In my October post explaining why I hadn’t bought any crypto so far in 2022, I said that I’d share when I did eventually buy. Well, I bought. Below, I explain why and what my investment strategy is for the months ahead.

Key Takeaways

- I made my first cryptocurrency investment for the year, buying bitcoin (BTC) and ether (ETH).

- Prompting the decision was a combination of on-chain, technical, fundamental and sentiment analysis.

- I plan to average in over the coming months and will buy more aggressively in the event of any flash crashes.

- Stay tuned for my 2022 recap before Christmas and 2023 preview in January.

Contents

Bottom Signals Everywhere

My crypto investment decisions typically draw upon several categories of analyses; on-chain, technical and sentiment. Each of these are signalling that now it an opportune time to buy bitcoin (BTC) and ether (ETH).

On the Chain

Market value to realised value (MVRV) measures the ratio of the sum USD value of the current supply to the sum realised USD value of the current supply. It has historically been one of the most reliable on-chain indicators of BTC market tops and bottoms.

In the past few weeks, Bitcoin’s MVRV ratio has been at near multi-year lows. Only twice has this ratio ever been lower; Jan. 2015 and Dec. 2018. Of course, prior performance doesn’t equal future results, but these 2 times proved to be exceptional buying opportunities.

On the Charts

I’m no day trader, but on the longer timeframes, some widely followed indicators are signalling that things can’t get much worse.

BTC has been trading below the 50-, 100- and 200-week moving averages (MAs) for 25 weeks, easily its longest-ever streak below the 3 psychologically significant MAs.

BTC price with the 50-, 100- and 200-week MAs

BTC price with the 50-, 100- and 200-week MAs

As for the relative strength index (RSI)—another key momentum indicator—it has been printing between 20 and 40 for half a year. Again, this has never happened before. An RSI print below 20 generally signals oversold conditions. (Although there was a 46-week period between Aug. 2014 and Jun. 2015 when BTC’s RSI was oscillating between 28 and 50.)

Weekly RSI (2012–2022)

Weekly RSI (2012–2022)

On the Socials

I’d like to preface this section by emphasising that this category of analysis involves a lot more ‘gut feeling’. Typically, you can cherry-pick data to fit your narrative. I’d never make an investment decision based solely on sentiment and social analysis. That said, in an immature asset class bereft of any widely agreed-upon valuation methodologies, I firmly believe that sentiment is at least worth considering.

Okay, here we go.

Conclusion: It’s a bloodbath out there. The sentiment on ‘Crypto Twitter’ is grim. Of what little engagement remains, the vast majority of it revolves around the FTX collapse.

Several recent headlines and events have also supported my sense that things can’t get much worse:

- Earlier this week, CNBC host Jim Cramer—a historically reliable counter-signal (see @CramerTracker)—urged investors to exit crypto.

- A CNBC survey from late November showed that 8% of Americans view cryptocurrencies positively, down from 19% in March.

- The widely followed Crypto Fear & Greed Index has been in the ‘Fear’ and ‘Extreme Fear’ ranges for at least the past month.

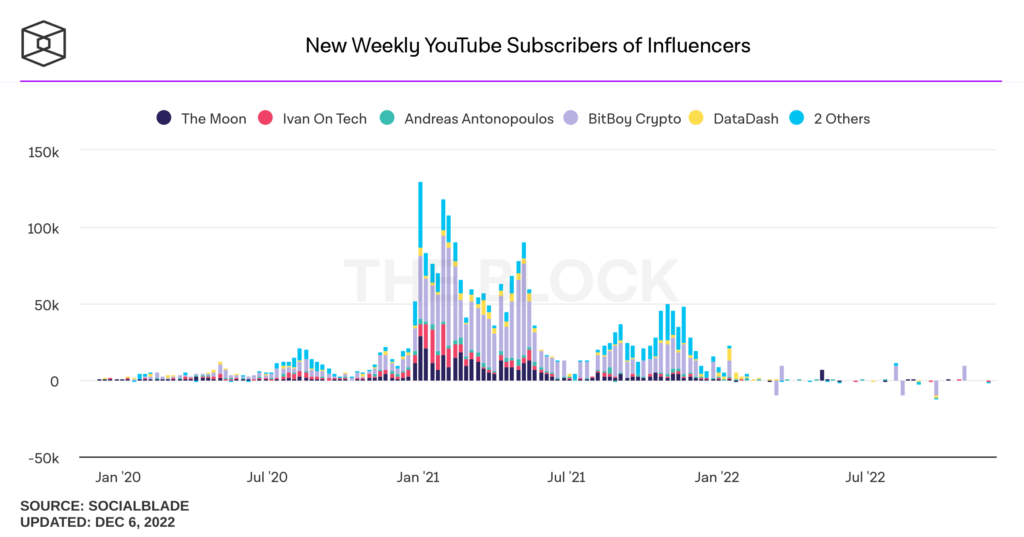

- New weekly YouTube subscribers (see below) of the top crypto influencers’ channels have been roughly flat for most of 2022.

Top crypto influencers’ YouTube channels have struggled for all of 2022 (Source)

Top crypto influencers’ YouTube channels have struggled for all of 2022 (Source)

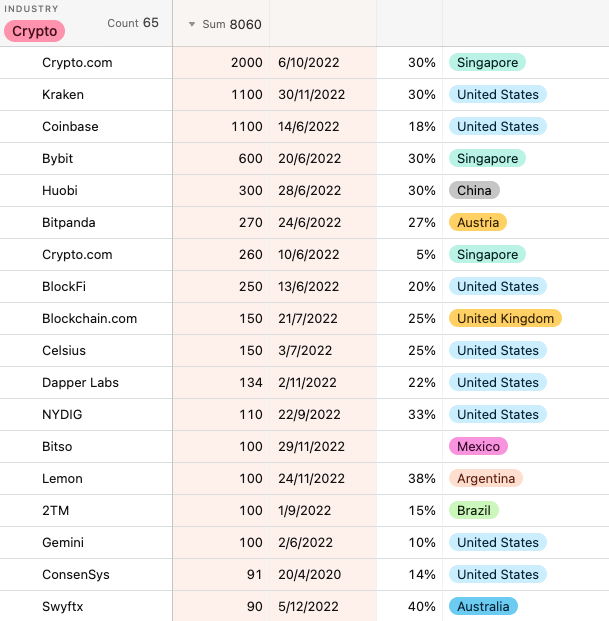

- Industry layoffs have lifted significantly in recent weeks. Below is a screenshot of the largest layoffs.

Crypto industry layoffs in 2022, ordered by largest numbers (Source)

Crypto industry layoffs in 2022, ordered by largest numbers (Source)

Look, I could add many more dot points to this list. But I think you get it.

The sheer volume of bottom-signal indicators and events has been too hard to ignore in recent weeks. Combined with on-chain and technical analyses, I feel confident buying in now.

Finally, the below point doesn’t really fit into any of the above categories, but I feel it’s important to cover…

The sell-off after the collapse of FTX. Notice how surprisingly muted the market reaction was?

If you told me that:

(i) one of the largest exchanges would collapse with an $8B hole in its balance sheet and over 1 million creditors;

(ii) a major fund (i.e. Alameda) collapsed simultaneously; and

(iii) the man at the helm—who had built deep relationships in Washington D.C. and was involved heavily in advocating for crypto policy—would (allegedly) turn out to be the industry’s very own Bernie Madoff…

…I’d never predict that BTC would fall by only 20%.

But that’s what happened. If that’s not a sign of seller exhaustion, I don’t know what is.

Now What?

I’ll continue to average in over the coming months—buying roughly every 3–4 weeks. (No altcoins for the time being. I’ll let you all know in January (see below) which ones I’m monitoring.)

Yes, things could get worse from here. Always a possibility, but I think the risk-reward is now favourable for long-term investors. If BTC and ETH flash crash due to another high-profile event, I’ll likely buy more aggressively. (It’ll depend on the nature of the event. If something did happen, another team member or I will absolutely be covering it.)

I hope you could apply my October post and today’s post to consider your investment goals and revisit your investment plan. These quiet market conditions are the perfect time to be doing that.

Before Christmas, I’ll publish a 2022 recap which will include investment lessons learnt and my opinions on the state of various sectors. This will be followed by a forward-looking post in January on how I expect 2023 to unfold, what projects I’m monitoring for investment purposes, and more.