Hi All,

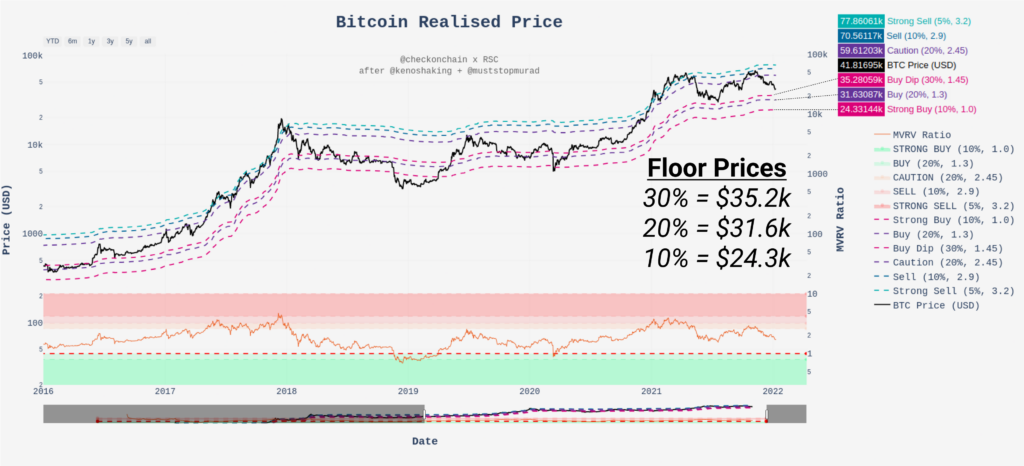

In the video over the weekend, we covered the concept of pricing bands based on MVRV. This post will present an even more refined model for the modern era.

Markets change. Especially new technology like Bitcoin.

We have previously noted in video posts that Bitcoin market participants have changed dramatically over the years:

- 2009 to 2013 – The cyberpunk years was a crowd of internet dwellers and very early pioneers who were heavily driven by computer science, software development, and cryptography

- 2013 to 2015 – The Libertarian and early adopters with some brought in from Silk road, others from aligned libertarian ideals, and even more from the price speculation.

- 2016 to 2019 – Retail speculation and rise of derivatives following the incredible textbook parabola of 2017. This was where Bitcoin entered mainstream attention both on the upside and on the way down

- 2019 to 2022 – Mature markets, macro themes, and institutionalisation. We are all familiar with this phase, and it is a slower, heavier beast with even larger narratives and forces at play.

What is important to note is that there was a distinct change in character following the 2017 top. Derivatives were part of the infrastructure, exchanges had grown up and hacks less frequent, and many altcoins had broken out into somewhat viable products and feasibility.

We also have a more ‘modern’ and holistic cohort of market participants, ranging from retail all the way through to pension funds. As a result, much of the 1 cent to $10 price action back in the early years simply is not indicative of the current market structure anymore.

I mentioned in last weekend’s video I would update the MVRV and Mayer Multiple to consider only data from 1-1-2016 onwards to calculate our probability bands. A few takeaway notes:

- Mayer Multiple barely changed at all! This is unreal and just goes to show that the 200DMA is such an important moving average as it captures ‘mean reversion’ accurately almost always, even before we have serious price charts, market infrastructure, or BTC on trading view.

- MVRV does have a significant change, with most of the pricing bands squeezed closer to price. The reason here is fewer 1 cent to $10 moves in a week, and more $5k to $10k in a month style moves. Folks realised profits more often and in larger sizes nowadays, whether as the early adopters invested $10 and saw it balloon to insane levels. Even after insane price rises, however, someone with $10k could buy the whole stack. Small change compared to today’s market really.

Using this updated pricing model, I have pulled out floor prices with 30%, 20%, and 10% probability of being exceeded. In other words, there is a 70%, 80%, and 90% probability of a bounce at these levels, respectively:

- Buy Dip (70% chance of bounce) = $35.2k

- Buy (80% chance of bounce) = $31.6k

- Strong buy (90% chance of bounce) = $24.3k

Remember, these are not guarantees, they are historical probabilities. I have included the link to this model in the description below, but have not yet integrated it to Check on-chain. I will get to this once I have verified it in more detail (as this is an alpha version). Consider this, your inside scoop!

Revised MVRV Pricing model using only data from 2016 onwards (Live Chart)

Revised MVRV Pricing model using only data from 2016 onwards (Live Chart)