Crypto-assets are an extremely risky asset class. It’s essential to know precisely what you’re buying, owning or using.

This resource covers the various risk types that exist in the crypto ecosystem. Use it as a starting point to help you understand your risk tolerance from which crypto-assets you hold, platforms you frequent or stablecoins you use.

Key Takeaways

- Managing risks starts with understanding your risk tolerance.

- Your risk tolerance will govern how far along the risk spectrum you go.

- There are many types of risks that are important to consider. Each will vary depending on your risk tolerance.

- Crypto-asset and volatility risk

- Platform risk

- Application or DeFi risk

- Stablecoin risk

- Hacker or scam risk

- Leverage risk

- Regulation risk

- Key ways to mitigate risk:

- Only hold BTC and ETH (especially if you’re new to crypto)

- Avoid leverage

- Use secure stablecoins

- Avoid concentration risk

- Be careful who you custody your crypto with

- Understand self-custody

- Be careful of scams—use best-practice security

- Don’t have all your funds in DeFi

Defining Risk

Risk is your exposure to danger, harm or loss. As crypto is inherently extremely risky, it’s even more important to understand the risks at play.

The crypto-asset market is speculative. The gains and losses can be extreme.

It’s essential to do your due diligence, understand the crypto-assets you own and familiars yourself with known risks and where this fits into your risk tolerance.

In crypto, there is an inherent risk of losing interest, principal, or both. Think of risk as “the art of not losing all your money”, whether you’re a trader or a long-term investor.

There can be many areas of risk in the crypto ecosystem, from stablecoin, regulatory, leverage, platform or scam risk. There are some things you can do to minimise your overall risk.

Types of Risk

Crypto is very risky and can become riskier depending on the things you do, assets you hold, exchanges you use or yield you gain.

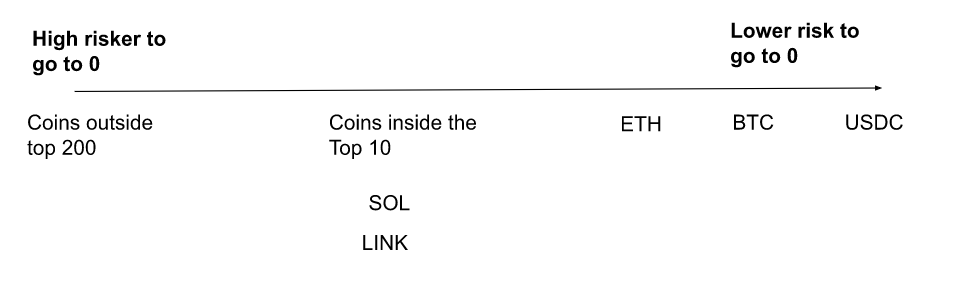

Below are some crypto risks and ways to think about them. *Assets classed as “less risky still pose significant risk and hold the potential to go to zero, even Bitcoin.

Crypto-asset and volatility risk

Appreciate the risk of volatility and long-term sustainability of your crypto-assets. Some are far more speculative than others or have unclear value capture (i.e. why does this token accrue value?) ‘Altcoins’ are generally considered any crypto-asset that isn’t bitcoin (BTC) or ether (ETH).

If you want to minimise significant losses, giant swings and the potential for your crypto-asset to go to 0, then staying solely in BTC is very common.

For example, in 2022, Terra (LUNA), a top-10 crypto-asset, went to near 0 in 48 hours. While in the 2022 crypto flash crash, 12,763 crypto-assets have fallen by at least 90% from their all-time high. Many won’t be back and will fade away. BTC has fallen by 67%, and its place in the ecosystem remains highly likely long-term.

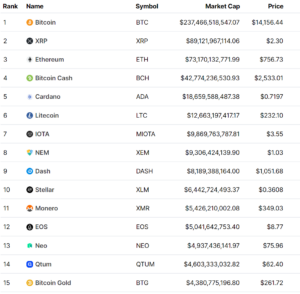

Remember, many crypto-assets previously in the top 10–15 (by market cap) have since been largely abandoned. Market sentiment can change rapidly.

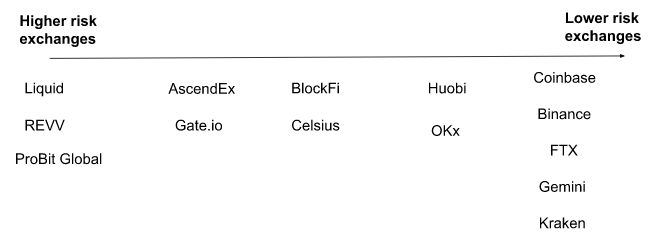

Platform risk

There’s an inherent risk when using exchanges or lending platforms. The level of risk depends entirely on the exchange or platform you’re using.

Coinbase, FTX or Binance carry relatively less user risk than lesser-known exchanges. But there’s still risk there. If these exchanges go insolvent, your crypto-assets are at risk as these platforms will often not insure your funds. This is why self-custody can be so important.

For example, Celsius recently stopped withdrawals due to liquidity risk. If Celsius becomes insolvent, all user funds locked in the platform could be lost.

When you see high APYs, these platforms will use investor funds through either DeFi or lending to institutional borrowers.

Application or DeFi risk

If you’re depositing a large portion of your crypto-assets into a DeFi app, it’s crucial to understand how it functions—particularly when it comes to its liquidation mechanism.

Separately, it’s important to appreciate how experimental DeFi is. It’s not uncommon that vulnerabilities are discovered in the smart contracts underpinning DeFi apps and protocols.

Malicious actors have stolen DeFi users’ crypto-assets many times over the years by exploiting certain DeFi protocols. (Look at how long this incomplete list is.) For example, Wormhole—an app to transfer crypto-assets between blockchains—was hacked for $326 million in early 2022.

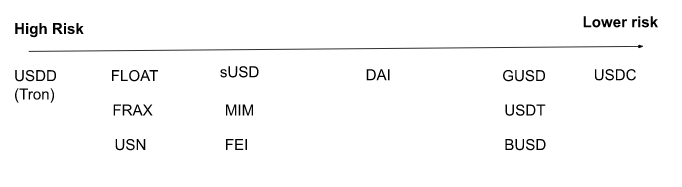

Stablecoin risk

Not all stablecoins are created equal. The type of stablecoin you use can increase or decrease your risk.

Stablecoins will vary in their design—from highly collateralised to algorithmic (backed by token design and code) or a mixture of both.

- Highly collateralised by fiat, robust reporting and highly regulated (e.g. USDC).

- Some are “algorithmic” collateralised by token design (e.g. UST, USDD).

- For example, TerraUST (UST) wasn’t 100% collateralised, de-pegged and collapsed due to poor token design.

- A mixture: Others are backed by a combination of highly regulated stablecoins such as USDC or other crypto-assets (e.g. DAI).

- These can also be known as ‘decentralised’ stablecoins—although labels like this are highly debated.

Some stablecoins offer high yields, so it’s important to be aware of the risks less collateralised stablecoins pose.

Below is an example of where certain stablecoins sit on the risk spectrum. Some vary from highly regulated, transparent reserves to a riskier make-up of what’s ‘backing’ the stablecoin.

Hacker or scam risk

Scam risk is one of the most common risks in crypto. Lax security practices and crypto scams pose a significant risk that isn’t to be understated.

Before signing a transaction with your Web3 wallet (e.g. MetaMask), remember to question exactly to whom you’re signing your wallet.

Read: Scam Protection Bible

Leverage risk

Leverage is when a person uses debt (i.e. borrowed capital) to undertake an investment. This may be in the form of leverage trading 2x, 10x or 100x.

Simply put, leverage exaggerates gains and losses. It can be very dangerous if you’re inexperienced and unaware of the significant financial risk involved.

Regulation risk

Although most countries are unlikely to outlaw Bitcoin, other crypto-assets—especially ‘altcoins’—carry a legitimate regulatory risk.

Much of the crypto landscape remains in a grey legal area. When comprehensive legislation inevitably arrives, highly centralised blockchain apps and protocols may suffer—along with their respective crypto-assets’ prices.

Ways to Mitigate Risk

Below are common ways that crypto-asset investors mitigate risk.

- Stay in bitcoin (BTC): Avoiding altcoins can be critical if you want to minimise your overall risk. Or, if you want to hold altcoins, ensure they are only 1–2% of your total crypto-asset portfolio.

- Avoid leverage: Unless you have excellent risk practices, are an experienced investor/trader and understand the risks, staying away from leverage can be important. Especially when there is high market volatility.

- Use secure stablecoins: Stick to USDC or other stablecoins which are highly regulated, transparent, fully backed reserves and highly collateralised. Avoid algorithmic stablecoins if you don’t understand their design or if they are offering APY that appears unsustainable. If you do, ensure you’re not overly exposed and understand the risk.

- Avoid concentration risk: If you’re lending, try not to have all your funds in one lender, especially if you choose to lend with any other exchange outside of Coinbase or Binance.

- Be careful of platform and dApp risk: When depositing your crypto-assets with riskier lenders such as BlockFi, Nexo or Celsius, ensure you’re not over-exposed. During highly volatile market conditions, withdrawing some or all funds can be wise. (Important: These platforms usually don’t insure users’ deposited funds.)

- Understand self-custody: If you’re using self-custody, ensure you are prepared and your crypto-assets are safe. Three self-custody tips:

- Transfer a small amount as a test when setting up a new wallet.

- Keep your primary crypto-assets and seed phrase separate from the internet. Ideally, use a hardware wallet.

- Test your secret recovery phrase to see if it is correct.

- Be careful of scams by following best practices such as:

- Bookmarking your most-used websites.

- Be on the lookout for phishing scams. (Phishing is by far the most popular scam category, per Scamwatch.)

- Separate your main stack from your MetaMask.

- Always use two-factor authentication (2FA).

- Don’t have all your funds in DeFi: Many crypto-assets remain experimental, from ‘altcoins’ to emerging Web3 and DeFi dApps. The best first risk management step is to ensure the bulk of your crypto-assets is stored privately.