Are you stuck holding lots of cryptocurrencies, trying to figure out what to do with them? Are you holding with the hope they will reclaim all-time highs in the next bull market? It’s a common mistake I see, and the paralysis can make you hold onto cryptocurrencies you maybe shouldn’t. Below, I cover how to reassess cryptocurrencies you’ve held for a long time.

Key Takeaways

- Buying too many altcoins is a very common trap that people fall into.

- When you find yourself with too many altcoins accumulated over the years, it’s best to look back and reassess and ask, “Exactly why am I holding this?”

- To decide on what to do next, follow these five steps:

- Look at the fundamentals

- Question if you’re too emotionally attached

- Consider the sunk-cost fallacy

- Talk to your tax accountant about your options

- Consolidate and prepare

- By the end, you should have a greater sense of where you stand, what you want to hold, and what you no longer believe in.

Contents

Too Many Alts, A Very Common Problem

Last week at Aus Crypto Con, I was humbled to meet many members and crypto enthusiasts.

But one thing stood out: many people mentioned they have way too many altcoins and they don’t know what to do next.

I see this all the time, where people will want exposure to all the hot narratives and categories. All of a sudden, they’re holding a long list of altcoins.

Now the market is turning; many are returning to crypto and looking at their stack of cryptocurrencies that look more like a car crash than a crypto portfolio.

Heading into 2024, you may have a lot of altcoins you’re holding from past crypto cycles and unsure exactly what to do.

When you find yourself with too many altcoins accumulated over the years, it’s best to reassess and ask yourself, “Exactly why am I holding this?”

What is too many?

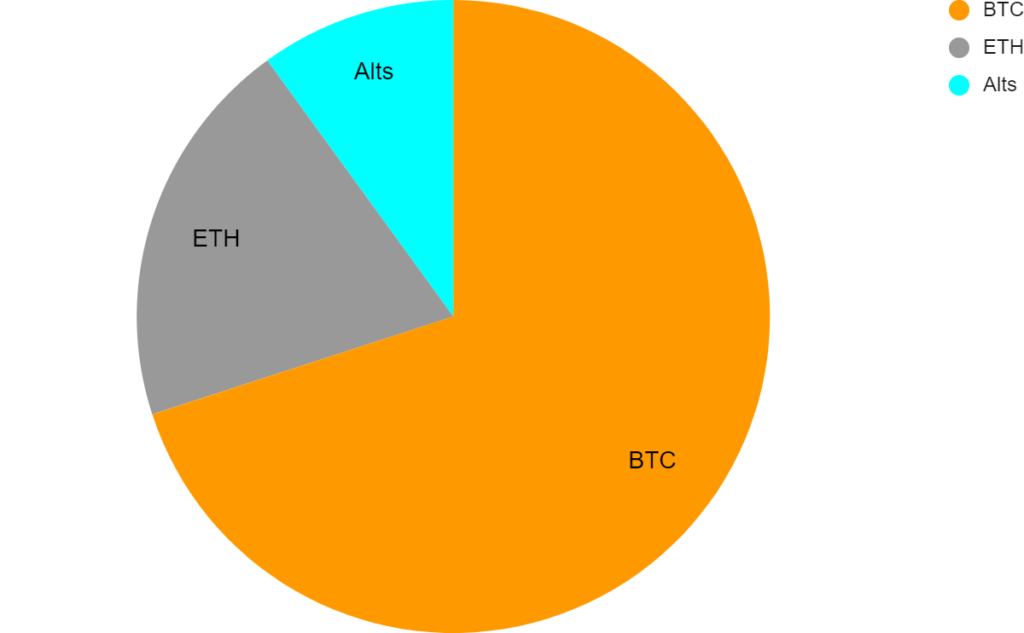

If this applies to you, it can be helpful to start by simply looking at a list of all the cryptocurrencies you hold. Even better, look at a pie chart of all your holdings. (The ‘Your Dashboard‘ section is ideal for this.)

Find out how much of your crypto portfolio is allocated to BTC, ETH and altcoins.

Our ‘Crypto Portfolio Structures‘ resource goes through different approaches to constructing a crypto portfolio. Everyone’s version of the ‘best’ structure is different because everyone’s goals and risk appetites are different.

That said, more seasoned long-term crypto investors tend to have the vast majority of their portfolios in BTC and ETH, and then they allocate 0.5–3% for each altcoin they hold.

Example of a relatively common crypto portfolio structure

Example of a relatively common crypto portfolio structureLooking To History

A thing many people underestimate is just how much the top cryptocurrencies change from cycle to cycle. See for yourself by looking at CoinMarketCap’s historical price data. What are the chances your altcoins will stay relevant by the time the next bull run kicks into overdrive?

Address This Issue With These 5 Steps

It’s time to reassess your existing cryptocurrencies. While it’s arguably impossible to remove your bias entirely, try your best to be objective when reviewing each one. You may have to make some tough calls.

To make a more informed decision on what you should do about your issue of having too many altcoins, follow these five steps:

- Look at the fundamentals

- Question if you’re too emotionally attached

- Consider the sunk-cost fallacy

- Talk to your accountant—you could save tax by selling

- Consolidate and prepare

1. Look at the fundamentals

For each altcoin, ask the following list of fundamental questions and answer with a ❌ (no), ✔️ (yes) or ➖ (uncertain).

| Fundamental | ❌(no) ✔️ (yes) ➖ (uncertain) |

|---|

| Timing—do they solve a growing need? | |

| Are they still building? | |

| Do they still have a community of developers and a growing ecosystem? | |

| Are they active across their socials? | |

| Have they gained any legitimate adoption? | |

| Are they being surpassed by competitors? | |

| Do they have sufficient runway left? | |

| Are the tokenomics sound or broken? (i.e. how useful is the token?) | |

| Do they have an outdated or redundant narrative? | |

| Are there any upcoming catalysts? | |

Example: Alternative L1 narrative

In 2021, a major narrative was the rise of alternative blockchains, which were attempting to build the most scalable blockchain possible. Ethereum was struggling to handle lots of demand, with transaction fees often exceeding $100 worth of ETH.

This gave rise to a slew of alternative layer-one blockchains (or L1s) which captured a decent amount of adoption, resulting in their native tokens drastically outperforming ETH. The big winners here were Solana, BNB Chain, Avalanche, Polkadot and Terra.

Now, in late 2023, these alternative L1s have a new competitor in the form of a wave of Ethereum L2s. Between Ethereum L1 and all its L2s, there is now a lot more blockspace to go around, weakening the powerful narrative that alternative L1s had in the last bull market.

2. Are you too emotionally attached?

If you did the above analysis and came out with many crosses (❌) but still want to hold, consider whether you’re too emotionally attached. If you are, it can be extremely difficult to make rational decisions.

A common trap I see is holding out for a cryptocurrency to get back to all-time highs.

Consider how much it will take to get back to all-time highs or break even. For example, if you’re holding a 70% loss, the cryptocurrency must be +233% to break even.

| How negative your altcoin is (%) | Price increase needed to return to break even (%) |

|---|

| -10% | +11% |

| -20% | +25% |

| -30% | +43% |

| -40% | +67% |

| -50% | +100% |

| -60% | +150% |

| -70% | +233% |

| -80% | +400% |

| -90% | +900% |

3. Consider the sunk-cost fallacy

The market does not care whether you (or anyone) have poured hours into researching and tracking a particular altcoin that you’ve held at a loss for years.

Consider the opportunity cost of continuing to hold. Do you see a higher probability of upside on something different versus this particular altcoin you’re holding?

There could be a greater opportunity cost in not realising any losses and using that new time, attention and capital to look at other cryptocurrencies that tick all the boxes in the above fundamental analysis table.

4. Consult your tax professional

A big part that is often overlooked is talking to your tax accountant.

Often, depending on where you live, you can tax-loss harvest any cryptocurrencies that you no longer want to hold.

I suggest the below piece if you are unfamiliar with tax-loss harvesting. (Again, I want to emphasise that these rules differ depending on where you live.)

5. Consolidate and prepare

Once you’ve reviewed your cryptocurrencies, you might find you’re holding too many cryptocurrencies you cannot humanly stay across.

In my experience, it’s better to be across a few things than the opposite—that is, spreading yourself too thin and trying hopelessly to capture every new narrative and trend.

By doing this process, hopefully, you can reduce the number of tokens taking up your mindshare, time and wallet so you can refocus on what you truly believe in.

Creating your own crypto strategy should help prevent you from getting back into this situation of having too many altcoins.

Read: Creating Your Personal Crypto Strategy

Recap

Hopefully, this gets you thinking and helps you reconsider your cryptocurrencies and make the most informed decisions possible. It is not intended to tell you when to buy and sell or the correct distribution of structuring your cryptocurrencies but to educate on the core issue of many holding vast amounts of altcoins, unclear what to do and stuck in decision paralysis.