Everyone needs a sell strategy, and often, the simplest one is the best. In this article, I’ll walk you through some selling scenarios and some strategies you could potentially utilise. I will also share my personal sell strategy and how I plan to execute it.

Key Takeaways

- Understanding the different scenarios that can take place will make you a better-informed seller.

- Effective selling hinges on preparation, including knowing what wallets contain which coins and how you plan to sell them.

- Having an ejection plan is important, and being prepared to accept when you’re wrong is crucial in making sound exit decisions.

Contents

Selling Scenarios

There are four general selling scenarios. This is not an all-encompassing list, but it’s important to understand these four scenarios so you can better execute your selling strategy.

Scenario 1: The Genius Scenario

All of us aim to sell crypto at the very top of the market. Here is the unfortunate truth: you are not a genius, I’m not a genius, none of us can sell the top. If you don’t believe me, go and read one of my previous articles that debunks the myth of selling at the top.

Scenario 2: The ‘Oh No’ Scenario

This is when you have a price target that never gets hit. You want to avoid this scenario; there’s nothing worse than hoping and praying that your price will get hit.

So, how do we avoid Scenario 2?

- Realistic Goals: Setting price targets is difficult, so you need to have realistic goals. Don’t aim for a crazy blow-off top. I always employ the “50% Idiot Theory,” meaning if I think a price will hit X, I’ll set my target at 50% of X.

- Stepped Sell Targets: Having multiple sell targets as the price increases is a good strategy. This way, you’re not putting all your eggs in one basket. As prices move up and you’re selling, it’s a good place to be, locking in profits.

- Don’t Get Stuck in an Echo Chamber: If you were around in 2021, you’ll probably remember the 100k Bitcoin prediction that many believed. I myself got sidetracked by that echo chamber, thinking Bitcoin would hit 100k in 2021. If you’re listening to bullish targets and you feel very bullish, make sure you also listen to someone who thinks the opposite. You don’t have to agree, but it’s always important to challenge your thought process.

- Accept That You Might Be Wrong: This is tough because ego gets in the way, but sometimes you’re wrong. Don’t cling to a target when it’s clear the market

Scenario 3: The Greed Scenario

You have a price target, and you’re supposed to sell there, but you feel the excitement and euphoria of the market movements, and you don’t sell because you think the price will just keep going up. This is why having goals is important—to ensure you actually execute your sell strategy rather than letting the excitement cloud your judgment.

Remember that crypto is very volatile, and regardless of when you sell, the price will likely dip below it at some point. This is illustrated by the Bitcoin chart here, showing that there were 101 weeks during which you could have sold your Bitcoin and eventually, the price would have dropped below your sell point. So, if you’re ever fearful because you’ve reached a price target and hesitate to execute your selling strategy, just remember that with the market’s volatility, the price is likely to go down again, and you’ll feel like a genius once more.

For further contrast, remember meme coins like Dogecoin have had 95% corrections. This basically means that if you sell your meme coin at any point in the cycle, it is highly likely that the price will drop below your sell price. Remember from Scenario 1: you’re not going to sell at the top, so just sell when it’s suitable for you and not worry about the FOMO or the greed of prices continuing to go up.

Doge Coin – Highs to Lows

Doge Coin – Highs to LowsScenario 4: The Likely Scenario

This is where the price is going up, you sell, the price goes up further, and then it crashes down drastically.

Remember, crypto is super volatile. We all want to sell at the top, we all want to avoid the ‘Oh No’ scenario of not selling at all, and we now know that if we sell at any point in time, it’s highly likely that the crypto price will drop below it, so we don’t need to fear missing out.

The reason why you really want to sell in this scenario on the way up is because it’s easier to sell into the euphoria and excitement. You want to sell when prices are moving up, not when they start to come back down because then you hesitate and start thinking you might just hold on a little longer until it rebounds to that higher price.

A simple way to think about this is that when it feels really hard to sell, it’s a good time to sell, and the opposite is true in a bear market—when it feels really hard to buy, it’s probably a good time to buy.

Let’s Get Your House In Order

It’s important to have everything ready when it comes to selling; you don’t want your price targets to be getting hit while you’re trying to figure out where your Ledger is or which exchange you can sell your token on. Now is definitely the time to make sure that everything is in order.

Where are your wallets?

Which chain are they on? Which hardware wallet are they on? Which exchange are they on? If you’re like me and have multiple wallets across multiple chains, it’s important to be very clear about where they are and know how to access them.

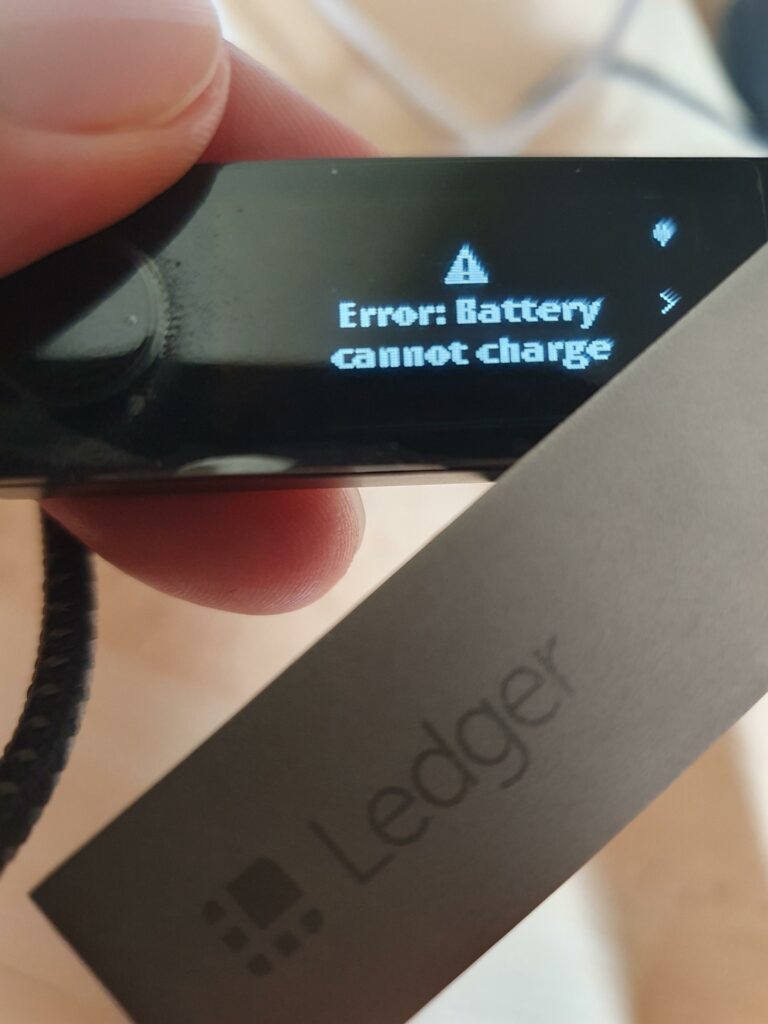

Is your hardware wallet ready?

Do you know where your hardware is? Have you used it lately? Has the battery run out? Perhaps do a test run to make sure you remember how to use your hardware wallet. Because if you’re like me, you’ve held a lot in a cold wallet for a long time. Make sure you know how to access it and get it off there.

Is your hardware wallet working?

Is your hardware wallet working?What exchange are you using?

Do you plan on using a decentralised exchange or a centralised exchange? Have this plan written down. Make sure you know where you’re going to send your coins to make the transaction. This leads easily to the next one.

What are you trading it into?

Are you trading into Australian dollars, U.S. dollars, a stablecoin, or maybe into BTC? This goes hand in hand with the exchange question above because you need to know what you’re selling your crypto into before you can really choose the exchange. Remember, the smaller the market cap, or the more unusual the meme, the less likely you’ll find it on the major exchanges, and you may need to be ready to use a DeFi application.

Tax considerations

You should definitely seek advice from a tax accountant on this. However, you should still understand your tax implications, especially if you’re considering selling and then reinvesting.

If you are thinking about reinvesting profits, think about tax implications and maybe keeping some money aside to pay the tax that you’ve made on the profits. Nothing worse than reinvesting it all and losing it than being stuck with a tax bill you have no money to pay.

How To Sell

There are three main ways that people usually sell their crypto: one is through price targets, another is a time-based strategy where they sell depending on the date rather than a price, and the third is dollar-cost averaging out. I’m not going into these in detail because you can see that in more detail in a previous Collective Shift report.

What I want to talk about is an ejection plan.

This coincides very well with the “Oh No” scenario in that no matter how good your plan or price targets are; sometimes you need to listen to the market and have a plan if your plan doesn’t go right. You don’t hold on like this tweet below when the market is telling you differently.

A big mistake I made in 2021 was that the market was telling me that the cycle was over, but I held on, partly out of false hope and, I think, partly out of fear and partly out of greed as I was dreaming about how much bigger my portfolio could be. Don’t be like this tweet.

I exited the market only after the Luna collapse, which, in hindsight, was clearly too late, but it could have always been later. So, make sure you know when enough is enough. I think the best way to think about an ejection plan is definitely coinciding with a date plan. If the market is still looking positive into Q4 of 2025, I will have my ejection plan to get out at that point.

My Personal Strategy

So, as I said at the beginning, simple is best, but it’s not really how it always works, is it?

My strategy combines price targets, time-based, and, something I didn’t mention above, sentiment-based strategies.

So, I feel my price targets are fairly moderate. I could be wrong, and I’m prepared to be wrong. These price targets align with my goals, and even if they were met today, I would sell because I’m so focused on achieving them. Would I feel FOMO? Absolutely. But I have some lifestyle chips that I need to cash in for. And for the record, I did apply my 50% Theory to my price targets.

I do have stepped price targets. Interestingly, my first step price target for Solana was triggered in January of 2024. This was because Solana had already done more than a 5X for me, and it was time to take some risk off the table. Had I not sold, of course my portfolio would be higher now. But I had a plan to derisk as Solana was not quite the powerhouse it is today, so I stuck with my plan and am happy I did. (for the record, yes, I do feel some regret selling so early, but I am proud of myself for sticking with the plan when it felt awkward to be selling)

I am very focused on time-based. As I said earlier, the longer we go into 2025, the more likely the cycle’s over.

So, if my targeted prices get hit earlier in 2025, the percentage amount I will sell will be less, but the later it is in 2025, the higher the percentage will be, and therefore, my higher price targets will have less of a percentage of the portfolio to sell.

This will affect my overall return, but I’m very focused on making profits.

Finally, sentiment—this is something I will follow closely. Think about the feeling and the price action we had after Trump won the election; that was euphoria, that was mania, everything went up, everyone felt amazing. Remember that feeling—if you’re feeling that again, it might be time to sell. That’s something I am going to be very focused on looking for. That feeling will change all my target prices and time-based prices—pardon the pun, but sentiment trumps prices.