Solana sol

Collective Shift Analysis

To see Collective Shift’s analysis, sign up for our membership!

Solana Summary

Solana is a layer-1 blockchain built to enable scalable and user-friendly dApps. It’s a highly scalable blockchain that can expand throughput (the number of transactions) beyond what is normally expected of a blockchain, boasting much faster transactions and significantly lower transaction fees compared to blockchains such as Ethereum.

Currently, Solana can process up to 50,000 (currently ~4,500) transactions per second (TPS), with a theoretical limit of 710,000.

Anatoly Yakovenko introduced Solana in 2017, and the network launched in early 2020. Despite being several years old, the network technically remains in ‘beta’ and is built alongside Solana Labs.

Solana has grown to become one of the largest and most used blockchains with a range of dApps continually deployed on the blockchain. Solana differentiates itself from other blockchains through various network features such as the Proof-of-History (PoH) consensus mechanism (a variation of proof of stake) and the ability to perform parallel transactions.

Where Is Solana Today?

The Solana community is currently working on Firedancer, a major infrastructure upgrade that will introduce a new validator client (software that runs Solana) and make the network more resilient, faster decentralised, robust and efficient.

The first release—Frankendancer’—was launched at the end of 2024, with the full release ‘Firedancer’ set for 2025.

SOL Token Utility

Solana’s native token is SOL and uses the SPL standard.

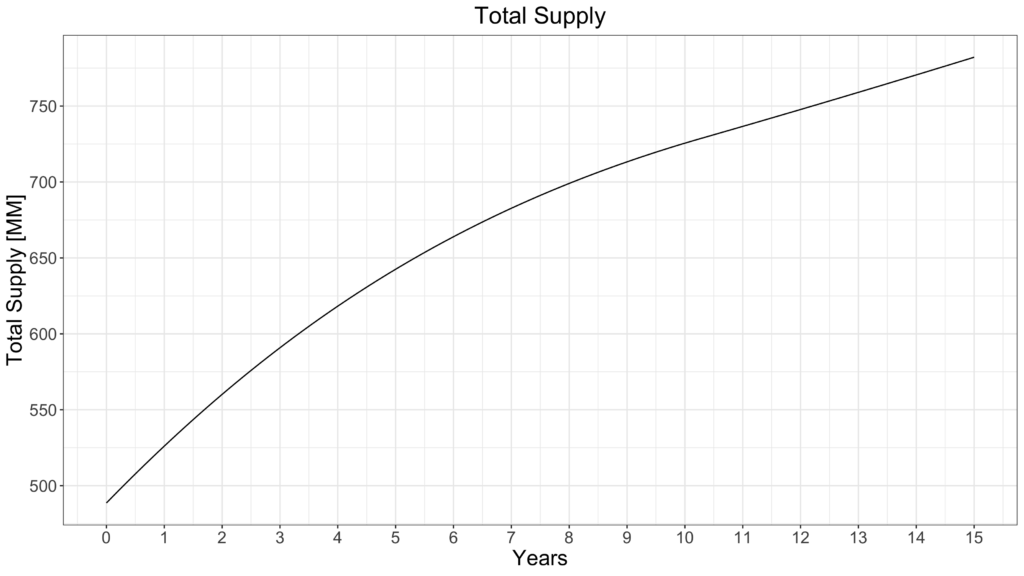

There is no maximum supply of SOL. Instead, Solana has a fixed year-on-year inflation rate.

According to Solana’s proposed inflation schedule, the initial inflation rate was set to 8% and is distributed through staking rewards. This inflation rate is reduced by 15% every year until reaching a long-term inflation target of 1.5%.

The plan is for the long-term inflation target to continue in perpetuity. The outlined inflation numbers do not consider any tokens lost or burned and, therefore, should be viewed as the upper limits of SOL inflation.

SOL has three primary use cases:

- Transaction fees: SOL is used to pay transaction fees incurred when using the network or smart contracts. (Users can pay a priority fee to accelerate their transaction. Leaders get 50% of priority fees for including the relevant transaction in its block, with the other 50% being burned.)

- Staking: For Solana’s proof-of-stake consensus mechanism to function, validators must stake SOL. It is the economic incentive used to operate the network. Holders can also delegate their idle SOL to a validator to earn staking rewards.

- Currency: As SOL is the native token, NFT marketplaces on Solana have started denominating in SOL.