If you’re interested in buying your first cryptocurrency, you should understand what you’re getting into. Being a new asset class, cryptocurrency prices tend to be a lot more volatile than more established assets. We explain this and other considerations below.

Key Takeaways

- If you’re curious about cryptocurrencies, you should strongly consider putting aside some time to learn about them before doing anything else.

- Despite there being several thousands of cryptocurrencies (i.e. ‘altcoins’) in existence, bitcoin (BTC) is easily the most well-known and established.

- For first-timers, here are 7 considerations:

- Understand crypto is highly risky.

- No such thing as guaranteed returns; be wary of high yields.

- Understand the risk profile; crypto prices can collapse quickly.

- Cryptocurrencies vary greatly in terms of their purpose, design and market cap.

- There’s limited protection for owners.

- Brushing up on security best practices is a must.

- Implementing a dollar-cost-average (DCA) approach can smooth out volatility.

Contents

- Importance of Staying In Bitcoin (BTC)

- Altcoins Come & Go

- Broader Risks In The Market

- 7 Considerations For First-Time Crypto Investors

- More Useful Information

Our free short course—Understanding Crypto & Buying Your First Bitcoin—is a great way to learn about what newcomers should know about crypto.

Importance of Staying In Bitcoin (BTC)

With the crypto market being so new and (relatively) small, it’s crucial to understand that it tends to be significantly more volatile than markets for other more established assets (e.g. stocks, bonds, real estate).

There are thousands of cryptocurrencies in existence. Throughout different periods, many of these have experienced extreme increases and decreases in price. In recent years, well over 5,000 cryptocurrencies have fallen by more than 95% in price.

For over a decade, Bitcoin (BTC) has been the most valuable of all cryptocurrencies. Compared to the rest of the market, BTC is widely considered the safest and least risky cryptocurrency to hold. (Of course, this does not guarantee that it will ‘succeed’. Nothing is certain.)

Given how much more risk is associated with holding any of the other thousands of cryptocurrencies, many people prefer to simply hold BTC and ignore the rest of the market.

As an example of just how risky some of these cryptocurrencies can be, a cryptocurrency called Terra (LUNA) became essentially worthless within a couple of days in 2022. Prior to the collapse, LUNA was ranked in the top 10 cryptocurrencies by market cap.

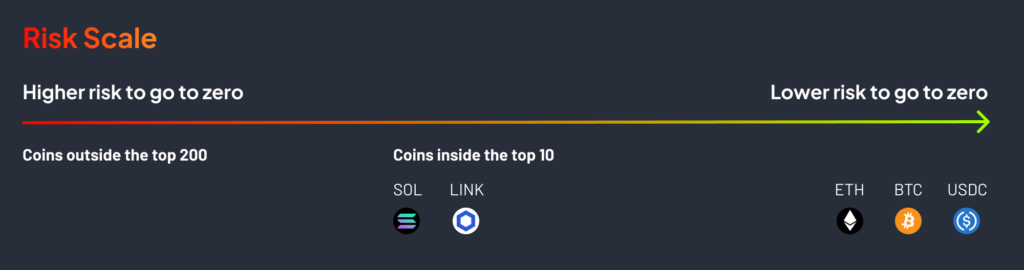

For anyone who is new and considering investing in cryptocurrencies, it’s hard to overstate just how important it is to understand the extreme extent to which risk varies between individual cryptocurrencies in the market.

Generally speaking, the lower the market cap of a given cryptocurrency, the greater the risk associated with owning it—or, in other words, the more likely it is to collapse and become worthless.

Altcoins Come & Go

The importance of staying in BTC is also reinforced once you understand that most altcoins fail or slowly fade into irrelevancy over a long enough timeframe.

There are many possible reasons why altcoins become worthless. Here are a few common reasons:

- Failure by the project to deliver on its promises. This may be due to an incompetent team, poor capital management and/or unrealistic goals.

- Inability to find product-market fit. The team built what was promised, but there was insufficient demand to use it.

- Smart-contract hack. The smart contracts built by the team are exploited by a malicious actor who steals a material amount of user funds.

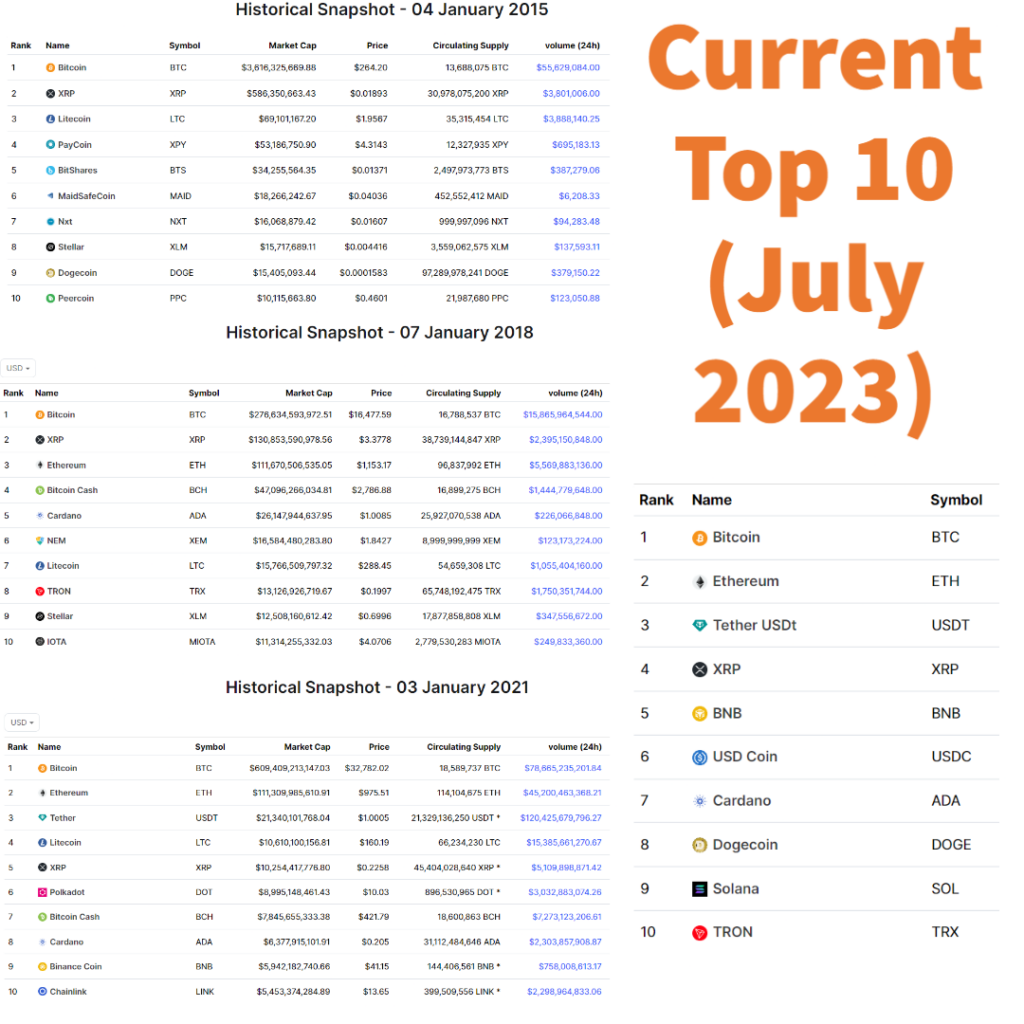

An effective way to understand how risky altcoins are is to look back at the market-cap rankings from years past. A website called CoinMarketCap lets you do this with its Historical Snapshots tool.

The below image shows a snapshot of the top 10 cryptocurrencies from 2015, 2018 and 2021. Notice how much this changes. (When you view the top 50, 100 and 200, these changes are even more pronounced.)

Broader Risks In The Market

Beyond volatility and altcoin risk, the following risks are also relevant:

- Exchange risk: Often, when holding your crypto with an exchange, you’re given an IOU. You don’t truly own that cryptocurrency until you transfer it off of the exchange and into your control.

- Storage risk: Storing your crypto correctly outside an exchange and in your own custody is not something to take lightly. If done incorrectly, you could lose some of your cryptocurrency.

- Scammer risk: Cryptocurrency users are heavily targeted by scammers, making the need for sound security practices particularly important.

- Smart-contract risk: Many cryptocurrency platforms or apps use computer code to work. If this code (called smart contracts) is faulty, the cryptocurrency held in the contract could become vulnerable.

For more, see our Top 3 Risks To Pay Attention To in our beginner course.

7 Considerations For First-Time Crypto Investors

| #1 Crypto is highly risky compared to other asset classes Even top cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) can fall significantly in value. However, they have stood the test of time compared to all other cryptocurrencies. While fundamentals are slowly becoming more important, prices are still largely driven by speculation. | |

| #2 No such thing as guaranteed returns; be wary of high yields In the crypto world, you may come across high annual percentage yields (APY) ranging from 10% to even 500%+ that can be generated from staking, lending, or depositing your crypto assets. However, anything promising a certain profit with no risk should be a red flag and warning sign. High APYs above 10% are considered exceptionally risky and often not sustainable. If you do not understand how “yield farming” works or where the yield comes from, it’s best to avoid it, especially as a beginner. | |

| #3 Be prepared for high volatility and understand the risk profile; assets can become worthless Cryptocurrency prices can swing wildly. If the idea of high volatility worries you, then cryptocurrency may not be for you. Even the biggest cryptocurrencies (e.g. BTC, ETH) can fall by 70% from all-time highs, and thousands of altcoins have become essentially worthless over the years. If you’re older or seeking retirement, it’s critical to understand these risks and only allocate a smaller % into crypto or steer clear of the riskiest crypto assets altogether. Please consider your time horizon and risk appetite. | |

| #4 One asset class, many varieties Bitcoin is the first cryptocurrency to be adopted and used as a digital store of value. It’s been available for over a decade, has a limited, fixed supply, and there is no issuer or controller sitting behind Bitcoin. All crypto assets won’t perform like Bitcoin—just because Bitcoin is doing well; it’s not to say another crypto will perform the same. All cryptocurrencies differ in their design, use case, scarcity (i.e. the supply of tokens) and how they accrue value. Read more: How To Categorise Crypto Assets | |

| #5 Limited protection There is often limited user protection. If you lose your cryptocurrency due to an error or transfer to the wrong address, you may be unable to recover the funds. Or if you fall victim to an online crypto scam, you may find it difficult to hold the party to justice. Important to consider if you are willing to lose some or all of your investment as there can be little consumer protection, and you are in control of your crypto. For those worried about this, consider trusting the most established exchanges (e.g. Coinbase) to hold your cryptocurrencies. Read more: Ultimate Guide to Storing Cryptocurrency | |

| #6 Understand security When swapping and engaging in crypto online, taking security seriously is essential. Never underestimate security and be across the top tips to protect your crypto and personal information. Activating 2FA is essential when buying your first cryptocurrency. See our Security Centre for security tips and resources. | |

| #7 Dollar-cost average (DCA) to ease volatility By adopting a DCA approach, you can buy small amounts of BTC periodically (e.g. daily, weekly, monthly) instead of spending a large sum at once. This can be particularly helpful in highly volatile asset classes such as crypto. |

More Useful Information

For more on how first-time investors can get started with cryptocurrencies, we highly suggest (i) viewing ASIC’s information about cryptocurrencies and (ii) listening to the below podcast featuring ASIC’s communications adviser and crypto-asset coordinator.

Go to the Collective Shift Security Center to learn about staying safe when interacting with cryptocurrencies.