One of the biggest traps you can fall into when diving into crypto is being unclear on your crypto goals. This resource will help you get the conversation started on your goals before diving into crypto and finding yourself deep in the weeds without a plan.

Disclaimer: We are not financial planners, and this is not investment advice—so it’s essential you think critically about your crypto investments and consider your own personal situation.

Key Takeaways

- One of the biggest traps you can fall into when diving into crypto is being unclear about your goals.

- Before you get started with crypto, establish clear goals that define what you want to get out of it.

- Setting clear goals and understanding your reasons for being here can help you avoid costly mistakes or succumbing to FOMO (i.e. fear of missing out).

Contents

- Why Set Goals?

- Setting Goals

- How to Set Effective Goals

- Understanding The Risks

- It’s On You At The End Of The Day

Why Set Goals?

If you’re ready to start buying, swapping and trading cryptocurrencies, it’s key to set some goals to understand exactly what you want to get out of it and develop a plan of attack!

Goal setting can help to create a clear plan, so you can avoid mistakes and the dreaded FOMO.

With so many different cryptocurrencies, it’s so important to plan your goals and what you want to get out of them before getting stuck in a bad situation or unclear about what to do next.

Goals help you understand what you want out of the crypto space. This can help in many ways, particularly during times of high volatility in the crypto market.

Setting Goals

Before you start getting into cryptocurrency, it’s crucial to establish clear, well-defined goals. Knowing exactly what you want to achieve will provide structure and direction to your journey in the crypto world. Without clear goals, it’s easy to get lost in the volatility, hype, and constant news cycles that dominate the cryptocurrency market.

Setting specific objectives not only helps keep you focused but also allows you to make smarter, more informed decisions based on your personal circumstances and risk tolerance.

Everyone enters the world of cryptocurrency for different reasons—some are looking to diversify their investment portfolio, others want to take advantage of potentially high returns, and some are simply curious about this new form of technology. Your personal goals will determine how you approach cryptocurrency, which assets you prioritise, and how long you plan to stay invested.

For example, someone aiming to accumulate wealth over the long term will have very different strategies compared to someone seeking quick profits through short-term trades. And if you’re someone who is purely interested in technology, you would have different goals than those who just want to grow their wealth.

To clarify your own crypto goals, take a moment to step back and ask yourself a few key questions. These questions will help you get a better understanding of why you’re entering the market and what you hope to achieve.

Start by asking a few important questions, such as:

| What Are You Here For? |

| A trader? |

| A long-term holder? |

| Are you interested in blockchain technology? |

| Want to understand crypto so you can become your own bank? |

| To expand your knowledge and land a job in the industry? |

| Which Cryptocurrency Areas Do You Want To Learn More About? |

| Do you want to learn about staking or yield opportunities? |

| Are you interested in getting involved with NFTs? |

| Do you want to use stablecoins? |

| Are you primarily focused on using DeFi? |

| Do you want to learn more about web3 as a creator? |

Key Questions To Ask

Only you can come up with your goals, but there are a few questions to ask that can inform your goals.

While no one else can define your cryptocurrency goals for you, several key questions can help you shape and refine them. These questions serve as a guide to ensure that your goals are well thought out, realistic, and aligned with your financial situation and risk tolerance.

| Are you a short-term trader or prefer long-term holding? |

| What is your timeframe? |

| How old are you? Are you approaching retirement age? |

| When do you need your initial capital back? |

| How much risk tolerance do you have? |

| How much money are you willing to invest and potentially lose? The loss part is essential— remember, crypto is extremely risky, and you can lose some or all of your initial investment, especially in ‘altcoins’ (cryptocurrencies outside of Bitcoin). |

| Do you have particular goals for why you’re allocating to crypto? |

How to Set Effective Goals

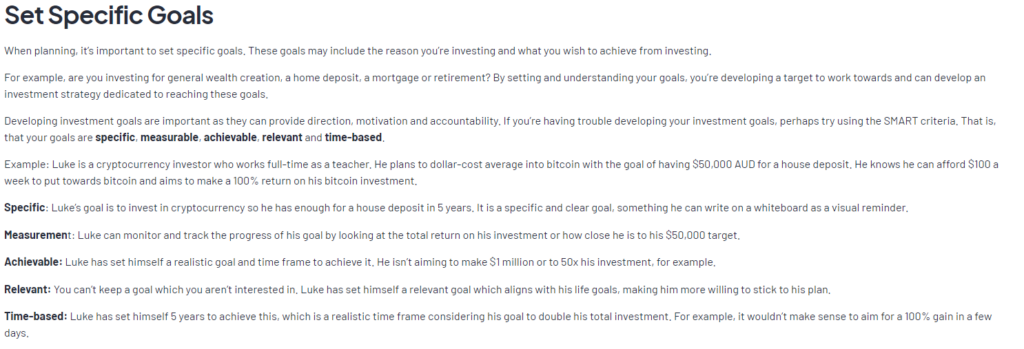

When setting goals in the world of cryptocurrency, it’s essential to apply tried-and-true principles that help ensure your success.

The following golden rules of goal-setting will guide you in crafting goals that are not only achievable but also strategic and aligned with your long-term objectives:

#1 Setting realistic goals: It’s easy to be swept away in euphoria or stories of people who’ve made massive gains overnight. A realistic goal might be something like gradually building your portfolio through consistent, calculated investments or aiming for a 10-20% return over a year.

#2 Being consistent: Rather than chasing every new coin or making impulsive decisions based on short-term market fluctuations, aim for consistency in how you manage your portfolio. The more consistent you are in your approach, the more likely you are to stay on track

#3 Avoiding ‘guaranteed money‘: In the world of crypto, there are no guaranteed profits, and any promise of ‘guaranteed money’ should be treated with extreme caution.

#4 Diversifying: Rather than putting all your money into one coin or project, it can be helpful to spread the risk to other coins or ensure volatile altcoins do not dominate your portfolio.

#5 Understanding the risks: By acknowledging and understanding these risks, you can create more informed goals that account for potential setbacks. For instance, if your goal is to achieve a certain return within a year, be prepared for the possibility that the market could dip significantly

Applying the SMART goal-setting framework can also help.

Understanding the Risks

When setting goals in the cryptocurrency space, it’s critical to understand the risks involved fully.

Cryptocurrencies are known for their volatility, regulatory uncertainty, and susceptibility to technological and market changes. By gaining a clearer understanding of these risks, you can set more realistic and informed goals, ultimately reducing the chances of making costly mistakes.

The unpredictable nature of the cryptocurrency market can often lead to emotional decisions, which is why having a firm grasp of the risks can provide clarity and help you approach it with a more strategic mindset.

Whether you’re a seasoned investor or a beginner, knowing the potential pitfalls is essential. For example, price volatility can swing both ways—leading to significant gains or losses within a short time frame. Similarly, security risks, such as hacking or phishing attacks, can compromise your holdings if you’re not using proper storage solutions. These and other risks, such as regulatory changes and liquidity issues, should be factored into your strategy.

Taking the time to learn and recognise these challenges will allow you to shape goals that align with your risk tolerance. Setting unrealistic expectations without considering these factors can leave you vulnerable to market fluctuations, leading to hasty decisions or missed opportunities.

We have two great resources to help you understand the risks:

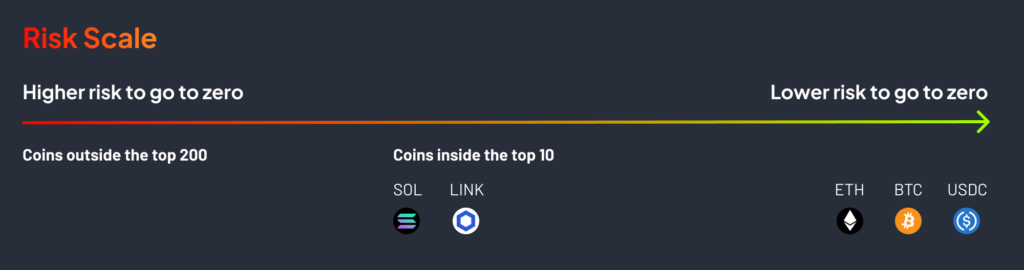

Anything outside Bitcoin is considerably riskier

It’s essential to be prepared to lose some or all of your initial investment if you allocate outside Bitcoin. This is because the further you go out of the top 10, 25, and 100+, the higher the risk your crypto could go to zero.

Even Bitcoin is not guaranteed to survive—at the end of the day, crypto and web3 are still in the early stages of their development—newer inventions or systems could outpace them.

Ultimately, It’s On You

This resource is designed to get the conversation started around your cryptocurrency goals and targets. We aim to provide insights and guidance, but it’s important to remember that we are not financial advisors or planners, and we cannot give you the definitive ‘answers’ to your specific financial situations.

We are all different and have varying circumstances and goals.

At the end of the day, only you have the responsibility to define and pursue your own financial goals. The decisions you make, whether in cryptocurrency or other investments, are yours to own.

What we can do is help you think critically about the right questions to ask, such as how much risk you’re willing to tolerate, what timeframes are realistic, and how you can structure your strategy around your personal objectives. By doing so, we aim to equip you with the information and context needed to make the most informed decisions possible.

Remember, setting and achieving your financial goals in cryptocurrency requires a thoughtful, educated approach.