dYdX ethdydx

Summary

dYdX is one of the largest decentralised exchanges (DEX) by volume—allowing users to trade with no intermediaries. It uses an order book—similar to most traditional exchanges—rather than an automated market maker (AMM) like Uniswap because the core team believes it enables for a superior trading experience.

The team is currently building its own blockchain on Cosmos with an in-built order book and matching engine. For now, the protocol runs on StarkEx, a layer-2 solution on Ethereum.

The mission

dYdX wants to recreate the central exchange experience that’s DeFi-native. It’s building an exchange to empower more traders to access powerful tools, assets and strategies to promote more transparent and fair financial products.

How else is dYdX different?

Outside of its order book design, dYdX focus’ on more sophisticated financial products. Exchanges like Uniswap provides simple token swaps and liquidity provision, while dYdX various advanced offerings such as perpetual trading, cross-margin trading and leverage products.

A brief history

dYdX was founded in Aug. 2017 by former Coinbase software engineer Antonio Juliano. The platform launched on Ethereum before moving to StarkEx in 2021 due to congestion issues.

dYdX started decentralising in Aug. 2021 with the dYdX Foundation. The next month, the DYDX token was airdropped to thousands of past users of dYdX.

Where to now?

dYdX is currently building its own blockchain (i.e. an appchain) via the Cosmos ecosystem. In its current form, the order book and matching engine are centralised (via StarkEx), with its upcoming ‘V4’ (new Cosmos release) set to play a big part in decentralising the protocol.

Milestone 2 is complete with the multiple testnets running the order book—look ahead for major announcements in H1 2023.

DYDX Token Utility

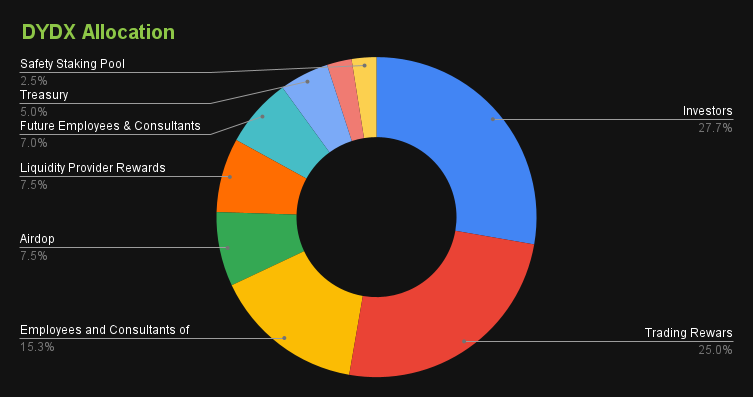

dYdX’s native governance token is DYDX. The maximum supply of DYDX is 1B and nearly 14% is in circulation as of this writing.

So far, DYDX has the following limited uses:

- Governance: Holders have limited control over decisions such as treasury spend.

- Reward and incentivisation: DYDX is historically paid to liquidity providers (LPs) and general users of dYdX, proportional to fees paid / by the total fees paid by all traders during that period. Currently, every 28 days, 2.9M DYDX is distributed to users.

Watch out for changing tokenomics

The release of dYdX V4 will, among other things, add functionality to DYDX as a network token that can be staked to help secure the dYdX blockchain. Another change may be that DYDX holders are entitled to a greater percentage of fees.

Collective Shift Analysis

To see Collective Shift’s analysis, sign up for our membership!