The most important thing when getting started in crypto is protecting your crypto assets. This means making sure your cryptocurrency or NFTs are securely stored.

This resource dives into wallets, key terminology and how to store cryptocurrency in different ways.

To learn more about cryptocurrency storage, see our complete list of resources at the bottom of the page.

What Is A Crypto Wallet?

A common misconception is that cryptocurrencies are stored in wallets, but technically speaking, they live on the blockchain to which they belong. For example, BTC is native to and stored on the Bitcoin blockchain.

A crypto wallet is a tool (app, device, or program) that holds your private key, allowing you to access and manage your cryptocurrency. You don’t need to understand what a private key is; just that it is your passcode to get access.

Wallets enable users to send, receive, and access digital assets. They can be entirely physical (hardware wallets), digital (software wallets), or a combination of both.

At a high level, a crypto wallet is the key to access your funds.

Read: What Is A Cryptocurrency Wallet?

Types of Wallets: Terminology

There are many types of cryptocurrency wallets. The first step is understanding the type of wallet you might need to use.

You can think of them in 2 ways:

- Cold wallet: No connection to the internet—your private keys are stored and generated offline.

- Examples: Ledger and Trezor.

- Hot wallet: Connected to the internet and generates your private keys online.

- Examples: MetaMask and Exodus.

There’s a range of wallet types—each serving different needs:

- Exchange wallet: Your exchange account—they’re almost always custodial. You’re not in control of your private key, instead, you trust the exchange.

- Examples: Coinbase, Zipmex and Kraken.

- Web wallet: A wallet extension in your browser used to interact with dapps.

- Examples: MetaMask, Phantom and Coinbase wallet.

- Desktop or software wallet: A program you install on your PC or laptop which allows you to access your cryptocurrency.

- Examples: Exodus, Electrum and Bitcoin Core.

- Mobile wallet: An Android or IOS app that allows you to connect to dapps or conduct transactions via your mobile.

- Examples: Argent, Rainbow and MetaMask.

- Hardware wallet: A device that secures your private keys offline. To conduct a transaction, you need to use the device manually.

- Examples: Ledger and Trezor.

Now we understand the types of wallets, let’s move on to how to store your cryptocurrency!

Which Crypto or NFT Do You Want To Store?

Before selecting a wallet, it’s crucial to consider which cryptocurrency you plan to store. Different wallets support different blockchains, and using the wrong wallet for a specific cryptocurrency can lead to loss of funds.

For example:

- Ledger supports many types of cryptocurrency wallets in one (just make sure you’re sending it to the correct account).

- MetaMask supports Ethereum and blockchains that are compatible with the Ethereum Virtual Machine (EVM).

- Phantom previously only supported Solana, but now offers Bitcoin and Ethereum support.

- Coinbase wallet only accepts Solana and Ethereum (EVM) networks

Use A Hardware Wallet

The safest way to store your cryptocurrency is to ensure it’s not connected to the internet.

A hardware wallet will generate your private key and recovery phrase offline. This is the ultimate way to secure your crypto assets.

Do not write your seed phrase on your computer or share it with anyone.

It’s best practice to store any NFTs or cryptocurrency you do not actively use in long-term cold storage.

Only hold a small amount?

If you have a minimal amount of cryptocurrency, you may not need a hardware wallet. As soon as your stack becomes a ‘significant amount’, we suggest investing in a hardware wallet.

We have guides on How To Set Up A Ledger S or video the official Ledger tutorial below.

Unsure how to send cryptocurrency? See our resource on How To Send Cryptocurrency To Hardware Wallets From Exchanges

Installing A Web Wallet For Using Dapps

If you want to participate in Web3 and crypto native applications (dapps), you’ll need to store some cryptocurrency or NFTs in a web wallet.

Caution: Web wallets are more prone to security issues. For example, if you go to a phishing website or sign a malicious transaction, you could have your wallet drained.

Only have funds or NFTs you immediately need in your web wallet. And be on the lookout for phishing scams.

It’s highly suggested to keep everything else in secure offline wallets.

Keep a burner wallet

For doing those extra risky activities online, it’s best to have a dedicated wallet for connecting, minting and interacting with dapps you are not 100% sure of, or new “risky” projects.

Read: Scam Protection Bible—How To Avoid Crypto and NFT Scams

Setting Up a Mobile Wallet

Mobile wallets are handy as they help you access dapps or send crypto on the go.

But they are highly risky. If you lose your phone and do not have the proper protection, your crypto might be at risk.

Caution: Always use biometrics and a strong password on your device and never keep your long-term stack in your mobile wallet.

Secure Your Recovery Phrase Somewhere Safe

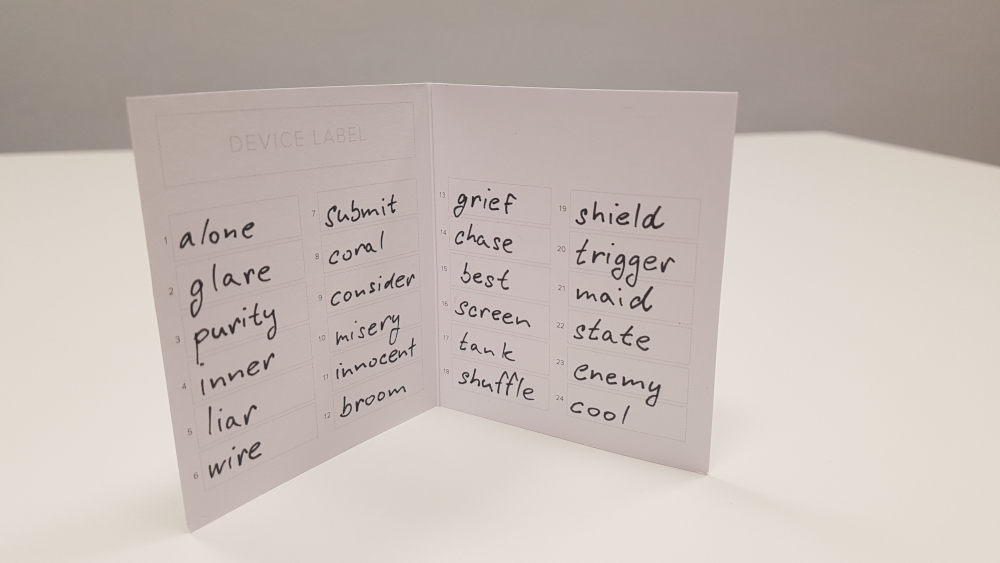

Your Recovery Phrase (also known as a seed phrase) is a 12 or 24 list of words that accesses your cryptocurrency.

You can enter your phrase into any compatible wallet if you forget your password or lose your device. Just make sure the wallet supports that cryptocurrency.

Important of having a back-up

It’s also important to back up your cryptocurrency. Having another copy is essential if you misplace your wallet credentials.

Who Do I Share It With?

Never share your seed phrase with anyone who asks.

The only case you will need to enter or share your recovery phrase is when you need to restore access to your wallet.

It’s critical to triple-check whether that wallet provider or extension is legitimate and not fake. Phishing is a real danger. Always check the URL is correct.

Read: What Is Phishing?

Where do I store it?

Written down offline: Store your phrase physically, not digitally.

Anyone who stores their recovery phrase in Google Docs, Microsoft Word, your notes app, or anywhere else on their computer or phone, is taking on additional (and avoidable) security risk. If someone gains access to your computer or accounts, they could steal your funds.

Physical vault: Many users place a backup, their Ledger or recovery phrase in secure vault storage.

Fireproof safe: If you’re storing your cryptocurrency at home, it’s wise to invest in a fireproof safe. In the unlikely event of a fire, you want to ensure you don’t lose your wallet or recovery phrase.

Metal storage: You can even go one step further and store your written seed phrase in a metal capsule. After all, paper is highly perishable.

Test Out Your Recovery Phrase or Backups

One of the most important steps in securing your cryptocurrency is properly backing up your recovery phrase (also known as a seed phrase). This recovery phrase is essentially the key to accessing your wallet if your device is lost, damaged, or needs to be restored. However, simply writing it down isn’t enough—you need to ensure it’s correct and functional.

We highly recommend testing your recovery phrase on a new or separate hardware wallet. This process ensures that, in case of an emergency, your recovery phrase will actually work and give you access to your funds. Failing to test your backup can lead to devastating consequences, such as permanent loss of your cryptocurrency if the recovery phrase was recorded incorrectly.

Why Testing Your Recovery Phrase Matters:

Analyst take (Nick): Even experienced users can make mistakes. For example, on an old wallet, I mistakenly miswrote one of my 24 words. I was able to realise the mistake but it shows the importance of double-checking!

Always do a trial run to ensure your crypto can be accessed.

Added Protection: Multisig

Multisignature (multi-sig) are crypto wallets that require 2 or more private keys to sign and send a transaction. The most popular multi-sig safe is Gnosis.

This may not be necessary for most people, but if you want to take the extra security step and understand how multi-sig works, it can be a helpful step to protect your cryptocurrency.

Caution: Be extremely careful with multi-sig wallets, as if you lose a set of keys, you could be locked out of your cryptocurrency.

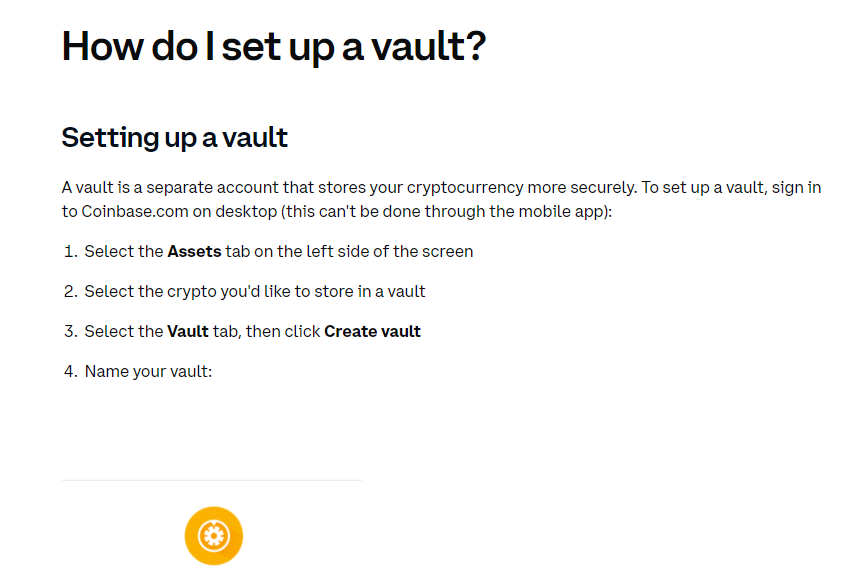

Online vault storage

You can also set up a vault with services such as Coinbase. It’s a separate account that stores your cryptocurrency more securely.

Don’t Want To Custody Your Crypto?

Being your own bank is a big responsibility, and you may not be prepared for this.

The good news is there are services known as ‘crypto brokers’ that can hold your assets for you, such as Caleb & Brown. It’s important to understand that you’re placing all your trust in another entity.

You can also choose to hold your cryptocurrency with exchanges, although consider whether they have insurance, consider the risks and always use 2FA.

Read: What Is 2FA?