Artificial intelligence (AI) has been one of the biggest narratives this cycle, with AI cryptocurrencies soaring to new highs. Below, I dive into whether the ‘crypto x AI’ ship has already sailed, why AI could need crypto, and ways to get exposure to this narrative.

Key Takeaways

- AI may need crypto to help reduce the centralisation of important technology, increase access to compute or data and provide an interoperable layer for AI agents to operate.

- There’s no clear ‘best’ way to get exposure to this narrative. Different ways include:

- Defacto exposure via L1 blockchains

- Protocols creating AI agents

- Marketplaces that bring together compute or data resources

- Apps that leverage or provide AI experiences

- Those on the sidelines haven’t missed out. Multiple AI-driven crypto waves are expected to continue, introducing new players to the market, and the narrative is likely to remain strong.

- The biggest concerns remain the technology challenges of blockchains supporting the computationally heavy resources AI needs and the timeframes for such projects to deliver.

- Despite a possible bubble forming, AI’s long-term impact remains extremely promising, with the best and most important breakthroughs likely still to come.

Contents

Disclaimer: Some Collective Shift team members, including myself, hold material amounts of assets listed in this article. See our Trust & Transparency page for full disclosures that are updated weekly.

Introduction: Is It Too Late?

The world of AI continues to progress rapidly and shows no sign of slowing. There’s a legitimate movement towards cryptocurrency and blockchains, which can play an important role in the future development, distribution and access to AI.ss

What do we mean by ‘AI’?

‘AI’ has existed since the early 1950s. It refers to machines that learn from experience, adjust to new inputs and perform programmed tasks. Examples of AI include self-driving cars, trading bots, chess computers and, of course, the ChatGPT chatbot.

These computer systems can be trained to accomplish specific tasks by processing large amounts of data and recognising patterns in the data. (For more, see the article linked below.)

The AI Crypto narrative is a strong one. After all, the crypto AI category is one of the most successful this cycle. It leads many to worry, panic and FOMO, wondering if they’ve ‘missed the boat’ on crypto AI.

Why it may not be too late

It’s a fantastic time to re-access this category, with AI coins some of the biggest losers in the recent altcoin sell-off.

As I explore further in this article, there are many reasons why cryptocurrency makes sense for AI, and we’re still relatively early in this narrative.

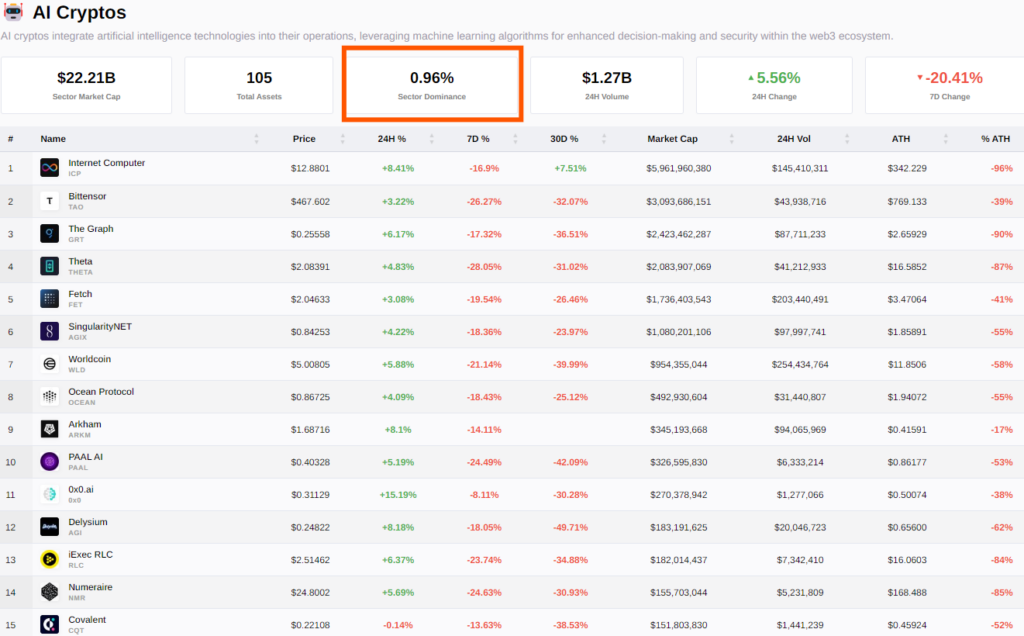

Perhaps the biggest indicator of how early we are is the total sector dominance, which is still less than 1%, with memecoins more than double at over 2%.

Top 15 ‘AI’ related cryptocurrencies (Source: CryptoSlate)

Top 15 ‘AI’ related cryptocurrencies (Source: CryptoSlate)

Think of ourselves at the end of the first ‘wave’ of AI x Crypto, with the overall narrative appeal remaining strong. We could enter a second ‘wave’ of attention fueled by further advancements such as real-world AIs that can go off in the world and work, new models from OpenAI (e.g. GPT-5) or Apple releasing a significant upgrade to Siri to realise the vision of a true digital assistant.

Below is a very simplistic visual indication of these waves and why more waves are likely to come: the middle shows the evolutions of ChatGPT alongside the launch of crypto-native AI cryptocurrencies.

About the AI Narrative

The simple way to understand the AI narrative is through the tremendous resources it requires, namely (i) clean, valuable data and (ii) access to computing power.

Essentially, computing power and data is arguably the most desirable commodity of the next decade.

This is why the biggest AI company, OpenAI, is working with Microsoft to build a $100B data centre to secure their computing needs.

Why Does AI Need Crypto?

Despite my initial scepticism, I have come around to the critical role cryptocurrency and blockchains could play in furthering AI. In short, crypto can allow AI to:

- gain increased global access to hardware and compute;

- build AI agents that can operate in 24/7 permissionless markets (e.g. Uniswap for trading, Render for compute); and

- facilitate the transparent exchange of quality data.

But there’s a big caveat: the jury is still out as to whether the above can be entirely achieved using non-crypto methods.

See below for a more extended look into how crypto fits in!

Centralisation: Considering it is one of the most significant technological shifts of our time, this technology should not be gatekept or centralised by the largest technology companies, such as Microsoft, which holds 49% ownership in OpenAI.

This is why Emad Mostaque, founder of AI company Stable Diffusion, is now building decentralised AI. It’s a question of not only who can access AI but also who governs it.

Eliminating bias: Bias is one of the biggest challenges these AI app creators face. Just recently, Google received pushback for bias in its latest Gemini program. Theoretically, bias can be helped by using blockchain’s transparency to incentivise removing content. (Worth noting, other non-crypto ways to achieve this are also being explored.)

Coordination and incentives: Cryptocurrency is tremendous for social coordination and using token incentives to run a network or service. If there will be a shortfall in supply to meet demand, emerging crypto-native protocols that democratise and increase access to compute are a clear need. Coordination is not only limited to compute but rather bringing together data, models and information that powers AI.

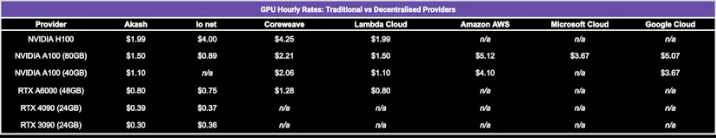

Affordability: With proper incentive alignment, crypto could provide greater affordability and flexibility for smaller consumers of AI services who are often priced out by larger organisations and well-funded startups.

As per a recent report by Nirmaan, the cost to run some of the top compute networks is “between 60–80% cheaper than their centralised counterparts.”

Nirmaan’s AI Thesis (Source: Nirmaan)

Nirmaan’s AI Thesis (Source: Nirmaan)AI agents: For the foreseeable future, AI agents likely will not be paid using traditional payment methods. They could, however, be paid in cryptocurrency (e.g. USDC, SOL, ETH). This is perhaps the best use case for AI in cryptocurrency, as these agents can operate on a level of interoperability that is not possible using traditional financial rails.

Crypto x AI Sector

This fast-growing sector already houses multiple categories. As per Binance Research, crypto x AI can be broken into three categories below.

- Application: Projects that leverage AI to offer consumer-facing experiences, such as games or trading. Example: Parallel (PRIME)

- Infrastructure: Projects that provide permissionless access to computing resources and services such as model training, finetuning, and inference. This can be divided into two subsectors:

- General-purpose computing. Example: Render (RNDR)

- Model training and finetuning. Example: Bittensor (TAO)

- Middleware: Projects that utilise the resources from infrastructure projects to provide products and services. Example: Fetch.AI (FET)

Ways To Get Exposure To The Narrative

There are many different ways to get exposure to this narrative. For the purpose of this content, I’ll only focus on crypto-native tokens and exposure.

Crypto x AI is very similar to the gaming sector in that there is no obvious ‘best’ way to get exposure to the narrative on a fundamental level. So far, most AI hype waves have ‘lifted all boats’, with most AI tokens rising and falling together.

As I dive into below, multiple ways exist to get exposure to this narrative.

L1 Blockchains

The AI narrative could result in surging demand for onchain payments, apps, and protocols building decentralised AI, making major L1 blockchains de-facto exposure.

After all, as covered, two of the most likely use cases for AI agents include data or compute marketplaces and crypto as the native bank account.

So, should you get exposure to the biggest chains home to AI protocols, agents and apps, such as the Ethereum ecosystem or Solana, or will there be purpose-built AI L1s?

Chains home to AI: Solana (SOL) is currently leading the pack in DePIN (Decentralised Physical Infrastructure) projects deployed on the network, with a few such as Render Network (RNDR) and IO.Net (no token yet) focused on AI.

Specific ‘AI’ L1s: I’m sceptical of any L1 marketing itself as being purely optimised for AI until these chains prove why it’s fundamentally different and needs its own. For those who may think the opposite, Ritual and Allora Network (both do not currently have a token) are in the early stages of creating AI-focused L1s

AI Agents

Protocols that facilitate the creation of AI agents. For example, Fetch.ai (FET) is creating a platform for autonomous AI agents. Other examples are Alethea (ALI) and Altered State Machine (ASTO).

Infrastructure

Infrastructure is the most developed and straightforward way to get exposure to this narrative.

As explained earlier, more supply is needed to meet the growing demand for compute. As a result, crypto-native marketplaces and protocols are marketing themselves as the answer.

The most popular compute marketplaces are Render (RNDR) and Akash Network (AKT).

However, the question remains for these projects: how can value flow to the native token? And what will happen once more supply floods the market and these services are commoditised?

Middleware services

Perhaps the middle layer between the blockchains and infrastructure captures the value? There is a range of middle services where value could lie:

- Data and monetisation services: For example, service providers such as SingularityNET (AGIX) and Ocean Protocol (OCEAN) may bring together AI data and monetisation.

- Decentralised model marketplaces: Do the models themselves or the platforms that allow the creation of such models generate value? For example, Bittensor (TAO) attempts to create a marketplace where anyone can contribute and benefit from AI models.

Applications

Or perhaps the applications built on top of all these layers garner all the attention and value? For example, Parallel (PRIME) is expanding beyond its trading-card game to build Colony, an AI-powered survival simulation game that will launch on Solana.

We can imagine many more application-level cryptocurrencies that leverage the above technology improvements through a fun and engaging app, game or tool.

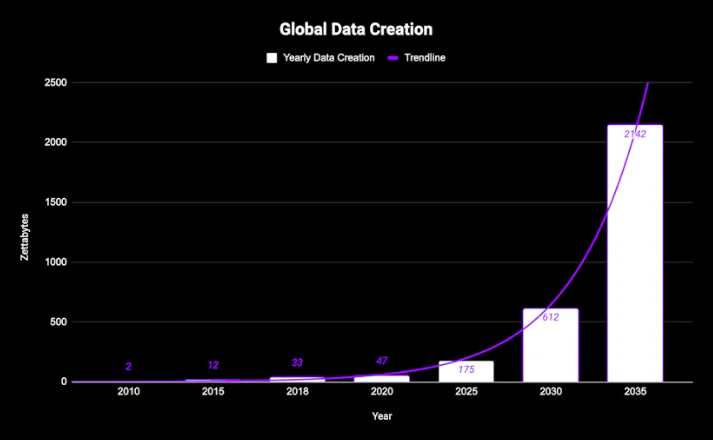

Storage

Data is king, and global data creation is set to soar in the next decade. AI requires significant data to train models, making storage a growing need. Filecoin (FIL) remains the market leader, and recently, Arweave (AR) expanded into creating a network on top of its storage blockchain to power new types of applications.

Nirmaan’s AI Thesis (Source: Nirmaan)

Nirmaan’s AI Thesis (Source: Nirmaan)Concerns

Overall, I’m quite optimistic about the potential for cryptocurrency and blockchains to provide the foundation, rails, applications and infrastructure for so-called ‘decentralised AI’. However, significant risks remain.

Technology challenges and limitations

The most significant risk is that blockchains are historically slow (relative to databases) and have limited capacity. This is a substantial obstacle to the direct integration of AI models onchain because these use cases require substantial throughput and resources.

The Crypto x AI narrative combines two historically difficult things: (i) blockchains and cryptocurrency incentives and (ii) AI. However, it could be too ‘early’, with the technical difficulty being too high and it taking longer to deliver.

We must consider the all important timing element. Although the trend could be right, will it take longer than expected to come to market?

Bitcoin had its fourth halving event, with bull markets typically topping out 365 to 500 days after that. This doesn’t leave much room for projects to deliver before another possible crypto or AI winter takes hold.

I’ve addressed challenges, with data, technology and computing, but another major bottleneck to the continuation of AI development is energy. AI requires tremendous energy; for some, such as Meta CEO Mark Zuckerberg, this is the biggest hurdle.

Volatility, scams and bubbles

If history is anything to go by, huge technological shifts attract mania and, finally, a bubble that bursts—for example, the internet dotcom bubble or even the railroad stock market bubble of the 1840s. If the AI bubble bursts, it doesn’t mean the death of AI—after all, the internet and railroads proved to be quite the megatrend.

Like any emerging narrative, it attracts grifters, value extractors and scammers—many projects will likely call themselves “AI” without using much AI, if any. This doesn’t always have to be malicious but rather an attempt to latch onto a narrative, even if it doesn’t make sense.

Valuations

As we saw in 2021, valuations are starting to become concerning.

Due to its affiliation with OpenAI’s Sam Altman, Worldcoin (WLD) currently has a fully diluted valuation (FDV) of $56B, ranking it sixth behind BTC, ETH, USDT, BNB and SOL. Meanwhile, Bittensor’s TAO has an FDV of almost $10B. As per CoinGecko, eleven AI cryptocurrencies currently have FDVs above $1B. In the short term, this could limit the upside potential of existing AI tokens.

No clear proven implementation and many AI tokens to enter the market

The current top tokens by market cap are still relatively unproven from a fundamentals standpoint. Seemingly, these ‘wave 1’ AI coins are mostly trading as de-facto exposure to the AI narrative.

Overall, despite my optimism about the sector’s potential, I can’t help but remain short-term bearish on the current ‘wave 1’ AI cryptocurrencies.

In part two, I’ll dive into the existing AI cryptocurrencies I’m most interested in, the new mega-merger of three top AI cryptocurrencies, and the ‘wave 2’ cryptocurrencies that I expect could disrupt the current market leaders.

Recap

I’ve explored why AI needs cryptocurrency and how it could play a significant role in its future.

Major technological shifts tend to come in waves, with the AI narrative so powerful it doesn’t appear it’s going away any time soon. Anyone waiting on the sidelines may not have missed the boat. Instead, there will likely continue to be multiple AI x Crypto waves to come, with a new batch of cryptocurrencies likely to hit the market and challenge competitors.

There is no ‘right’ way to get exposure, and there are many unproven ways to capture exposure to this narrative, from the blockchains to the infrastructure, apps or middleware services built using the technology.

The biggest challenge remains technological hurdles and bottlenecks that could restrict growth, and like any breakthrough technology, the bubble could burst—but it isn’t to mean the underlying narrative is over.