Modelling market cycles is tricky business, specifically because there is no explicit roadmap or guarantees about the future. However on-chain data can certainly help us identify inflection points, leveraging the reaction people have to the incentives of profit and loss.

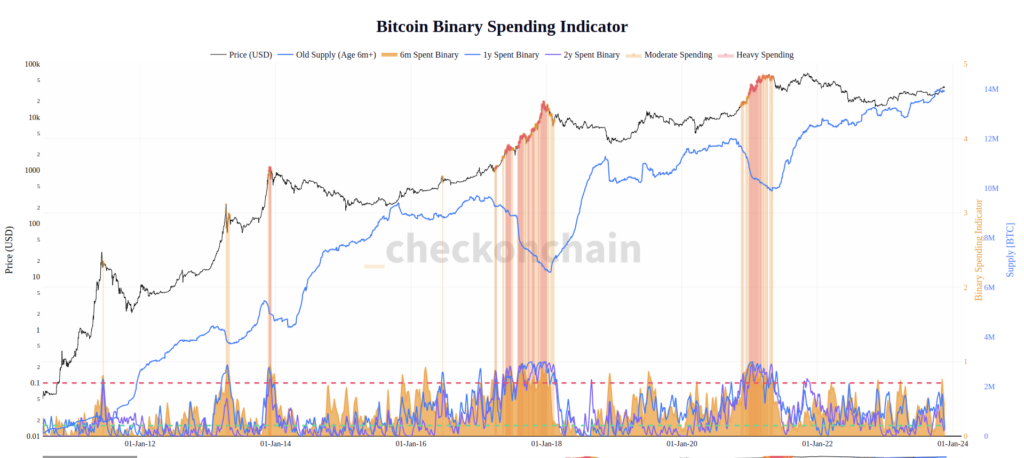

Today we will focus in on the Long-Term Holder cohort, as they are often most active around market cycle inflection points. Generally speaking, there are three core areas they shift their behaviour:

- At cycle bottoms, where first-cycle LTHs who survived the bear often capitulate at the lows.

- As we approach and break ATHs, as the first LTHs start to lighten the load and take profits.

- At cycle tops, when LTH spending peaks, and these newly circulating coins over-saturate demand.

Naturally, the second two are most relevant to us, as we are now 110%+ off the bottom, and I would argue firmly within a bull market. Of course it is impossible to guarantee how long this will be true, the world may implode tomorrow and experience a sharp sell-off.

But across several indicators we have the following constructive headwinds:

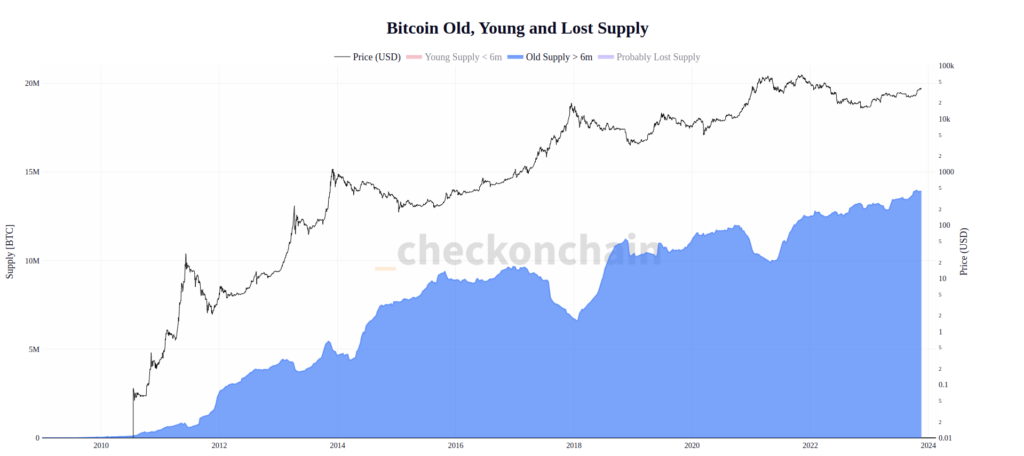

- Supply is tight as we explored over recent weeks, and seen in Long-Term Holder Supply metrics. With ETF approvals likely and the halving assured, the supply dynamics look really promising.

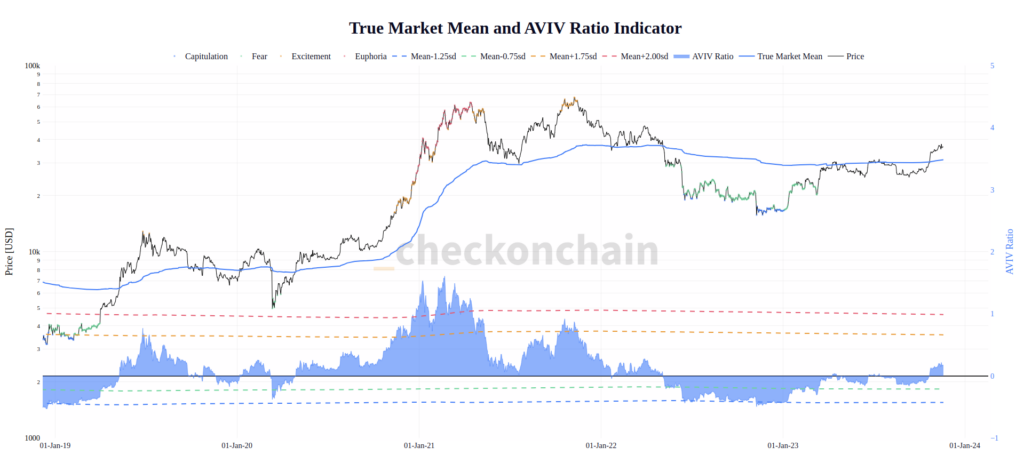

- We are above the cycle mid-point measured both visually around $30k, but also by breaking the True Market Mean Price

All of these dynamics suggest we have likely transitioned from the Tentative Bull Market, and into a Confirmed Bull. Essentially, the market has now convinced us, performed well, and held onto all of the years gains. No doubt it will be rocky and volatile on the road ahead, and we are well overdue an angry pullback.

However I suspect sentiment and attention have now shifted firmly towards the positive. The bears were and are wrong. Now we have to ride the bumpy road back to ATH and keep an eye out for the second LTH inflection point.

Given I started really diving deep into on-chain data when I joined Glassnode in Feb 2021, this is arguably the first bull market I am going through with all the tools in my belt. Prepare for yet another learning curve folks, it is going to be a fun one.