DeFi is one of the fastest-growing crypto sectors, and investor demand for convenient ways to gain exposure to it is soaring. Indices are one way to gain instant exposure to DeFi. This resource covers the value proposition of DeFi indices before detailing some that are available as of this writing.

How Are DeFi Indices Useful?

There are several reasons why an investor may opt for a DeFi index, as opposed to investing in multiple individual DeFi tokens. Some of these reasons are explained below.

DeFi is hyper-innovative and fast-moving: More and more DeFi projects are going live each week. All the while, the relatively established DeFi projects continue to upgrade and become more extensible. Such vibrant innovation demands a significant amount of time to monitor. This can be near impossible, particularly for those who don’t work full-time in crypto.

DeFi indices can help gain broad exposure and are actively managed or maintained. So, when promising projects emerge, the communities or fund managers can adjust the index and/or design automatic rebalancing mechanisms.

Potentially more cost-efficient: For those who invest in individual DeFi tokens, high transaction fees can eat away at any gains. As of this writing, all top DeFi protocols run on Ethereum. With gas fees at historically high levels, buying and selling individual DeFi tokens can be expensive, particularly for those who are investing 3- and 4-figure sums.

Simplicity: Buying and selling cryptocurrencies can be hard to track, especially for those living in countries like Australia where cryptocurrency sales are recognised as CGT events. Tax reporting is typically a lot simpler for those who buy and sell indices.

Top DeFi Indices

*The composition and weighting of each of the following indices are current as of this writing. Compositions and weightings will change. View the most up-to-date allocation on the respective index’s webpage.

DeFi Index (‘sDEFI’) on Synthetix

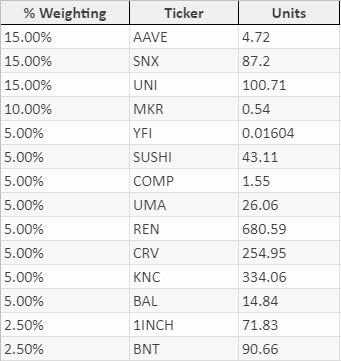

sDEFI is a synthetic DeFi index token that tracks a basket of DeFi tokens through Chainlink-supplied price feeds. Weightings are determined by SNX holders. Rebalances are currently performed ad hoc. The community is discussing a move to a more frequent rebalance schedule.

DeFi Pulse Index (‘DPI’)

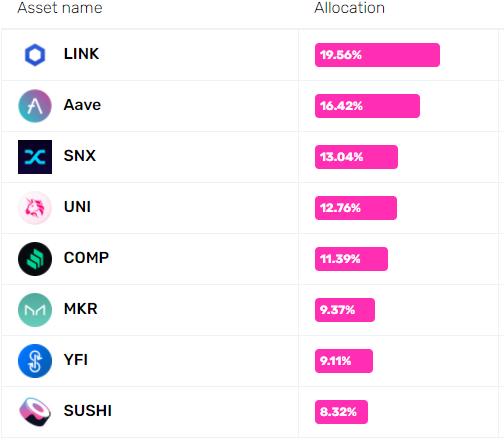

DPI is an index is weighted based on the value of each token’s circulating supply focusing on projects which have significant usage and a commitment to ongoing development. DPI is governed by $INDEX holders.

Changes to the index are determined in the 3rd week of the month, with changes happening on each month’s first business day. As part of the inclusion criteria, tokens must be listed on Ethereum and the dapp associated with the token must be launched and functional for at least 180 days.

DEFi+L on PieDAO

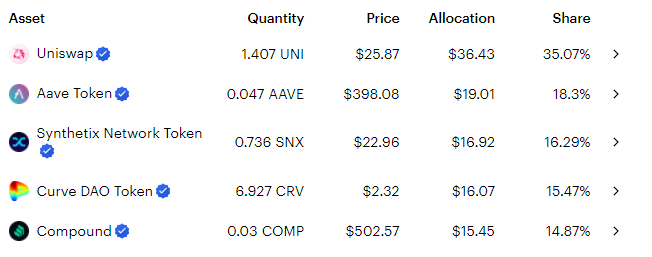

PieDAO has several DeFi indices, the largest being DEFI+L, an index for large-cap DeFi projects.

DEFI+L actively rebalances, with allocation determined using a strict methodology—with a percentage share proportional to the market cap of each project weighted through a ‘Sentiment Score’ assessing each project’s innovation, functionality to the DeFi ecosystem and growth potential.

PieDAO also offers DEFI+S for those who also want exposure to lower-cap DeFi tokens. Additionally, DEFI++ is a combination of DEFI+L and DEFI+S.

DEFI Top 5 Tokens Index (‘DEFI5’)

DEFI5 is a passively managed index that tracks the top 5 DeFi tokens by market cap. The index runs through Indexed Finance, a decentralised protocol for passive portfolio management.

Bitwise DeFi Crypto Index Fund

Crypto asset management firm Bitwise launched a DeFi-specific index fund in early 2021. (Read the launch press release.) By tracking an index of the largest DeFi tokens, Bitwise aims to create a secure, diversified portfolio of tokens designed to disrupt the financial ecosystem. Accredited investors have a private placement with the fund via Bitwise Asset Management. Minimum investment is US$25,000.

Bitwise Decentralised Finance Crypto Index—that is, the underlying index—follows a formal methodology for screening risks. As per its fact sheet:

“Assets are screened and monitored for certain risks, weighted by market [cap], and rebalanced monthly. The Fund aims to track the Bitwise Decentralized Finance Crypto Index, and assets are held in custody with a regulated, third-party custodian.”

As of this writing, constituents are AAVE, SNX, UNI, MKR, YFI, COMP, UMA, LRC and ZRX.

Bitwise was founded in 2017 and manages more than $900 million in assets across many funds, institutions, financial advisors, and more.

Comparing DeFi Index Performances

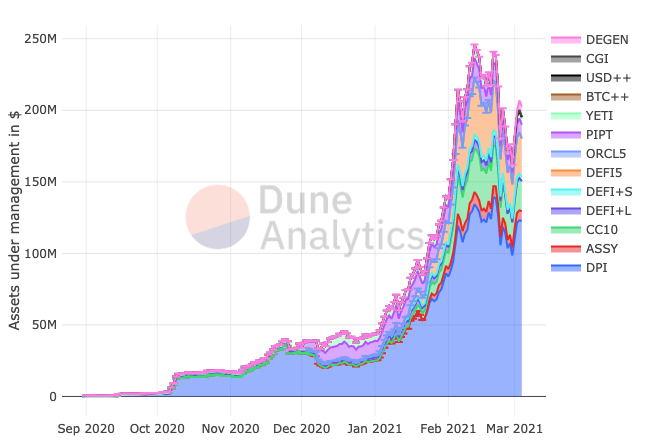

This Dune dashboard displays real-time data on several DeFi indices. (Read our post from Mar. 5, 2021, covering this dashboard.)

Ultimately, all DeFi indices are different. Factors that help investors choose a particular index include:

- The tokens which constitute the index

- The weighting of each token

- The frequency of rebalancing

- The administrative structure of the index