Overview

Protocol Name: Aave V2

Yield Strategy: Decentralised Lending

Current APY (Feb. 2022): 1.33% – 2.79% on Stable Coins, 0.01% on ETH

Accepted Assets: Various Stables and Governance Tokens (list here)

Protocol & Vault Background

Aave (previously EthLend) is a decentralised borrowing and lending platform originating on Ethereum but has since expanded to other blockchains such as Polygon and Avalanche. The protocol allows users to earn a yield on deposits or use deposits as collateral to borrow against. The protocols’ most popular markets are major stable coins followed by Eth and various governance tokens.

Yield Generation

Users can earn passive income on Aave by depositing assets into the protocol. Deposited assets are lent out to borrowers at a variable or stable interest loans. The interest collected from borrowers is redistributed to depositors minus protocol fees.

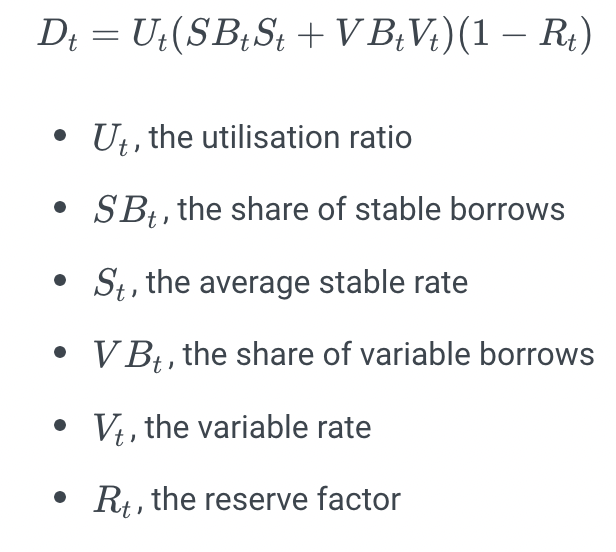

The above screenshot from Aave documentation displays how interest paid to depositors is calculated. It is important to note that ‘the average stable rate’ and ‘the variable rate’ of interest are driven by asset utilisation (the utilisation ratio). Therefore, the utilisation rate of deposited assets is the primary driver of depositor yield. As a general rule of thumb, higher utilisation symbolises higher borrower demand for an asset, which will drive higher interest rates paid to depositors. It is also important to note that Aave does not offer fixed income products as yield is determined by variable factors such as utilisation rate.

Risks

Users who deposit assets into Aave face four primary types of risk:

Interest-rate risk: Depositors on Aave are susceptible to large swings in interest rates, given Aave only offers depositors a variable interest rate based on utilisation.

Asset risk: Each new asset whitelisted by Aave introduces additional asset risk to the protocol. If deposited assets become valueless, Aave may become insolvent depending on the protocol’s exposure to the failed asset. Having diversified collateral helps reduce the protocols overall asset risk.

Liquidity risk: Aave requires sufficient liquidity to facilitate basic operations. For example, liquidity is needed to allow users to borrow assets and is also required to enable depositors to withdraw assets. If there is no liquidity in the protocol, the protocol cannot function, potentially leading to a bank run.

Protocol risk: The fourth risk Aave depositors face is general protocol risk. Protocol risk includes the risk of smart contract bugs, hacks, and bad internal actors (rugs).

Analyst Take

Aave is one of the oldest and most respected protocols within DeFi, making the protocol an excellent point of entry for users new to DeFi. Aave is also considered one of the safest protocols in DeFi, which is reflected in some of the industry’s lowest APYs on stablecoins.

I recommend using Aave if you have a large allocation of idle stablecoins in your wallet. Aave would represent a low-risk source of passive yield for these investors. Aave could also be suitable for users looking to earn a higher cash yield than traditional finance accounts.

However, it is essential to note that deposits into Aave are not protected by federal governments and are riskier than conventional finance accounts. Despite the increased risk, the opportunity to earn significantly higher rates than those found in traditional finance may fit into some users’ risk profiles.

How to Deposit

To deposit assets into Aave, users will need a wallet capable of connecting to mainnet Ethereum or another chain supported by Aave. Most of the Collective Shift team uses MetaMask as their primary transactions wallet. Users will also need to ensure enough funds are in their wallets to deposit into Aave and cover gas fees.

Navigate to the Aave protocol page, and select the ‘Deposits’ tab. On the Deposits page, users can search for the asset they wish to deposit and see the corresponding current APY. To deposit assets, users will need to sign an ‘Approval’ function (if it is the first time depositing that asset into Aave) and sign the actual deposit transaction.

How to Collect Yield

After users deposit an asset into Aave, they receive an ‘a-token’ in exchange. For example, if users deposit DAI into Aave, they will receive aDAI. An ‘a-token’ is an ERC-20 token representing a claim to a user’s deposit plus any interest the deposit has accrued. For example, if you deposit 100 DAI into Aave, you will receive aDAI in return. Let’s assume after 1 year, the average interest rate on DAI was 3%. Therefore, you could swap your aDAI for 103 DAI (your initial 100 DAI deposit plus the 3% interest earned).

While the back-end (outlined above) can be complicated for new users, Aave does an excellent job of simplifying the process on the front-end. For most users, the depositing and claiming process will feel similar to depositing and withdrawing cash on a bank’s smartphone app.