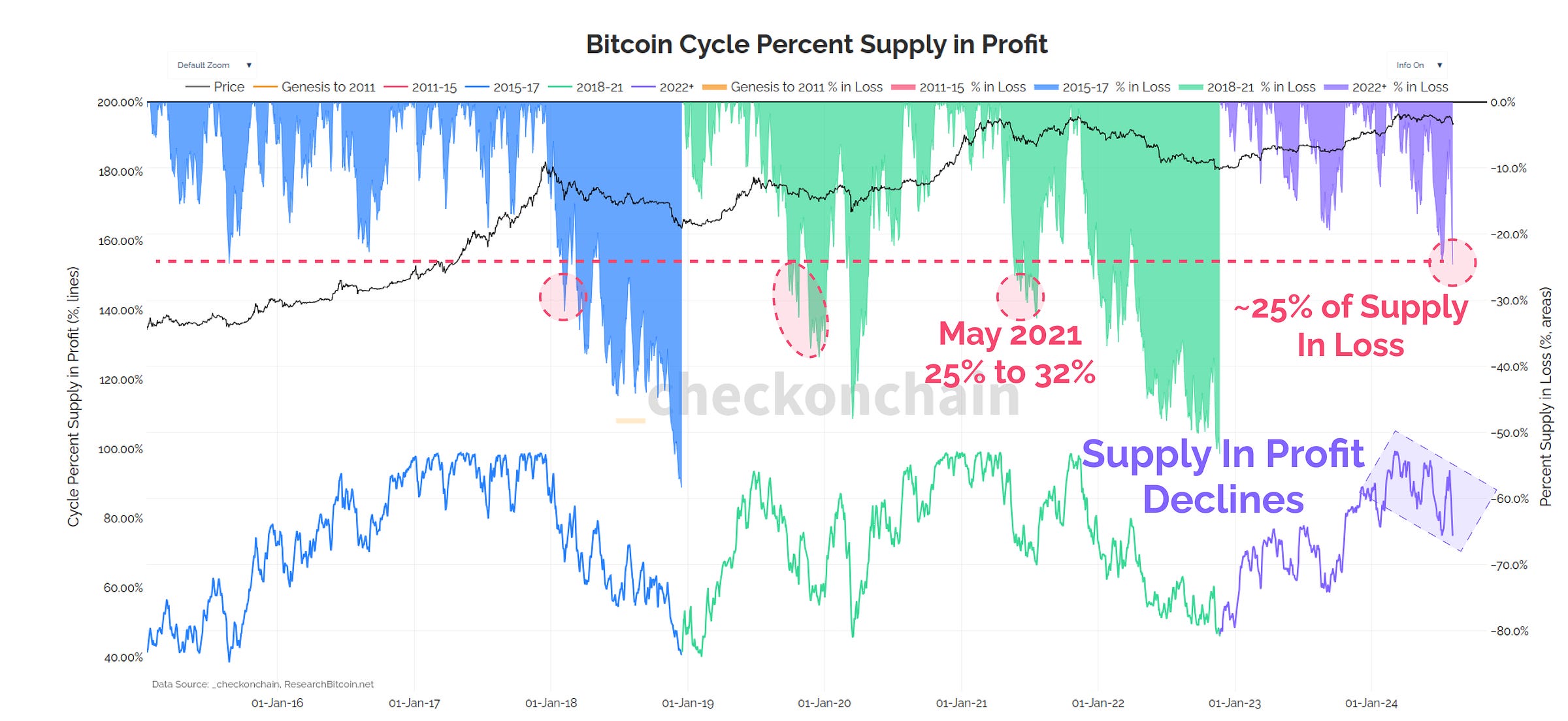

The chart below shows the percent of the Bitcoin supply held in profit (lines) and loss (areas). From this perspective, things look pretty angry, as 1-in-4 units of BTC are now held below their cost basis.

When I first developed this, I used it to assess periods when too many people, bought too many coins, at too high of a price.

With a quarter of the supply underwater, conditions are similar to May 2021, mid-2019, and the start of the 2018 and 2022 bears.

It is likely investor sentiment has taken a serious and strong jab to the face.

Live Chart

Live ChartA Bloody Nose

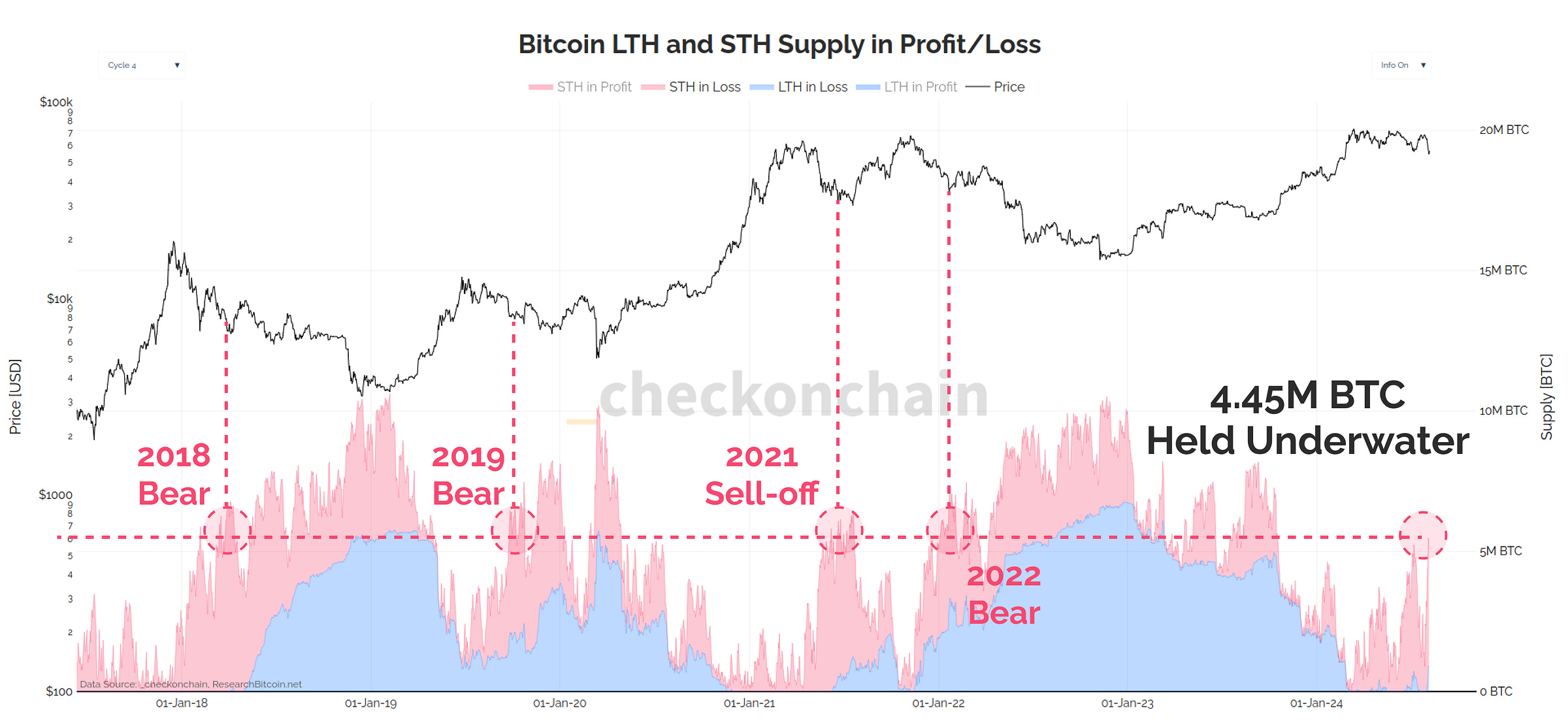

On an absolute basis, over 4.45M BTC held by Short-Term Holders are held below their cost basis. Around 900k BTC held by Long-Term Holders are in a similar position, although these are folks from back in the 2021 cycle, so I am not too concerned about them.

Once again, we see parallels to the 2018-19, and 2021-22 bear market conditions.

Live Chart

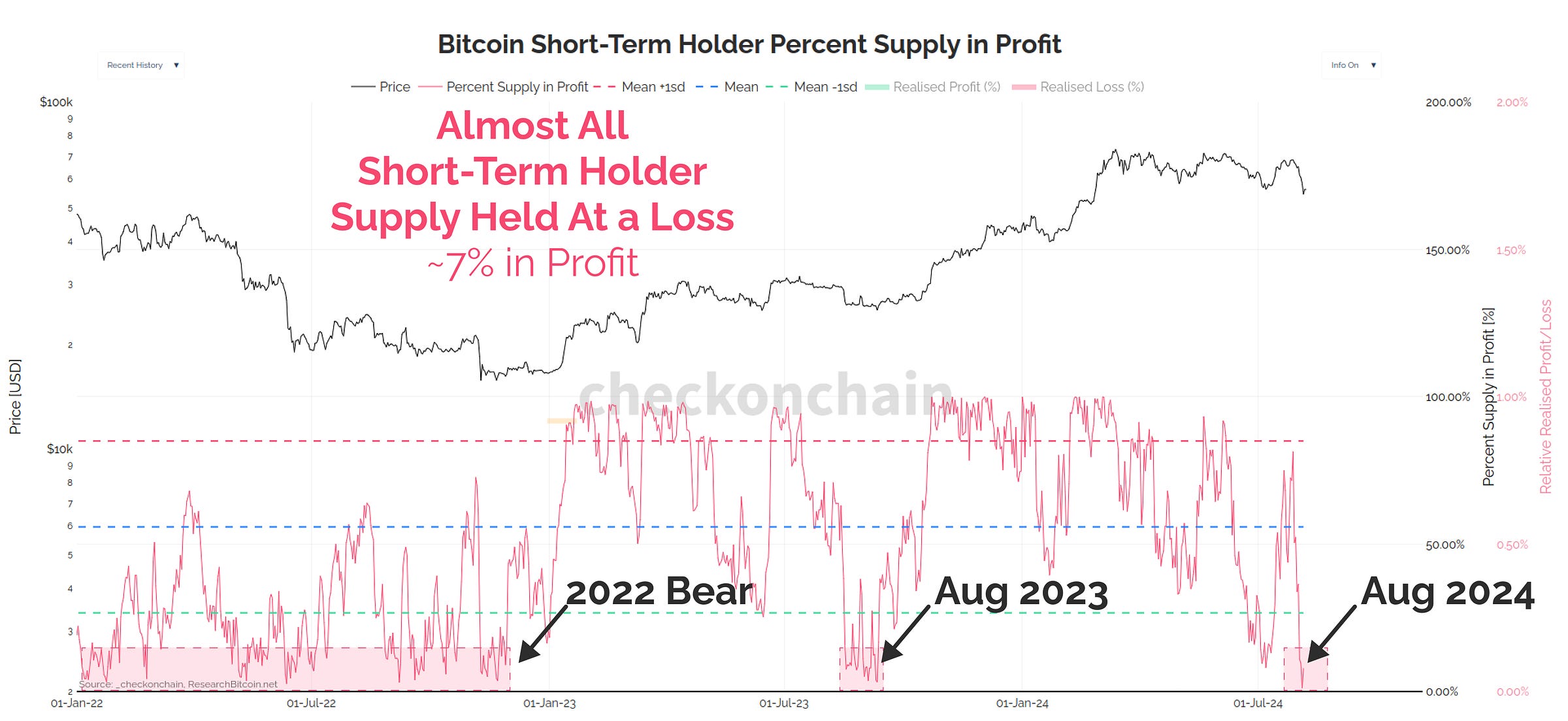

Live ChartAt the depths of the sell-off, 100% of Short-Term Holders were in the red. This has recovered marginally to around 7% being in profit, but I am still expecting there to be some turbulence in the immediate term as these folks wrestle with their bloody portfolios.

Live Chart

Live ChartBut The Bell Hasn’t Rung…Yet

To quickly recap, we have over 25% of the supply in loss, and on this basis, the conditions are similar to previous bear market conditions.

One bear market goggle on.

However, this isn’t the whole story. Just because a coin is ‘in-loss’, doesn’t tell us about how bad it really is. As a HODLer, I am all too familiar with hitting the buy button, and the market insta-dipping -5% to -10%. That’s just another day in Bitcoin.

What can be scary, and can break investor sentiment at scale is when those losses are over -20%, or worse. So the next metric shows the percent of the Bitcoin Market Cap which is held at an unrealised loss. This is the magnitude of the damage.

Whilst the NUMBER of coins in loss is similar to bear market conditions, the magnitude of the Unrealised Loss is not (yet).

Just 8% of the market cap is underwater, which is a far cry from the -21% which broke the spirit of the bulls in 2018-19, and 2021-22.

Live Chart

Live ChartSelling Low

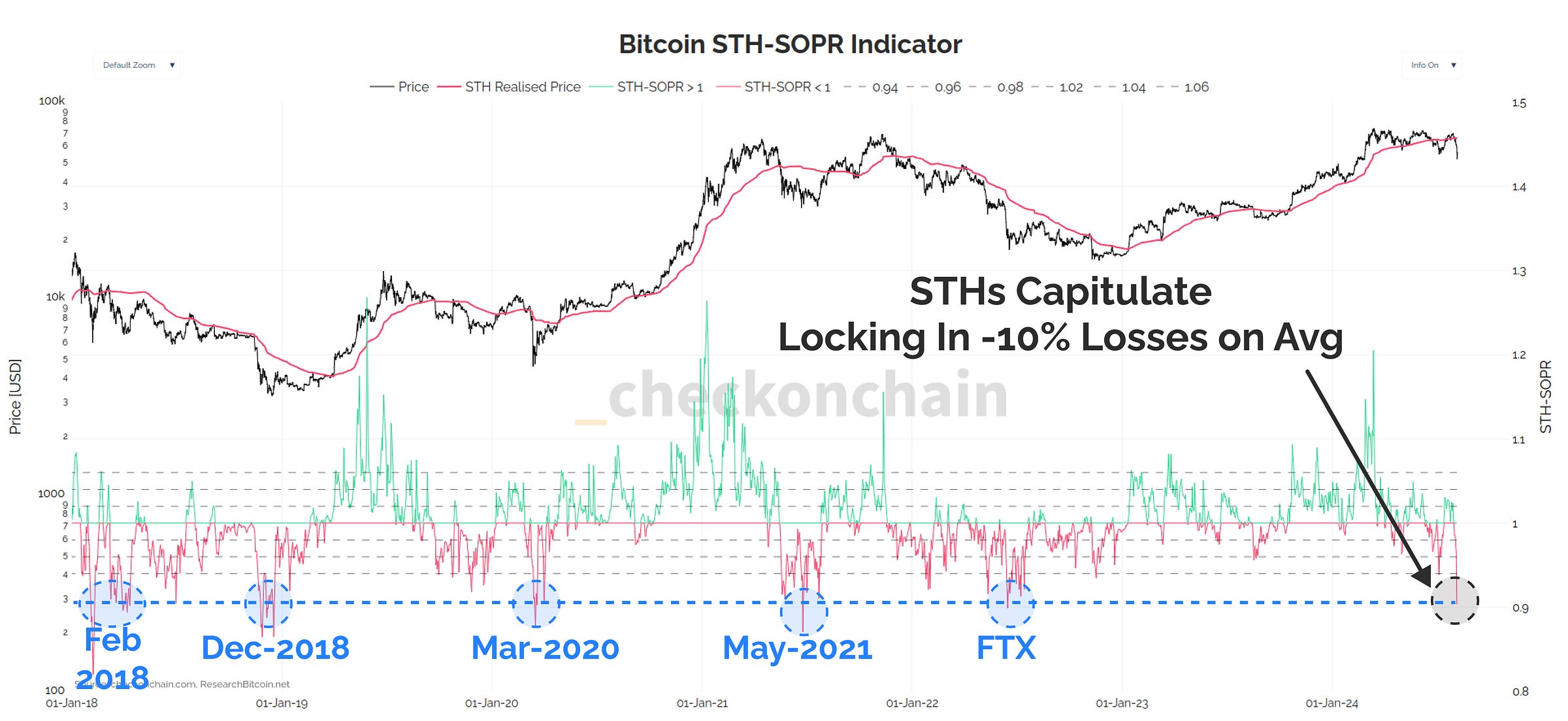

The final step in this damage assessment is to see whether folks actually panicked and sold their coins at the lows. For the Short-Term Holder cohort, the average coin that moved onchain locked in a -10% loss, driving STH-SOPR down to 0.9.

This ‘mini-capitulation’ event is on the same scale as previous bear market lows, including the wild sell-off that occurred in March 2020.

Live Chart

Live ChartSince SOPR measures the average percent profit/loss locked in, we need to also look at the absolute magnitude as well.

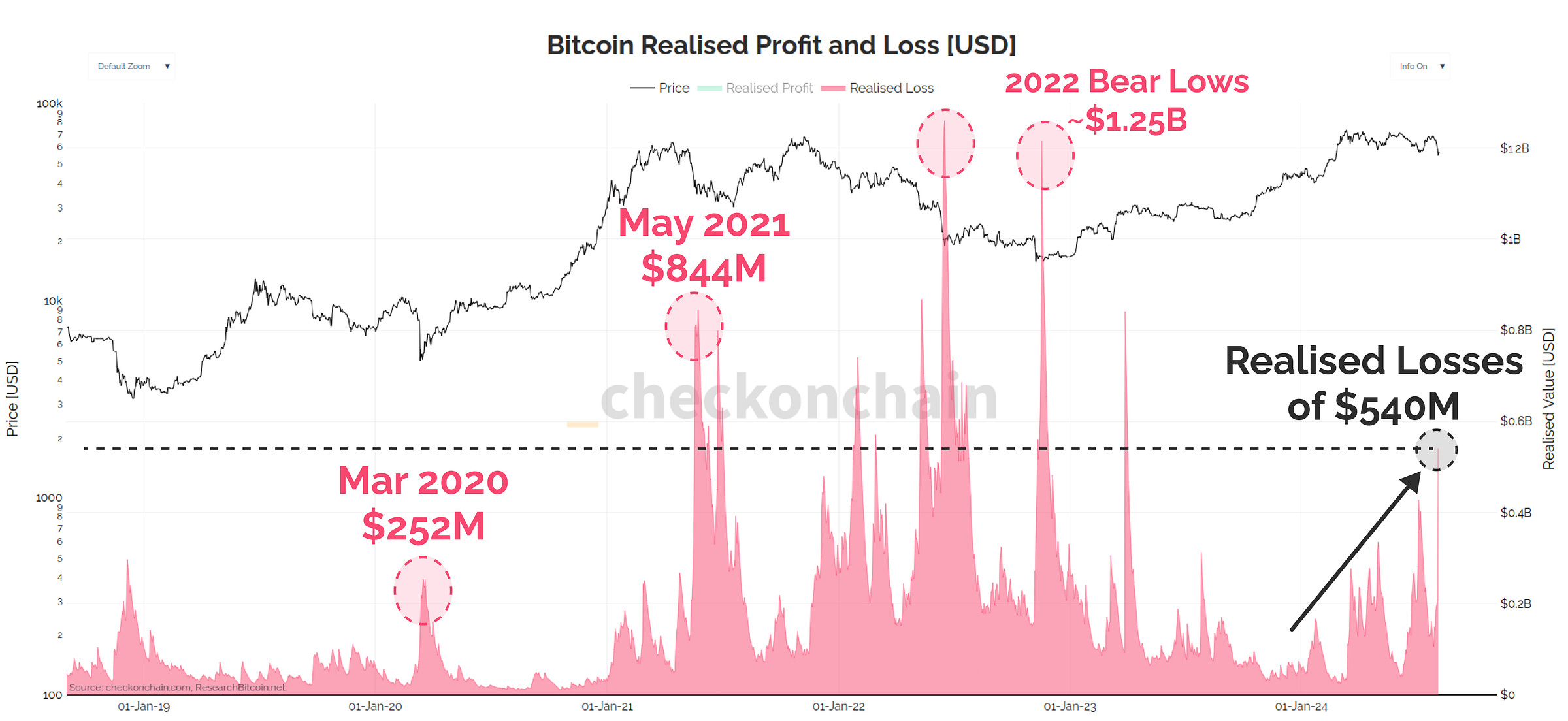

In total, the losses investors locked in on Monday hit $540M, which is the seventh largest capitulation event in history (on a USD basis).

Note again, that May 2021 was 50% larger in magnitude, and the pain was sustained for over two months.

Also note, that it is very common for the market to go through a ‘second-leg’ sell-off, so I am prepared for this over the next week.

It is too early to make any firm conclusions from this, but it is possible we just watched a major wash-out of the speculator cohort. What will be critical to watch from here on is whether these losses subside quickly (a good sign), or are sustained at elevated levels (a not so good sign).

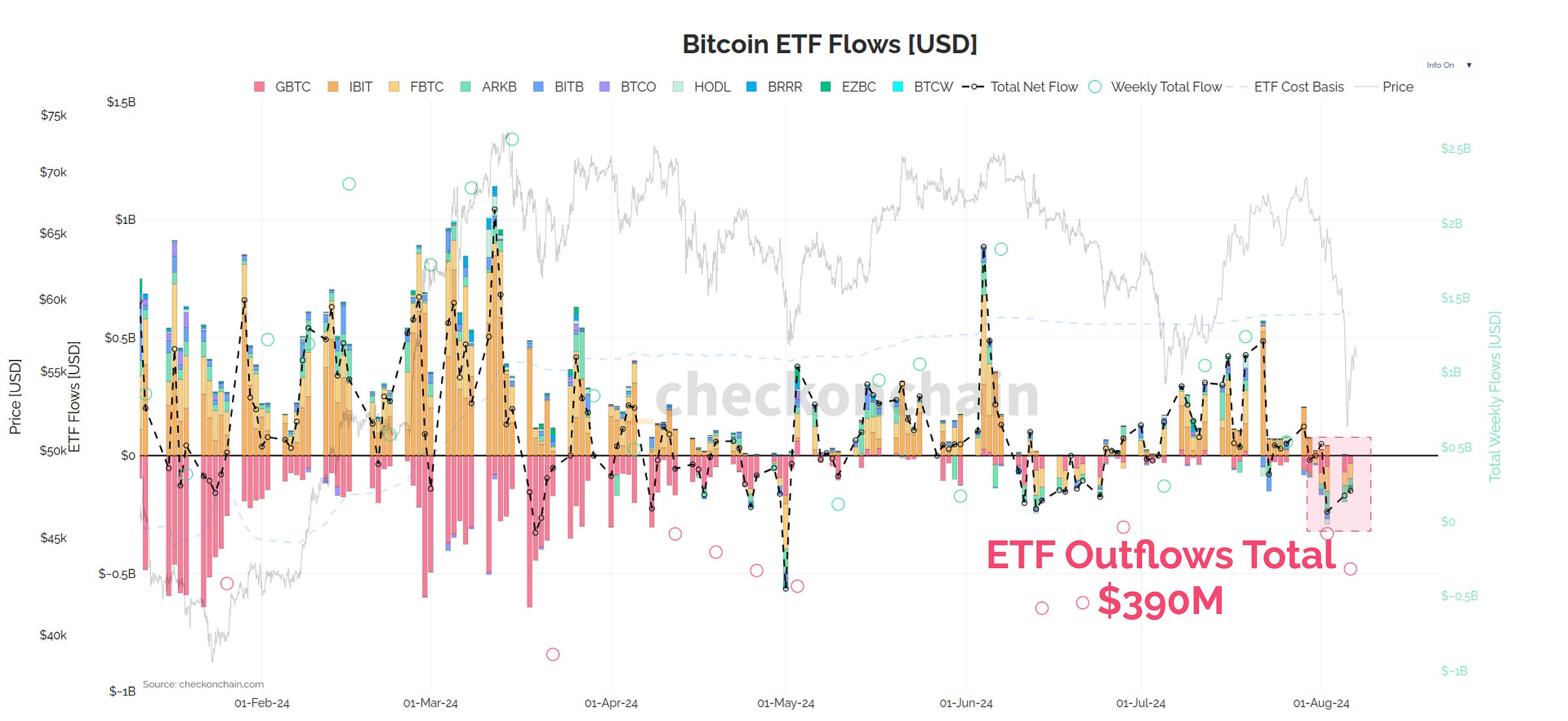

Finally, and as expected, the ETFs saw a fairly large batch of outflows totalling $390M. It is once again too early to draw a strong conclusion from this, as deleveraging events like Monday force all investors to clear risk from the books.

I am going to keep an eye on whether flows stabilise over the coming week, especially if volatility comes down.

Live Chart

Live ChartClosing Thoughts

There is no question, the Bitcoin bull took a decent punch in the face this week, and a very large proportion of holders are now underwater on a decent chunk of their holdings. In my view, it is appropriate to keep one bear market goggle on, as the conditions have many similarities to the start of previous bear cycles.

I also expect the market to attempt a second leg sell-off in the coming weeks, as it very rarely V-bottoms after an event like this without at least another gut check.

However, with all of this said, the magnitude of the damage is some distance away from the spirit breaking sell-off that we saw in May 2021, which mortally wounded the bull. We’re certainly not out of the woods, but I am not yet at the stage where I am putting on both bear market goggles.

The plan is to observe how sustained the losses are, and whether investor behaviour switched from ‘buy-the-dip’ into ‘sell-the-rip’ basis as we move ahead.

Check the Analyst has one bear market goggle on, and is cautious.

Check the HODLer is patiently waiting for more bites at the cheap corn cherry.

Thanks for reading,

James