There are several ways to stake your ETH on the Ethereum blockchain. In this resource, we explain these ways and break down the pros and cons of each. (This resource assumes you generally understand staking. If you don’t, see our Ultimate Guide to Staking.)

Key Takeaways

- Validators help secure the Ethereum blockchain and are compensated with ETH staking rewards.

- The rate of return, or APR, changes based on various factors.

- There are 4 ways to stake ETH:

- Solo staking: Full rewards but requires 32 ETH and relatively high technical knowledge.

- Staking as a service: It still requires 32 ETH. Must pay a small fee.

- Pooled staking: The most popular option because you don’t need to have 32 ETH. Must pay a small fee.

- Centralised exchanges: Usually offers the lowest rewards. Only option with exchange risk.

- Staking is not risk-free. Each of the 4 options include different types of risks. The ‘best’ option for you will depend on your skill level, goals and risk tolerance.

Contents

Ethereum Staking 101

The Ethereum blockchain relies on validators to keep it running properly. To become an Ethereum validator, you need to deposit 32 ETH to a certain address. This act is known as staking (i.e. you put your 32 ETH ‘at stake’ to become a validator).

You can still stake ETH even if you don’t have 32 ETH. When you do this, you won’t be a validator but you’ll still get some staking rewards. More on this below.

Important: As of Mar. 2023, validators can’t withdraw their staked ETH. Withdrawals are expected to launch in mid-April 2023.

How much is the APR?

There’s no fixed annual percentage return (APR) for ETH. The APR constantly changes and depends on several factors, such as:

- network activity;

- total ETH staked;

- number of validators; and

- the value captured by MEV, which boosts staking rewards and therefore the APR.

The APR will gradually reduce as more ETH is staked and more validators activate. The APR you receive may also be lower depending on the staking option you choose—as exchanges will often take a higher fee, resulting in a lower APR.

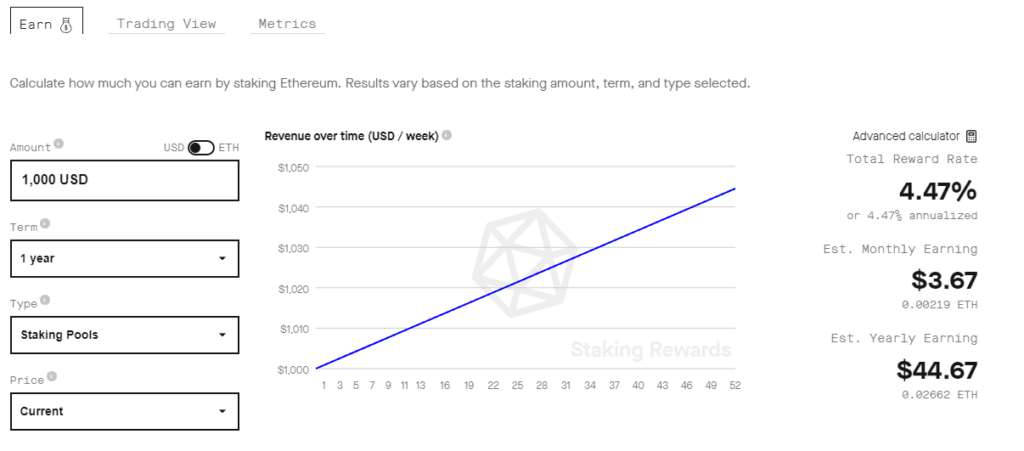

Calculating ETH staking rewards

Need help determining how much you could be earning? Staking calculators estimate how much ETH you could accrue depending on the amount, type, price and time staked.

Ethereum Staking Options

There are 4 ways to stake your ETH to receive rewards. Each has pros and cons and depends on the ease of use, decentralisation preference, skill level and time or difficulty to set up. These 4 options are solo staking (or at-home staking), staking as a service, pooled staking (or liquid staking) and exchange staking.

Solo staking (at-home staking)

Solo staking is the act of managing and running your own Ethereum node. It’s the most challenging but most decentralised and gives the total rewards. As of Mar. 2023, approximately 4.7% of Ethereum validators are solo stakers. (More on solo staking.)

Benefits: Full control, lowest trust assumptions, maximum rewards and most impactful for the network (full decentralisation).

Negatives: Requires 32 ETH, highest technical knowledge and dedicated computer connected to the internet. Carries risk of penalties (slashing).

Staking as a service (SaaS)

SaaS is for users who still want to run an Ethereum node and stake their 32 ETH but aren’t comfortable dealing with hardware. Staking-as-a-service options allow you to delegate the hard part while you earn native block rewards. (More on staking as a service.)

Benefits: Higher rewards than pooled staking, maintaining your node and no third-party smart contract risk.

Negatives: Requires 32 ETH, keeping your own set of validator credentials and trusts staking operator.

Liquid staking (pooled staking)

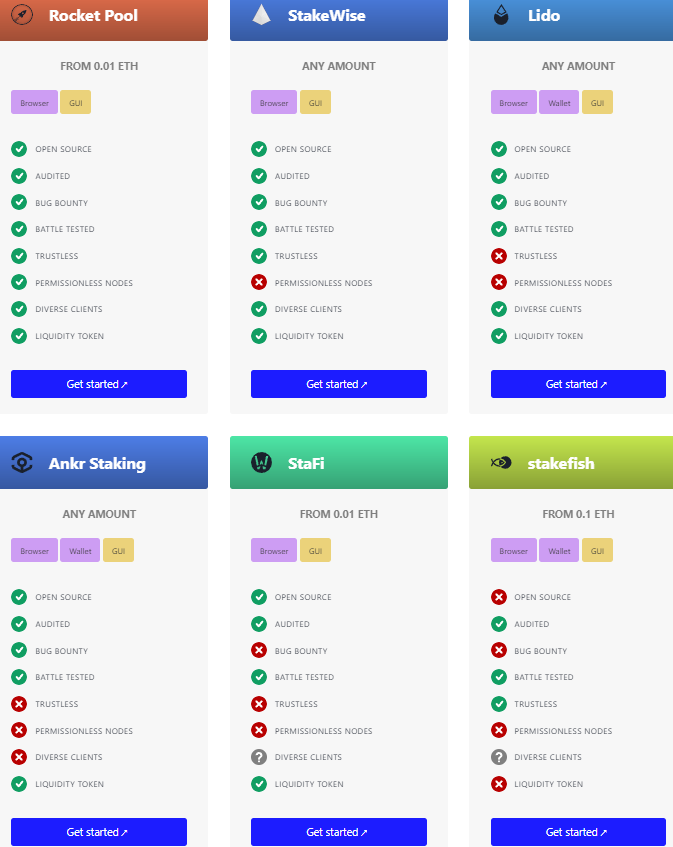

Liquid staking, or pooled staking, is the most accessible method while retaining ownership over your ETH. Users can stake with as little as 0.01 ETH—making it the easiest way to earn staking rewards and participate in securing Ethereum. It makes staking as simple as a token swap. (More on liquid staking.)

The most common method provides liquidity tokens that can be used in decentralised finance (DeFi), such as Lido’s stETH and Rocket Pool’s rETH.

Benefits: Stake any amount (low barrier to entry), the easiest way (stake now) and instant liquidity via liquid tokens.

Negatives: Non-native to Ethereum (requires third parties, smart contract risks and higher trust assumptions) and smaller rewards.

Centralised exchanges

This is the easiest way to earn ETH staking rewards without using crypto wallets or interacting directly with the Ethereum blockchain. Many centralised exchanges provide staking services, such as Coinbase or Binance, for those who are don’t like holding ETH in their own wallets or using Ethereum-based apps. All you need to do is deposit your ETH into the exchange’s staking program. (More on exchange staking.)

Benefits: Stake any amount, never have to leave an exchange and most accessible.

Negatives: Highest trust assumptions (trusting an exchange with your ETH), lowest rewards (exchanges often take a higher fee), and contributes to network centralisation.

Which Is Right For You?

Each ETH staking option has unique pros and cons. There’s no ‘best’ option. It depends on your preferences and circumstances.

| Who Are You? | Best Option |

|---|---|

| I want to run my own node | Solo staking |

| I don’t want to run my own hardware | Staking as a service |

| I don’t own 32 ETH and want to retain my ETH | Liquid staking |

| I don’t want to use MetaMask or an Ethereum-based app | Exchange staking |

Pooled staking is the most common to date

If the following applies to you, then you’re probably best suited to choose pooled staking.The most common option for many is using pooled staking. Pooled staking is probably best for you if you:

- own less than 32 ETH;

- don’t want to run a node or manage your own validator keys;

- want to help Ethereum decentralise; and

- value a user-friendly experience.

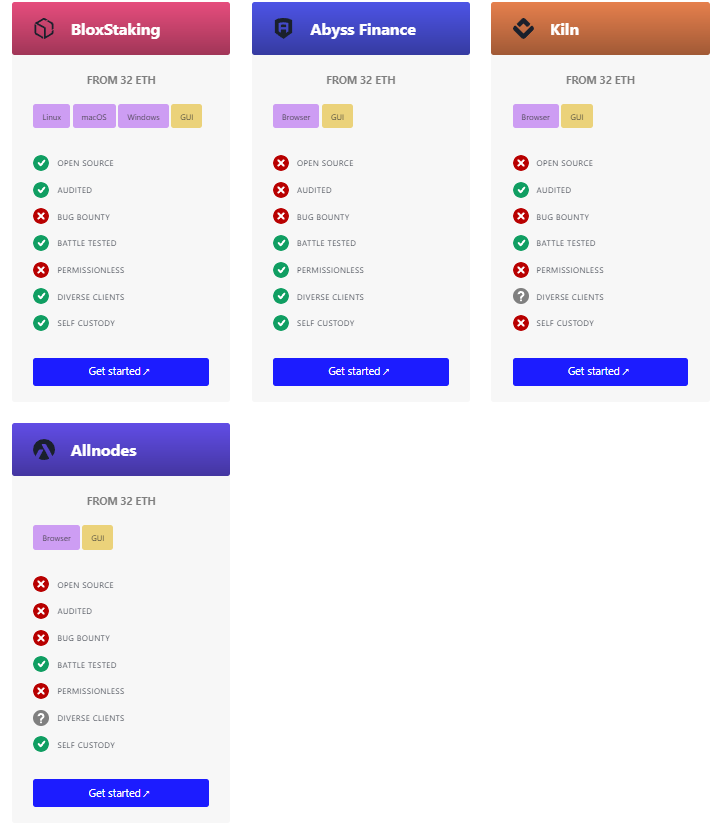

There are many pooled staking platforms. Pros and cons of each can be found in the below screenshot.

FAQ

There is no ‘Eth2’ token native to the protocol, as the native token ETH did not change when Ethereum switched to proof-of-stake.

Other ETH tokens do represent staked ETH. Examples include rETH (Rocket Pool), stETH (Lido) and ETH2 (Coinbase).

No, there are risks with Ethereum staking, including but not limited to the following:

- Withdrawals locks/limited: ETH withdrawals are currently not live (scheduled for Apr. 2022), and if they go live, it may be weeks to months before you can withdraw your ETH.

- APR or price volatility: APR is not fixed and depends on external conditions. If you are buying just to stake, consider APR or price volatility may outweigh returns.

- Slashing risk: Potential of losing some cryptocurrency if the validator you’re staking with misbehaves (known as “slashing”). Likewise, solo home stakers face slashing risk.

- Exchange risk: If the centralised exchange you use to stake shuts down or becomes insolvent, you may risk losing your ETH.

- Smart contract risk: Pooled staking relies on third parties building smart contract dApps. If there is an error in the code or smart contract, your ETH may be at risk.

- Collusion risk: Delegating ETH to pooled staking carries a minimal risk of validator collusion that could impact the staking provider.

- Trusting third parties: Like exchange risk, trusting any party to help in the process creates some trust assumptions. The only way to avoid this risk is by home staking.

Pooled staking liquid tokens (which represent your ETH), such as Lido’s stETH, can depeg from its 1:1 ETH price. This should be less common when ETH withdrawals are activated. Although your ETH should always be redeemable 1:1 when withdrawing.

Withdrawals are in the testing phase (as of Feb 2022). All indications are withdrawals will go live in April 2023. There may be a limit on how much ETH you can withdraw or how long you’ll have to wait in queue to withdraw.

Watch the below video from Collective Shift for more on staking on the Ethereum blockchain.