Launching in July 2021, EIP-1559 will overhaul how the Ethereum fee market works. (EIP stands for ‘Ethereum Improvement Proposal’.) It is arguably Ethereum’s most significant change yet and will deliver several benefits, including ones that enrich the value proposition of ether (ETH).

Background on Ethereum’s Fee Market

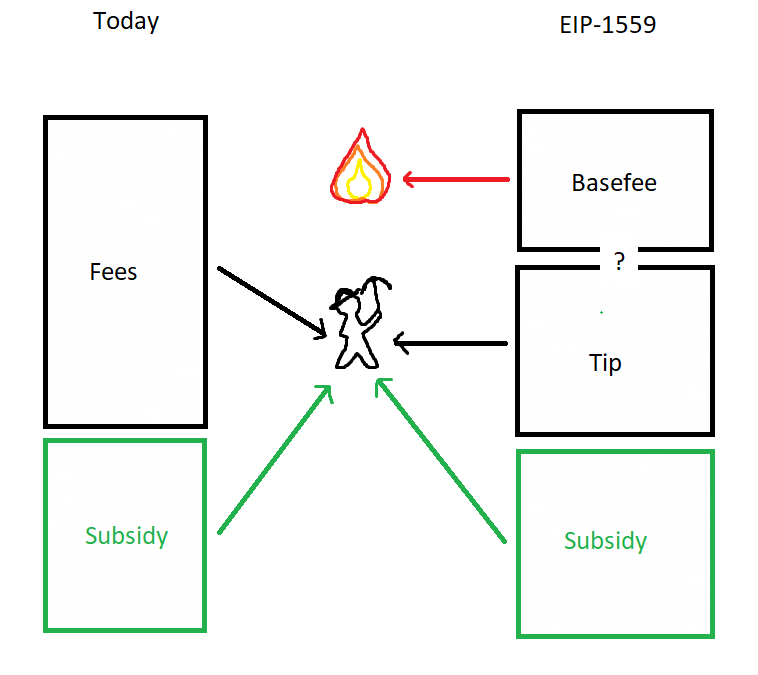

In the current Ethereum fee market, Ethereum prices transaction fees using a simple auction mechanism where users send transactions with bids to compete for space on the next Ethereum block. Ethereum miners monitor these bids and prioritise transactions with the most gas, which they collect as revenue.

Read: What Is Gas on Ethereum?

There is also a hard gas limit of 12.5 million per block and therefore, some transactions wait for several blocks before getting included. This hard cap leads to price auctions on gas fees between users bidding to be included in the next block, which is inefficient.

What Is EIP-1559?

EIP-1559 is a proposed change to Ethereum’s transaction pricing mechanism. With EIP-1559, transaction fees will have a base fee and a tip.

Base fee

- Set by the protocol and adjusts every block based on network activity.

- Doesn’t go to miners, but rather is burnt (i.e. permanently removed from ETH’s circulating supply).

Tip

- Set by the market.

- There is no minimum tip.

- Goes to the miner.

Impact of EIP-1559

UX improvements

With EIP-1559, transaction fees will be far more predictable than what they currently are. This will bolster user experience (UX) as currently an uncomfortable amount of guesswork is associated with setting a transaction fee.

(This guesswork makes it more likely that users will overpay or underpay. When the latter happens, users can end up waiting for a relatively long time for their transaction to confirm—assuming they don’t speed it up.)

Monetary policy

Ethereum’s current annual network issuance is roughly 4.5%. (Put another way, the supply of ETH increases by roughly 4.5% each year.) Because base fees will be burnt once EIP-1559 goes live, ETH will become less inflationary, and possibly even deflationary.

If more is burned on base fee than is generated in mining rewards then ETH will be deflationary and if more is generated in mining rewards than is burned then ETH will be inflationary. Since we cannot control user demand for block space, we cannot assert at the moment whether ETH will end up inflationary or deflationary, so this change causes the core developers to lose some control over Ethereum’s long term monetary policy.

Miners

EIP-1559 will cause miners’ revenue to fall and become more predictable.

Common Misconception About EIP-1559

There’s no guarantee that EIP-1559 will lower gas fees in the long term. Yes, gas fees may fall because users are less prone to overbidding. However, this improved predictability could result in more people using Ethereum compared to today. Ultimately, gas fees can decrease in the long term if Ethereum becomes more scalable.

Further Reading

- EIP-1559 FAQ (Vitalik Buterin)

- We answered the most popular questions about Ethereum’s EIP-1559 (Uncommon Core)

- Analysis of EIP-1559 (Derebit Insights)

- Transaction Fee Mechanism Design for the Ethereum Blockchain: An Economic Analysis of EIP-1559 (Tim Roughgarden)

- Breaking Down The Fee Market (EIP-1559) (BitMEX Research)