Have you heard about blockchain but can’t quite understand exactly what it is? Our resource explains its core concepts and dive into various real-world use cases, such as tokenisation, decentralised finance (DeFi), gaming, and AI.

Key Takeaways

- This is a Beginner video introducing Blockchain Technology.

- Blockchains and Cryptocurrency are not the same thing. The underlying innovation is Distributed Ledger Technology (DLT).

- Transparent blockchains can be an advantage and a disadvantage depending on your perspective.

- The majority of cryptocurrencies are not decentralised. Meaning there is often a company behind it.

- The most common consensus models are Proof Of Work (BTC) and Proof Of Stake (ETH).

00:00 What Is Blockchain?

00:55 Blockchains

01:37 Blockchain vs Crypto

02:30 What’s the big deal?

03:27 Data Ownership

03:55 Transparency

04:18 Consensus

Understanding Blockchain: The Basics

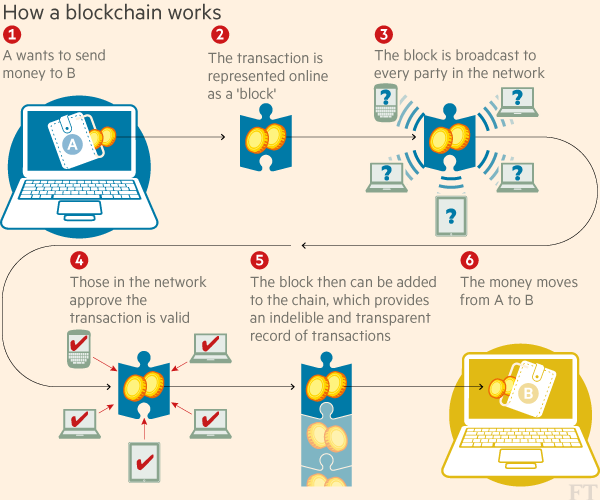

Simply put, a blockchain is a form of distributed ledger technology. (Distributed ledgers are databases maintained by multiple parties rather than one.)

The data that blockchains store are organised into ‘blocks’. Blocks are linked together using cryptographic hashes. This creates a ‘chain’ of blocks. Because blocks are ordered in a specific way, their data is immutable. (If something is ‘immutable’, it cannot be changed.)

Source: World Economic Forum Via Financial Times

Source: World Economic Forum Via Financial TimesIt’s worth pointing out that blockchain technology isn’t the same as cryptocurrencies. A cryptocurrency is a digital asset or digital form of money that runs on blockchains and other forms of distributed ledger technology.

For example, the bitcoin (BTC) cryptocurrency runs on the Bitcoin blockchain network. Another well-known blockchain, Ethereum, has a native cryptocurrency called ether (ETH).

Read: What Is Cryptocurrency?

The Big Deal With Blockchain

Blockchains are decentralised in nature, meaning no single actor controls the network. This is different from the centralised databases we see used today by banks and social media platforms, for example.

Operating on a centralised system is problematic for many reasons. One big reason is security. If a central database gets hacked, everything stored on it becomes vulnerable. Another reason is data ownership. In today’s world, you rarely own your data. Worse still, your data is often monetised by the very networks you trusted it with.

This brings us to another significant issue with centralised databases: transparency. It’s virtually impossible to verify how centralised network operators use your data.

How It Works: Consensus Explained

Each node participating in a blockchain network has its own version of the truth. (A node is simply a participant in a blockchain network. Nodes communicate with other nodes to ensure the blockchain’s security and integrity.)

Remember, blockchains are decentralised. So, you may be wondering: How on earth do all nodes agree on a unified transaction ledger without the help of a central authority?

It has to This all has to do with what we call blockchain consensus protocols. Think of these as the set of rules that define how nodes achieve consensus on a single state of the blockchain ledger. (‘Achieving consensus’ is another way to say ‘reaching an agreement’.)

Often misunderstood, any given blockchain consensus protocol has multiple key components. For example, Bitcoin uses the Nakamoto consensus protocol, which features a block-proposing scheme called proof of work (PoW).

Proof of Work Vs Proof of Stake

Proof of Work (PoW)

The most well-known consensus mechanism is Proof of Work (PoW), used by Bitcoin. In PoW, miners compete to solve complex mathematical problems, and the first one to solve the problem gets to add the next block to the blockchain. This process requires significant computational power and energy, but it secures the network by making it extremely difficult to alter the blockchain.

Proof of Stake (PoS)

Another popular consensus mechanism is Proof of Stake (PoS), used by Ethereum and over 90% of crytpocurrencies. In PoS, validators are chosen to add new blocks based on the amount of cryptocurrency they “stake” or lock up in the network. PoS is more energy-efficient than PoW and is seen by some as a more sustainable long-term solution.

Different networks use various consensus mechanisms based on their needs, but PoW and PoS are the two most common models.

Advantages and Disadvantages Of Blockchains

One of the main reasons blockchain has generated so much attention is due to its decentralised nature.

In a blockchain, no single entity or central authority controls the network. This starkly contrasts traditional centralised databases, like those used by banks or social media platforms, where one company or institution has complete control over the data.

But let’s dive deeper into these pros and cons.

Advantages

- Security: Since it is decentralised, there’s no central point of failure, making it more secure against hacking attempts. If a hacker wanted to alter the data on a blockchain, they would need to control more than half of the network’s nodes, which is incredibly difficult and resource-intensive.

- Transparency: Transactions are recorded on a public ledger, which is open for anyone to view. This transparency can build trust, especially in sectors where accountability is essential.

- Data integrity: The immutable nature means that once data is recorded, it cannot be changed or tampered with. This ensures that the information remains accurate and trustworthy over time.

Disadvantages

- Scalability: One major challenge is scalability. As the number of users and transactions increases, it becomes harder for the network to process them efficiently. Solutions like layer 2 scaling and more performant layer 1 blockchains are being developed, but this remains a significant issue.

- Energy consumption: Some consensus mechanisms, like Proof of Work (PoW), require substantial computational power. Bitcoin, for example, consumes a large amount of electricity to secure its network, raising concerns about its environmental impact.

- Transparency drawbacks: While transparency is often seen as a benefit, it can also be a disadvantage. Since blockchain data is open for anyone to see, this may raise privacy concerns in certain applications, especially where sensitive data is involved.

Blockchain Use Cases

Blockchain technology has far-reaching applications across various industries, far beyond its association with cryptocurrencies like Bitcoin. It is revolutionizing many sectors, including finance, social media, gaming, and AI. Below are some of the most impactful real-world use cases.

Real-World Tokenization (RWA)

Tokenisation refers to converting real-world assets into digital tokens on a blockchain. These tokens represent ownership or rights to physical assets such as real estate, artwork, treasury bonds or even commodities like gold.

Tokenisation democratises access to traditionally illiquid assets, enabling a broader range of investors to participate in markets that were once limited to high-net-worth individuals and provides costs and time savings.

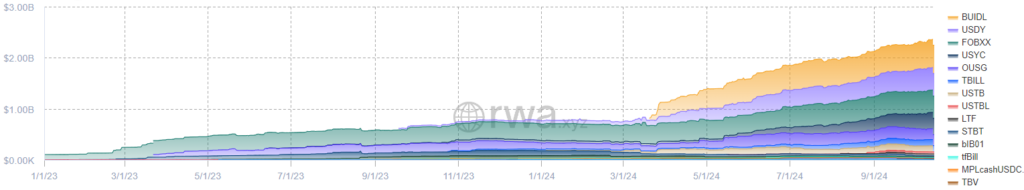

Treasury bonds have been one of the most successful examples of RWAs moving on chain, increasing to $2.4B as of Oct.16 2024.

Tokenised Treasuries (Source: RWA.XYZ)

Tokenised Treasuries (Source: RWA.XYZ)Interest in RWAs is heating up, with Visa launching a tokenisation platform on Ethereum in 2024.

On-Chain Stock Exchanges

Traditional stock markets operate through centralised exchanges involving brokers and other intermediaries. A new alternative is blockchain stock exchanges, where stocks and other securities can be traded directly on a blockchain. This can reduce fees, improve transparency, and allow faster settlement times.

For example, companies can issue security tokens, which represent shares of the company, directly on chain. These tokens can be traded peer-to-peer, removing the need for an intermediary.

Decentralised Finance and Token Swapping

Decentralised Finance (DeFi) is one of the most widely used applications for this technology. It allows users to access financial services without the need for a central authority, such as a bank. Through DeFi platforms, users can lend, borrow, earn interest, and even swap tokens—all without intermediaries. Popular DeFi protocols like Uniswap and Aave facilitate these activities in a decentralised manner, using smart contracts.

Token swapping, a key feature of DeFi, allows users to exchange one cryptocurrency for another without relying on centralised exchanges. These swaps happen automatically via liquidity pools and are governed by smart contracts.

Social Media

Traditional social media platforms like Facebook and Twitter are centralised, meaning they control user data, content, and monetisation. Blockchain-based social networks aim to give users more control over their data, ensuring privacy and ownership and even enabling direct monetization of content. New crypto social media platforms can allow users to earn cryptocurrency rewards for creating and sharing content. This decentralised approach ensures that users have complete control of their posts, and their data cannot be easily censored or monetised without their consent.

Stablecoins

Stablecoins are another popular use case. Stablecoins are a type of cryptocurrency designed to maintain a stable value by being pegged to traditional assets like the US dollar or commodities such as gold.

Unlike volatile cryptocurrencies like Bitcoin, stablecoins offer a way to transfer and store value without the risk of significant price fluctuations. Popular stablecoins like Tether (USDT) and USD Coin (USDC) are widely used in the crypto market for everyday transactions, cross-border payments, and as a reliable medium of exchange in DeFi applications. Their stability makes them an essential tool in the adoption of blockchain technology for financial purposes.

The total amount of stablecoins has grown from zero in 2017 to almost $180B in 2024.

Gaming

Crypto gaming is gaining significant traction, especially with the rise of play-to-earn models and non-fungible tokens (NFTs). Using blockchain, game developers can create in-game assets that players own and can trade on decentralized marketplaces. These digital assets, represented as NFTs, can include everything from rare items to characters and real estate in virtual worlds.

Games like Axie Infinity, Illuvium and Off The Grid are pioneering this space, allowing players to earn real-world value through in-game actions and trades. Blockchain ensures transparency in ownership, scarcity of digital items, and secure peer-to-peer trading.

Money

At its core, blockchain technology was developed to improve how money is transferred and managed. Cryptocurrencies like Bitcoin offer a decentralised alternative to fiat currency and traditional banking systems. Bitcoin allows no single person or entity to change the supply or “rules of the game” to bring fairness back to currencies.

Other higher-speed networks and cryptocurrencies offer faster, cheaper, and more secure transfers, especially for cross-border payments.

Additionally, governments are developing central bank digital currencies (CBDCs) in response to the rise of cryptocurrencies. These are digital versions of national currencies that operate on blockchain networks, offering the benefits of faster transactions and enhanced security while still being regulated by central authorities.

Artificial Intelligence (AI)

The combination of blockchain and artificial intelligence (AI) is unlocking new possibilities in the digital world. It can provide a secure, decentralised framework for storing and sharing AI models, for AI agents to work or earn and ensuring data integrity and ownership. In return, AI can help the cryptocurrency industry, particularly in areas like smart contract execution, auditing for exploits or bugs and data analysis.

For more beginner resources, click the button below!