Price targets are critical to any crypto sell strategy, but knowing where to set them is often challenging. Below, I dive into why setting realistic targets is essential and explore the potential projections for BTC, ETH and SOL in the current bull market.

Key Takeaways

- Setting sound sell targets can help avoid unrealistic goals, such as a target requiring cryptocurrency to attain a Bitcoin-like market cap.

- Based on dominance levels and past market cycles, BTC’s benchmark ranges from $130,000 (USD) to $180,000.

- Based on similar analysis, ETH and SOL price projections range from $7,000 to $10,000 and $400 to $700, respectively.

- All numbers mentioned are simple projections to help see if your price targets are realistic.

- Other factors help determine whether the cryptocurrency can hit the targets (e.g., unlocks, inflation). Whether you should sell depends entirely on your personal crypto goals or whether you choose a time-based approach.

Contents

Why Realistic Projections Are Important

Setting realistic goals is core to any sound sell strategy. Instead of succumbing to fear of missing out (FOMO) and getting caught up in the bull market mania, it helps to have figures in place and an action plan ready.

A critical part of this is mapping out different scenarios for how high those cryptocurrencies could go.

Practical example

Having a goal that is too unrealistic can be damaging and result in holding it all the way up and down (i.e., round-tripping), which means missing out on capitalising on the bull market.

Let’s use Sui (SUI) as an example, which currently has a market cap of $5.8B (USD) and an FDV of $21B.

We have two holders: James and Jim.

James heard social media influencers talk about SUI as the “next 100x opportunity,” which he uses as his target. For this to play out, SUI would need a market cap of $580B, making it more than 7x bigger than SOL’s current market cap and nearly double ETH’s.

If James is hellbent on holding until this market cap is hit, he might be waiting awhile!

On the other hand, Jim is targeting a 10x, meaning SUI would have a market cap of $50B. Although this lofty goal is much more achievable than James’s $500B figure.

I can’t tell you how often I’ve heard someone say, “XRP will hit $10 or even $20!”

This is perhaps the most common trap I see people fall into. Unit bias occurs when holders think that because the cryptocurrency is less than a dollar, it is ‘cheaper’ and offers higher gains.

I see these headlines everywhere, and it’s incredibly damaging.

Example of ambitious price predictions (Source: BraveNewCoin)

Example of ambitious price predictions (Source: BraveNewCoin)But price doesn’t work that way. Market cap and circulating supply must also be considered.

For XRP to hit $20, its market cap would have to be $1.1T, nearly the current market size of Bitcoin.

How High Will The Majors Get?

In this analysis, I will cover the three top cryptocurrencies by market cap: BTC, ETH and SOL.

These are not intended to be financial projections, advice or valuations.

Instead, they are designed to help you keep your mind ticking so you can see whether your price predictions are realistic. They provide a baseline based on previous market cycles and projections of total market cap.

I’ll use simple projections to represent price and market cap targets and possibilities.

Before we dive into more analysis, let’s anticipate how high the total crypto market could go this cycle, which will help inform us of different price scenarios.

| Cycle | Previous Cycle Start | Previous Cycle Peak | % Increase From Cycle Low To High |

|---|

| 2012 | $44M | $14B | ~33,990% |

| 2016 | $8B | $800B | ~9,900% |

| 2020 | $200B | $3.1T | ~1,450% |

Crypto market cap growth cycle to cycle. *A cycle here is within three months of the halvingHow high will it go this cycle?

Based on the ‘bottom’ market cap hitting $800B during the FTX bottom, if we account for a total 500% growth, we hit a total market of roughly $5T. I will use this figure throughout the piece as my Moderate/Base (most likely) case.

| Outlook | % Increase | Estimated High Market Cap |

| Conservative | 300% | $3.3T |

| Moderate | 500% | $4.8T |

| Optimistic | 700% | $6.4T |

Total market cap projectionsTo hear from the rest of the team, watch our October Monthly Q&A, where we shared some additional price targets.

Bitcoin (BTC)

There are a few ways to project BTC’s top for this cycle, which I’ve summarised below. To explore these simple projections, click on the drop-down boxes below.

| Projection Type | Potential Price Target | Potential Market Cap Target |

| 60% market cap dominance at peak | $138,000 | $2.5T |

| Market cap growth cycle to cycle | $142,105 | $2.7T |

| Previous ATH to ATH growth | $153,000 | $2.9T |

| Average expert projection | $180,000 | $3.4T |

Simple projections to estimate Bitcoin targetsThe most basic projection for BTC assumes it hits a dominance level of at least 60%. Assuming the crypto market cap reaches $5T, BTC will be ~$138,000.

See the table below for further estimates, with moderate and optimistic outcomes.

| BTC Dominance | Market Cap (Moderate) | Price (Moderate) | Market Cap (Optimistic) | Price (Optimistic) |

| 50% | $2.5T | $123,762 | $3.75T | $185,644 |

| 55% | $2.75T | $136,139 | $4.125T | $204,200 |

| 60% | $3T | $148,515 | $4.5T | $222,772 |

| 65% | $3.25T | $160,891 | $4.875T | $241,337 |

If Bitcoin follows the same trend as other cycles, BTC’s market cap could grow to $2.7T, which would give an estimated price per bitcoin of $142,105

| Cycle | Previous Cycle Start (Peak) | Previous Cycle Peak | % Increase |

| 2012 | $44M | $14B | ~33,990% |

| 2016 | $6.5B | $317B | ~4,800% |

| 2020 | $160B | $1.3T | ~712% |

| 2024/25 | $900B | $2.7T | ~200% |

*Red represents estimatesIf we follow a similar projection from BTC’s ATH growth, taking the average of the moderate ($136,842) and optimistic case ($171,053), BTC’s price is projected at ~$153,000

| Cycle | Market Cap Peak | ATH to ATH gain |

| 2012 | $12B | N/A (off base of $0) |

| 2016 | $317B | 2,542% |

| 2020 | $1.3T | 310% |

| 2024 (Moderate) | $2.6T | 100% |

| 2024 (Optimistic) | $3.25T | 150% |

*Red represents estimates| Who? | Price Target End Of 2025 |

| CryptoCo | $130,000 |

| CoinPedia | $140,449 |

| Stock-to-Flow model | $184,500 |

| Bernstein analysts | $200,000 |

| Standard Chartered | $250,000 |

Ethereum (ETH)

With fewer cycles under its belt, there is less historical data to compare prices to. However, we can use two similar price projections:

Ethereum (ETH) Price Estimates at Different Dominance Levels

For ETH to achieve the much-hyped ‘$10,000’ mark, a lot must go right. In the moderate case, ETH’s dominance would need to hit 25%, and in the optimistic case, it would achieve a 15–20% market share.

It shows how big the market cap would grow to hit these $10,000+ price projections.

| ETH Dominance | Market Cap (Moderate) | Price (Moderate) | Market Cap (Optimistic) | Price (Optimistic) |

| 10% | $510B | $4,250 | $765B | $6,375 |

| 15% | $765B | $6,375 | $1.1T | $9,563 |

| 20% | $1T | $8,500 | $1.53T | $12,750 |

| 25% | $1.275T | $10,625 | $1.9T | $15,938 |

Moderate and Optimistic assume a $5T & $7.5T peak market capETH Price Projections Based on Past Market Cycles

If ETH increases by ~300%, following the same trajectory as previous cycles, it could reach $7,000. This could provide a realistic base case for ETH this cycle.

| Cycle | Previous Cycle Start | Previous Cycle Peak | % Increase |

| 2016 | $13 | $1,350 | ~10,284% |

| 2020 | $150 | $4,800 | ~3,100% |

| 2024 | $1,750 | $7,000 | ~300% |

*Red represents estimates & assumes the start of the cycle is 400 days from the last halvingSolana (SOL)

SOL has even less historical data and cycles to compare, but we can extrapolate Solana’s second-cycle price projection based on ETH’s second-cycle growth.

| Projection | Market Cap | Price |

| SOL dominance level of 7.5% | ~$405B | $695 |

| Price high against low | ~$270B | $400 |

| Compared to ETH price second-cycle | ~$347B | $576 |

| Compared to ETH market cap second-cycle | ~$260B | $450 |

Summary of SOL projections. *Market cap adjusted for SOL inflation assuming a May 2025 SOL top.Takeaway

The analysis shows that for SOL to hit levels between $800 and $1000, it’d require SOL to attain almost 10% dominance in the market and the total crypto market to hit the upper bound of $5–7T. It would also require SOL to hit a total market cap of over $400B, which is exceptionally high and could be challenging to maintain.

Therefore, a projection of $400-600 would be more realistic.

The inflation rate (i.e., the percentage of new coins/tokens issued divided by the current circulating supply) is worth considering when applying projections to SOL. According to Solana Compass, it is currently 4.96%. This compares to BTC and ETH, which have annual inflation rates of under 1.0%.

In general, the longer the bull market goes, the ‘harder’ it will be for SOL’s price to move, not to mention the large amounts of unlocks that BTC or ETH did not have to contend with.

Finally, the upper bound of SOL’s price could be limited to reaching Ethereum’s current market size. If SOL had the same market size as ETH today, it would mean a price of $652 per SOL.

| ETH Second Cycle | Start of Cycle | End of Cycle | % Gain |

| ETH price (400 days from halving) | $150 | $4,800 | 3,100% |

| ETH market cap (400 days from halving) | $15B | $580B | 3,766% |

ETH price second cycle performanceIf we apply these figures to SOL, we get a SOL price ranging from $450 to $576. Applying the average of these two projections gives us $513 per SOL.

| SOL Second Cycle Projections | Start of Cycle | End of Cycle Projection | % Gain |

| SOL price (400 days from halving) | $18 | $576 | 3,100% |

| SOL market cap (400 days from halving) | $6B | $260B(~$450) | 3,766% |

SOL second cycle projections Considering that Solana has already reached an all-time high in this metric, the market cap is an important data point.

Because SOL has only been through one complete cycle, it has a sample size of one, where SOL accelerated 13,000% in its first cycle, reaching an ATH of $250.

Another way to consider SOL’s price projection or target is to combine its early price performance with the average of BTC and ETH gain in their second cycles.

SOL has already climbed 2,000% this cycle, but if we factor in the above performance of last cycle and the other majors, we can use a baseline of 3,500%.

This leaves us with a base case of $400 per SOL.

We can see how big the market cap for SOL will have to grow and attain these high levels in this bull market. This isn’t to say it can’t, especially over future cycles, but it is a healthy reality check.

| SOL Dominance | Market Cap (Moderate) | Price (Moderate) | Market Cap (Optimistic) | Price (Optimistic) |

| 5% | $250B | $463 | $375B | $695 |

| 7.5% | $375B | $695 | $562B | $1,043 |

| 10% | $500B | $927 | $750B | $1,391 |

| 12.5% | $625B | $1159 | $937B | $1,739 |

Moderate and Optimistic assume a $5T & $7.5T peak market cap (not accounting for SOL inflation)SOL dominance topped 2.8% in the last bull market and surpassed 3.5% this year.

Why Price Targets Are Not Everything

I’ve reviewed various ways to consider how high prices can go through this cycle for the major cryptocurrencies. These are not sell targets but are designed to get you thinking about whether or not your existing sell targets are achievable.

Other factors such as token unlocks, demand drivers and adoption significantly impact whether a cryptocurrency can reach your target price.

Importantly, timing can be the most critical factor outside price, which we will cover in subsequent articles. For many, their exit is directly tied to historical timeframes.

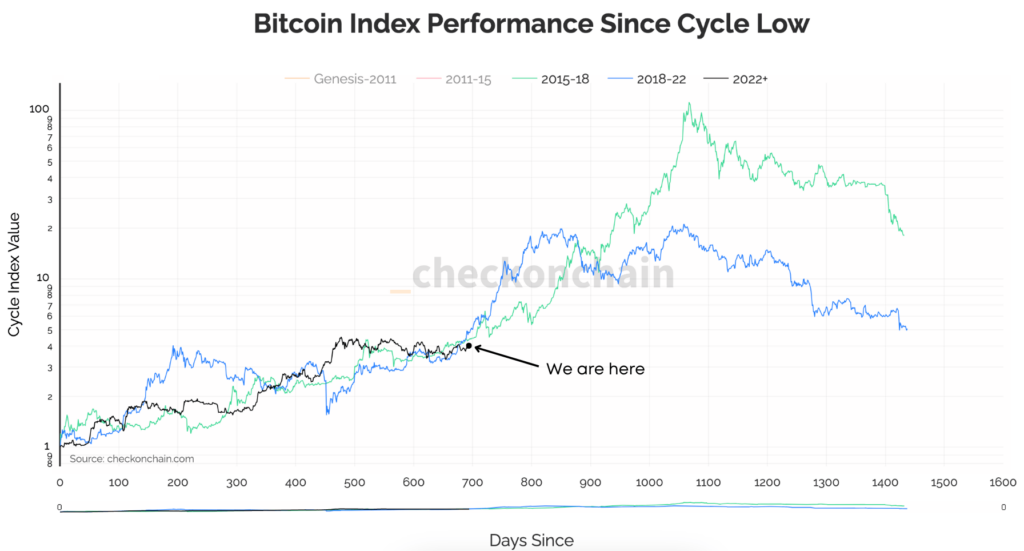

The below graphic from Checkmate’s Checkonchain says we have another 100 to 300 days before a typical cycle peak.

Finally, whether or not you sell might be less about specific cycle highs and more about personal targets tied to your personal goals. If you need a refresher or haven’t thought about your goals, see three of our most valuable resources to help inform you on your journey: