Jumped into buying without knowing how to secure your cryptocurrency properly? You’re not alone. Dive into our guide to decode the importance of wallets, sidestep common pitfalls, and the 5 key principles of mastering cold storage.

Contents

What Is Cold Storage?

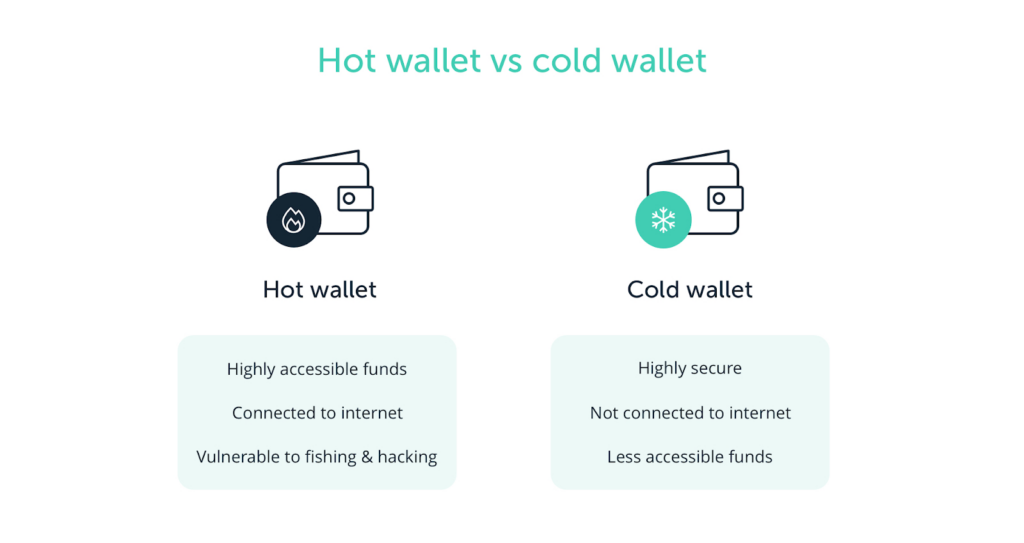

To truly master cold storage, it’s important to understand the key differences between hot wallets and cold wallets, as they serve distinct purposes when it comes to securing your cryptocurrency. Knowing when to use each type of wallet can help safeguard your assets from potential threats and ensure you’re using the most appropriate security measures for your digital holdings.

What Are Hot Wallets?

Hot wallets are cryptocurrency wallets that are always connected to the internet. These wallets generate their recovery phrase (seed phrase) online, and you can access them from web browsers, desktop applications, or mobile apps.

They are generally recommended for smaller amounts of cryptocurrency that you intend to use often.

| Pros | Cons |

| Intuitive user interface & instant access | More vulnerable to theft |

| Access to wide variety of applications | Less secure |

Examples: MetaMask, Phantom and Coinbase Wallet

What Are Cold Wallets?

Cold wallets, on the other hand, are stored offline, away from internet access. These wallets are often referred to as hardware wallets and are considered one of the safest methods of cryptocurrency storage because they are disconnected from the online world. Cold wallets generate their recovery phrase inside the physical device, ensuring it never touches an internet-connected platform.

It is the preferred choice for long-term storage of large amounts of cryptocurrency. Cold wallets are typically accessed only on rare occasions, such as when you want to move or sell a significant portion of your holdings.

| Pros | Cons |

| Safer | Slower to access |

| Offline | Difficult to use |

Examples: Ledger or Trezor hardware wallets

It is best practice to store large amounts of cryptocurrency in cold storage, not connected to the internet.

Common Mistakes

We have a strong member base who share their experiences. Over the years, we have identified a few common mistakes people make regarding cold storage.

- ❌ Using cold wallets in the wrong ways. Often, it’s misused and connected to many different decentralised applications.

- 🦺 Not stored correctly. Often, people forget the secret recovery phrase, write it down incorrectly or do not store it securely.

- 🤫 Sharing their cold storage plan or seedphrase. Remember, your seed phrase or cold storage plan is only for you and your trusted family.

- 🔃 Funds in cold storage are not segregated and accessed too often. Ensure your cold storage funds are only reserved for long-term holding.

- 🔙 No backup. You’d be surprised at how many users never back up their wallets!

6 Steps To Master Cold Storage

Now we know a little more about cold storage and some common mistakes, let’s go over Collective Shift’s top 5 basics to master cold storage. 👇

1. Get a Hardware Wallet

The number one tip we can give you is a hardware wallet.

They don’t cost much, especially considering how much value they help protect.

We’ve got a specific resource that explains:

- how to choose the right hardware wallet for you; and

- the importance of checking the device is authentic.

Read: Store Cryptocurrency In Crypto Hardware Wallets

2. Think About How You Store Your Cold Wallet

Keep your cold wallet offline, never share it with anyone, and ensure the storage location is physically safe.

Storing your cold wallet safely is just as important as setting it up correctly.

When storing your cold wallet securely, think about the following:

- Keeping it out of view—out of sight, out of mind.

- Make sure it’s fire & waterproof; popular options include home safes or safety deposit boxes.

3. Limit Connecting Your Cold Storage To Dapps

As a general rule, limit connecting any long-term illiquid cryptocurrency on hardware wallets to decentralised applications (dapps).

For most, it’s best to avoid connecting to external sites and only do so for the most trusted (e.g. MetaMask).

To add an extra level of security, many maintain a separate hardware wallet for voting on governance proposals or staking ETH.

4. Back Up & Do A Trial Run!

A backup and a trial run are essential in adding an extra layer of security. The peace of mind it gives is incredible.

Nothing is more heart-wrenching than losing and restoring your wallet’s access, only to find out your PIN is wrong or your recovery phrase isn’t working.

That moment of panic is crazy, trust us. We’ve seen it.

We suggest a trial run with an extra hardware wallet when setting up your device to ensure your recovery phrase is correct and any issues are found before it’s too late.

We’d hate for you to end up like the poor souls who have lost or been locked out of their cryptocurrency!

5. Segregate & Keep Most In Cold Storage

Lastly, ensure you keep most of your cryptocurrency, which should be your long-term holdings, in cold storage.

This is 90% for some, but there is no fixed number. It is any significant majority you would be devasted to lose.

Users often keep too much cryptocurrency connected to hot wallets or on exchanges and not enough in cold storage.

The 1/10/90 rule

Think of your cryptocurrency like your regular money or bank accounts.

Everyday Wallet: <1% should ever be carried in your physical wallet, whether this is cash or cards without a limit.

- Crypto example: Your hot wallet you carry around on your mobile.

Moveable: <10% should be ever accessible or readily moveable.

- Crypto example: Your more complicated web wallet (such as MetaMask) for more frequent and larger onchain activity.

Long-term: >90% should be locked for the long term.

- Crypto example: Your hardware wallet you keep offline and a majority of your non-urgent or non-moveable crypto stack.

6. Don’t Forget To Prepare A Will

One critical but often overlooked step in securing your cryptocurrency is ensuring it’s accessible to your loved ones in the event something happens to you.

While most people focus on securing their assets during their lifetime, it’s equally important to plan for the future and prepare a legally binding will that outlines how your cryptocurrency can be accessed after you’re gone.

Without proper planning, your cryptocurrency could be locked away forever, inaccessible to anyone, no matter how much value it holds. Cold storage, hardware wallets, and recovery phrases are incredibly secure, but that security becomes a double-edged sword if no one else knows how to access your funds.

Why Preparing a Will Is Essential:

- Secure Transfer of Assets: A will ensures that your loved ones can legally and securely inherit your cryptocurrency without unnecessary delays or complications.

- Detailed Instructions: Include specific details about the location of your cold storage, your hardware wallet’s PINs, passwords, and most importantly, the recovery phrases that will allow them to access your wallets.

- Minimise Confusion: Without clear instructions, your loved ones might face significant challenges navigating the complexities of cryptocurrency storage. A well-prepared will minimizes confusion and ensures the smooth transfer of assets.

What to Include in Your Will:

- Location of Cold Storage: Specify where you store your hardware wallet, whether in a safe, safety deposit box, or other secure locations.

- Access Details: Clearly outline the PIN codes, passwords, and recovery phrases required to unlock and recover the funds from your wallet.

- Appoint a Trustee or Executor: Choose someone you trust to execute your will and handle the process of accessing and distributing your cryptocurrency.

Consult a Legal Professional:

To ensure everything is done correctly and complies with local laws, it’s a good idea to consult with a legal professional experienced in digital assets. This way, you can make sure your cryptocurrency storage plan is legally binding and properly structured.

Planning for the future with a well-thought-out will doesn’t just protect your assets—it protects your family’s financial security as well. Don’t let all your efforts to secure your cryptocurrency go to waste by neglecting this final, vital step

For more, see this explainer!

Conclusion

In this guide, we’ve highlighted a range of essential tips and tricks to help you master cold storage and keep your cryptocurrency safe from online threats. From understanding the differences between hot and cold wallets to properly managing your recovery phrase, these strategies are designed to protect your digital assets from theft, loss, or accidental errors.

While cold storage is one of the most effective methods for securing your cryptocurrency, it’s important to remember that security is a continuous process. The level of protection you achieve is ultimately up to you and the steps you’re willing to take to safeguard your funds. No matter how much cryptocurrency you hold, it’s crucial to stay proactive and vigilant in maintaining your security.

Finally, remember the three keys for to master cold storage

- Invest in a hardware wallet

- Practice security habits

- Follow the 5 cold storage tips

Further Resources

As you can tell, we take security and storage very seriously.

For more resources, check out the below links!