Ethereum is the second-largest cryptocurrency but has not yet had its ‘moment’ in the bull market. I dive into why it remains highly relevant, how attention may eventually shift toward Ethereum, and why it’s currently hard to fade.

Key Takeaways

- Ethereum is yet to break from the pack, following the same broad gains as the rest of the market.

- Lagging institutional flows could mean the market is increasingly overlooking ETH, making it a great time to pay attention.

- Despite a likely ETF rejection this month, preparing for an eventual approval could be wise due to the potential for a Bitcoin-like supply shock.

- Combined with ETH’s unique deflationary supply, strong demand, increasing ETH locked in smart contracts, reducing ETH on exchanges, and new demand-side impacts due to re-staking, paying attention to ETH is incredibly important.

Ethereum Yet To Break From The Pack

Ahead of Ethereum’s transition to proof of stake (PoS) in Sep. 2022, I argued why the move could be bullish for ETH due to:

- ETH becoming a yield-bearing asset;

- the network’s reduced environmental impact, and

- changes to ETH’s tokenomics.

It didn’t quite unfold as expected due to the lengthy bear market.

Fast-forward to 2024, and ETH has not performed like some other cryptocurrencies so far in this bull market. Since the start of 2023, ETH is +150%, only slightly better than the altcoin market (+125%), measured below as TOTAL3, the combined market cap of all cryptocurrencies other than BTC and ETH.

BTC (orange), ETH (grey) and TOTAL3 (red) (total market cap minus BTC and ETH) price performance since Jan. 2023 (Source: TradingView)

BTC (orange), ETH (grey) and TOTAL3 (red) (total market cap minus BTC and ETH) price performance since Jan. 2023 (Source: TradingView)Mismatch of Institutional Flows

One metric that shows Ethereum is possibly going under the radar is the relative lack of institutional demand.

In the last few years, Ethereum experienced net outflows faster than other cryptocurrencies. Of note, despite the bull market, ETH is the only asset to experience net outflows so far this year.

Is this a sign a large portion of the market is underexposed to ETH? The table below shows the relatively stagnant AUM levels.

ETH flows by assets year over year (US$M)Is ETH Still Bullish?

Does this mean ETH has failed? Is ETH no longer the second ‘best’ cryptocurrency? Should you abandon ETH for greener pastures?

These are all good questions. While ETH is not “too big to fail” and has unique risks, it could prove unwise to bet against Ethereum’s vast ecosystem of developers and users. Below are six reasons why.

#1. Expecting ETF Rejection, But Preparing For An Approval

The most significant tailwind for ETH is a possible spot ETF product in the U.S. However, hopes of an approval in May are slim. One of many indicators suggesting this is a prediction market on Polymarket, where traders are pricing an approval at 7%.

So, how should you play the SEC’s upcoming decision and likely denial?

If the SEC denies the applications, it could argue that ETH is a security and generate negative headlines that could place downward short-term pressure on ETH. But this could be the most opportune time to pay attention.

Ahead of the launch of the spot Bitcoin ETFs, I explained why BTC could follow a ‘buy the rumour, buy the news’ pattern, which is what happened.

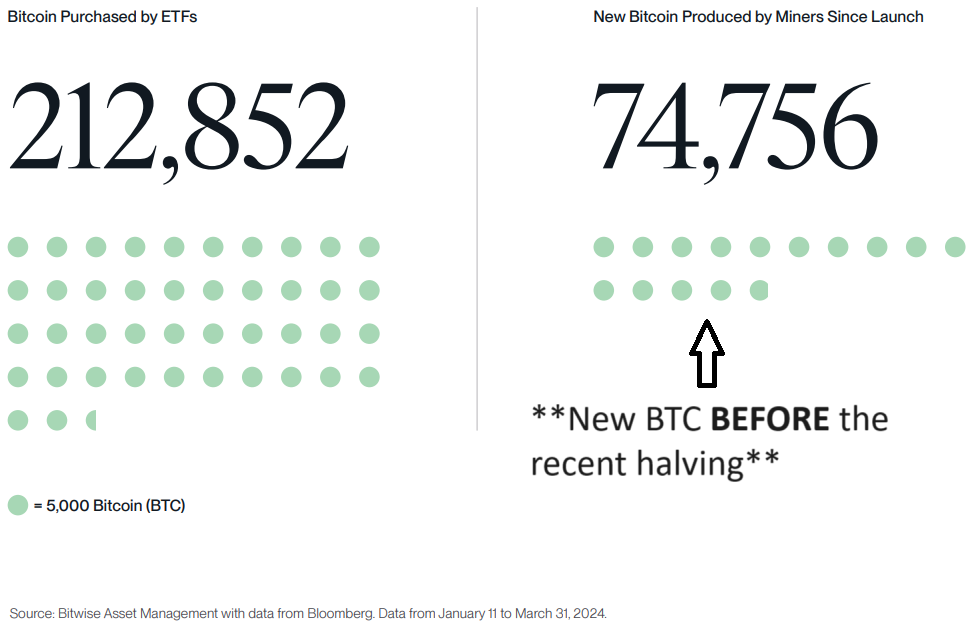

Should these Ethereum ETFs get approved, I expect a similar pattern to unfold, albeit to a lesser extent. We saw the tremendous spot accumulation of BTC, with demand far outpacing supply (see below), which could be a playbook for ETH.

To avoid being left behind, it could be wise to prepare for an eventual ETF approval. Knowing precisely when this milestone arrives is virtually impossible. However, I struggle to see it never happening. (Although if granted, an ETH ETF will likely not see the same level of demand, similar supply/demand mechanics could unfold.)

Bitcoin: Demand From U.S. ETFs vs. New Supply (Source: Bitwise)

Bitcoin: Demand From U.S. ETFs vs. New Supply (Source: Bitwise)#2. ETH Burn & Supply Shock

Ethereum’s burning mechanism means the supply of ETH is continually adjusting. If the demand to use the Ethereum blockchain hits a certain level, the supply becomes deflationary (i.e. more ETH burned than issued).

Variables such as increased network activity help contribute to higher transaction fees and drive yields higher, creating a flywheel of growing demand and decreasing supply.

Despite the daily ETH burn rate hitting a yearly low, resulting in increased issuance and inflationary effects, the trend remains downward. Since the Merge in 2022, ETH has been deflationary. The current annual inflation rate is -0.21%.

Although this hasn’t led to a price rally just yet, how long will it take for the market to factor in a deflationary supply compared to other cryptocurrencies with higher issuance rates? (SOL 4.5%, DOT 10%, XRP 8%, AVAX 10%, etc.)

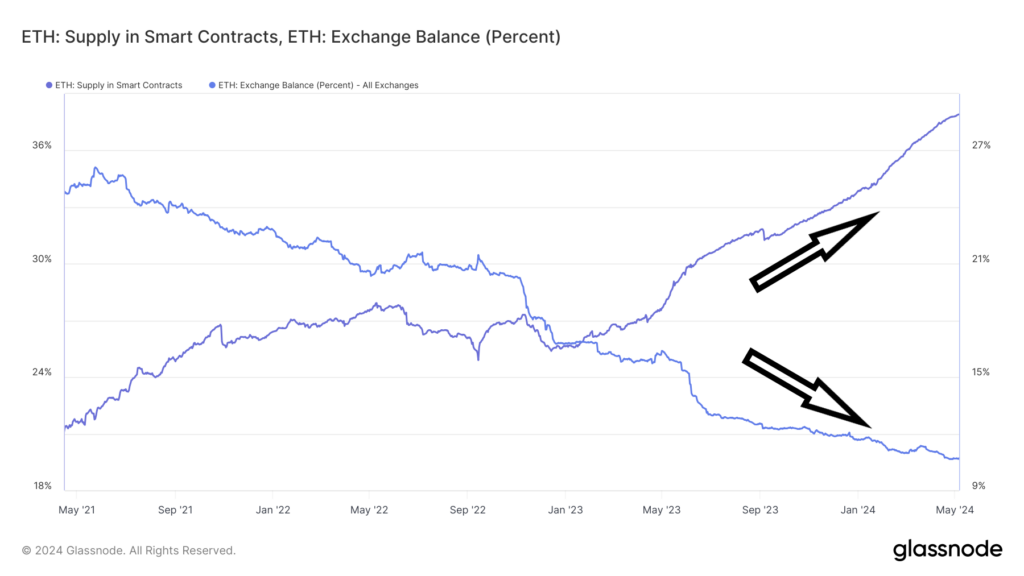

#3. ETH In Smart Contracts vs Exchange Balances

A core catalyst for why ETH should still be front, and centre of our attention is the increasing amount of ETH put to work and held in smart contracts. The increase comes when the amount of ETH on exchanges is going down.

The inverse relationship between the two is helped by the growth of ETH staking (a rate that increased from 15% to 27% since May 2023).

In other words, more ETH is being put to work (showing increased utility), leaving less available on exchanges to sell readily (impacting sell pressure).

Source: Glassnode

Source: Glassnode#4. ETH Demand Side

We’ve talked a lot about the supply impacts of Ethereum, but there are changing demand-side reasons to pay attention to, such as the introduction of restaking.

Restaking EigenLayer

Restaking is finally here, and it’s a core change to the ecosystem that may profoundly impact ETH demand.

The rise of EigenLayer restaking protocols can increase demand for ETH in a few ways:

- Encouraging staking: EigenLayer allows for additional earnings on staked ETH, attracting more participants and reducing available supply.

- Locking up ETH: Restaking increases the amount of ETH locked up, decreasing its circulation and potentially impacting its price.

- Boosting network utility and security: Now staked ETH can be used to secure other chains, it puts Ethereum’s massive security and economic value to work, reinforcing and increasing its utility.

- Increasing yields: The potential for multiple reward layers increases potential yields generated via ETH (while increasing the risk), providing increasing yield opportunities for ETH.

- Growing blockchain demand via spurring innovation: EigenLayer fosters innovation on Ethereum, potentially leading to new applications that generate more activity in the Ethereum blockchain.

Ethereum remains the most popular blockchain

Despite the rise of Solana and performant L1 blockchains, Ethereum and its L2 ecosystem still have a substantial market share across the space.

Combining the market share of Ethereum and its network of L2s shows a clear theme: users and developers continue to build in the Ethereum ecosystem or on Ethereum-compatible blockchains.

Demand is reflected in underlying profit/revenue metrics, with the Ethereum network generating $370M in profit on ~$825M in revenue. In a 2023 analysis, VanEck’s Head of Digital Assets Research explained that ETH’s staking rate “creates a major new competitor to U.S. T-bills” and could see its revenues “rising from an annual rate of $2.6B to $51B in 2030.”

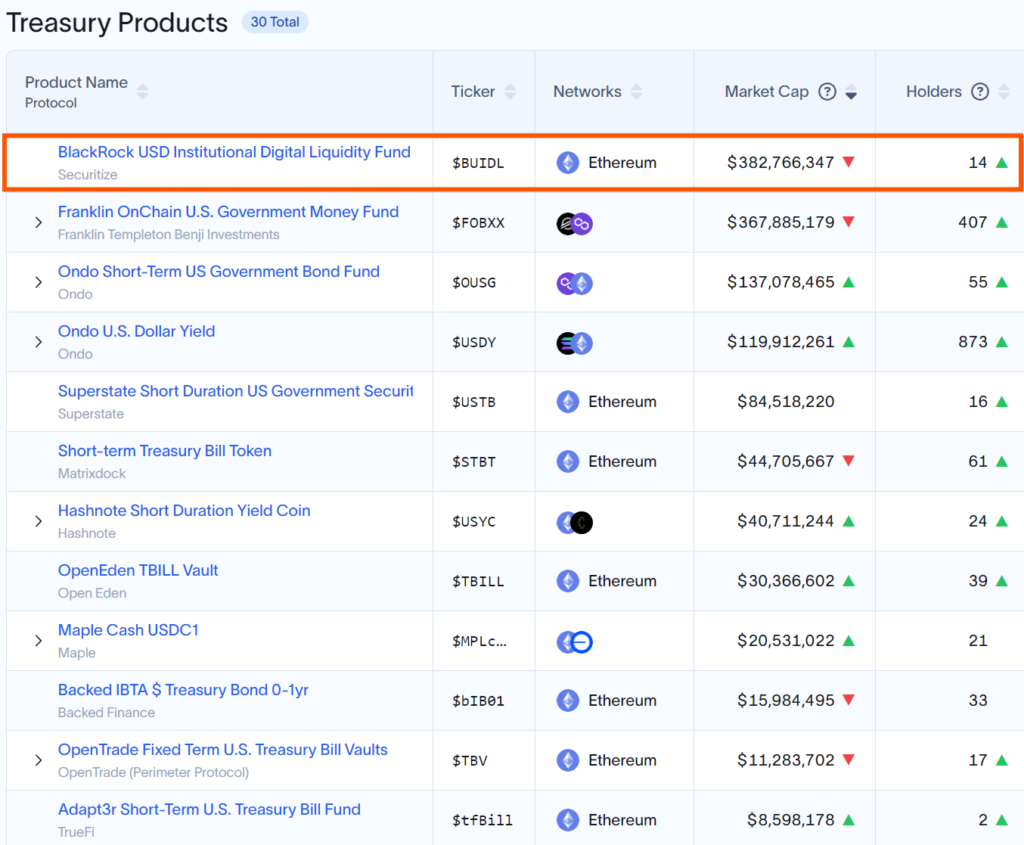

Qualitative signals paint a similar, if not more powerful story. Ethereum continues to be the go-to blockchain for major organisations, signalling a greater degree of trust in the network’s performance compared to other blockchains.

- PayPal first deployed its PYUSD stablecoin on Ethereum.

- Visa piloted stablecoin settlement and wallet abstraction on Ethereum.

- BlackRock deployed its BUIDL fund on Ethereum (now the most popular treasury fund).

In short, the network remains profitable, highly demanded and used by major institutions.

Ethereum dominating as the most popular chain to deploy RWAs (Source: RWA.xyz)

Ethereum dominating as the most popular chain to deploy RWAs (Source: RWA.xyz)#5. ETH Scaling Efforts Continue to Progress

Finally, you should pay attention to Ethereum because of increasing L2 adoption.

As I explored in March, the Dencun upgrade profoundly impacted Ethereum by making it significantly cheaper to use L2s. So far, costs on these networks are down by ~90% or 10x. For example, swapping tokens on a DEX on Optimism now costs roughly 1–2 cents instead of 30–50 cents.

The impact is felt across many core metrics (e.g. active address, stablecoins bridged, TVL, contracts deployed) that are growing strongly. The trend looks set to continue, with another big 12 months for L2s, with Arbitrum (BOLD) and Optimism (Cannon) set to release significant milestones in terms of decentralisation. (More on the state of L2s in my recent post.)

Separately, other teams are working on ways to take L2 scaling to the next level. For example, Mega Labs and Paradigm are building MegaETH and Reth, respectively. (For more on these, watch this recent presentation from Yilong Li, co-founder of Mega Labs.)

#6 Ethereum Upgrades

Ethereum will keep upgrading over the coming years. Although the next upgrade (i.e. Pectra) won’t be as important as Dencun, it will contain several minor changes targeting ‘the Purge‘ phase of Ethereum’s roadmap (i.e. removing old network history and simplifying the network). A confirmed date for Pectra should come later this year. Most are expecting it to go live in Q4 2024 or Q1 2025.

Recap

Ethereum has yet to ‘break out’ and remains in the middle of the pack, following the same broad gains as the rest of the market. It suggests that the market is overlooking ETH, especially if we look at institutional flows across major investment products.

However, a possible ETH ETF rejection could be the most important time to pay attention; an eventual spot ETH ETF could result in major supply-side pressure. Combined with ETH’s unique deflationary supply, increasing ETH locked in smart contracts, reducing ETH on exchanges, new demand-side impacts via restaking and the continued strength of the network as a whole, users should still be paying close attention to Ethereum.