These monthly reports—available to Pro members only—cover altcoins that have recently caught our analysts’ attention. In these reports, we share our opinion on these altcoins’ progress and outlook. (For the purpose of this report, altcoins are defined as cryptocurrencies that are not BTC or ETH.)

Key Takeaways

- Solana is in the early stages of an airdrop season, a period of significant wealth generation that should further galvanise the community and help ensure the network’s long-term success—much like Ethereum in 2020 and 2021.

- Avalanche had already been attracting institutions this year after Evergreen Subnets were introduced, and this may only accelerate after JPMorgan and others shared cost-saving results from a pilot involving Avalanche subnets. Watch for gaming on Avalanche to feature prominently in December.

- Arbitrum is preparing to welcome its first Orbit chains, which could help attract new users and developers. The no-vesting honeymoon for Offchain Labs employees and investors is nearing its end. The big unlock of 1.16B ARB will happen in late March, followed by monthly unlocks of 92.6M ARB.

- dYdX Chain launched last month, and it was announced that 100% of network fees will go to validators and stakers. Also, a six-month incentive program worth $20M of DYDX started in late November.

- Arweave continues to process all-time-high transaction volumes while holding permanent storage costs constant, indicating the protocol’s scalability.

Contents

Solana (SOL)

Analyst take: Solana continues to progress on various fronts (e.g. network performance, differentiated use cases, user growth, enterprise adoption) and has plenty to get excited about for 2024. Further, the commencement of airdrop season will drive significant wealth to the Solana community, which should only galvanise it further.

Inaugural Airdrop Season Kicks Into Gear

In recent weeks, a trio of Solana-based projects announced their own governance tokens and airdrops events:

- Oracle network Pyth announced the PYTH token.

- Liquid-staking protocol Jito announced the JTO token.

- DEX aggregator Jupiter announced the JUP token.

Indeed, the Solana ecosystem is going through its first airdrop season. This is very promising to see as far as the long-term outlook for the Solana ecosystem and the SOL token is concerned.

After all, airdrop seasons tend to be lucrative wealth-generating events for an ecosystem’s most engaged users. (As more money is airdropped to active community members, their affinity for that particular ecosystem grows stronger. This effect was evident in the Ethereum community in 2020 and 2021.)

Many other apps and protocols on Solana will tokenise in 2024. Examples include Wormhole, Phoenix, Tensor and Drift. These wealth-generation events should further galvanise the Solana community, resulting in airdrop recipients using some of this newly acquired capital to buy SOL and other Solana-based assets. (Arguably, this expected behaviour has contributed to the recent price rallies in Solana-based NFTs (e.g. Mad Lads, Tensorians) and BONK, the leading memecoin on Solana, which is +916% since November 1.)

Reminder: We maintain an airdrops watchlist, which includes a member-only section with our top actionable items. The next update is due on Feb. 13, 2024.

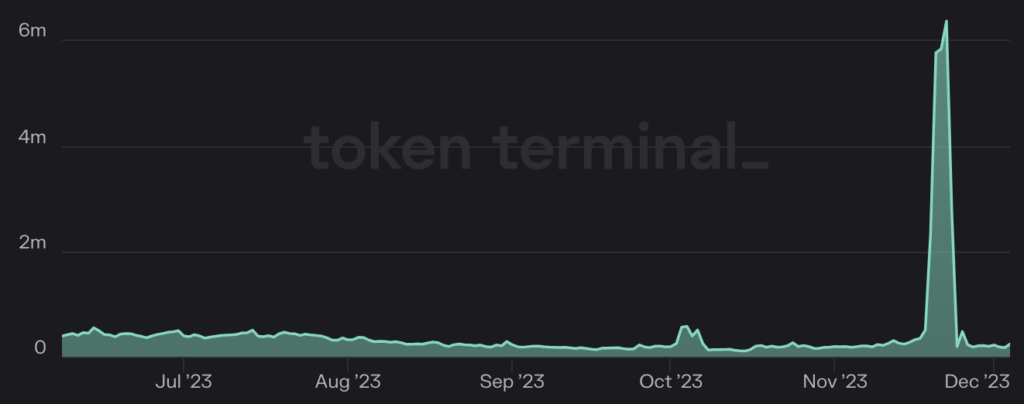

Strong Increase In Onchain Activity

The commencement of airdrop season has predictably been met with a surge in activity on the Solana network, as people rush to use as many protocols as possible in an attempt to qualify for the wave of airdrops that are anticipated for 2024.

While it is hard to get too excited about this surge in activity, it is encouraging to see that Solana has handled this increased usage without encountering any performance issues. (For those unaware, Solana had multiple episodes of heavily degraded performance in 2021 and 2022, where the blockchain was essentially unusable.)

Avalanche (AVAX)

Analyst take: AVAX soared by 90% in the last 30 days, partially due to the news that its subnets were used by JPMorgan and others in a pilot overseen by the Singaporean central bank. Network activity exploded to record highs in November, though this is misleading given that it was caused by speculators pushing inscriptions. Separately, expect gaming on Avalanche to come under the spotlight in December, with four gaming-focused subnets rumoured to be launching.

Subnets Used in Pilot Overseen By Singapore’s Central Bank

JPMorgan and others used an Avalanche subnet (i.e. a dedicated version of the blockchain to meet specific needs) in a pilot as part of the ‘Project Guardian’ initiative overseen by the Singaporean central bank. A summary report by JPMorgan and Apollo Global noted that the pilot generated meaningful cost and time savings compared to legacy processes.

While this is positive for Avalanche, it is worth noting that JPMorgan has yet to commit to using Avalanche moving forward. The banking giant may prioritise its own blockchain solutions (e.g. Tokenized Collateral Network) over Avalanche subnets, which have become particularly appealing to institutions this year after enterprise-friendly Evergreen Subnets were announced in April.

Activity Spikes, But Mainly Due to Speculation

Activity on Avalanche’s C-Chain surged to a record high in November. Importantly, the uptick was driven by ASC-20s (i.e. the Avalanche equivalent to Bitcoin’s BRC-20 tokens) comprising over 95% of onchain transactions. While this development is still somewhat positive, it would have been far more encouraging if the source of this activity spike was more legitimate and not rooted in speculation.

Arbitrum (ARB)

Analyst take: With work on EIP-4844 (i.e. Proto-Danksharding) taking longer than expected, the market’s attention has shifted away from L2s such as Arbitrum for the time being. Near term, the most important indicator to be tracking for Arbitrum is the adoption of Orbit chains, as their usage directly impacts demand for using Arbitrum’s rollups. Finally, note that sizable ARB token unlocks start in late March.

The First Orbit Chains Nearing Mainnet Launch

As Matt covered earlier this year, every Ethereum L2 solution is starting to grow its own independent ecosystems of chains. Arbitrum’s version of this is Orbit chains.

In late October, the Arbitrum Foundation announced that Orbit was ready for mainnet. It also named various Orbit chains that were under development, as shown in the below image.

Expect these Orbit chains to go live in the coming months. Xai, a gaming chain, is almost certain to be one of the first Orbit chains to go live, given it was the first one to be announced earlier this year. (The fact that Offchain Labs was a seed investor in the entity behind Xai also helps.)

Largest Incentive Campaign to Date

A windfall of capital was made available to various Arbitrum-based projects in early December, after the Arbitrum DAO approved an additional 21.1M ARB to be granted under its Short-Term Incentive Program (STIP). In total, 26 projects received this additional funding, including Gains Network (4.5M ARB), Stargate (2M ARB) and Wormhole (1.8M ARB).

These Arbitrum-based projects will use these allocations to run incentive campaigns and reward users. Therefore, don’t be surprised to see various metrics on Arbitrum trend higher over the coming weeks.

Heavy ARB Token Unlocks Coming Soon

It’d be remiss of us not to highlight the sizeable amount of ARB tokens that will start vesting in late March. This year, ARB has enjoyed relatively weak sell-side pressure—especially when compared to its rival, Optimism, where 32.2M of the team and investors’ OP allocation has been vesting monthly since July, following a major unlock in June.

dYdX (DYDX)

Analyst take: The dYdX Chain is finally live! Trading volumes and fees are growing strongly, partially due to a governance-approved incentive program that will pay out $20M in DYDX tokens over six months. If the chain proves to be popular among traders, it should result in greater demand for DYDX, given that 100% of the chain’s transaction fees go to validators and stakers. Finally, like ARB above, beware of significant DYDX token unlocks in the year ahead.

dYdX Chain Launches, All Fees Going To Validators & Stakers

The long-awaited milestone took place in November, starting with a beta version before launching in full a couple of weeks later. It ended a period of more than 18 months since the core team said it was leaving Ethereum to build a Cosmos-based appchain. (We have covered the progress of dYdX Chain’s development in earlier Altcoin Reports (e.g. January and September) and Nick’s deep dive in June.)

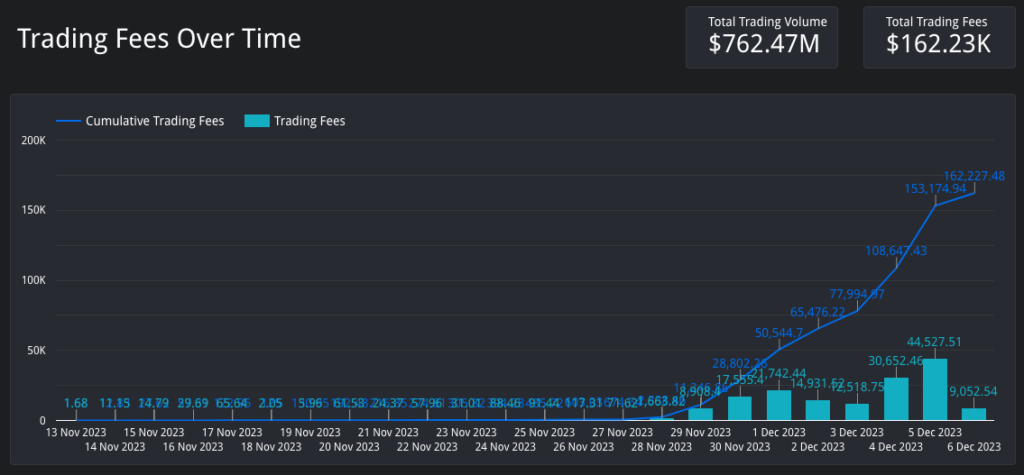

Importantly, it was also confirmed last month that dYdX Chain validators and stakers (i.e. those who stake their DYDX tokens to validators) would receive 100% of the chain’s transaction fees. These fees include USDC-denominated trading fees, and USDC- and DYDX-denominated gas fees from transactions.

Since the full launch in late November, volumes and trading fees on the dYdX Chain have surged. Accelerating this growth is a six-month incentive program that also went live in late November after being approved by governance. This program will pay out $20M worth of DYDX to various types of users.

Targeted Attack Causes Insurance Fund To Cover For $9M

dYdX Chain’s launch was partially overshadowed by an incident on Nov. 18 in which a targeted attack on dYdX v3 resulted in heavy liquidations, causing the v3 insurance fund to spend ~$9M (i.e. ~40% of its balance) to fill gaps on liquidations processed in the protocol’s YFI market. No user funds were affected. In response, the team increased initial margin requirements for YFI and other relatively illiquid tokens.

Arweave (AR)

Analyst take: Arweave continues to process all-time-high transaction volumes while holding permanent storage costs constant, indicating the protocol’s scalability. It’s particularly encouraging to see this happening during an extended NFT bear market, suggesting that Arweave is finding product-market fit beyond the use case that made it a household name amid the NFT hype in 2021 (i.e. using Arweave for storing metadata).

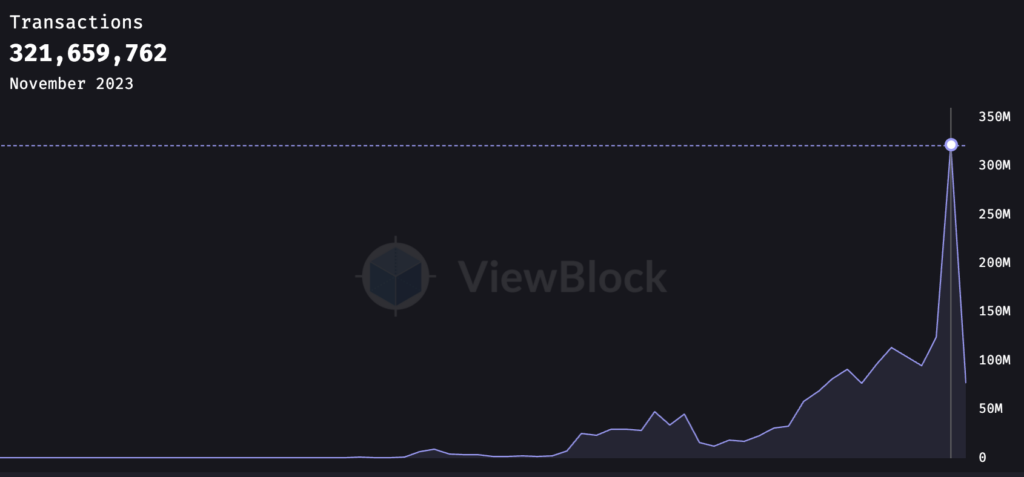

Monthly Transactions Surge To Record Highs

Arweave processed a staggering 321.7M transactions in November, easily surpassing the previous monthly high from October. Compared to Nov. 2022, this most recent monthly transaction count was more than 10 times higher.

This record month was met with an uptick in fee revenue, with Arweave taking in 3,535 AR worth of transaction fees in November. Encouragingly, the cost to permanently store data on Arweave has held steady at 0.86 AR tokens per gibibyte (GiB) in recent months, indicating that the network is managing to handle this considerably heightened network activity.

NFT Interest Remains an Opportunity

The record highs look even better considering the prolonged NFT bear market of the past two years. Permanent storage of NFT metadata is a proven use case of Arweave, and today, there are far fewer NFT collections launching than in 2021 and early 2022.

For what it’s worth, this demand driver may soon return for Arweave, if the recent resurgence in NFT trading volumes is anything to go by. This metric is nearing its tracking towards its 2023 highs. Should this momentum continue, more NFT collections will likely go live, a non-trivial portion of which will choose to store the relevant metadata on Arweave.

Upcoming Milestones & Conferences

| Project | Event | Expected Date |

|---|---|---|

| Jito (JTO) | JTO token generation | Dec. 6 |

| Synthetix (SNX) | ‘Andromeda’ release | December |

| Frax (FXS) | Fraxchain release | Early 2024 |

| Blast (BLAST) | Mainnet release | February |

Want more altcoin content? See November’s report covering UNI, OP, STX, SNX and ILV.